From looming PEIA and Medicaid shortfalls to crisis-level vacancies at state agencies, years of so-called “flat” state budgets are leading to real reductions in public services for West Virginians all across the state. HB 2526, the governor’s proposed personal income tax cut plan, would worsen these issues, leading to near-immediate budget shortfalls and eliminating the surplus “safety net” that lawmakers have grown increasingly reliant on in recent years to fund priorities like PEIA, higher education, economic development, and tourism.

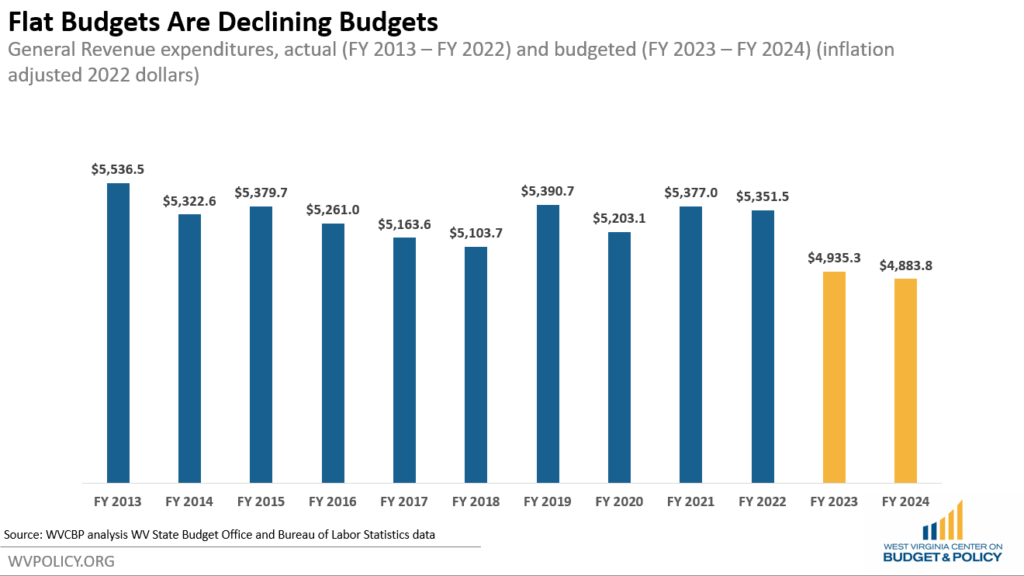

We’ve discussed at length that flat budgets are actually declining budgets, as they fail to keep up with inflation and rising costs. After adjusting for inflation, the governor’s proposed FY 2024 budget is over $500 million less than the FY 2019 budget.

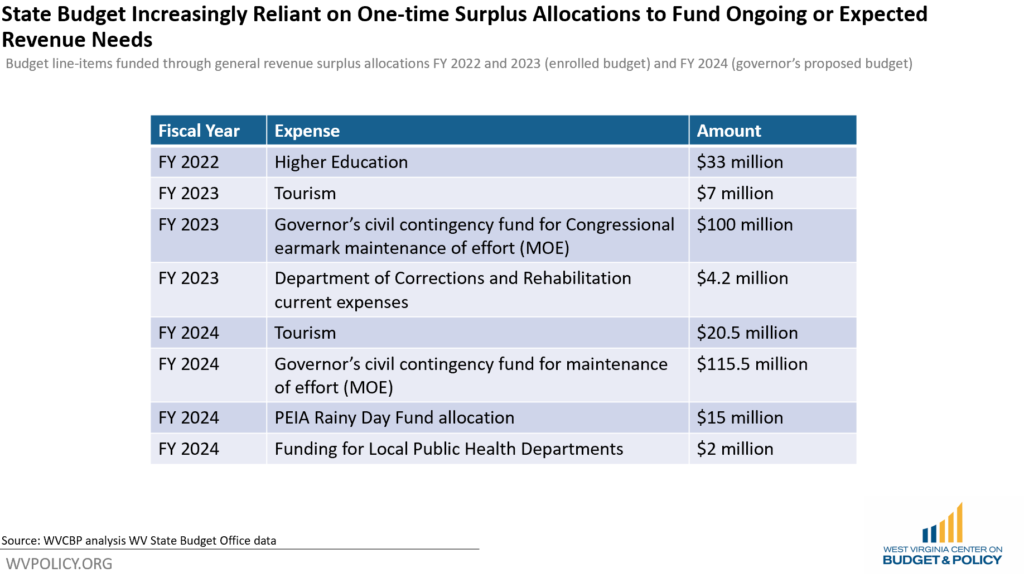

In addition to consistently underfunding state programs and filling state budget holes with temporary federal funds, another way lawmakers have been able to maintain a relatively flat budget in recent years has been to fund ongoing or expected state needs with short-term surplus funds. State lawmakers have long identified spending priorities for any surplus funds that come in during a given year, putting those potential expenditures in the “back of the budget” to be funded with any excess state revenues. Since surplus revenues historically have been one-time or unexpected funds, it made sense for these “back of the budget” items to cover one-time expenditures.

However, in recent years, this practice has become more prevalent as Governor Justice has created artificially low revenue estimates, leading lawmakers to address growing budget needs by including ongoing state program costs and pent-up state needs as part of their “back of the budget” priorities. In recent years, General Revenue surplus allocations have replaced higher education funding not included in the General Revenue budget, filled the PEIA Rainy Day Fund, funded economic development projects, and paid for current expenses and needed maintenance at various state agencies. In addition to being a fiscally irresponsible practice, as expected state costs should be built into the General Revenue budget, it could be giving legislators a false sense of security that it will be possible to maintain a flat budget in future years—and by extension a false belief that the state can “afford” permanent tax cuts without painful budget tradeoffs.

To use specific examples, higher education and public health are often targets of cuts when the budget is tight or revenues are down. After adjusting for inflation, state higher education spending is down 25 percent over the last decade, while public health department funding is down 18 percent or $3.8 million over the last decade. In recent years, even though the state has enjoyed revenue surpluses, higher education has still seen ongoing or expected costs funded through one-time surplus funds rather than through the General Revenue budget. In FY 2022, $33.2 million was provided through surplus or “back of the budget” allocations. While the full higher education budget was allocated from the General Revenue Fund in FYs 2023 and 2024, a large proposed line-item of $75 million is included in the surplus section of this year’s budget to address deferred maintenance for the state’s colleges and universities — needs that have built up due to years of not keeping pace with expected costs. While public health funding in the General Revenue Fund did increase slightly in recent years following the pandemic, after adjusting for inflation, the FY 2024 General Revenue allocation is still nearly $4 million less than it was a decade ago. In the governor’s proposed FY 2024 budget, an additional $2 million is allocated via the surplus —funding that is much-needed but should be built into the regular General Revenue budget going forward as it will also be an ongoing need.

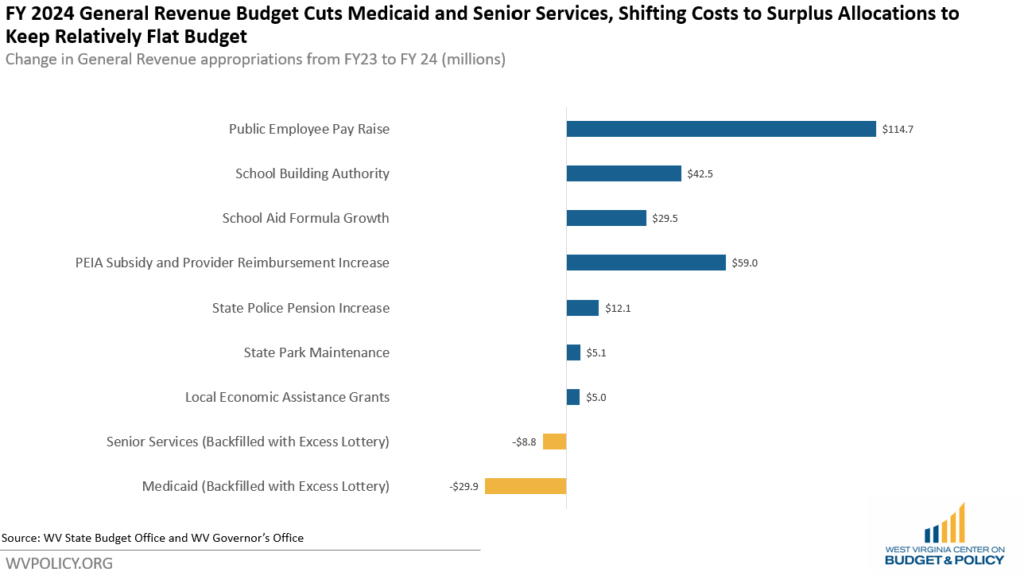

Also included in the governor’s proposed FY 2024 budget is a $29.9 million cut to Medicaid and an $8.8 million cut to senior services. Both are backfilled with excess lottery funds, but this begs the question: why do this if these are annual costs to each program? Even if alternative funds are available to cover these costs this year, moving them out of the General Revenue budget means that any “flat” budgets going forward will not account for these ongoing budget needs.

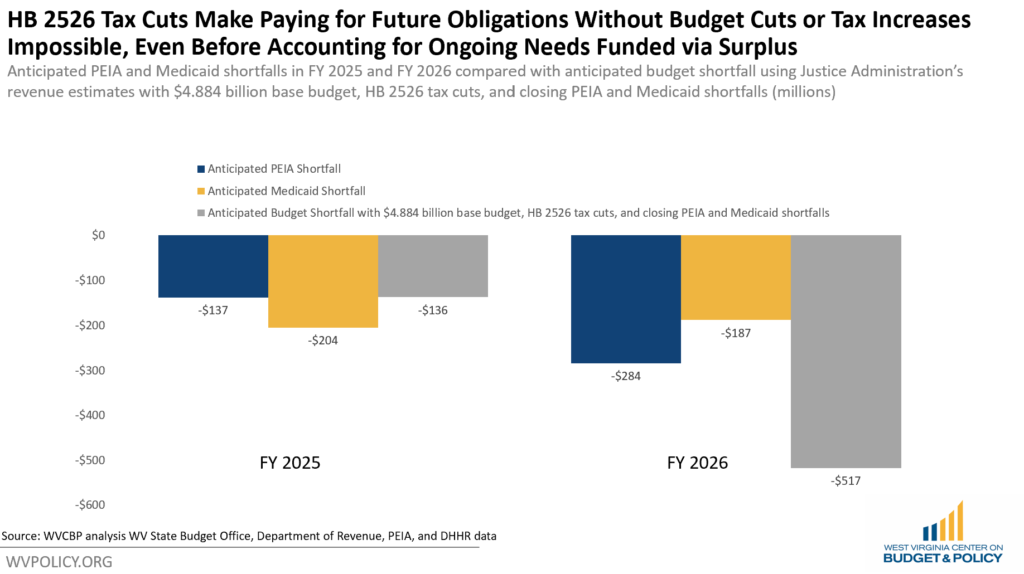

This phenomenon of using surplus dollars to pay for annual or expected state budget costs should give lawmakers pause as they consider their commitments to fiscal responsibility and big, budget-busting tax cuts. As we’ve highlighted previously, the governor’s tax plan would quickly create budget shortfalls within the existing General Revenue budget, which we’ve established does not even represent all of the ongoing program costs across our state’s agencies and programs.

Even using the administration’s very optimistic revenue estimates in FY 2025 and beyond, the state budget would see a shortfall almost immediately if HB 2526 is enacted even with a continued flat budget and simply paying for the anticipated PEIA and Medicaid shortfalls in upcoming years. What’s more, if we add ongoing spending that has been covered by surplus funds in recent years like higher education, tourism, and economic development, the budget shortfalls will skyrocket — and lawmakers will find themselves with no other option than to make significant budget cuts or increase taxes.

Four years of flat budgets have already led to immeasurable negative consequences for workers, children, and families throughout our state. Enacting tax cuts that would force cuts to a state budget that’s already failing to serve West Virginians would be short-sighted and fiscally irresponsible.