Senator Joe Manchin sits at the center of the Build Back Better Act negotiations currently taking place in Washington. The WVCBP strongly urges him to recognize the urgency of our state’s needs and move quickly to support workers and families in West Virginia.

We agree that Congress must pass the bipartisan infrastructure bill, but we know our needs extend beyond investments in our roads and bridges. That’s why we believe Congress must pass both the Bipartisan Infrastructure Framework and the Build Back Better Act.

The urgent moment is now. To truly meet the needs of West Virginians, we are calling on Senator Manchin to help bring together a targeted, responsible reconciliation package that will:

Read our full statement here.

And for more on how the Build Back Better Act targets some of the exact issues West Virginia has long struggled to adequately address, check out this recent article with insight from WVCBP executive director Kelly Allen.

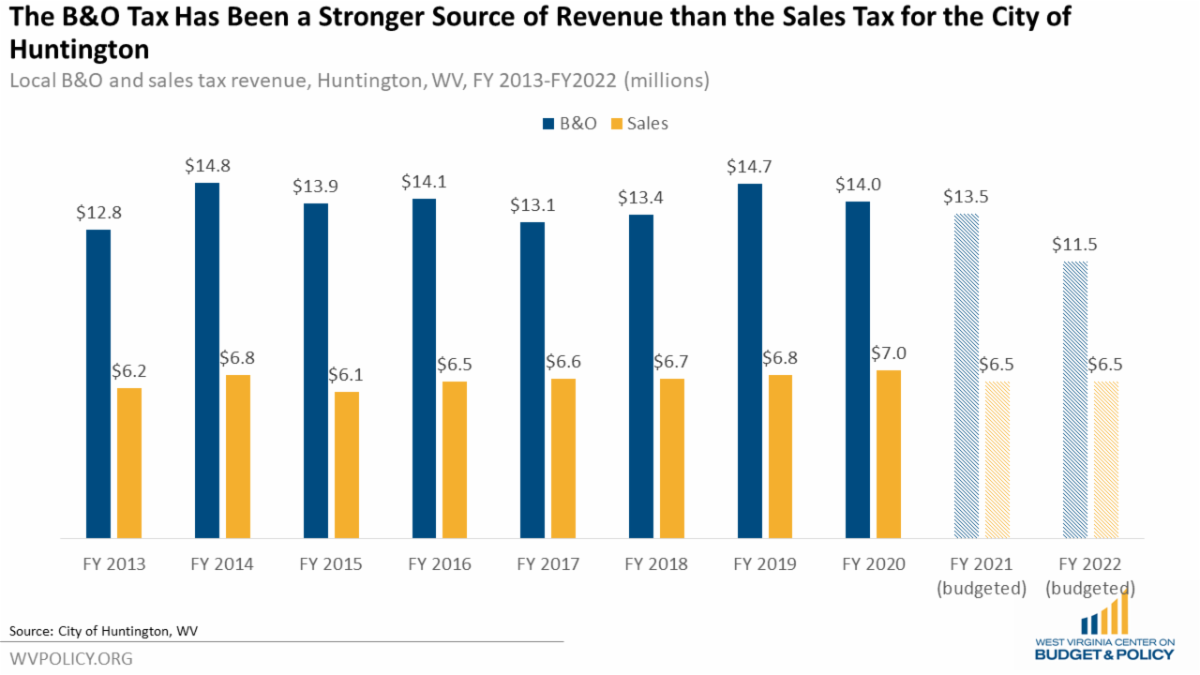

The city of Huntington voted earlier this month to eliminate the city’s Business and Occupation (B&O) tax for restaurants and retailers, which is expected to result in an annual revenue loss of $2 million. The city is hopeful that the revenue loss will be offset by increased local sales tax revenue. However, this is a regressive and possibly short-sighted decision for numerous reasons. In addition to shifting tax responsibility away from businesses and onto consumers, current increased levels of sales tax revenue may not last and other threats to local revenue from the state legislature are on the horizon.

The legislature passed House Joint Resolution 3 last session, creating a ballot measure that would allow the legislature to eliminate up to $378 million in local property tax revenue. Municipal governments account for 6.7 percent of all property tax revenue collections in the state, meaning cities could lose over $25 million if the ballot measure is successful. This would create additional strains on local government finances just as they are recovering from the pandemic, even before these municipalities cut any taxes of their own.

Read Sean’s full blog post here.

Join us for our 9th annual Budget Breakfast!

Each year, the WVCBP holds this event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our chosen keynote speaker, to be announced closer to the event.

Please find further event details below. You can purchase a ticket for the event here.

WHAT: WVCBP’s 9th Annual Budget Breakfast

WHEN: January 21, 2022. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2023 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

WHO:

PLEASE NOTE: The cost of a single standard ticket is $50, but if you take advantage of our Early Bird Special (available to all who register by 12/31/21), you will receive $10 off.

We appreciate your support of the WVCBP and our work, and we hope to see you in January!

West Virginia faces a pivotal moment as we begin to emerge and recover from the COVID-19 pandemic and recession. While the pandemic brought many of its own unique challenges that have been addressed by prompt local, state, and government action, an important takeaway that was highlighted during the pandemic was that there are also longstanding, structural challenges to the economic mobility and well-being of our people — challenges that the pandemic did not cause. For that reason, simply returning to the pre-pandemic economy and system is not an option. In order to move our state forward and create a West Virginia that allows all in the state to thrive, we must implement policies that ensure everyone can achieve shared prosperity with the resources needed to balance work, care for family, feel a sense of community, and meet their basic needs.

Earlier this summer, the WVCBP released our Blueprint for an Equitable Economic Recovery. This week we highlighted the tax and budget recommendations included in that report to ensure that all West Virginia families can thrive.

Read the full report here.

To get a sense of a state’s values, one often need look no further than its tax system.What a state spends its tax dollars on and how it acquires those tax dollars typically reveals a lot about the priorities of its people — what they care about and what they stand for. In theory, it’s a direct reflection of their collective values.

And in West Virginia, we’ve seen perennial efforts to shift who pays taxes from the highest-income earners and corporations onto low- and middle-income families. Over the past two decades, state taxes paid by individuals and families increased while taxes paid by businesses declined. At the same time, low- and middle-income families have been paying a greater share of their income in taxes than wealthier West Virginians. This has coincided with either flat or less investment in the public programs and services that benefit us all.

This week, we hosted a webinar that dove into West Virginia’s tax system, who pays, and how we can protect current programs and services while growing the pie for everyone. You can view the recording here (Access Passcode: bHUn.5GC).

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.

Earlier this year, our federal policymakers sent money to families so people can pay their rent and put food on the table, helped school districts protect teachers’ health and get kids back into the classroom, and boosted vaccine distribution—all of which will help accelerate our economy and address the immediate health and economic impacts of the pandemic.

Congress acted because we raised our voices together and demanded help. With short-term relief on the way, now Senator Manchin and Senator Capito need to look to our future and pass economic recovery legislation that ensures everyone can thrive, no matter what we look like or where we come from.

Our elected officials are drafting recovery legislation now, so it’s time to make yourself heard again. Tell them you want our government to support working families and invest in our economic recovery by making health care coverage more available and affordable, permanently expanding relief for struggling people, and ensuring children get the support they need to succeed.

Please join us in urging Senators Manchin and Capito to support the Build Back Better recovery agenda by sending them a letter here.