Today is the last day of West Virginia’s 2023 Fiscal Year. Undoubtedly in the coming days, Governor Justice will tout the so-called revenue “surplus” from this fiscal year, but it cannot be overlooked that a significant portion of that surplus was only made possible due to the Justice Administration intentionally low-balling revenue estimates, thus all but guaranteeing a massive end-of-year surplus. WVCBP executive director, Kelly Allen, recently published an op-ed further detailing how this manipulation of the revenue estimation process has harmed the state’s ability to fund quality public services. You can read it below:

For West Virginia to thrive, we need great schools, safe communities and quality infrastructure. With the end of the state’s fiscal year upon us, the upcoming days will undoubtedly be inundated with news releases and news coverage of West Virginia’s revenue surplus. Unfortunately, rather than the surplus signaling a thriving economy, it is more the result of Gov. Jim Justice’s administration intentionally underestimating how much revenue the state would bring in this year and, by extension, underfunding public services across the state.

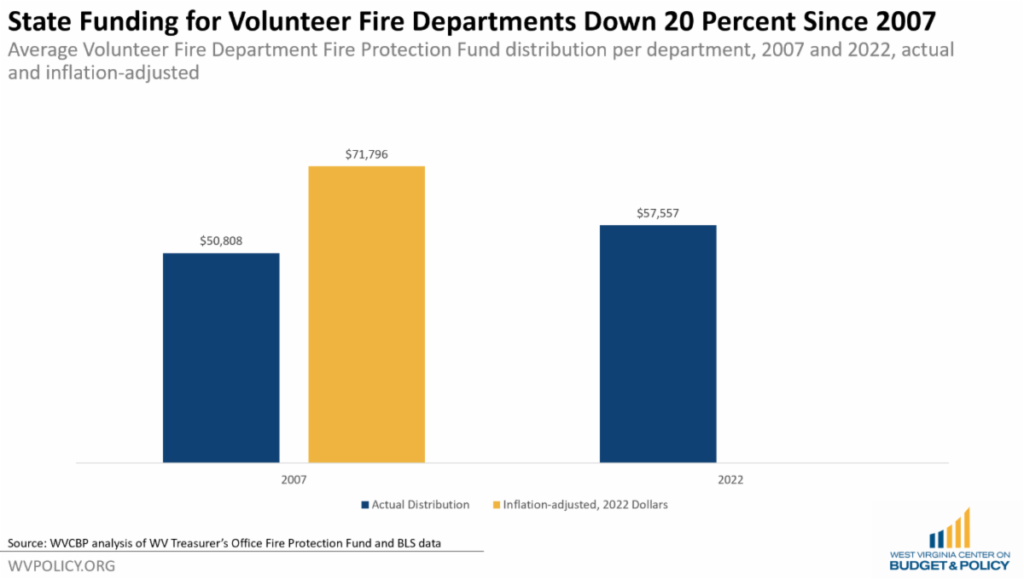

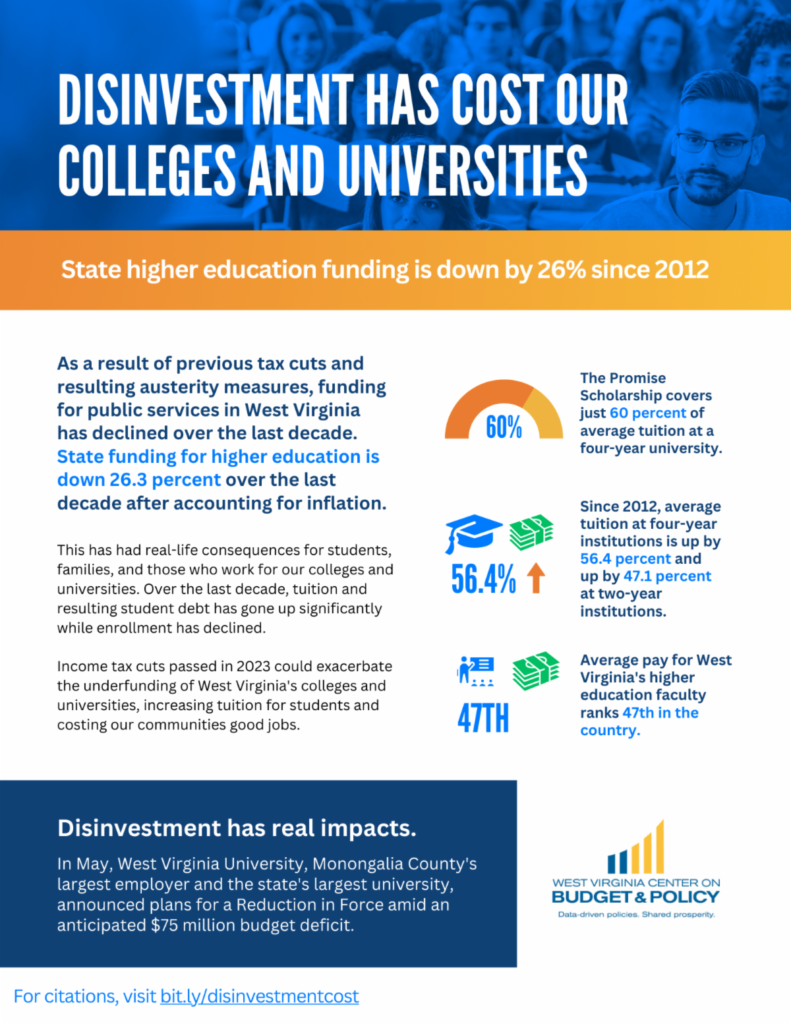

The consequences of that underfunding can be seen everywhere. Rather than using these taxpayer funds to strengthen our schools and public services, chronic underfunding has contributed to West Virginia University’s budget crisis, the struggles facing our volunteer fire departments and Emergency Medical Services, the state of emergency in our correctional facilities and thousands of families losing their child care assistance last fall.

In West Virginia, the governor has the sole authority to control the size of the budget through a very unique revenue estimate process. Because our state constitution allows the governor alone to estimate how much revenue is expected in a particular year, he also controls the size of the annual state budget, since states must enact balanced budgets. Lawmakers cannot exceed the top-line number they are given, unless they raise taxes.

And for the past several years, the Justice administration has gamed that system — intentionally underestimating expected revenue to hold the budget flat, thus guaranteeing large “surpluses” on paper only. Presumably, this tactic has been deployed to manufacture a narrative of economic strength to make the case for Justice’s 2023 income tax cuts. But the reality is that state costs aren’t flat, which is why responsible budgeting takes inflation into account. Just like household budgets, costs rise for things the state pays for — medical costs, salaries, fuel, utility costs, and on and on. Without accounting for inflation in the budget, our state agencies and public services have essentially been trying to do the same job with less funding.

After adjusting for inflation, West Virginia’s fiscal year 2023 budget was 15% below expenditures in our last prepandemic year, FY 2019, a reduction of hundreds of millions of dollars.

This widespread disinvestment is why it is so unsurprising to see mounting crises all over the state. A devastating budget crisis at the state’s largest university, costing hundreds of jobs, and shortfalls at colleges and universities throughout the state. Thousands of families losing the subsidy that helps them afford child care and have the flexibility to go to work. Volunteer fire departments and EMS on the verge of closure as costs rise and funding stays flat. Historic increases in PEIA premiums for state employees that will make it harder for these employees to afford quality health care services, as well as more difficult to fill vacant state positions.

If the Justice administration had projected revenue honestly, lawmakers could have covered growing PEIA costs, rather than shifting them onto workers, saved hundreds of jobs at WVU and other colleges and universities, and extended child care subsidies for thousands of families. Instead, that taxpayer funding was held aside to create the illusion of room for 2023’s income tax cuts that mostly benefit the wealthy, all while the public services that benefit us all went ignored.

Those income tax cuts will throw kindling on an already roaring fire, diverting even more resources away from public services that touch us all and into the pockets of the state’s wealthiest people. Two-thirds of the income tax cuts are going to the top 20 percent of households, with one out of every six dollars going to the richest 1 percent. And, in future years, automatic triggers could reduce income tax revenue even further, unless lawmakers reverse them — potentially leading to increasingly dire consequences for our schools, communities and infrastructure.

So, when you hear about West Virginia’s historic revenue surplus in the coming days, take a look around and ask yourself if your children’s school, your local fire department, your library and your community programs have the resources they need to serve all of your neighbors. And if not, exactly who is West Virginia’s “surplus” great for?

You can find the full op-ed here.

This blog post was authored by Teri Castle, the 2023 Criminal Legal Reform Summer Research Fellow for the West Virginia Center on Budget and Policy.

Seventeen years ago, I was being held in Western Regional Jail, waiting to be transferred to Lakin Correctional Center. I had just been convicted of first-degree murder and sentenced to a life sentence “with mercy.” During that time, my sister Linda brought Alantis, my daughter, to visit me. My little girl, only two and a half years old, walked into the visiting room, her eyes filled with excitement. We had a “contact visit,” playing, talking, and laughing together. The hour flew by too quickly, and the moment came for them to leave. I hugged and kissed Alantis goodbye, but she clung to me, refusing to let go. Linda had to force her away from me. Tears streamed down both of our faces as they left.

I quietly walked down the hall, into my cell, and contemplated suicide. I had allowed a relapse to take me away from my child, possibly for the rest of my life. I felt worthless and depressed. Lakin Correctional Center became my home shortly after that visit, and it would be nearly a year before I could see Alantis again.

When I entered Lakin, I found myself thrown into a world I could never have imagined. The noise level was unbelievable. The intake process was invasive. We were deloused. Every part of our bodies was checked for drugs and contraband. Then we were placed in the segregation unit until our classification process was complete. Each day, we were only allowed an hour in the dayroom, enough time to shower and make a phone call. Outside recreation depended on the Shift Commanders’ discretion.

I had a lot of time to think about my life. Where had I gone wrong? When I became pregnant, I moved out to the country with my friend Gary, hoping to avoid drug use. For an entire year, I believed I had overcome my addiction. In April 2003, I welcomed Alantis into the world, and life was good.

Then Gary had a medical emergency and died right in front of me. Shortly after the funeral, I relapsed.

Sitting in Lakin Correctional Center, guilt overwhelmed me for both the crime I had committed and for letting myself and my daughter down. Alantis was left alone, as I was her only parent. Thankfully, my sister Linda decided to raise her in my absence.

During my early days in prison, that guilt manifested as anger. I despised myself, and my situation. I stayed in trouble due to my bad attitude. I spent a lot of time in segregation, which is being placed in a single cell for 23 hours a day. You are allowed out only for a shower, phone calls with lawyers, and one hour of recreation each day. Spending 30 or 60 days segregated can be challenging because you are left alone with your thoughts.

After several years on this path, I decided it was time for a change. I wanted to be in the general population so that I could be in Alantis’ life, even if it was only through phone calls. l started therapy and signed up for trauma classes. I found new ways to deal with my guilt that didn’t involve angry outbursts. A prison treatment program and the lessons of A Woman’s Way Through the Twelve Steps helped me learn how to forgive myself and move forward.

Despite the physical separation, the bond with my daughter remained strong. We spoke on the phone almost every day. I loved hearing her voice, her laughter. We would talk about everything. She would tell me about her many pets: a bunny, a turtle, and a cat. She wanted to be a veterinarian when she grew up. I began writing her letters with questions about her pets, favorite colors, and favorite activities. We were becoming friends. She would always write back with questions for me. I wanted her to feel comfortable telling me anything and everything. I started making her arts and crafts. The bracelets were her favorite. The felt jewelry box I sent her to put them in was also a big hit.

Alantis wanted to come to see me, so Linda started bringing her to Lakin once a month as a reward for my good behavior. Those visits were precious. I remember when Barbie came out with the Nutcracker movie. Alantis came to visit me. She was so excited to show me the Nutcracker dance she had learned. She received a standing ovation from all the visitors. Even the correctional officer was smiling. It was a great day. Unfortunately, I didn’t have any money on my books so I couldn’t take a picture with her. My sister offered to pay, but that was against the prison’s rules.

The 16 years I spent at Lakin Correctional Center were hard. I was finally granted parole in 2021. Alantis was 18. Since being released I have continued my sobriety, completed a bachelor’s degree at Marshall University, and most importantly, I have been a role model to my daughter. I supported her as she obtained her TASK certificate and driver’s license, and helped her enroll at Marshall University.

None of that would have been possible if I couldn’t have maintained our relationship while I was incarcerated. I was fortunate to have the resources to pay for the phone calls, video chats, and arts and crafts. Video calls are a terrific–but expensive–way to stay connected with your children. When I was at Lakin, we paid $3.00 for each 15-minute video call.

A lot of families don’t have the resources to support the children they are now raising, much less extra money to pay for travel or video calls. Children are especially harmed when a parent is incarcerated.

Approximately one in 10 West Virginia kids have had a parent incarcerated at some point in their childhood. The Centers for Disease Control considers parental incarceration to be a traumatic experience that has a devastating impact on a child’s well-being. A parent behind bars is linked to illnesses like asthma, depression, and anxiety; acting out; economic hardship; and poorer physical and mental health in adulthood.

Keeping Families Together

There are a few ways that the Division of Corrections and Rehabilitation (DCR) can help families stay connected:

West Virginia has an incarceration rate that is higher than any country in the world. The best family policy would be to ensure that fewer parents go to prison in the first place.

Read Teri’s full blog post.

West Virginia University is facing a projected $75 million shortfall. With significant budget cuts and a reduction in force on the horizon, there has been much talk about how the university arrived at this place. A recent article, featuring comment from WVCBP executive director Kelly Allen, provides further details. Excerpt below:

WVU administrators have been selling the reduction in force (RiF) not as an unfortunate necessity, but as a canny pivot toward a leaner future. That narrative has been difficult for many faculty to accept.

At the May 8 Faculty Senate meeting, Gee laid out his underlying reasons for the proposed strategic cutbacks, including the significant reduction in faculty and staff numbers. He listed the usual suspects: the approaching demographic cliff, diminishing state support, persistent inflation and rising college dropout rates.

But the most damaging force, he said, was academia’s own intransigence.

“Higher education has lost the support and trust of the American public. It is that simple,” he said. “We are our own worst enemy in that regard. I want to be very blunt: we have been isolated, we have been arrogant, we have told the American public what they should think … we have to turn that around almost immediately, otherwise we have a very bleak future indeed.”

The cure for this loss of enthusiasm, Gee continued, is to recommit to student success above all else—to reaffirm WVU’s land-grant mission, “which we’ve drifted away from.” In terms of programmatic restructuring, Gee said WVU must “differentiate” itself by bolstering its distinct offerings and paring down everything else.

Many WVU faculty members believe Gee’s diagnosis is dishonest and worry his prescriptions could do more harm than good.

“For President Gee to blame faculty for this, it adds insult to injury, but it’s also just disingenuous,” Bergner said. “I understand there’s a budget crisis, but you can’t say responding to that is going to make us more student-centered or mission-oriented … You can say it’s an unavoidable tragedy and will hurt those things, but you can’t paint it as enhancing them.”

A spokesperson for the university said Gee’s schedule precluded him from speaking with Inside Higher Ed.

Kelly Allen, executive director of the nonprofit West Virginia Center on Budget and Policy, said Gee’s rhetoric is eerily similar to that used by Republican state lawmakers in discussing the need for funding cuts.

“This is a trend we have been seeing in public education as well: enrollment is declining as our state population is declining, and so it’s fine—or even better—for schools to make do with less,” she said. “That’s really a convenient excuse and maybe even a way for some folks to escape accountability.”

“Penny-Wise and Pound-Foolish”

Neither Gee nor Reed placed much emphasis on the role of state disinvestment in creating WVU’s budget problems, an omission that Allen said was curious. West Virginia’s state funding for higher education has decreased by over 25 percent in the past decade, according to a Center for Budget and Policy study.

“They are truly selling state disinvestment short; that’s the primary reason for these budget shortfalls, not these universal problems,” Allen said. “Couching the cuts in this rhetoric about the arrogance of academics is odd and really reflective of how state lawmakers think … I worry higher ed leaders are falling into the same trap as lawmakers: being penny-wise and pound-foolish.”

Read the full article here.

For more information on the broader cost of disinvestment from higher education, see Kelly’s recent blog post and accompanying infographic.

West Virginia, alongside the rest of the nation, began rolling some residents off of Medicaid and CHIP in April upon expiration of the continuous coverage protection triggered by the COVID-19 pandemic.

Join us and our colleagues at Think Kids on 7/12 at 12pm for an informal conversation and updates on what this means and how folks can take steps to maintain their coverage. All are welcome, especially community resource organizations working in this space.

Register here.

Learn more about the Medicaid unwind and its early impacts in the Mountain State in our recent blog post here.

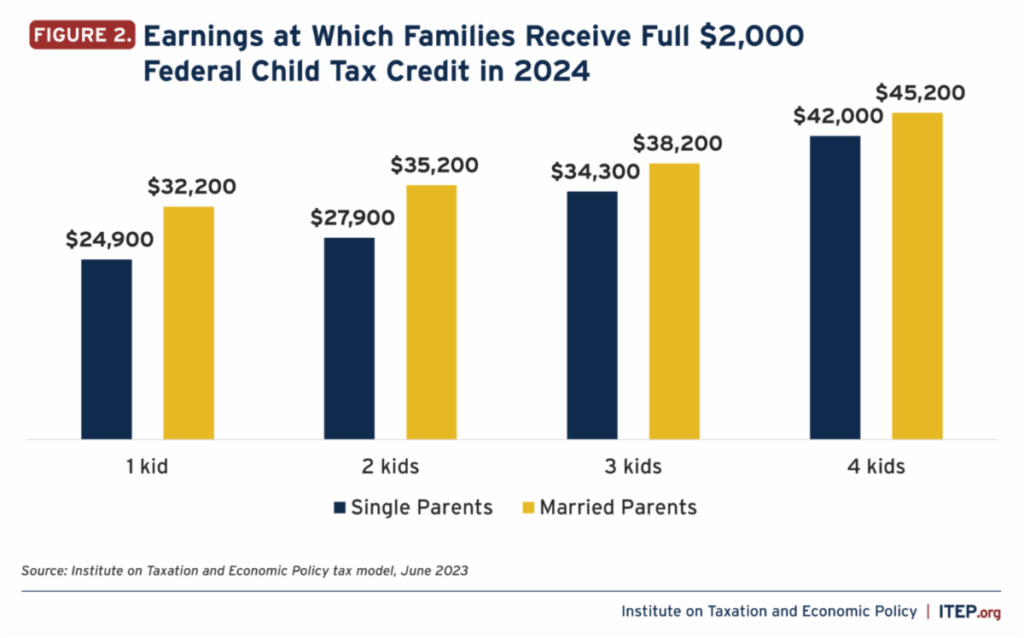

The temporary expansion of the Child Tax Credit (CTC) in 2021 was incredibly successful–cutting child poverty nearly in half that year–but has since expired. Now, House Democrats are introducing a proposal to expand the CTC again. The proposal would benefit 60 million children nationwide, including 92 percent of West Virginia kids. A recent brief from our colleagues at the Institute on Taxation and Economic Policy (ITEP) provides further details on the proposal. Excerpt below:

Democrats in the House recently introduced a proposal to enhance the federal Child Tax Credit (CTC) based on the successful temporary expansion of the credit in 2021. The temporary expansion – part of President Biden’s economic rescue plan in response to the COVID-19 pandemic – cut child poverty roughly in half that year and was designed to help nearly every middle-class family with kids. The new proposal has the support of over 200 House Democrats and largely mirrors a proposal included in the President’s annual budget request.

ITEP estimates that if this plan were in effect next year, it would benefit more than 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income. This proposal stands in contrast to a recent proposal from House Republicans, which would mostly benefit the richest Americans and foreign investors.

The House Proposal Increases the Credit Amount and Makes it More Useful for Middle-Class Families

Mirroring the temporary expansion from 2021, the House proposal makes several changes to the credit. The proposal:

It Also Fixes the Biggest Problem with the Current Child Tax Credit

The proposal’s change with the greatest impact is making the CTC fully available to all children in low- and middle-income families. The current rules contain two limits on the refundable part of the Child Tax Credit, making it unavailable to children in the poorest families. The refundable portion of the credit is the amount that parents can receive on top of their tax refund if they have no or low tax liability. The first limit in current rules bars families from receiving the full Child Tax Credit as a refundable credit. (The refundable portion of the credit will be limited to $1,700 per child next year rather than the full $2,000.) The second limit on the refundable part of the credit is an earnings requirement. The refundable portion of the credit is limited to a fraction of the family’s earnings above $2,500.

Combined, these two limits mean that the credit is reduced or entirely unavailable to the children who need it most, including children raised by grandparents, parents with disabilities, or parents working as full-time caregivers. Next year, for example, a single-parent household with two children will need at least $27,900 in earnings to receive the full credit under current law.

It is not logical to deny a credit meant to help children to the families who most need the income boost. The House proposal would fix this problem by making the credit fully refundable. This change would make children in low-income families the biggest beneficiaries if the legislation were in effect next year. Families making less than $25,000 would receive nearly a third of the total benefit and would receive an average tax cut of more than $4,000.

Restoring the enhanced Child Tax Credit would help millions of children in low- and middle-income families. Congress achieved a remarkable feat by cutting child poverty by half in 2021. There is no reason that this proven and effective policy should become a thing of the past. This proposal from House Democrats would help orient the tax code toward those who need the support, rather than big businesses and the already wealthy.

Read ITEP’s full brief.

Would you like to learn more about the status of infant and maternal mortality/morbidity in the Mountain State or share how it has impacted your life or the lives of your loved ones? Join our community conversation on July 21, 2023 at 12pm. All are welcome, particularly Black families and families of color who’ve experienced infant and maternal loss, inaccessible or biased health care, or are passionate about these issues. We are grateful for your voices and expertise.

You can register for the meeting here and RSVP to the Facebook event here.

We hope to see you in July!

To learn more about the status of infant and maternal mortality in West Virginia, see our recent blog post here.

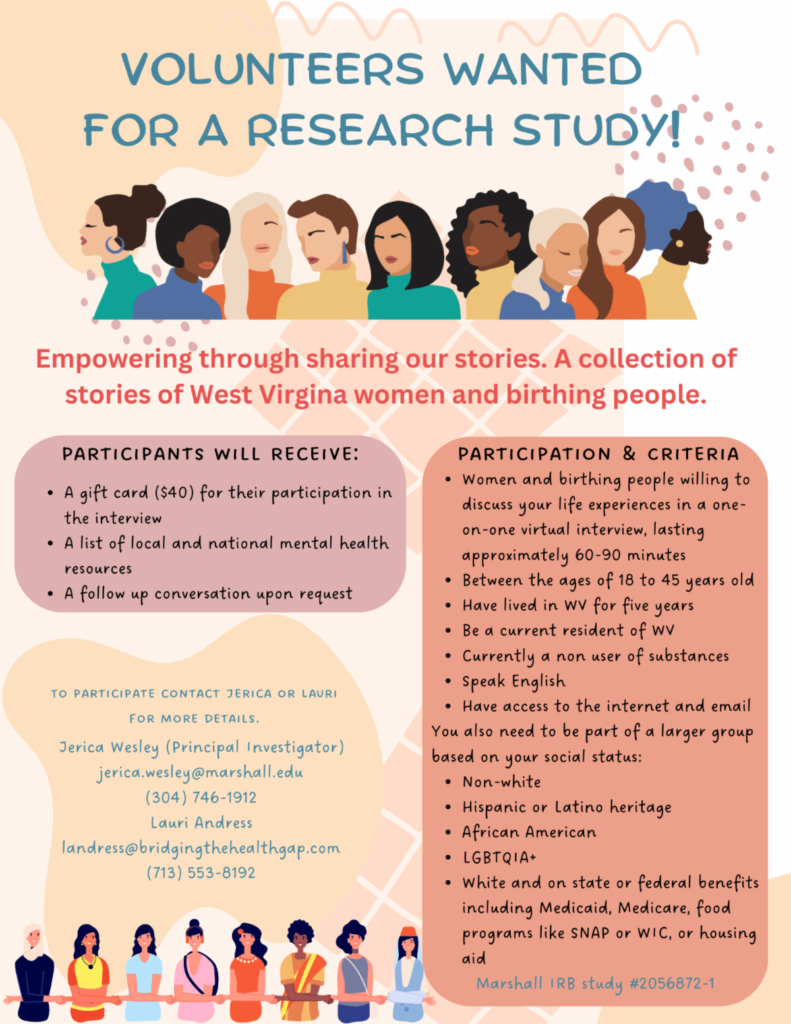

Dr. Jerica Wesley from Marshall University and Dr. Lauri Andress from Andress & Associates are seeking volunteers for a research study to learn more from West Virginia women and birthing people about their health care experiences. Currently there is little state-level data publicly available about the disparate experiences of birthing people across race. This study seeks to empower West Virginians through the sharing of stories and to gather qualitative data to inform advocates and policymakers.

Contact Dr. Wesley (jerica.wesley@marshall.edu /304-746-1912) or Dr. Andress (landress@bridgingthehealthgap.com /713-553-8192) to participate or for more details.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.