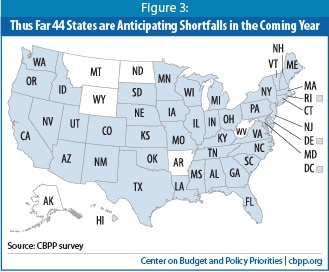

Last week, the Center on Budget and Policy Priorities updated their list of states with budget shortfalls in FY 2012. As you can tell from the chart below – or from reading the paper last week – the Mountain State is one of 6 states that does not have a budget shortfall in the upcoming fiscal year. In fact, our base-budget (General Revenue + Lottery Funds) is about $250 million more than last year’s budget.

Let me explain in more detail.

While the Great Recession officially began in December 2007 and ended June 2009, the economic recovery has been anemic for most part of the country. For West Virginia, we’ve seen a large drop in labor force employment over the last 3 years, but a steady rise in non-farm jobs. West Virginia has lost 1.5% of its job base, compared to the US average of 5.6% (Dec-07–Jan-11). All together, West Virginia has lost fewer jobs than 45 states. This is the single largest reason why the state has been able to weather the recession better than most states. And a lot of it has to do with West Virginia being an energy state.

However, West Virginia has preformed better economically than most states for several other important reasons:

Housing bubble had smaller impact on state’s economy

Unlike many states, West Virginia did not see rapid growth nor a rapid drop in housing prices. The chart below shows the five-year change in home prices, from 2005 to 2010. As you can tell, the states that suffered the worst from the housing bubble – Nevada, Florida, California, and Arizona – have seen rapid declines in home values. West Virginia, on the other hand, has seen home values increase by 6.3 percent over this period.

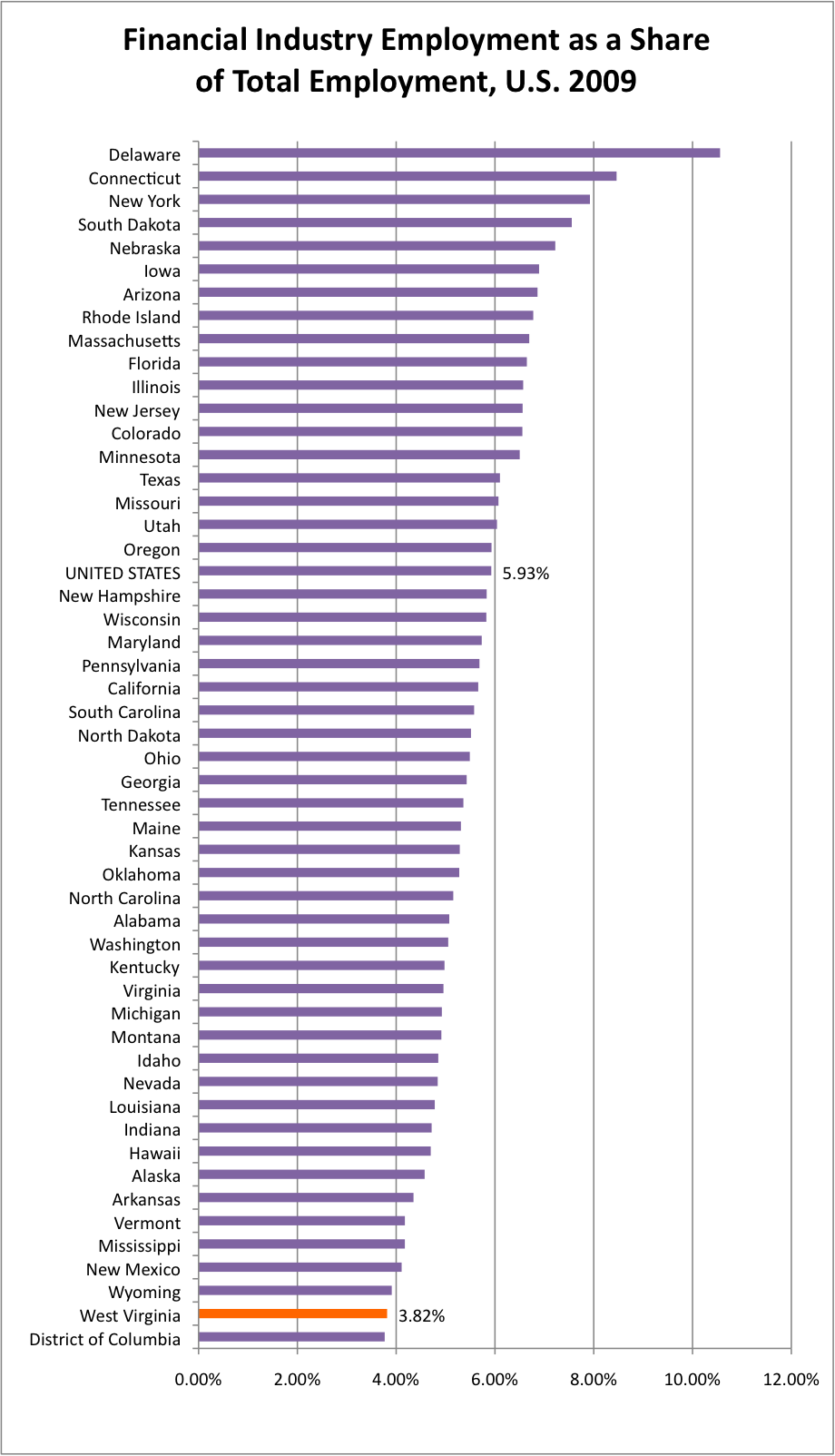

Financial Industry small part of state’s economy.

The financial industry makes up a smaller share of total employment in West Virginia, 3.8%, than any other state in the nation (aside from DC). According the BEA, finance and insurance makes up about 4.8% of our state’s GDP compared to a national average of 8.3%. From 2007-2009, employment in the financial industry declined by 7% on average and only by 5% in West Virginia.

While West Virginia’s under reliance on the financial sector helped it avoid a lot of pain, its over reliance on transfers proved helpful.

As Sean pointed out here, West Virginia relies for more of its income from transfer payments (mostly Social Security) than any other state in the country. This mostly due to the fact that West Virginia has the second oldest population in the nation. Therefore, the state receives a higher share of Social Security payments. Unlike wage income that fell during the recession, transfer payments (including one-time Social Security payments) actually increased due to the Recovery Act – the bulk of which rose when the state was sliding deep into the recession (2nd Quarter 2010).

West Virginia was also well positioned (due to being a low-income state) to benefit disproportionally from other parts of the Recovery Act, including tax credits (e.g. Making Work Pay, Child Tax Credit, EITC, etc.) and increased eligibility in food stamps (SNAP).

In short, we are poor and we are old.

Recovery Act Fiscal Relief

The Recovery Act provided about $728 million in state aid, including about $462 million in enhanced Medicaid funding, $218 for K-12 and higher education, and $48 million for general government services. (The reason the Recovery Act provided aid for public education and Medicaid is that they represent over half of all state expenditures.) So far, the state has spent about almost all of these funds and has received an additional $136 million when Congress appropriated additional state aid in August 2010.

Without the state fiscal relief included in the Recovery Act, West Virginia would have had to cut an additional $250-$350 million from both its FY 2010 and FY2011 budgets to stay at the previous year’s level.