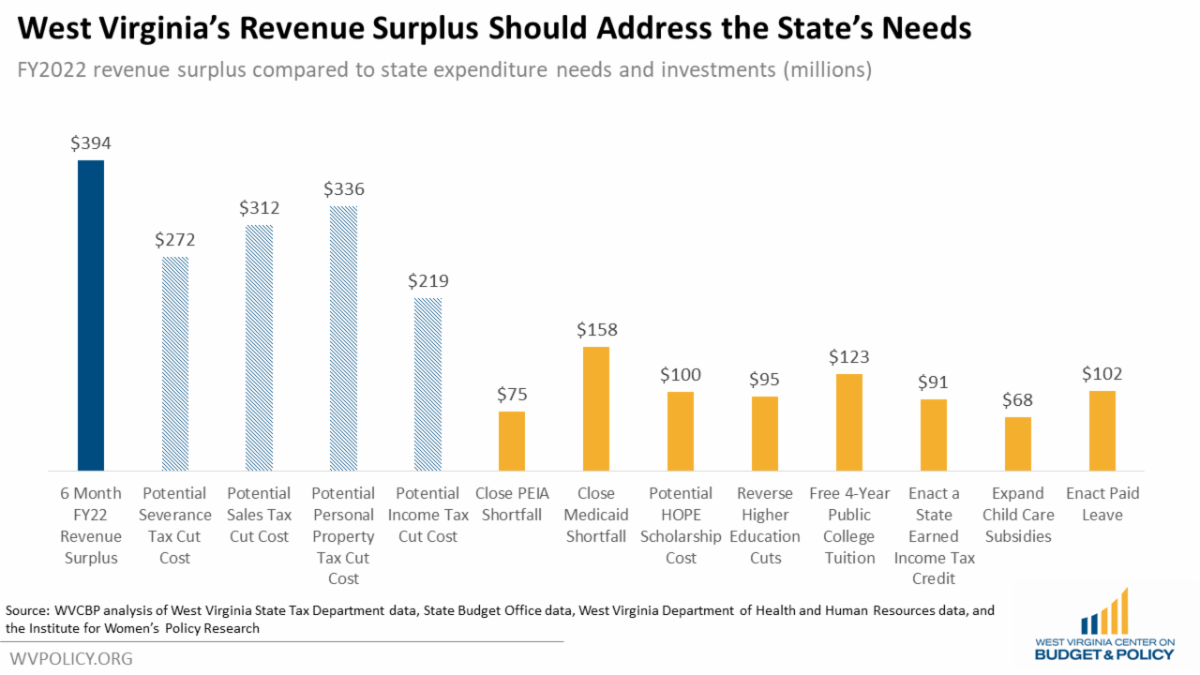

Earlier this month, Governor Justice released his FY 2023 budget proposal. Once again, the governor is proposing a relatively “flat” budget with few changes from the previous year. However, like with the FY 2022 budget, low revenue estimates and lack of a six-year plan are complicating the budget picture, preventing investments in the state’s needs, and will likely generate misleading revenue “surpluses.”

The FY 2023 official revenue estimates are likely overly conservative. And of note, state legislators cannot exceed the governor’s revenue estimates when crafting their versions of the state budget. So while a low revenue estimate can be used to manufacture headline grabbing “surpluses,” legislators are unable to make new investments in education, health, families, and workers, and instead are left with “flat” budgets that do not address the state’s needs.

Further complicating the picture is the lack of a six-year plan in the governor’s budget proposal. The six-year plan would outline spending plans for future years and is an essential tool for identifying future needs and structural issues within the budget. Despite the lack of critical information on future needs from the six-year plan, and with low revenue estimates creating the facade of fiscal strength, legislators have already targeted the FY 2022 surplus to pay for a variety of tax cuts, including cuts to the severance tax, sales tax, and personal income tax. This could spell trouble for West Virginia’s financial future.

Artificially inflating the revenue surplus with low revenue estimates while neglecting the state’s needs in order to justify tax cuts is not a sound fiscal strategy, and West Virginia workers and families deserve better.

Read Sean’s full blog post here.

Learn more about the proposed sales tax cut here.

The WVCBP is hiring!

We are currently accepting applications for two positions, criminal justice policy analyst and summer policy associate. Applications for both positions will be accepted through Wednesday, February 16. You can find further details here.

Criminal Justice Policy Analyst

The WVCBP is seeking a criminal justice policy analyst to assess the state’s current criminal justice landscape and the impacts of potential reforms. The criminal justice policy analyst plays a crucial role in conducting data-driven research and analysis, educating stakeholders including members of the public and elected officials, and advocating for policy reforms to advance equity, safety, and shared prosperity for all West Virginians.

You can find the full job description here.

Summer Policy Associate

The WVCBP seeks a summer policy associate for an internship to work on issues associated with our research and advocacy priorities. Our summer policy associate works closely with WVCBP staff, coalition partners, and stakeholders in an immersive experience involving research on/advocacy for evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians.

The WVCBP internship program’s mission is to partner our organization with highly motivated undergraduate and graduate students committed to building shared prosperity through policy change. Our internship program prepares students for potential employment in the non-profit policy world by training them to conduct rigorous data and policy analysis or outreach and advocacy while developing effective communications strategies.

You can find the full job description here.

While no bill has been introduced yet, there has been talk amongst West Virginia legislators to — yet again — cut the state’s already low severance tax. This would prove costly and harmful to our state budget.

An additional severance tax cut would largely serve out-of-state corporations and would mean West Virginia could miss out on hundreds of millions of much needed new revenue that it could otherwise use to address outstanding needs or make new — and necessary — investments.

West Virginia’s natural resources are finite, and West Virginians deserve to benefit from their extraction.

Learn more in Sean’s blog post or in our educational video.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) stopped being distributed.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here or in an article featuring our data here.

Find guidance on how to collect the remainder of your Child Tax Credit payment here.

During the legislative special session convened by Governor Justice in early January, the West Virginia Legislature passed a massive corporate incentive package, despite ample academic research and numerous examples from the state’s own history indicating that these sorts of economic development subsidies largely fail to achieve their goals. As a result, over $300 million in American Rescue Act Funds — intended to provide relief to workers and families as pandemic hardship continues — will instead be diverted to fund tax breaks for wealthy companies, primarily the Nucor Corporation. Last week, a Mountain State Spotlight article revealed that the report provided to legislators detailing the projected economic impact of the legislation was rushed and likely overstated the economic benefits of the deal. This week, a MarketWatch article, featuring comment from WVCBP executive director Kelly Allen, provided further details on the deal and insight into why policy experts from multiple states are concerned. Excerpt below:

West Virginia taxpayers will pay $1.7 billion to attract a profitable steel company to a corner of the state where workers from Ohio and Kentucky may also be employed, thanks to what some observers call a hurried deal struck in a special session of the legislature in January.

The deal includes $1.35 billion in tax credits over several years and $315 million in cash to match the company’s investments in infrastructure. The company in question is steelmaker Nucor, who issued a press release in December calling 2021 “the most profitable year in Nucor’s history,” and alerting Wall Street to expect “the highest quarterly earnings in Nucor’s history” for the fourth quarter. Meanwhile, Mason County, home of the proposed plant, has an unemployment rate of 2.7%, the lowest on record.

Nucor did not respond to a request for comment.

As the numbers come out, what may be more shocking about the deal is the way several state advocacy groups have banded together to express concern about it.

“In this case, West Virginia taxpayers are on the hook, while Kentucky and Ohio will see a substantial portion of any economic and tax-revenue benefits – although research shows these deals rarely produce their promised value to local communities,” said Kelly Allen of the West Virginia Center on Budget and Policy, in a release.

Read the full article here.

Last Friday, the WVCBP hosted our ninth annual Budget Breakfast! Our senior policy analyst, Sean O’Leary, provided his analysis of Governor Justice’s 2023 proposed budget, and keynote speaker, Brian Elderbroom of Justice Reform Strategies, presented on how West Virginia can improve community supervision practices to safely address the state’s current incarceration crisis.

If you couldn’t join us last week, you can find the event recording here, the link to the presentation slides here, and Brian’s recent brief on improving community supervision in the Mountain State here.

You can find media coverage of our event here and here.

Many thanks to those who joined us live and our sincere gratitude to this year’s incredible event sponsors!

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.