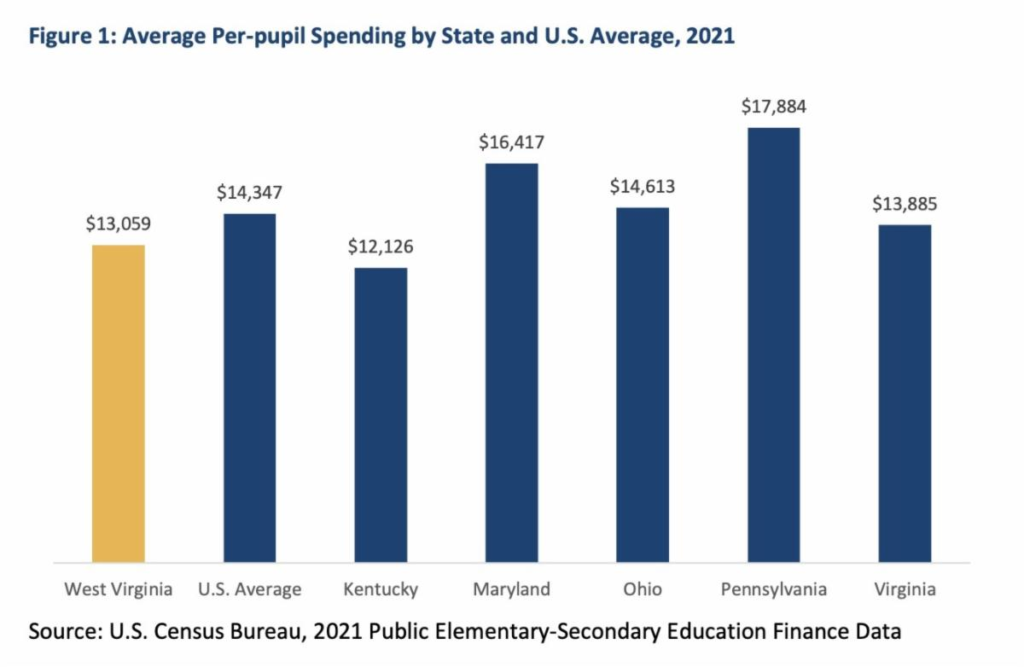

The vast majority of school-age children in West Virginia attend and receive their education through the public school system, and West Virginia’s state constitution requires “a thorough and efficient system of free schools.” But a growing Hope Scholarship voucher program is diverting public resources away from the public education system and the nearly 250,000 children served by it, with little oversight and no public accountability measures.

A new analysis from the WVCBP provides the first in-depth look at the harmful impacts of diverting taxpayer dollars away from the public education system to unaccountable private schools. Statewide, public school districts will lose an estimated $21.6 million in state aid funding for the 2024-25 school year, including funding for approximately 364 staff: 301 professional educators and 63 school service personnel. These costs come even before an eligibility expansion goes into effect that would extend eligibility to families who already send their children to private schools or home school; this expansion is expected to quintuple the annual cost of the program.

The brief also examines the lack of necessary oversight and public reporting on the Hope Scholarship, making it impossible for parents, citizens, and policymakers to assess the impacts of the program on student achievement. Currently the program has no cost or enrollment caps, no income eligibility limits, and requires no public accountability through collection and publication of program data.

“Around the state, school districts are already warning that reductions in state funding due to the Hope Scholarship are resulting in fewer resources for our public school students, including the loss of teacher and school service personnel positions. Every dollar spent on voucher programs comes at the cost of other priorities, including our constitutionally-required public education system,” said Kelly Allen, brief author and executive director of the Center.

“Lawmakers must halt further expansion of the Hope Scholarship and implement public reporting and accountability measures before expending more resources on an unproven and potentially harmful program,” Allen continued.

Key Findings

You can read the full brief here.

WVCBP executive director, Kelly Allen, recently published an op-ed detailing the need for the governor’s administration to return to the long-held practice of providing a six-year financial plan as part of the annual budget package to allow lawmakers to make informed and responsible fiscal decisions. Read the op-ed below:

The only thing West Virginia lawmakers are constitutionally required to do during the Legislature’s regular session is to pass a state budget for the ensuing fiscal year. But responsible stewardship requires looking beyond just the next year to ensure the state is on a sustainable fiscal path, as elected officials make decisions that will affect revenue and the budget for years to come.

While, in recent decades, West Virginia has consistently utilized a long-range budget assessment known as a “six year financial plan,” such a plan has not been produced for the past three years, with no reasonable explanation as to why.

Over that period, lawmakers have made significant, sweeping changes to the state’s tax system and passed broad new programs with large price tags — all without the benefit of a long-term fiscal forecast. It is imperative that, when lawmakers come back to the Capitol in January, their budget package includes a six-year financial plan to help strengthen their fiscal stewardship of the government.

Historically, the executive branch has led development of the six-year financial plan, which is logical because the governor’s administration determines the annual budget that is presented to the Legislature based on the reported spending needs of the various state agencies. Put simply, the executive has ready access to the folks in each agency who can let them know what their budget needs will look like in upcoming years.

That long-range budget planning has been included in each Executive Budget dating back as far as the West Virginia Budget Office’s archive allows you to look (currently fiscal year 2007). The six-year financial plan contained expected revenue, as well as anticipated growth in existing programs, over the next several years. Taken together, lawmakers could see where any anticipated deficits or surpluses existed and plan accordingly.

For example, they could see how much PEIA, Medicaid and retirement costs were anticipated to grow in future years. This helped with planning as they considered new legislation that had ongoing costs. If a deficit was anticipated the following year just from funding existing programs, lawmakers knew they would likely either need to raise taxes or make cuts if they had a new program they wanted to pass. On the other hand, if more revenue than expenditures was expected to come in, they could spend a bit more.

According to the executive budget package from fiscal 2021, “the goal of the ‘Six Year Financial Plan’ is to provide the West Virginia Legislature and citizens a clear understanding of not only the FY 2021 budget, but also the larger, long-term implications of the decisions made today on the state’s future fiscal outlook.”

Earlier this month, Pew Charitable Trusts released a report about sustainable state budgeting. In its West Virginia fact sheet, it commends West Virginia for being one of 20 states to publish a long-term budget assessment, but pointed out that “the three editions of the governor’s budget report released since fiscal 2021 have not included the six-year plan” and that “legislators, journalists and researchers have mourned the loss of the six-year plan which they considered a valuable tool for assessing long-term fiscal health.”

Pew concluded with a recommendation that West Virginia reintroduce the six-year plan into the budgeting process, even if that means tapping a different agency or a legislative office to produce the analysis. Pew also suggests that the state could use ranges for revenue and spending to show a spectrum of plausible outcomes, rather than exact estimates if that has become too onerous. Further, it suggests budget stress testing as a best practice for sustainable budgeting.

Since the last six-year plan was made available, the Legislature has made numerous decisions that affect the base budget and revenue going forward — from tax cuts to creation of the Hope Scholarship and significant PEIA changes.

It is more imperative than ever that lawmakers and the public call on the governor’s administration to bring back the six-year financial plan, particularly ahead of any future triggers that will further reduce revenue with additional income tax cuts.

As the 2024 legislative session approaches, the West Virginia Center on Budget and Policy staff would like to invite you to join us at our inaugural Budget and Bites Happy Hour, taking place on January 17, 2024.

For the past 10 years, the WVCBP has hosted our annual Budget Breakfast to provide analysis of the Governor’s proposed budget. Don’t fret—we’ll still provide our budget analysis at Budget and Bites, but we wanted to evolve our event into something more informal and fun. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and have the opportunity to engage with the rest of the WVCBP team.

Please find further event details below. You can register for the event here. Please note, RSVP is required.

WHEN: January 17, 2024 from 4:30-6:00pm.

WHAT: At 5:00pm, executive director Kelly Allen will introduce senior policy analyst Sean O’Leary, who will give a short analysis of the Governor’s proposed budget. Guests can ask questions and enjoy an informal meet and greet with the rest of the WVCBP team following the presentation. Appetizers and drinks will be provided.

WHERE: West Virginia School Service Personnel Association Conference Center (1610 Washington St. E., Charleston, WV 25311)

PLEASE NOTE: The cost of a single standard ticket is $50, but if you take advantage of our Early Bird Special (available to all who register by 12/31/23), you will receive $10 off.

We appreciate your ongoing support of the WVCBP and we hope you can join us at next year’s event!

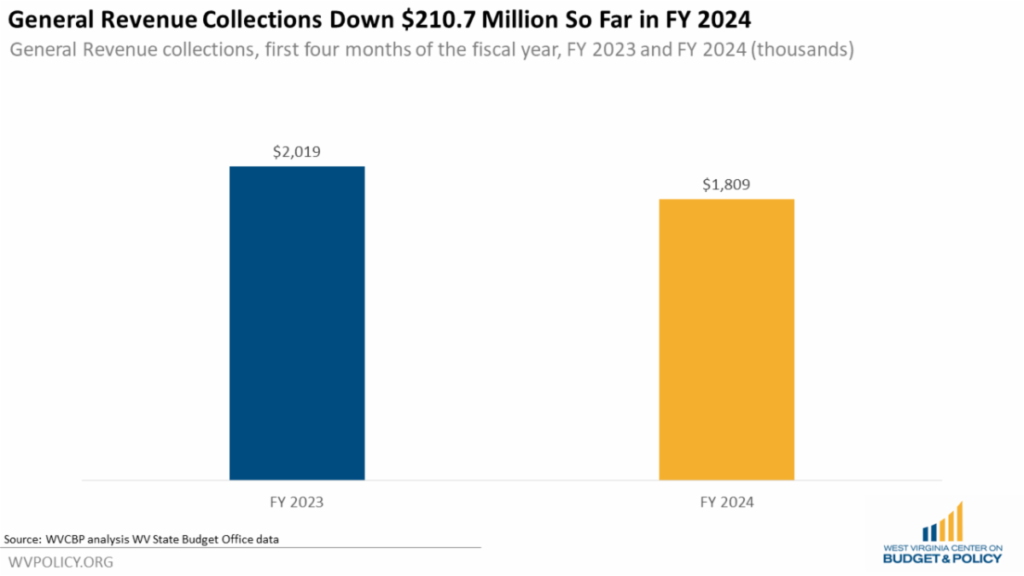

Governor Justice continues to tout the revenue “surplus” resulting from his administration’s artificially low revenue estimates, but comparing this fiscal year’s revenue collections to last year’s reveals the truth: revenue collections are on the decline. A recent article, featuring insight from WVCBP executive director, Kelly Allen, and WVCBP senior policy analyst, Sean O’Leary, provides further details. Excerpt below:

West Virginia’s revenue collections for November were $404.8 million, $44 million above estimates, according to a monthly budget report released by Gov. Jim Justice. Fiscal year-to-date collection from July to November stands at $2.2 billion, exceeding estimates by $286.2 million.

However, when comparing November’s actual tax collection to the same month last year, the report showed several categories on a downward trend.

The $404.8 million collected in November, while above Justice administration estimates, was actually $75.4 million less than what was collected in November 2022, when the state brought in $480.2 million.

The same was true for year-to-date collection. While the $2.2 billion reported exceeded estimates by $286 million, it was actually down by the same amount, $286 million, from the the previous year. West Virginia’s year-to-date revenue at this point in 2022 was $2.5 billion.

The personal income tax collection is of particular note, as it likely will continue to be affected by the historic cut enacted in 2023 by the Justice administration and the West Virginia Legislature.

November’s personal income tax collection was $140.7 million, $9.3 million above estimate. However, the report shows collection in that category also was down from last year, when the state collected $158.9 million.

From July to November, the state has collected $937.5 million in personal income taxes, which is $130.7 above the Justice administration’s estimate. That total is down from last year’s collection of $982.2 million during the same time frame.

November’s corporation net income tax collection of $9.5 million was $6.5 million above estimate. But that amount was still less than the $11.8 million collected in November 2022.

Severance tax collection saw the most significant decrease. The state collected $41.3 million in November, which was $8.9 million above estimate but below the $112.3 million collected during the November 2022.

Year-to-date figures for severance taxes also show a significant drop. From July to November, the state collected $76.2 million, a $377 million — or 83% — decrease over the $453.5 million collected during the same period last year.

Kelly Allen, director of the West Virginia Center on Budget & Policy, an independent think tank, said it’s concerning to see the state’s actual budget gap approaching $300 million while the governor touts exceeded estimates.

In West Virginia, the governor has the ability to base the state budget on revenue estimates determined by his own administration. For the past several years, Allen said, the Justice administration has created flat budgets based on artificially low estimates.

When the government brings in more than the estimate, she said, the difference is labeled a “surplus.”

“For just about anyone else, a surplus means all of our bills are paid and we have money left over,” she said.

State leaders used the “surplus” to support the personal income tax reduction, along with revenue that was artificially booming because of inflation, increased severance tax revenue driven by high natural gas prices and an influx of COVID-19 relief funding, Center on Budget & Policy analyst Sean O’Leary said.

“Since the revenue estimates are again artificially lowballed to force a flat budget, exceeding the estimates tells us very little about the state’s revenue situation,” O’Leary said.

Comparing current data to last year’s numbers is a better indicator of whether the state is making progress or not, O’Leary said. Looking at those numbers, he said, it’s clear that personal income tax revenue is falling behind and severance tax numbers are reflecting the result of the volatile boom/bust energy cycle.

“West Virginia was bailed out by high natural gas prices last year, with the severance tax accounting for almost half of the ‘surplus.’ That cushion is no longer there,” O’Leary said.

State agencies and services are likely to remain underfunded in coming years as a result of the administration’s use of flat budgets, Allen said.

“It’s hard for me to see a surplus when I see so many needs in public agencies across the state that have been ignored or punted down the road to create the illusion that we could afford these tax cuts,” she said.

Read the full article here.

Read Sean’s blog post on West Virginia’s growing revenue gap here.

West Virginia’s regional jail system has been under fire recently, facing a host of issues including overcrowding, extraordinarily high death rates, and numerous lawsuits related to abuse and deplorable conditions. A recent article, including insight from the WVCBP’s criminal legal policy analyst, Sara Whitaker, details ways lawmakers can begin to address some of the issues plaguing the system. Excerpt below:

In just the past four years, 85 people have died in custody, more than a quarter of them at the Southern Regional Jail alone. Overcrowding has led to lawsuits that allege people are sleeping in puddles of water on concrete floors and peeing in showers due to lack of commodes. And in October, a federal judge blasted jail officials for intentionally destroying jail records that could have factored into a class action lawsuit.

After a rapid fire special session in August secured pay raises for correctional officers and money to fix basic things — like water lines and locks on cell doors — lawmakers still have a ways to go to address issues. Come January, they’ll have the opportunity to take another whack at the problem. Here’s what some experts and advocates say could help the system.

1. Commissioning a study to identify the problems

The first step towards solving any problem is clearly defining what it is, according to Danny Murphy, West Virginia director for the conservative think tank Right on Crime.

Murphy, a former federal prosecutor and military officer, said his group supports “evidenced-based solutions,” but those rely on lawmakers first undertaking a full study of the system.

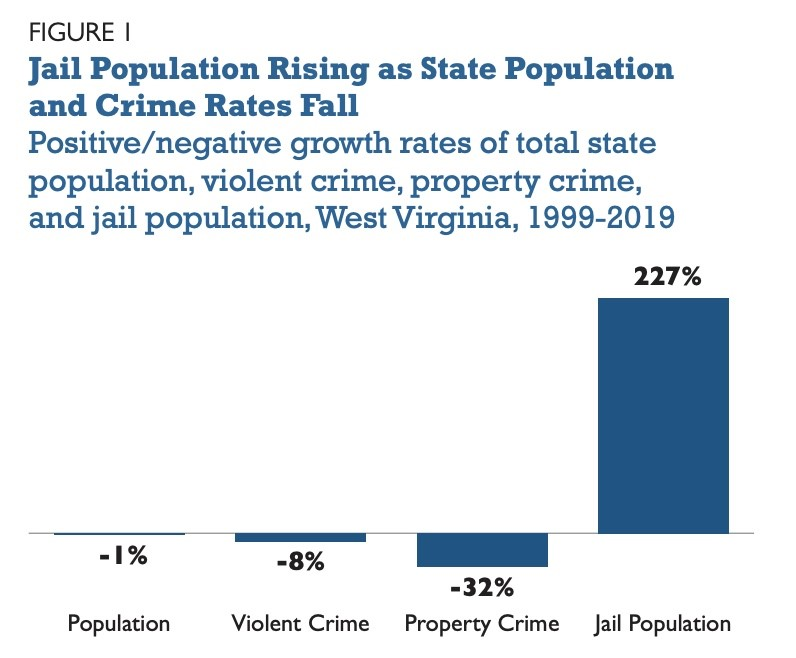

He pointed to a study conducted by Michigan as a good model for West Virginia to follow. Through examining a decade of arrest data, Michigan lawmakers learned jail populations steadily rose, while crime rates fell in that state. Bench warrants were one of the main drivers.

The end result was a package of bipartisan bills that addressed alternatives to arrest, community supervision, bench warrants and how low level traffic infractions are handled.

Murphy said commissioning a study would be a good first step for the Legislature.

2. Treating substance abuse behind bars

Nationally, an estimated 65% of people in jails and prisons struggle with substance abuse. And increasingly, making sure people behind bars receive treatment for their addiction is seen as a way to help them return to being productive members of society.

A focus on treatment was one of the keys to turning the Boyd County Jail in Kentucky around. A few years ago, the jail was under federal investigation following a few years marked by escapes, a riot and the killing of a man in custody.

Today, those problems are well in the rearview mirror — the federal government even contracts with the jail to hold federal inmates. Part of that was Boyd County Jailer Bill Hensley tapping into state resources to institute multiple programs to assist inmates who suffer from drug addiction.

Joanna Vance, program coordinator for the American Friends Service Committee in Charleston, has long advocated for reform in corrections. She said emphasizing drug treatment behind bars — even if it’s just a short stay at the regional — goes a long way in reducing recidivism.

Lawmakers could put more funding towards evidence-based treatment behind bars, such as medication-assisted treatment and peer support specialists who have been through both addiction and the jail system.

3. Issuing ID cards to ease transitions

Those on the outside might not pay it too much mind, but a driver’s license isn’t just for getting behind the wheel or buying a pack of cigarettes.

It’s literally the backbone of being able to function in daily society — everything from jobs to housing to safety resources are contingent on producing a valid form of identification.

And for folks in and out of the jail system, Vance said a lack of ID is a huge barrier for the services they need to successfully reintegrate into society. It becomes a Kafkaesque journey — to get an ID, they need an address, to get an address, they need an ID.

To help people transition out of West Virginia’s jail system, reenter society and lessen the chances of reoffending, lawmakers could have state officials come to facilities to issue identification cards for those who need one, according to Sara Whitaker, criminal justice analyst with the West Virginia Center on Budget and Policy.

While a law passed in the August special session takes a step in that direction — it allows state prison IDs to be used to get an ID from the DMV — it doesn’t address the problem for people who have only been to jail and not prison.

4. Pumping up the funding

Attorney Stephen New, who is in the midst of settling a case against the Southern Regional Jail for deplorable conditions found in 2022, said the simplest — and most effective fix — is putting more money into the system. One recent example of money solving problems, he said, is that since lawmakers raised correctional officers’ salaries in August, the Department of Corrections and Rehabilitation has been able to hire more than 220 new officers.

But Elaine Harris, representative for the Communication Workers of America District 213 — which represents correctional officers in the state — warned that premium hikes to the state’s public employee health insurance will effectively zero out the raises next year.

With a 24% rise in PEIA premiums this year, accompanied by an extra charge if a married state employee’s spouse qualifies for health insurance through other employment, the rise in take home pay for new correctional officers has only worked out to about $150 extra a check. And PEIA is considering another hike next year.

Harris said one way lawmakers could keep the gains seen in correctional officer hiring is by addressing the rise in PEIA premiums through either subsidies to the system or additional raises for state employees.

5. Using citations to keep minor offenders out of jail

Finding ways to prevent jail from being the de facto option could greatly reduce the strain on the system, according to Deborah Ujevich, interim director of West Virginia Family of Convicted People.

According to the 2022 annual report of the state Division of Corrections and Rehabilitation, four out of five of the top charges for admissions were non-violent — bench warrants, simple possession of drugs, obstruction and fugitive warrants. Ujevich said relying more on citations — essentially tickets — for misdemeanors like trespassing could help keep minor offenders out of jail in the first place.

So lawmakers could, like their counterparts in Michigan, amend state code to allow for summons to be issued to court like speeding tickets.

But Whitaker warned that could backfire, by leading police officers to overcharge people to make sure they go to jail. For instance, a case of simple possession of heroin could be turned into a “possession with intent to deliver” case in order to get somebody off the street, even if the charge doesn’t stick over the long run.

A way to avoid that is making it harder for folks to go to jail pretrial. Whitaker said one way to do that is by having a lawyer on hand when bond is set, which could help keep low-level offenders out.

6. Implementing bail reform in West Virginia

About four out of five people being held pretrial in West Virginia are charged with felonies, according to Whitaker, meaning any bail reform has to address felonies.

She pointed to a 2020 reform to the law which required all cases, including felonies, to have a mandatory bail review date three days after an initial appearance.

Whitaker said the law put a dent in the jail population, but lawmakers rolled it back the following year by clarifying the rule was only for select misdemeanors.

Reinstating the 2020 version of the law would be one step the Legislature could take to reduce the number of people going into jail, Whitaker said.

Another option would be to eliminate cash bonds entirely, replacing the system of bondsmen with expanded electronic monitoring and regular drug tests.

This idea is picking up steam in other jurisdictions across the country; in 2017, New Jersey got rid of bonds in most cases and in September, Illinois banned the practice outright. The Cook County Jail in Chicago — which holds roughly the same amount of people as the entire West Virginia regional jail system — saw a 12% drop in its jail population compared to the year prior within a month after the ban.

Read the full article here.

The third annual West Virginia Black Policy Day, hosted by Black by God The West Virginian and the West Virginia Black Voter Impact Initiative, is scheduled for February 7, 2024. In addition, the event organizers are offering a series of educational webinars leading up to the event.

October’s webinar provided valuable insights about Legislative Interims and Black infant and maternal health policies, November’s webinar gave a preview of the 2024 Black Policy Agenda, and December’s webinar detailed how Black Policy Day continues the legacies of African American organizations working in the pursuit of change.

You can watch the October webinar recording here, the November webinar recording here, and the December webinar recording here.

You can register for next month’s webinar (taking place on January 16 at 7pm) here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.