On Monday, the Governor announced that some state agencies will have to reduce their budgets by 7.5 percent next year to make way for a projected budget gap in the FY 2013-14 budget that begins on July 1, 2013. Left untouched by the budget cuts are the school-aid formula, corrections programs, the legislative and judicial branches, Medicaid, and other health-related social services.

According to the WV Budget Office, the state faces a budget gap of $389 million in FY 2014. The 7.5 percent in cuts to some agencies will reduce this gap by $85 million, or close to 2 percent of the projected FY2014 budget, while surplus lottery ($81 million) and general revenue ($87 million) will reduce the gap by another $169 million. This leaves about $135 million in revenue or cuts that will need to be filled (assuming the projections included in last year’s budget are correct) in order to balance the budget.

According to Governor Tomblin, the cuts are necessary because of anticipated increases in Medicaid expenditures and declining severance tax and lottery revenues. While Medicaid costs are rising exponentially (mainly because the increased federal match rate (FMAP) provided by the Recovery Act and the Jobs Act has expired) and the warm winter and drop in gases prices has slowed severance tax collections, this does not tell the whole story.

What was not mentioned by the Governor or the media (see here and here) was the erosion of the corporate tax base, which is the result of cuts to the corporate net income tax and the business franchise tax. There was also no mention of the reduction and future elimination of the sales tax on food. Neither of these tax cuts – not to mention dozens of other tax credits and exemptions passed over the years – were paid for with other revenue. This means that the state has drastically reduced the revenue it needs to meet its budget priorities.

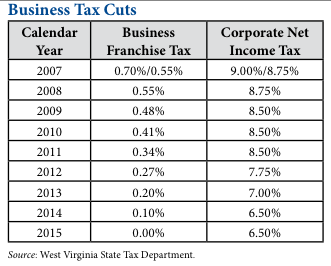

To get a better idea of what I am talking about, let’s look at how the business tax base has shrunk over the last few years. Beginning in 2007, the state began reducing its corporate net income and the business franchise tax rate. Between 2007 and 2013, the corporate net income tax will be reduced from 9 to 7 percent and the business franchise tax will be reduced from 0.7 percent to 0.2 percent (see table below). Eventually the business franchise tax will be eliminated and the corporate net income tax will fall to 6.5 percent.

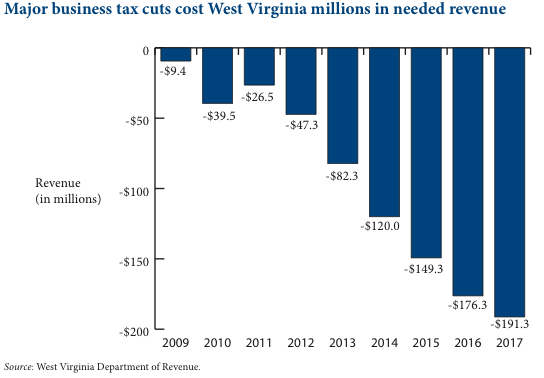

Because of these rate reductions to the state’s two main business taxes, it has reduced business tax revenue dramatically. According to the WV State Tax Department, these tax cuts will reduce revenue by $82 million in 2013 and $120 million in 2014. Once all the cuts are fully implemented, it will reduce revenue by close to $200 million (see chart below) per year.

This post continues here.