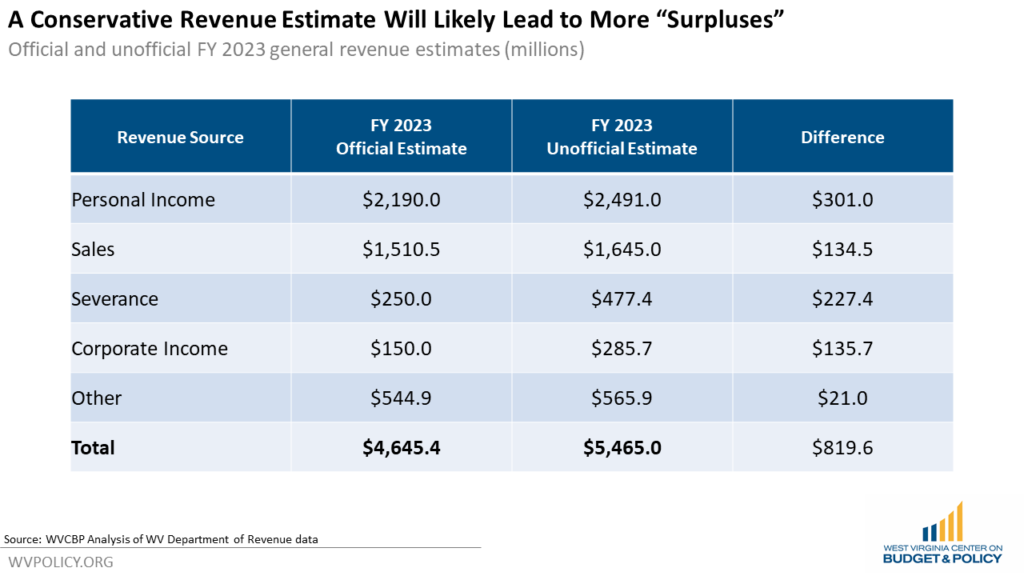

West Virginia is one of very few states where revenue estimates are made by the governor alone. Official revenue estimates determine the total size of the state budget, and lawmakers cannot exceed the official estimates when funding state agencies and programs. Governor Justice’s administration seems to be exploiting that power by setting flat budgets year after year, even as an “unofficial revenue estimate” from the Department of Revenue shows significantly higher expected revenue than the official estimate – a discrepancy of nearly $820 million in FY 2023. Artificially lowering official revenue estimates, and by extension the state budget, takes fiscal authority away from the Legislature, robs citizens of public services they should be receiving commensurate with the taxes they’ve paid, and will likely lead to major acceleration of the tax cuts in HB 4007 if it is ultimately passed.

Last week when debating HB 4007, House Finance Chairman Householder commented that the state is “expecting” a nearly one billion dollar budget surplus in FY 2023. He seemed to be referring to the Department of Revenue’s budget presentation from earlier this session where, for the first time in memory (and maybe ever), they presented both official and unofficial revenue estimates. While the “unofficial revenue estimate” projects over $5.4 billion in state revenue in FY 2023, the “official estimate” – which, again, is the estimate that determines how much legislators can spend on the state budget in a given year – is only $4.645 billion.

Having both an official and unofficial revenue estimate is highly unusual, and it’s hard to imagine why the Department of Revenue chose to provide both this year. Perhaps it is conservatism because of highly unusual and extraordinary trends in tax collections due to the pandemic and federal aid, the political benefit of being able to tout surpluses, or to help accelerate tax cuts. Regardless, the bottom line is clear: an “expected” surplus is not a surplus at all and if revenues are projected to be higher than the “official estimate,” they should be built into the state budget process so that taxpayers receive the services they paid for and lawmakers can assert their constitutional authority to allocate the state’s expected revenues to agencies and services. By failing to include an additional expected $820 million in the state budget, the Justice Administration is tying the hands of legislators while denying state agencies and programs the resources they need.

While the reasoning behind setting artificially low official revenue estimates is unclear, the resulting surplus in FY 2023 will have a perhaps unintended consequence on HB 4007, legislation that would lower and ultimately eliminate the state’s progressive personal income tax. In addition to a 10 percent income tax cut, HB 4007 sets up a Stabilization and Future Economic Reform (SAFER) Fund to enact additional personal income tax cuts in future years. Each year, 50 percent of any revenue surpluses would be diverted from the state’s Rainy Day Fund to the SAFER fund, an account whose funds can only be used to further cut the income tax.

If West Virginia simply meets its “unofficial revenue estimate” of $5.4 billion in Fiscal Year 2023, $410 million (half of the $820 million “expected” surplus) would be placed into the SAFER fund in one year alone, potentially eliminating another 20 percent of the income tax and, with it, nearly 10 percent of the state’s budget each year after that. Artificially low revenue estimates could create a death spiral scenario where legislators are cutting taxes in the name of “surpluses” while the state budget is slashed to the bone. Of note, continuing income tax cuts would overwhelmingly benefit the wealthy. For the average West Virginian, the small tax cut they receive would be dwarfed in comparison to the cuts to public services and programs needed to offset the reduction in income tax revenue.

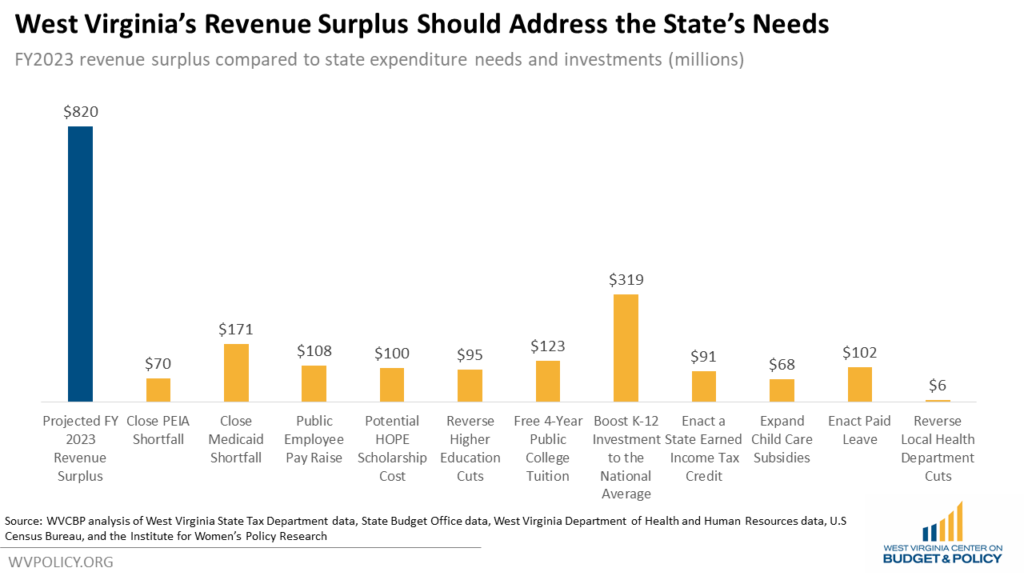

In addition to accelerating proposed income tax cuts in HB 4007, artificially low revenue estimates resulting in a flat budget have real and measurable consequences for public services. They result in lawmakers not having the ability to adequately address current needs or to make new and necessary investments. In the coming years, the state is facing several required expenditure needs that will likely require additional revenue, even if the budget remains “flat.” The state’s Public Employee Health Insurance Agency is facing a $70.2 million deficit in FY 2022, and a total deficit of $185.2 million through FY 2025, even with increasing state employer contributions. And while the state’s Medicaid program is currently enjoying a surplus, that surplus is being used to help balance the the FY 2023 budget, which includes a $108 million public employee pay raise. In FY 2024, Medicaid is projected to face a $171 million deficit, and a total deficit of $649 million through FY 2027. The state will also face $100 million in Hope Scholarship costs if the program is expanded as expected in 2026.

Beyond the state’s looming financial obligations, artificially low revenue estimates prevent the state from making much-needed investments in education, health, and its workforce. With artificially low revenue estimates keeping the budget flat, legislators cannot consider reversing years of cuts to higher education and public health departments. They cannot consider boosting child care subsidies or enacting paid leave. In 2017, per pupil public school spending in West Virginia was $647 below the national average. By 2019 the gap had grown to $1,117. With flat budgets, West Virginia’s investment in K-12 education will continue to fall behind, while the state will also be unable to make higher education more affordable. When so many needs remained unaddressed, what good is it to have a surplus – particularly one that creates a false sense of prosperity?