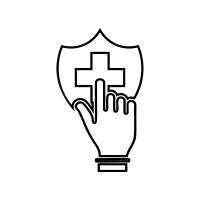

New SNAP restrictions included in the federal debt ceiling deal will impact West Virginia more severely than any other state on a per capita basis due to the Mountain State’s aging population. Nationwide, nearly 750,000 older adults aged 50-54 will be at risk of losing their food assistance due to these new provisions, including 7,000 in West Virginia. These SNAP changes will go into effect this fall just as federal SNAP dollars are already leaving the state economy due to pandemic-era SNAP programs ending, potentially burdening an already stressed charitable food sector and removing millions of dollars from the food economy.

The SNAP changes in the debt ceiling agreement expand mandatory work reporting requirements as a condition of receiving SNAP benefits to include persons between the ages of 50-54. Currently, SNAP has an existing work reporting requirement that requires most adults between 18-49 without children in the home to comply with onerous work reporting requirements or otherwise prove they qualify for an exemption to the requirement.

A significant body of research has found that these work reporting requirements do not improve employment or earnings – they just take food assistance away from those who need it. Ample evidence also shows that many adults who do meet exemptions from the requirement are not properly screened and lose food assistance even when they should not.

Food Insecure Households Already Hit Hard with End of Pandemic SNAP Benefits

The end of the COVID-19 public health emergency’s SNAP provisions is already resulting in nearly 170,000 total households across West Virginia losing a cumulative $36 million/month in federal food assistance. While households of all ages have been impacted, older adults have been hit especially hard, as the pre-pandemic monthly average SNAP benefit for older households is only $75/month or $2.50 per person/per day.

Older SNAP recipients who only qualify for the minimum SNAP benefit in West Virginia saw their monthly food assistance allotment shrink from $283/month to $23/month after the discontinuation of the pandemic-era emergency allotments. Notably, West Virginia already has one of the highest food insecurity rates in the country for people in their 50’s.

WV Knows What to Expect from Failed Work Reporting Requirements

West Virginia has recent experience and data on the impacts of enacting work reporting requirements as a condition of receiving SNAP. In 2016, then Governor Earl Ray Tomblin directed the Department of Health and Human Resources (DHHR) to implement a pilot program to require work reporting restrictions for childless adults ages 18-49 (referred to as “able-bodied adults without dependents” or “ABAWD”) in the nine counties with the lowest unemployment statewide. SNAP recipients who could not prove to DHHR that they were employed 20 hours/week or engaged in an approved work activity were removed from SNAP. The results, presented by DHHR to the House Committee on Health and Human Resources aligned with findings from other studies around the country: “Our best data does not indicate that the program has had a significant impact on employment figures for the ABAWD population in the 9 issuance-limited counties.”

A WVCBP analysis of the nine-county work reporting requirement similarly found that the SNAP work requirements had virtually no impact on employment. Before the pilot program began, the nine counties had identical employment growth relative to the rest of the state. However, in the years post-implementation, West Virginia’s overall employment growth outpaced that of the nine counties by a ratio of two to one.

SNAP is a Critical Support for Older Adults Facing Barriers to Employment

Older adults now subject to work reporting requirements face unique challenges when it comes to finding and maintaining a job. Throughout West Virginia, adults with disabilities who are unable to navigate the complex, paperwork-intensive processes involved to secure SSI disability benefits often rely on SNAP benefits to keep food on the table.

In West Virginia, there are over 549,000 adults living with a disability while less than 71,000 currently qualify for disability benefits. Work reporting requirements as a condition of receiving SNAP for older adults ignores the stark realities facing people who struggle with disabilities, chronic illness, and other barriers to work. Because West Virginia has an older population along with the highest percentage of disabled persons in the country, the new SNAP restrictions enacted as part of the debt ceiling deal will disproportionately hurt aging West Virginians.

Read Seth’s full blog post.

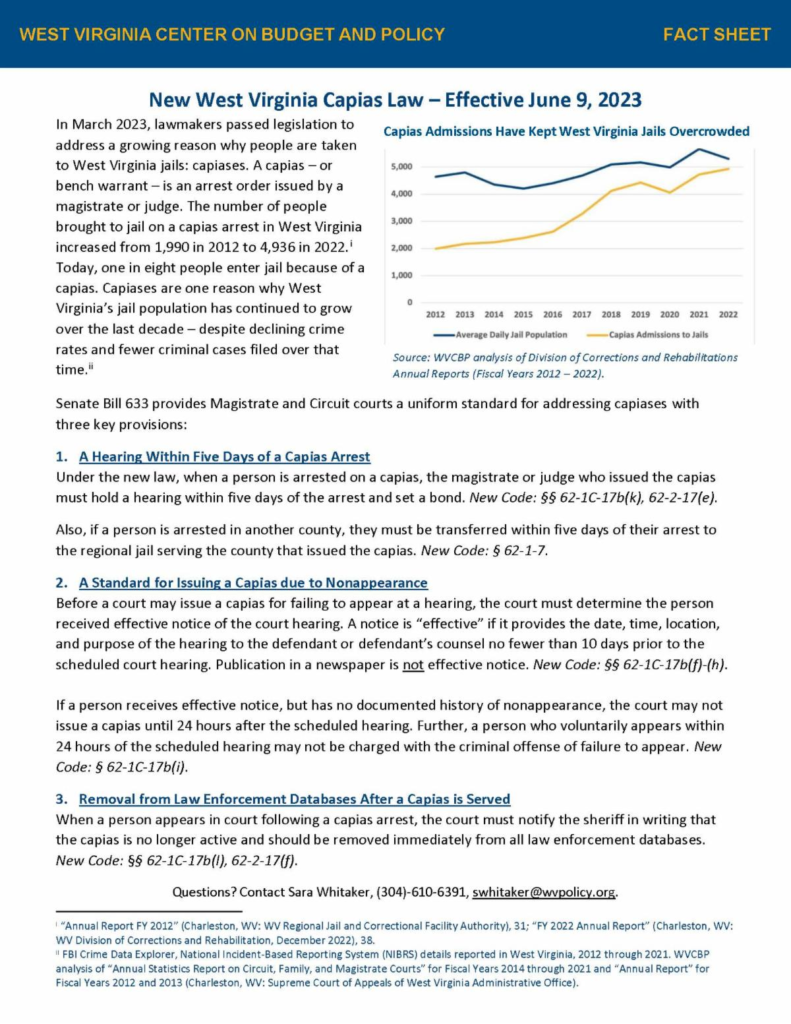

WVCBP criminal legal policy analyst, Sara Whitaker, recently authored a publication detailing a new law (SB 633) that went to effect earlier this month to attempt to address West Virginia’s dangerously overcrowded jail system via decreased reliance on pre-trial detention. Sara was interviewed on a recent episode of Us & Them to elaborate on the costly and inequitable nature of pre-trail detention and the cash bail system. Excerpt below:

West Virginia’s state prisons and jails are overcrowded and understaffed.

Just over half of those who are incarcerated have not yet been found guilty of a crime, they’re in a cell because they can’t make their bail. Many of those people are poor and a disproportionate number are Black.

On this episode of Us & Them, host Trey Kay takes a look at what contributes to the racial disparities in our justice system. Black people make up about 3.5 percent of West Virginia’s population but 12 percent of the state’s incarcerated population. Why are people of color overrepresented in the criminal justice system?

Bail options are an important point where racial disparities can be on display and when a person’s freedom depends on their access to cash or property, some say Black West Virginians are disproportionately harmed.

“Pretrial detention has been called the front door of mass incarceration,” says Sara Whitaker, who spent nine years as a public defender in Kanawha County, West Virginia.

“People who are jailed while they’re awaiting trial are more likely to be convicted, more likely to receive a jail or prison sentence upon conviction and more likely to receive a longer sentence than those who are not detained prior to trial,” Whitaker says. “In West Virginia, like in most places, whether you’re jailed prior to your trial or not depends on how much money or wealth you have.”

Whitaker is now a criminal legal policy analyst with the West Virginia Center on Budget and Policy. She says bail options are some of the first points in the system where racial disparities can be on display.

Listen to the full segment here.

Read Sara’s blog post on the implementation of SB 633 here and the accompanying fact sheet here.

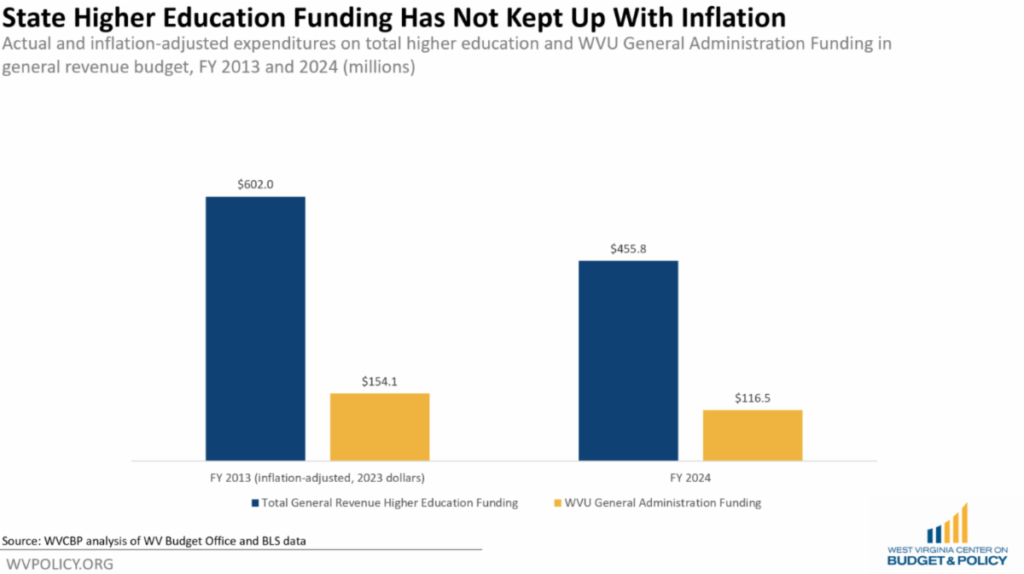

West Virginia University is currently facing a $45 million budget shortfall for the upcoming fiscal year, expected to balloon to $75 million annually by 2028. A recent article, featuring insight from WVCBP executive director Kelly Allen, explains how this budget deficit could have been significantly mitigated had the state not disinvested from higher education in recent years. Excerpt below:

If West Virginia lawmakers had kept higher education funding at the same levels as a decade ago, WVU would have an estimated additional $37.6 million in state funding for the coming fiscal year, closing the majority of this year’s budget gap, according to an analysis by the West Virginia Center on Budget & Policy.

“A big part of the story with WVU’s budget crisis is reduced state investment in higher education,” said Kelly Allen, executive director of the think tank.

“Higher education is always the first thing in the budget to be cut when times are tough, and lawmakers have never gone back and made up those funding cuts or losses as state revenues have grown and built back up in recent years.”

WVU is tightening its belt while facing the likelihood of being down $45 million next year — potentially growing to $75 million over the next five years if steps aren’t taken to control costs. University leaders are working through how to deal with that potential loss.

Officials have said the financial strain is directly related to declining student population.

The West Virginia Center on Budget & Policy’s analysis concluded that an additional factor is deeply reduced funding for colleges and universities.

Over the last decade, state higher education funding is down by about a quarter, adjusted for inflation, the think tank said. Over the same period, the value of the Promise Scholarship has eroded.

Temporarily, federal covid relief cushioned those financial challenges, according to the think tank.

“While students and families have long felt the impacts on tuition of reduced public investments in higher education, federal pandemic relief temporarily cushioned colleges and universities from some of the broader institutional impacts. As those federal funds are drying up, state funding austerity is fully in view,” the center wrote.

Nowhere have the impacts been more visible than at West Virginia University, where the administration plans to layoff faculty, eliminate programs, and implement a host of other cost reduction measures in response to the projected budget shortfall, according to the think tank.

“But far fewer of these measures would be necessary if state funding for colleges and universities had simply been maintained at the same levels as a decade ago.”

Read the full article.

For more information on the broader cost of disinvestment from higher education, see Kelly’s recent blog post and accompanying infographic.

The temporary expansion of the Child Tax Credit (CTC) in 2021 was incredibly successful–cutting child poverty nearly in half that year–but has since expired. Now, House Democrats are introducing a proposal to expand the CTC again. The proposal would benefit 60 million children nationwide, including 92 percent of West Virginia kids. A recent brief from our colleagues at the Institute on Taxation and Economic Policy (ITEP) provides further details on the proposal. Excerpt below:

Democrats in the House recently introduced a proposal to enhance the federal Child Tax Credit (CTC) based on the successful temporary expansion of the credit in 2021. The temporary expansion – part of President Biden’s economic rescue plan in response to the COVID-19 pandemic – cut child poverty roughly in half that year and was designed to help nearly every middle-class family with kids. The new proposal has the support of over 200 House Democrats and largely mirrors a proposal included in the President’s annual budget request.

ITEP estimates that if this plan were in effect next year, it would benefit more than 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income. This proposal stands in contrast to a recent proposal from House Republicans, which would mostly benefit the richest Americans and foreign investors.

The House Proposal Increases the Credit Amount and Makes it More Useful for Middle-Class Families

Mirroring the temporary expansion from 2021, the House proposal makes several changes to the credit. The proposal:

It Also Fixes the Biggest Problem with the Current Child Tax Credit

The proposal’s change with the greatest impact is making the CTC fully available to all children in low- and middle-income families. The current rules contain two limits on the refundable part of the Child Tax Credit, making it unavailable to children in the poorest families. The refundable portion of the credit is the amount that parents can receive on top of their tax refund if they have no or low tax liability. The first limit in current rules bars families from receiving the full Child Tax Credit as a refundable credit. (The refundable portion of the credit will be limited to $1,700 per child next year rather than the full $2,000.) The second limit on the refundable part of the credit is an earnings requirement. The refundable portion of the credit is limited to a fraction of the family’s earnings above $2,500.

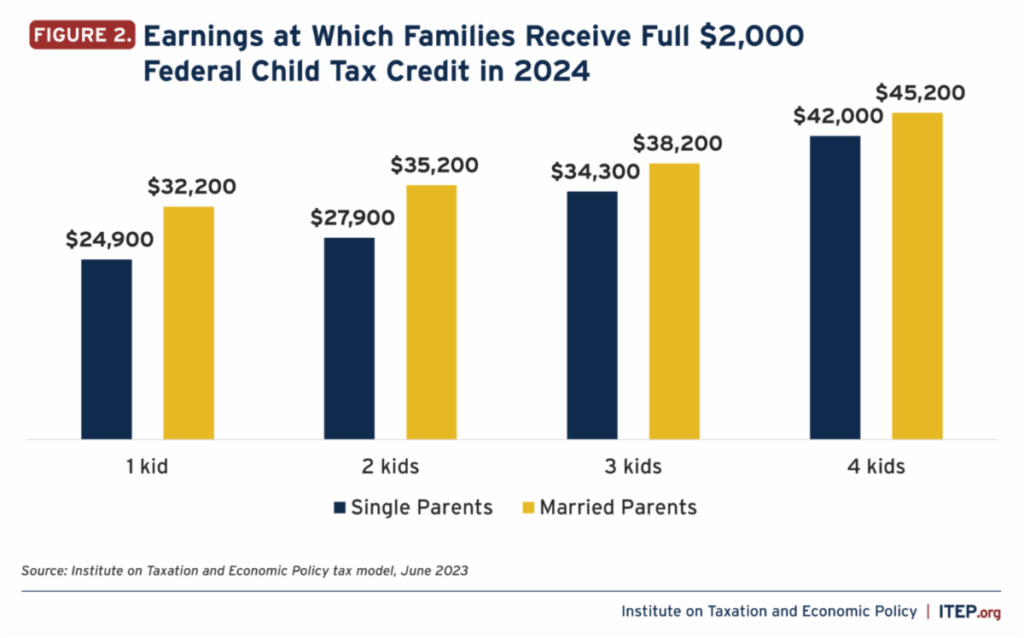

Combined, these two limits mean that the credit is reduced or entirely unavailable to the children who need it most, including children raised by grandparents, parents with disabilities, or parents working as full-time caregivers. Next year, for example, a single-parent household with two children will need at least $27,900 in earnings to receive the full credit under current law.

It is not logical to deny a credit meant to help children to the families who most need the income boost. The House proposal would fix this problem by making the credit fully refundable. This change would make children in low-income families the biggest beneficiaries if the legislation were in effect next year. Families making less than $25,000 would receive nearly a third of the total benefit and would receive an average tax cut of more than $4,000.

Restoring the enhanced Child Tax Credit would help millions of children in low- and middle-income families. Congress achieved a remarkable feat by cutting child poverty by half in 2021. There is no reason that this proven and effective policy should become a thing of the past. This proposal from House Democrats would help orient the tax code toward those who need the support, rather than big businesses and the already wealthy.

Read ITEP’s full brief.

Would you like to learn more about the status of infant and maternal mortality/morbidity in the Mountain State or share how it has impacted your life or the lives of your loved ones? Join our community conversation on July 21, 2023 at 12pm. All are welcome, particularly Black families and families of color who’ve experienced infant and maternal loss, inaccessible or biased health care, or are passionate about these issues. We are grateful for your voices and expertise.

You can register for the meeting here and RSVP to the Facebook event here.

We hope to see you in July!

To learn more about the status of infant and maternal mortality in West Virginia, see our recent blog post here.

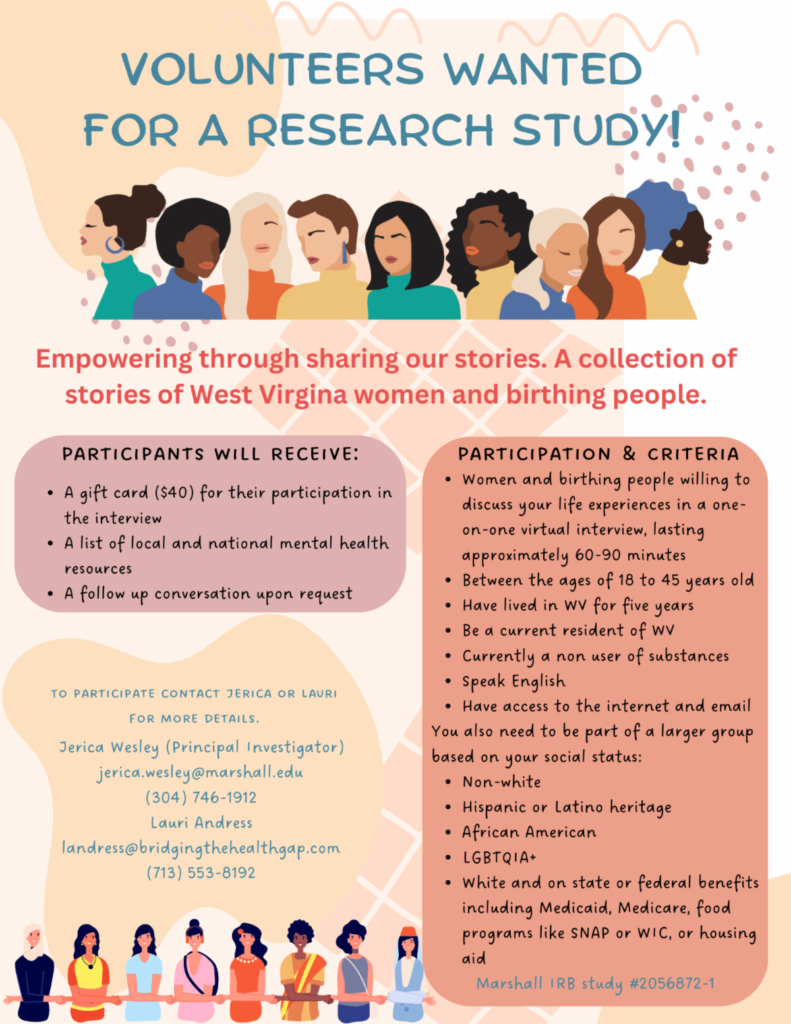

Dr. Jerica Wesley from Marshall University and Dr. Lauri Andress from Andress & Associates are seeking volunteers for a research study to learn more from West Virginia women and birthing people about their health care experiences. Currently there is little state-level data publicly available about the disparate experiences of birthing people across race. This study seeks to empower West Virginians through the sharing of stories and to gather qualitative data to inform advocates and policymakers.

Contact Dr. Wesley (jerica.wesley@marshall.edu /304-746-1912) or Dr. Andress (landress@bridgingthehealthgap.com /713-553-8192) to participate or for more details.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.