Come work with us! We’re hiring two full-time, paid summer fellows.

The WVCBP seeks a Criminal Legal Policy Fellow to research and write about best practices for improving the criminal system, with a focus on the areas of excessive sentences and reducing the harms caused by jails and prisons.

The WVCBP also seeks an Economic Justice Research Fellow to research and analyze issues associated with economic security in West Virginia.

Our summer fellows are paid $20.00 per hour. A typical fellowship runs for 10-12 weeks from mid-May to early August. Fellowships are full-time at 37.5 hours per week and include two paid holidays, three paid vacation days, and one sick day.

Find further details and instructions to apply here. The deadline to apply for both positions is Wednesday, Feb. 15.

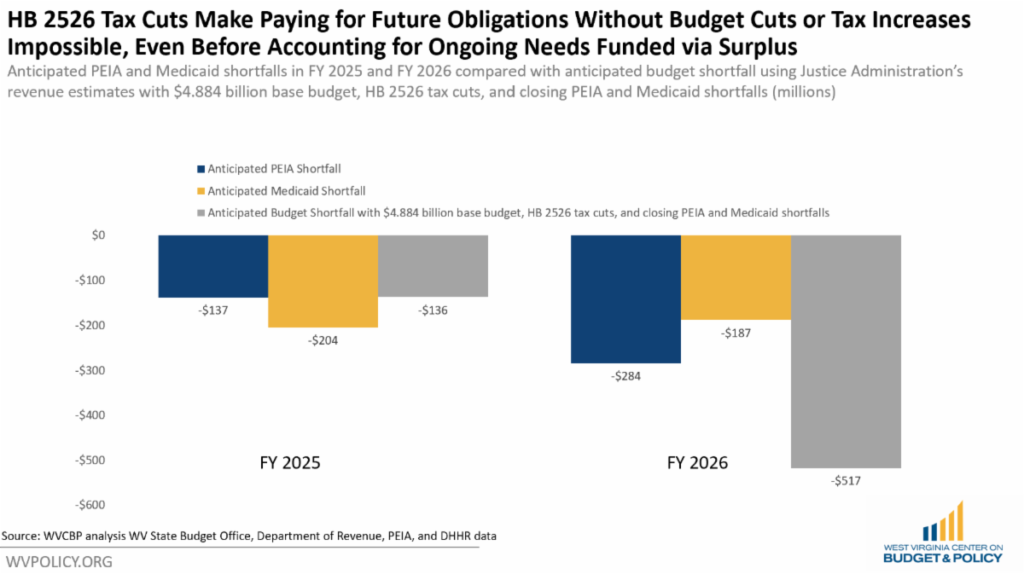

From looming PEIA and Medicaid shortfalls to crisis-level vacancies at state agencies, years of so-called “flat” state budgets are leading to real reductions in public services for West Virginians all across the state. HB 2526, the governor’s proposed personal income tax cut plan, would worsen these issues, leading to near-immediate budget shortfalls and eliminating the surplus “safety net” that lawmakers have grown increasingly reliant on in recent years to fund priorities like PEIA, higher education, economic development, and tourism.

We’ve discussed at length that flat budgets are actually declining budgets, as they fail to keep up with inflation and rising costs. After adjusting for inflation, the governor’s proposed FY 2024 budget is over $500 million less than the FY 2019 budget.

In addition to consistently underfunding state programs and filling state budget holes with temporary federal funds, another way lawmakers have been able to maintain a relatively flat budget in recent years has been to fund ongoing or expected state needs with short-term surplus funds. State lawmakers have long-identified spending priorities for any surplus funds that come in during a given year, putting those potential expenditures in the “back of the budget” to be funded with any excess state revenues.

Lately, this practice has become more prevalent as Governor Justice has created artificially low revenue estimates, leading lawmakers to address growing budget needs by including ongoing state program costs and pent-up state needs as part of their “back of the budget” priorities. In recent years, General Revenue surplus allocations have replaced higher education funding not included in the General Revenue budget, filled the PEIA Rainy Day Fund, funded economic development projects, and paid for current expenses and needed maintenance at various state agencies. In addition to being a fiscally irresponsible practice, as expected state costs should be built into the General Revenue budget, it could be giving legislators a false sense of security that it will be possible to maintain a flat budget in future years—and by extension a false belief that the state can “afford” permanent tax cuts without painful budget tradeoffs.

This phenomenon of using surplus dollars to pay for annual or expected state budget costs should give lawmakers pause as they consider their commitments to fiscal responsibility and big, budget-busting tax cuts. As we’ve highlighted previously, the governor’s tax plan would quickly create budget shortfalls within the existing General Revenue budget, which we’ve established does not even represent all of the ongoing program costs across our state’s agencies and programs.

Even using the administration’s very optimistic revenue estimates in FY 2025 and beyond, the state budget would see a shortfall almost immediately if HB 2526 is enacted even with a continued flat budget and simply paying for the anticipated PEIA and Medicaid shortfalls in upcoming years. What’s more, if we add ongoing spending that has been covered by surplus funds in recent years like higher education, tourism, and economic development, the budget shortfalls will skyrocket — and lawmakers will find themselves with no other option than to make significant budget cuts or increase taxes.

Four years of flat budgets have already led to immeasurable negative consequences for workers, children, and families throughout our state. Enacting tax cuts that would force cuts to a state budget that’s already failing to serve West Virginians would be short-sighted and fiscally irresponsible.

Contact your legislators today and make sure they know what you want them to prioritize over the next several weeks. The choice could not be more clear: windfall tax cuts for the wealthy and corporations or investments in PEIA, our schools, infrastructure, supports for workers and families, and other critical needs. You can send them a message here.

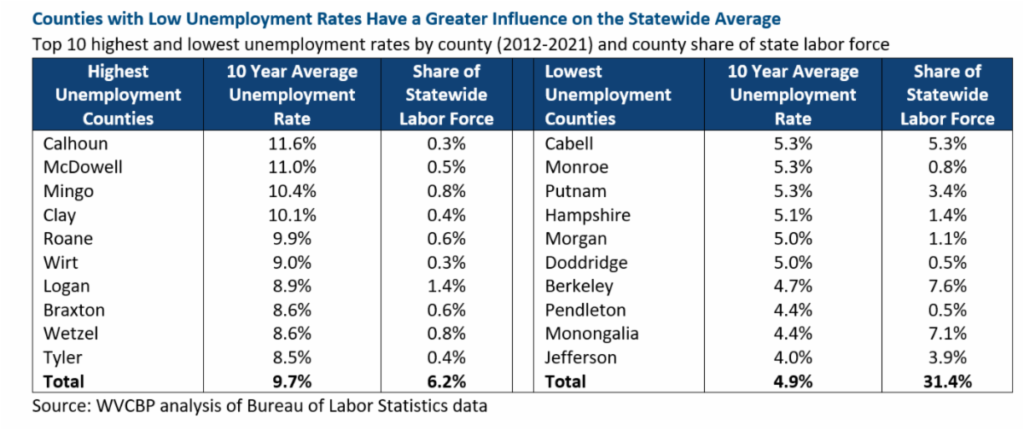

Last week, the West Virginia Senate passed SB 59, legislation to reduce unemployment protections for workers who lose their job through no fault of their own while increasing bureaucratic red tape. Last year, similar legislation was introduced, and we published a blog post debunking the arguments in favor of this policy.

SB 59 is based on anecdotes rather than facts. It assumes that a one-size-fits-all approach works for unemployment. Under SB 59, the availability of unemployment benefits would be based on the statewide unemployment rate. As such, populous counties like Monongalia and Berkeley would dictate the benefits available to workers in counties that have far fewer job opportunities available to them. Notably, those likely to need unemployment for a longer period of time are those in rural areas, workers with disabilities, or those who don’t have access to transportation and internet. One size does not fit all.

The argument that SB 59 would have an impact on workforce participation is based on a misunderstanding of how unemployment insurance functions. To be eligible, one must have worked in the last year and lost a job through no fault of their own. This legislation targets people who are already in the workforce.

Finally, the idea that we must reduce benefits to give a break to employers is not based in reality. In 2022, all West Virginia employers already saw a 25 percent tax reduction in unemployment insurance costs. Further, the state’s unemployment rate is at an all-time low.

SB 59 is a solution in search of a problem that would disproportionately harm rural West Virginia workers on the basis rhetoric instead of facts and data. The WVCBP will continue to oppose the bill as it moves to the House.

Read our full blog post here.

Reading scores in West Virginia declined significantly during the pandemic. This legislative session, a bill has been introduced to add assistant teachers to select classrooms in the attempt to improve education outcomes. However, given the state’s notoriously low educator pay and with a significant PEIA shortfall looming, experts are concerned there would be difficulty filling these positions. A recent article, including analysis from the WVCBP, provides further details. Excerpt below:

Some lawmakers see the value in putting extra helpers in public school classrooms, especially as they seek to turn the tide on the state’s reading scores. A piece of House legislation, which is backed by the state department of education, would add early childhood classroom assistant teachers to first-, second- and third-grade classrooms with more than 12 students to help teachers improve education outcomes, including literacy. The Senate is looking over a similar piece of legislation.

Statewide, counties would need to fill up to 2,500 teachers’ assistants positions during a teacher shortage; this school year, more than 1,500 staff positions were unfilled at the K-12 level, according to the West Virginia Department of Education.

West Virginia has one of the lowest starting salaries for teachers in the country, and the Public Employees Insurance Agency, or PEIA, the teachers’ insurance provider, is facing a financial crisis and uncertain future.

Del. David Elliot Pritt, D-Fayette, is a middle school teacher and a parent of children in public school. He backed the bill, which came with a nearly $100 million price tag.

“The ramifications are immeasurable,” he said. “How is it going to be funded and how we are going to fill these positions when it is funded – that’s the burning question. I think in our border counties, these positions will be more difficult to fill.”

He said, historically, the state health insurance plan has been “the carrot to entice people into the job” because of low teacher salaries.

“Now, our pay isn’t competitive,” Pritt said, and “our benefits aren’t sustainable.”

The West Virginia Education Association supports the bill but echoed similar concerns about how the state will come up with thousands of qualified classroom assistants.

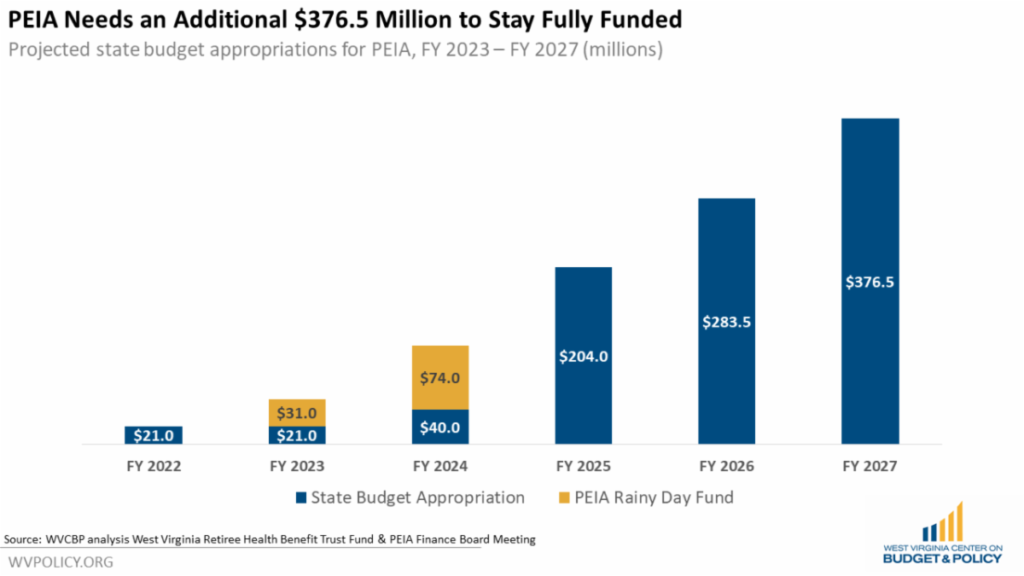

PEIA’s uncertain future could impact hiring efforts.

The [2018 West Virginia teachers’] strike didn’t negotiate major changes to PEIA, and now, the future of the insurance is unclear. In early January, right before lawmakers would gather for the Legislative session, Wheeling Hospital announced that it would stop accepting PEIA patients in July. More than 200,000 public employees in West Virginia use PEIA.

On the first day of session, state senators passed a bill to increase the amount that PEIA reimburses hospitals.

However, the fix was short-term, and the health insurance agency faces an expected $376 million shortfall by 2027, according to analysis from the West Virginia Center on Budget and Policy. There is no long-term funding plan for the insurance, though a PEIA task force – born out of the 2018 teachers’ strike – recommended state funding. The group’s recommendations were never implemented. Gov. Jim Justice created a $100 million PEIA Rainy Day Fund to keep it afloat; that fund is set to expire in 2024. Meanwhile, PEIA’s expenses have continued to increase annually while premiums haven’t risen to keep up with expenses, like rising prescription drug costs.

Wheeling Hospital, which is a part of the WVU Hospital network, said PEIA was not adequately reimbursing the hospital for its care of PEIA patients. Jim Kaufman, president and CEO of the West Virginia Hospitals Association, told MetroNews that other hospitals have discussed getting rid of PEIA.

“We’ve had time to work on this, and the fact that the task force has not been meeting – following through to find a long-term funding source – is very concerning,” said Fred Albert, president of the West Virginia chapter of the American Federation for Teachers union. “It looks like the predictions show that we’re going to have a major train wreck. If our public employees and school personnel don’t have a good health care package, that was what was so attractive for so long … we’re going to have some major issues.”

Christy Day, spokeswoman for the WVDE, said in an email, “The future of PEIA has not weighed on efforts or decisions to fill vacancies in these much needed areas.”

Read the full article here.

Read our blog post detailing the looming PEIA shortfall here.

Claims of historic revenue surpluses continue to be touted by public officials to call for personal income tax cuts. And yet, our state is currently experiencing numerous funding crises and suffering the consequences of severe underinvestment in critical needs.

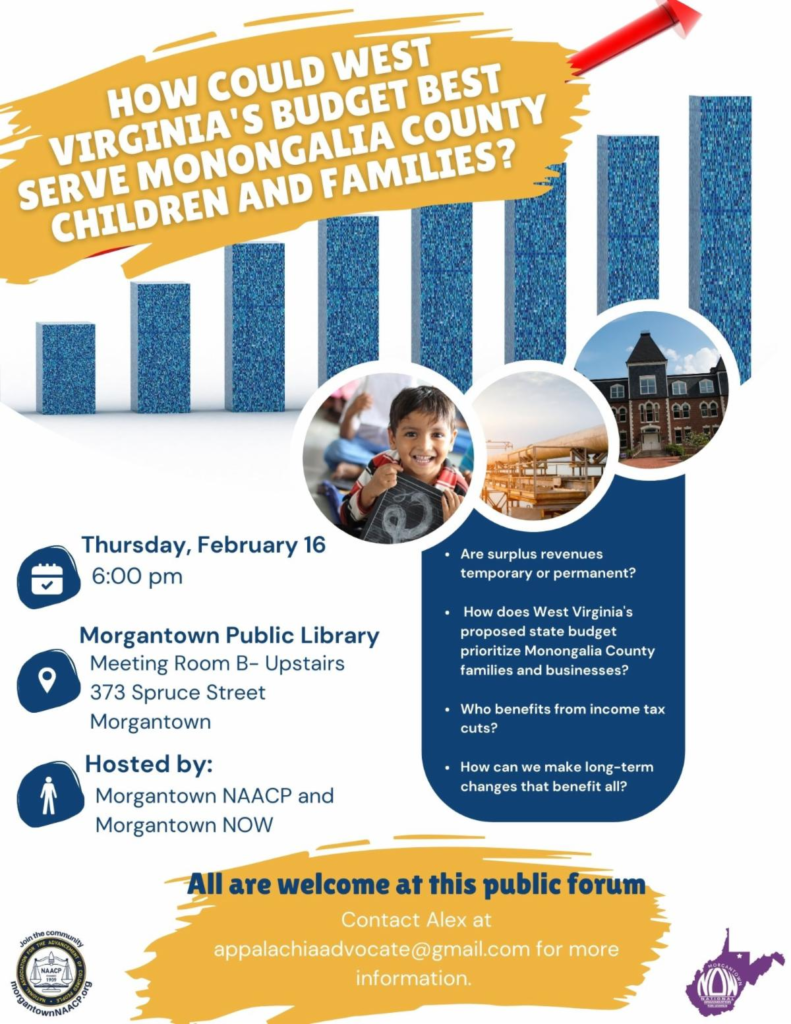

After years of flat budgets and major proposed tax cuts, how is the West Virginia state budget serving Mountaineer children and families?

Join us as we discuss what the budget tells us about the state’s priorities and the extent to which the revenue “surpluses” are legitimate. We also hope to learn about your priorities for the ongoing state legislative session.

Our public forum will be held Thursday, Feb. 16 at the Morgantown Public Library (373 Spruce St., Morgantown, WV 26505) at 6pm. RSVP here.

Black Policy Day is coming to the Capitol on February 15!

Join the WV Black Voter Impact Initiative and their partners for breakfast at the Cultural Center starting at 7:00am, followed by a series of activities and speakers related to the Black policy framework.

The day will include a breakfast event that reviews the Black Policy Agenda and provides information about current opportunities and resources. The afternoon will include a youth-centered lunch event with accompanying activities. Throughout the day, there will be opportunities to engage in meetings with lawmakers, space for vendors and tabling

opportunities, youth activities, and much more. Some of the events that day will include an option for virtual participation via a live stream.

Learn more and register for the event here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.