This afternoon the Senate Finance Committee introduced their version of the FY 2024 budget. Notably–to account for their plan to cut taxes for the state’s wealthiest households and businesses–the Senate’s proposed budget is significantly smaller than the budget proposed by the governor. The Senate budget proposal relies on one-time surplus funds to pay for ongoing, permanent costs to the state. While that may not pose a budgetary issue this year, once their tax cuts are fully phased in, enacted legislation fully hits the base budget, and temporary surpluses come back to earth, the Legislature will face difficult decisions that include making more budget cuts, raising other taxes, or both.

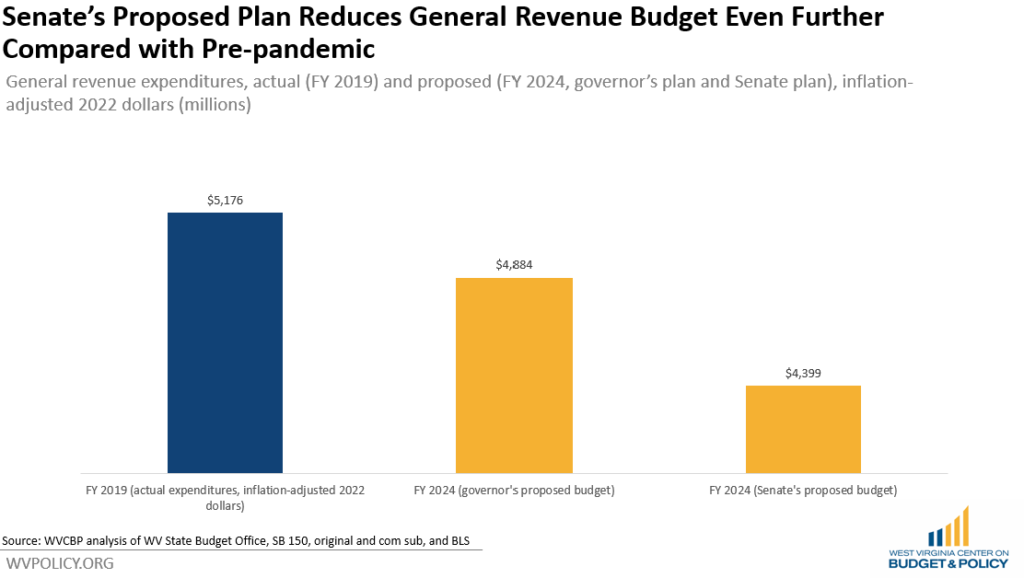

After adjusting for inflation, the Senate’s proposed general revenue budget is $777 million less than FY 2019’s expenditures.

The Senate’s budget cuts $524.6 million from the governor’s proposed base budget and adds $38 million in new proposed spending, coming in at $485 million less than the governor’s proposed general revenue budget. The Senate backfills the $524.6 million in cuts by proposing to pay for it with anticipated FY 2023 surplus dollars. However, the bulk of the spending cuts from the general revenue budget are ongoing, permanent programs that the state will have to find a way to fully fund once the temporary surplus is gone. Under the Senate’s proposed budget, the general revenue appropriation for Medicaid is all but wiped out, going from $264.7 million to $736,428, while the appropriation for Social Services (which is largely foster care) is cut from $224.6 million to $4.6 million. Together, these two cuts account for $484 million of the $524.6 million in General Revenue cuts.

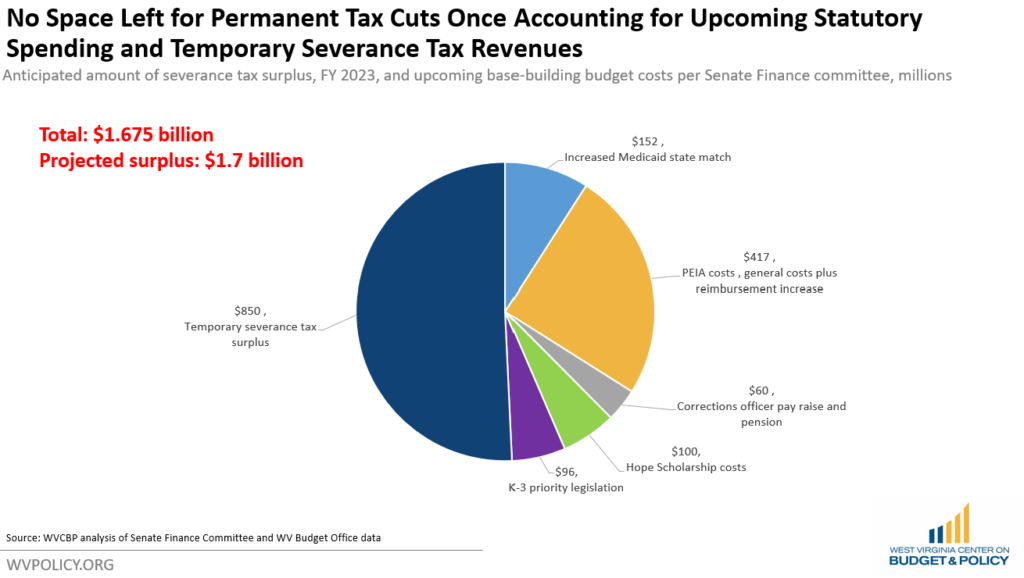

As we’ve highlighted in previous posts, the surplus is largely a mirage built on lowballed revenue estimates and higher than expected natural gas prices, and cannot responsibly be depended on to fund ongoing, permanent expenses.

Both the major reductions in general revenue spending and the reliance on the surplus are to make room in the budget for tax cuts. The income tax reductions in SB 424, would cost $429.6 million when completely phased in. However, the full cost of the bill is much higher. In addition to cuts to the personal income tax, SB 424 offers rebates for personal property taxes paid under the six categories that were considered—and rejected by voters—in Amendment 2. According to the fiscal note from the tax department, it is impossible to estimate the full cost of that provision, but it could approach around $357 million, which would make the full cost of SB 424 over $786 million annually once fully phased in—far greater than the Senate’s self-imposed $600 million tax cut cap.

In addition, since SB 424 contains triggers to further reduce the personal income tax based on sales tax collections, its cost could grow more every year. And again, according to the fiscal note prepared by the tax department, it is unclear when these further reductions would occur, meaning that the $786 million price tag of SB 424 could quickly grow even more expensive. Once the personal income tax is fully eliminated, SB 424 would cost well over $3 billion annually.

While cutting taxes, the Senate’s proposed budget is also adding new spending that grows over time. The Senate budget adds $38.2 million in new spending, most of that coming from the Third Grade Success Act (SB 274), which increases FY 2024 costs by $33.7 million. But the cost of the program increases in the following years, climbing to $96.8 million when fully phased in. This means future budgets will have to accommodate this rising cost, as well as the rising costs of the HOPE Scholarship, PEIA, Medicaid, and other programs, all while revenues are falling as a result of the tax cuts.

As we showed previously, once accounting for new base budget spending from enacted legislation and temporary severance tax revenues, the surplus is gone—leaving no room for permanent tax cuts.

The use of the temporary surplus to pay for ongoing costs to make room for permanent tax cuts is fiscally reckless. The Senate’s budget, along with SB 424, would permanently reduce state revenues and shift tax responsibilities from the wealthy to low- and middle-income West Virginia families. It would also significantly weaken the state’s ability to make new investments desperately needed after years of flat budgets and austerity. There is no permanent fix to PEIA, no boosting funding for higher education, and no way to navigate possible future budget shortfalls caused by even more tax cuts or the inevitable decline in natural gas prices and revenue growth. As misguided and irresponsible as the governor’s/House’s tax plan is, the Senate’s budget and tax plan rely on the same tricks and harm the state in much the same way.