After five years of flat budgets, lawmakers returned to Charleston for the 2024 legislative session with many important spending priorities to address major needs. Members of the Republican majority have said they want to provide pay raises for public employees and raise starting salaries in sectors with vacancies, increase provider reimbursement rates, and address child care affordability and provider sustainability. Meanwhile, already enacted legislation like the Hope Scholarship and the Third Grade Success Act, as well as ongoing programs such as PEIA and Medicaid, will necessitate growth to the base budget. Given all of these needs and spending obligations, the slowing of state revenues even before the impact of 2023’s tax changes has fully been felt should raise serious concerns for lawmakers.

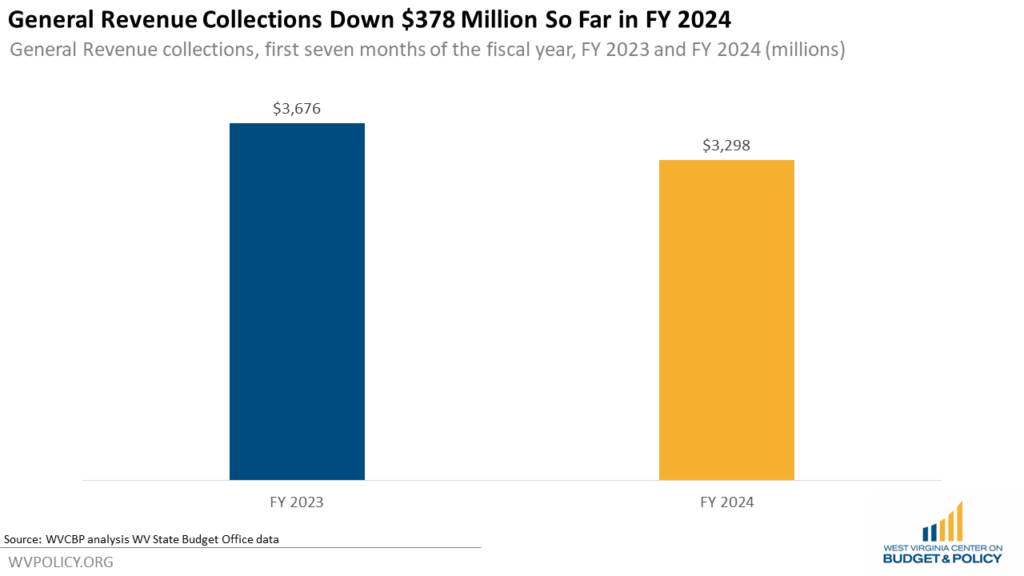

While Governor Justice and administration officials are touting a revenue surplus when measured against their flat revenue estimates, the state’s General Revenue collections are down $378 million (10 percent) compared with the same period in FY 2023.

This revenue gap is explained by both a collapse in severance tax revenue and self-inflicted revenue declines stemming from 2023’s income tax cuts.

Severance tax collections in FY 2024 are down 73 percent relative to this point in FY 2023. And while personal income tax collections are down only $75 million compared to this time in FY 2023, revenue officials have said the full impact of the income tax cuts will not be felt until later in the year, due to what is known as the SALT workaround related to 2023’s SB 151. That legislation allows pass-through businesses to prepay income taxes during the first half of the fiscal year and receive credit for those taxes paid during the second half of the fiscal year. So while SB 151 was officially revenue neutral for the full fiscal year, it frontloaded personal income tax collections to the first half of the year. Revenue officials have said they expect to finish FY 2024 with personal income tax revenues down 10-15 percent compared to last year. However, because of what is essentially a timing issue, some policymakers are under the incorrect impression that the personal income tax cuts have not reduced revenues, while in reality the full impact of the cuts will not be felt until later this year.

Given the timing issues related to tax collections and the yet-to-be-implemented provisions of 2023’s tax cut legislation, lawmakers should not assume that the first half of FY 2024’s tax collection patterns–particularly regarding the personal income tax–will continue. Revenue officials told Senate Finance committee members earlier this year that they expect General Revenue growth to shrink by 1.6 percent annually between 2023 and 2029. And notably, that is before any additional income tax cuts are automatically triggered.

Lawmakers have identified important spending needs in their communities and advanced bills out of committees to raise starting pay for school service personnel, offer doula coverage to Medicaid and PEIA enrollees, provide raises to non-uniformed correctional staff, and make our child care system more sustainable. But without preserving the revenues needed to fund these programs, lawmakers will have to make tough decisions when it comes to determining which of these priorities will make it into the budget and receive needed resources.

Read Sean’s full blog post.

Proposed and enacted tax cuts continue to crowd out long-needed spending priorities in Governor Justice’s budget, which relies on one-time surplus revenue that will likely soon dry up to fund ongoing, permanent costs. The FY 2025 budget package once again lacked a six-year plan, leaving the impact of proposed and enacted tax cuts on future budgets unclear and significant questions about potential future budget deficits that will be left to the next governor and Legislature unanswered.

The FY 2025 Proposed Budget

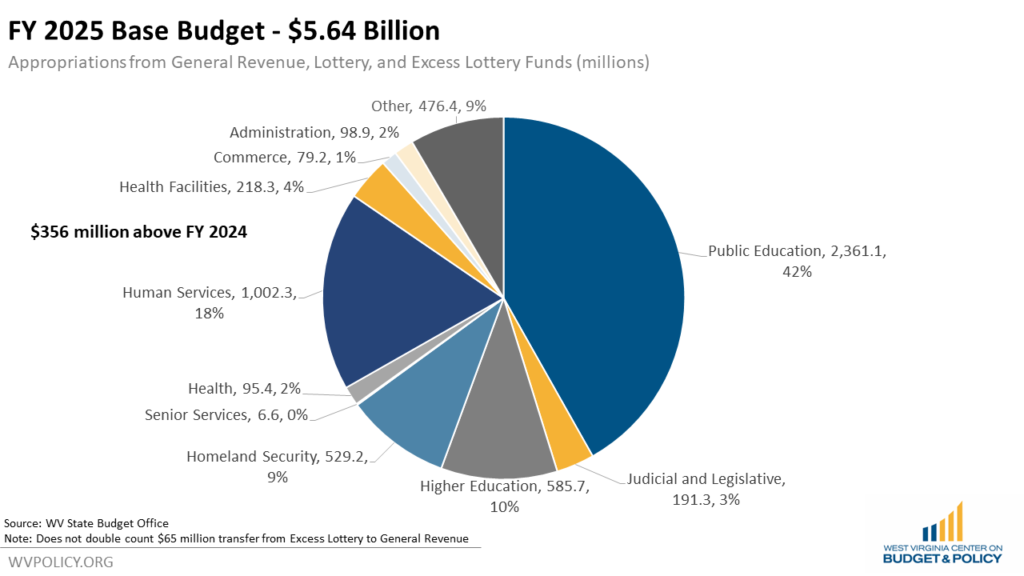

Governor Justice proposed a $5.64 billion base budget, which includes General Revenue and Lottery appropriations. Public education remains the largest area of the budget, at $2.36 billion, or 42 percent of the base budget. The Department of Human Services–which houses the state’s General Revenue appropriations for Medicaid as well as for Social Services–is the second largest, at $1.0 billion, or 18 percent of the base budget.

Budget Increases

Governor Justice’s proposed budget is $356 million above the final FY 2024 budget. Much of that increase comes from the Governor’s proposed five percent average pay raise for public employees, at a cost of $123 million. Other proposed increases include $100 million in the Governor’s Civil Contingent Fund, which includes $50 million for flood resiliency programs and $50 million to match Congressional earmark funding. Further, $56 million is allocated for contract nursing in various state-run hospitals, $23 million is allocated for tourism marketing and development (up from $7 million in FY 2024), $19 million is allocated for higher education, and $3.5 million is allocated for the Chief Medical Examiner to clear a state backlog of autopsies.

State Funding Falls Short of Inflation

Even with the proposedincreases in the FY 2025 budget after several years of flat budgets, the FY 2025 budget fails to keep pace with inflation, essentially resulting in cuts by attrition. Because of increasing costs, state agencies and programs are able to do less over time when funding stays flat. This is a key driver of some of the funding crises we are seeing across the state. For example, higher education has been one of the services most affected by the erosion of state funding. After adjusting for inflation, the FY 2025 budget is $427 million less than the FY 2019 budget.

Child Care One of State’s Most Pressing Needs

One important area of the budget that has experienced both cuts and attrition from flat budgets has been Child Care Development, which helps fund subsidized child care for West Virginia families of low- and middle-incomes. State funding for Child Care Development is down 50 percent in nominal dollars when compared with FY 2014.

Child care is one of the state’s most pressing needs. While the governor proposed a small child care tax credit during his State of the State address, the state’s needs are greater than what a tax credit can address. Additionally, a tax credit approach will likely only reach families who can afford the up-front cost of child care, failing to increase child care affordability, accessibility, or supply.

One-time Funding Used for Ongoing Needs

Once again, the FY 2025 budget proposal uses one-time surplus funding to fund ongoing costs. Chief among these is the state’s Medicaid program. Facing a significant funding shortfall largely attributable to the expiration of pandemic-era federal funding increases, Governor Justice’s proposal uses $155 million in surplus funding to close the gap, leaving the serious question as to how Medicaid will be funded in the future unanswered, particularly as tax cuts accelerate and continue to erode revenue. Other areas receiving one-time surplus funding rather than permanent funding include the School Building Authority for deferred maintenance and additional fire and EMS support.

Tax Cuts are Growing Costly

The impact of 2023’s income tax cuts are apparent in the FY 2025 budget proposal. Personal income tax collections are projected to be down sharply from their pre-tax cut level. In FY 2023, the state collected $2.66 billion in income taxes. In FY 2025, the state is estimated to collect $2.02 billion, a drop of $640.3 million, or 24 percent. And the full impact of the tax cuts has yet to be felt in revenue collection reports, as the personal property tax rebates portion of the bill–expected to cost about $200 million annually–has not gone into effect yet.

In addition, Governor Justice proposed three additional tax cuts during his State of the State address that would cost West Virginia millions in lost revenue.

Tax Cut Triggers Complicate Budget Process, Jeopardize State Needs

Included in last year’s income tax cut are triggers that will automatically enact further cuts to the income tax until the tax–currently making up 40 percent of the state’s General Revenue Fund–is eliminated. These triggers mean that more tax cuts that primarily benefit the wealthy come first when state revenues grow. In addition, the lack of long-term budget planning from the Justice administration to identify when these triggers may be met further complicates the budgeting process.

Beyond causing budget problems in future years, the tax cut triggers are expected to come into near immediate conflict with the costs of already enacted legislation. The costs of the Third Grade Success Act, the expansion of the Hope Scholarship, the public employee pay raise, and the estimated increased costs of Medicaid and PEIA mean that already enacted legislation will put state spending over the tax trigger threshold in the next few budget years.

As long as lawmakers continue to prioritize tax cuts that reduce the revenues needed to pay for public services, other needs will go unaddressed unless lawmakers can find ways to offset new spending via cuts elsewhere in the budget. That means that worthy and necessary priorities like teacher pay raises, permanent funding for fire and EMS, funding for more Child Protective Services workers, Medicaid funding, a pay raise for home health care workers, and funding for child care subsidies will essentially be pitted against each other in order to prioritize tax cuts that overwhelmingly benefit the wealthy.

Read Sean’s full blog post.

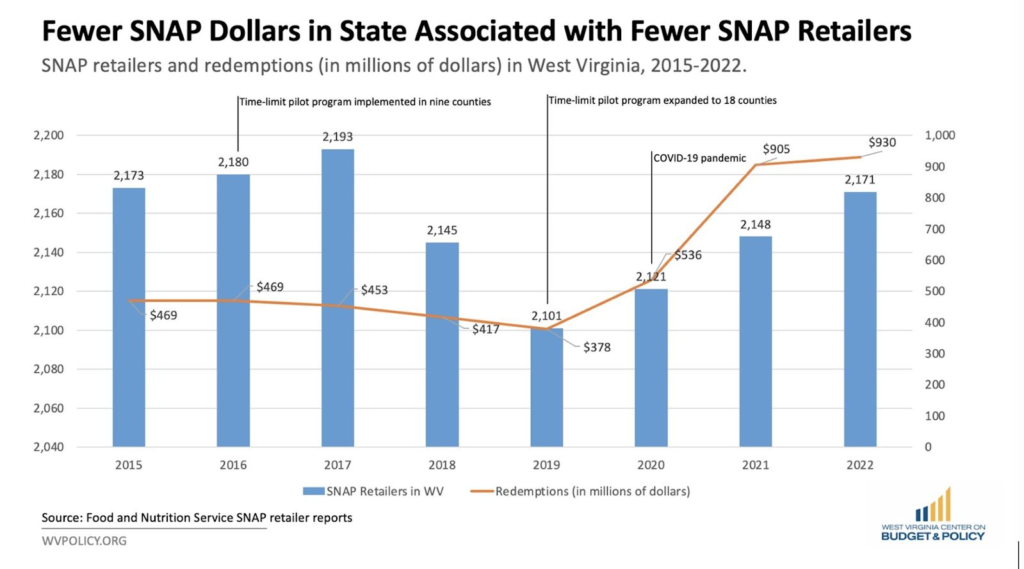

Lawmakers in the WV Senate are expected to consider SB 562, which would drastically increase bureaucratic red tape in the Supplemental Nutrition Assistance Program (SNAP), which provides critical food assistance for West Virginia families.

SNAP brings millions of federal dollars into our food economy, helping support families and local retailers. SB 562 would kick West Virginia families off SNAP by imposing a confusing and ineffective work requirement on most adults up to sixty years old, including those with children over six years old.

SNAP already has work requirements for adults without children and requires all working-age adults to register for work and accept a job if offered. A recent study from the US Department of Agriculture’s Federal Nutrition Service found that mandatory work requirements have no positive impact on employment or earnings but do drastically reduce SNAP enrollment and decrease family food security.

SB 562 would undermine the great work the state’s SNAP E&T program is already doing through job training partnerships in their voluntary program, because the program does not have the administrative capacity to find employment and training slots for everyone who would be required to have one.

The legislation would also undermine our state’s child care system, diverting limited child care subsidies away from working families with children to those who are subject to the mandatory work training programs outlined in this bill.

Please use this form to contact your Senators and urge them to reject SB 562, which would cut food access for families and undermine our child care system.

Read our fact sheet further detailing how policies that restrict SNAP harm families, retailers, and the charitable sector.

The full WV Senate will soon consider SB 614, a “student discipline” bill that will result in an increased number of K-6 students being removed, suspended, and/or expelled from elementary classrooms. The legislation would allow teachers to remove students from the classroom, bar them from riding the bus home, potentially subject them to law enforcement interactions if their parents are unable to pick them up, and exclude them from school until a risk assessment is completed. If passed, the legislation will disproportionately impact students of color, students with disabilities, and poor students and contribute to the school-to-prison pipeline.

Please use this form created by our friends at Mountain State Justice to contact your Senators and urge them to reject SB 562.

Read this important commentary from our colleague, Dr. Shanequa Smith, detailing why students need enhanced supports in order to thrive, not increased disciplinary measures.

West Virginia Black Policy Day, hosted by Black by God The West Virginian and the West Virginia Black Voter Impact Initiative, took place this past Wednesday at the State Capitol. This annual event provides the opportunity for Black West Virginians to speak directly to lawmakers and advocate for the needs of their communities. A recent article provides further details. Excerpt below:

For many Black West Virginians, each 60-day legislative session starts with a question: will this year be the one when lawmakers truly address the needs of Black communities?

Year after year, the answer has been frustrating, as inaction continues. Black West Virginians are more likely to have health problems, face issues with unemployment, and experience poverty than their white counterparts.

Black youth are suspended more frequently from school than their white peers, while adults struggle with unemployment, the criminal justice system, and crises in maternal health and substance use. West Virginia’s only historically-Black land-grant institution has struggled to overcome decades of state underfunding, amounting to more than $850 million.

With little action from lawmakers, Black advocates argue that communities must make their voices heard.

“If we do not educate people on the problems facing our communities, they will not understand,” said Dr. Shanequa Smith, a co-founder and organizer of Black Policy Day.

And the demands of Black communities were on full display from the start of the day, as hundreds of students, members of Black sororities and fraternities, speakers and attendees called for lawmakers to enact a community-driven “Black Policy Agenda,” a set of proposals that includes the creation of tax credits for diversity and inclusion, more support for people leaving the justice system, a state minority health equity team, and equal funding for West Virginia State University.

Black Policy Day attendees also highlighted the importance of passing the CROWN Act, legislation that would prohibit discrimination based on hairstyle or texture. A bill has been introduced several times in recent years and a version of the bill passed the Senate in 2020 before stalling in the House, but the measure still hasn’t passed the full state Legislature.

Lawmakers in the state Senate are trying again this year, introducing two different CROWN Act bills.

Even as the CROWN Act proposal remains in the air, people attending Black Policy Day said that the event was about more than one piece of legislation or specific policies. The more important thing, they argued, was that people learn about their political leaders, and how to advocate for their needs.

“Our lives matter, what we value matters, and our voice matters,” said Dr. Kristi Dumas, a member of the Beckley Human Rights Commission.

Read the full article.

The WVCBP is hiring a state policy fellow!

The position is a two-year research-focused fellowship dedicated to making change through careful research, thoughtful advocacy, and strong partnerships.

The fellowship is a project of the State Priorities Partnership, a national network coordinated by the Center on Budget and Policy Priorities, one of the nation’s premier policy institutes. As part of this exciting project, you’ll be a member of a cohort of policy fellows working in states across the country. Fellows will receive training and career development, work with mentors, and have access to ongoing opportunities for professional growth.

Applications are due February 29, 2024.

Learn more and apply here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.