Lots of action happened at the Capitol this week as we hit day 50, known as Crossover Day. Bills (other than the budget) must pass out of their originating chamber by day 50, otherwise they are dead for the year.

Here’s what we were watching this week:

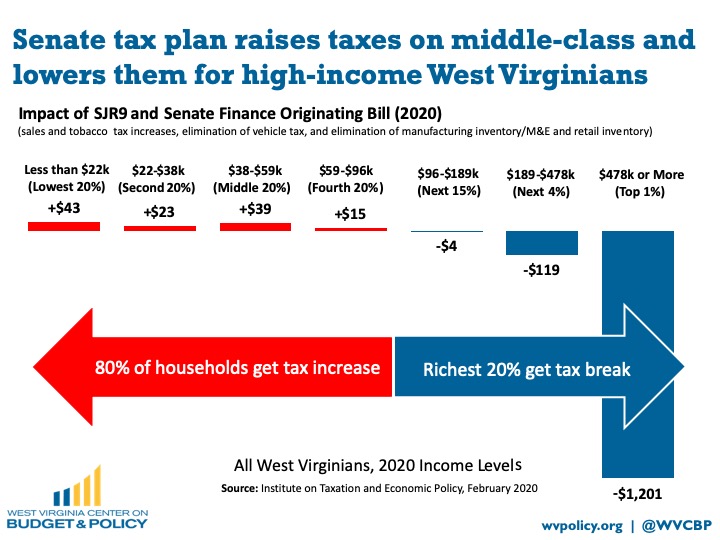

SJR 9 + SB 837 This week the Senate voted on its two-pronged proposal to eliminate the business personal property tax on machinery and equipment. SJR 9 would have amended the state’s constitution and given future legislatures a “blank check” ability to eliminate the personal property tax, thereby taking taxing authority away from counties and local governments, who use funds raised from the personal property tax to pay for public services like police and fire protection, public school funding, and other local needs.

SB 837 was the proposal itself that would have been enacted once the constitutional amendment was passed. It would have eliminated the property tax on machinery and equipment, largely to the benefit of manufacturers and out-of-state corporations. As a sweetener, or more accurately a red herring, it also eliminated the personal property tax on vehicles. To offset these cuts, SB 837 raised the sales tax by .5 percent and increased the tax on tobacco and vaping products.

Altogether, the proposal would have raised taxes on 80 percent of West Virginians and made our tax system even less fair and equitable. Read more in Sean’s blog post.

Fortunately, the proposal did not gain the needed 2/3 support of the Senate and was defeated, as a bipartisan group of members voted no.

SB 528 The Uniform Worker Classification Act and an ALEC-model bill, SB 528, passed the Senate on Monday and now heads to the House. If enacted, this bill would allow employers to misclassify workers as independent contractors, allowing them to skirt wage and overtime laws, the Human Rights Act, and workers’ comp and unemployment rights. SB 528 would take West Virginia in the wrong direction. We should be protecting worker safety and discouraging wage theft. If enacted, this would be the most extreme worker misclassification law in the country.

Read more in Ted’s blog post.

SB 648 This week also saw the overwhelming Senate passage of SB 648, to provide dental benefits to Medicaid-enrolled adults. Over 300,000 West Virginians for whom dental care is currently out of reach would benefit from this bill. The state is likely to see cost-savings from reduced emergency department utilization and improved health outcomes. SB 648 now heads to the House for consideration.

Take action today by urging your legislators to support this bill.

Multiple industry tax breaks A flurry of industry tax breaks, HB 4019, 4439, and 4421, all passed the house this week. HB 4439 would allow coal companies “to decrease their total coal production and total coal employment in the state and still claim rebate tax credits for increased coal production at the same time”.

HBs 4019 and 4421 are both tax breaks for natural gas producers and storers, which put future state and local revenues at risk.

Read more from Ted on all three bills.

With Crossover Day behind us and most major pieces of legislation in place, the Senate began work on the FY 2021 budget this week, presenting its version of the budget bill in the Senate Finance Committee.

The Senate has made a number of changes to the governor’s proposed budget, both on the revenue and spending side, and reflecting bills that have passed the Senate.

Since the Senate reduced revenue by $12.4 million, and increased spending by $33.4 million, the Senate also has to make some cuts to the governor’s budget proposal. And cut they have, taking the budget knife to many of the governor’s proposed spending increases, including cutting $10.5 million from the governor’s Jobs and Hope initiatives, $4 million from his tourism increases, and $10 million from the governor’s proposal to clear the Intellectual/Developmental Disabilities Waiver wait list.

Read more in Sean’s blog post.

Last week the House overwhelmingly passed HB 4543. This bill would help many diabetic West Virginians by capping the amount private insurers can charge for copays on life-saving insulin at $25 per month.

Now we need your help making sure that the bill gets through the Senate in time for consideration prior to the end of the legislative session. Please contact members of the Senate Banking and Insurance committee and ask them to consider and support this important bill. In particular, Chairman Michael Azinger can be reached at 304-357-7970 and Vice Chair Charles Clements can be reached at 304-357-7827.

We are looking for a research associate for the summer of 2020. Our summer research associate will work closely with WVCBP staff, coalition partners, and other stakeholders to collect and analyze data to provide evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians. If interested, please submit your application package by Friday, March 13.

Read more here.

Registration is now open for this year’s Summer Policy Institute! Join us at Fairmont State University this July for a great weekend of policy discussion and networking!