After four years of flat budgets failing to keep pace with inflation and the needs of West Virginians, Governor Jim Justice announced another year of largely the same during his annual State of the State Address which took place Wednesday evening.

Instead of presenting a budget that meets the needs of all West Virginians, Governor Justice has committed to personal income tax cuts that will disproportionately benefit the wealthiest in our state.

You can find WVCBP executive director Kelly Allen’s full statement below. You can read her comments included in a recent article reporting on the Governor’s address here.

Years of flat budgets don’t exist without consequences. They harm all West Virginians, particularly children, working families, and communities of color who have all seen their communities underinvested in over recent years. Yesterday, we–alongside the WV NAACP, the WV Education Association, and additional partners–held a press conference outlining what a budget that works for the people would look like.

You can access the press conference recording here.

While Governor Justice and other public officials continue to tout the “historic revenue surplus” and call for further tax cuts benefiting the wealthy, ordinary West Virginians are experiencing daily the impacts of state programs and services that have been underinvested in. WVCBP executive director, Kelly Allen, published an op-ed recently explaining how this disconnect came to be and why flat budgets fail to keep pace with the needs of our state. Excerpt below:

Why does West Virginia have a surplus of tax revenue that isn’t getting to where it is most needed and where it would have the greatest impact for our state’s residents? The biggest reason is that, in West Virginia, the governor’s administration has complete power over the size of the budget through the state’s revenue estimates, or the amount of tax revenue expected to be collected in the upcoming year. Those revenue estimates effectively set a cap on the state budget. Since West Virginia is constitutionally required to have a balanced budget, the legislature cannot spend more than the revenue estimate unless it votes to raise taxes.

During the pandemic, conservative revenue forecasts made sense because there was so much uncertainty in our economy. But last month, the governor’s deputy revenue secretary told lawmakers that the revenue estimates aren’t actually based on what revenues are expected to be according to economic forecasting. Instead, they are simply matched to the amount the governor wants the budget to be — which for the last four years has been flat.

Underestimating West Virginia’s incoming revenues, and by extension its budget, means that West Virginia taxpayers are paying for services they aren’t receiving. State agencies and programs cannot request and receive taxpayer funds that aren’t built into the budget, so instead, the manufactured surplus goes to things like cash handouts to big corporations and university baseball fields. Further, legislators are handcuffed by the governor’s low-balled revenue estimates and budgets as well since they are constitutionally required to balance the budget.

In the upcoming legislative session, lawmakers will have a lot on their plates to address four years of pent-up needs driven by flat revenue estimates and flat budgets. They need to fully fund PEIA and Medicaid, provide raises to state and local employees in order to address vacancies, and invest in children and families, to name just a few.

Make no mistake, the reason these programs are now in crisis is because they haven’t been addressed in a sustainable fashion year after year. Continuing to kick the can down the road is no longer an option as the circumstances become increasingly desperate. Our lawmakers must ensure that West Virginians’ needs are being met and that state programs and agencies are receiving the taxpayer funds that have been coming in.

Moreover, all of our lawmakers must recognize the choice they will be making as they work to pass a budget in 2023. Will they address the obvious consequences emerging throughout our state of four years of underfunding services and programs, or will they pass tax cuts that overwhelmingly benefit the wealthy and corporations?

In reality, West Virginia doesn’t have a surplus — we have severely underfunded programs and services because taxpayer funding is not getting to the places it’s supposed to go to improve the well-being of all our people. But our legislators won’t be able to address real needs until we stop prioritizing tax cuts for the wealthy and corporations and the governor presents a legitimate budget that rises to meet the needs of our people.

Read Kelly’s full op-ed.

Watch the recording of the WVCBP’s recent Facebook Live exploring the same topics.

As the 2023 legislative session gets underway, the West Virginia Center on Budget and Policy staff would like to invite you to join us at our 10th annual Budget Breakfast, taking place on January 20, 2023.

Each year, the WVCBP holds this event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our chosen keynote speaker, to be announced closer to the event.

Please find further event details below. You can register for the event here.

WHAT: WVCBP’s 10th Annual Budget Breakfast

WHEN: January 20, 2023. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2024 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

WHO:

We appreciate your ongoing support of the WVCBP and we hope you can join us at this year’s event!

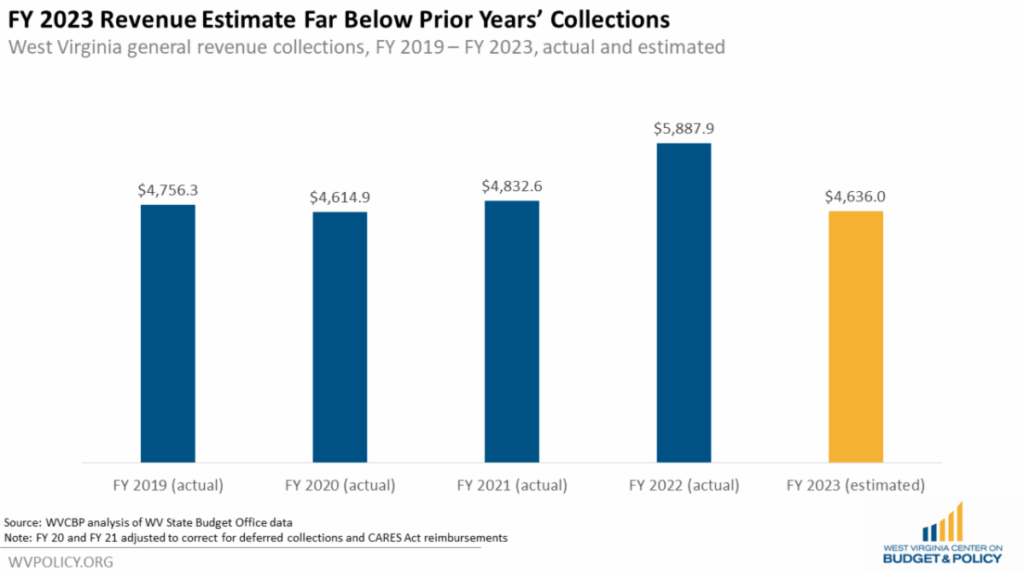

Governor Justice has once again touted the state’s so-called “surplus” as reason to pursue more tax cuts favoring the wealthy. But make no mistake, the state’s surplus isn’t a sign of uncharacteristically strong revenue growth, or a sign that the state’s needs are all being met. Instead, the surplus has been largely manufactured by artificially low revenue estimates, unexpectedly high energy prices, and a flat budget that is ignoring state needs. Further, there are indications that revenue growth is starting to slow, which should be a strong sign to any tax-cut-hungry lawmakers to pursue those cuts cautiously.

As of December 2022, West Virginia’s FY 2024 budget is running a healthy surplus, with revenue collections exceeding estimates by $833 million. But just like last year, those revenue estimates were set to be artificially low, designed to create the illusion of a surplus.

The FY 2023 revenue estimate of $4.6 billion is $1.2 billion below actual collections in FY 2022 and $120 million below actual collections in FY 2019. That means one of two things: either the administration unreasonably expected an economic collapse in FY 2023 that would wipe out four years of growth, or the revenue estimate was intentionally low-balled to manufacture a surplus.

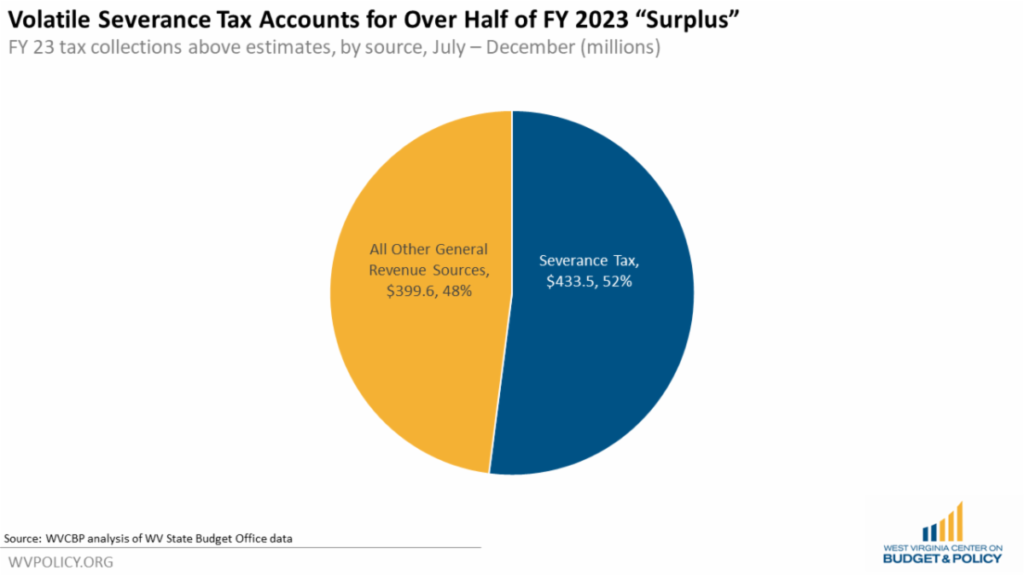

What’s more, the majority of the current $833 million surplus is from severance tax collections, which are being boosted by a temporary surge in energy prices, along with the low revenue estimates. Severance tax collections in FY 2022 totaled $768.8 million, but the estimate for FY 2023 is only $250 million. The combined impact of that artificially low revenue estimate and surging energy prices is that the severance tax is coming in at $433.5 million above the estimate as of December 2022, accounting for 52 percent of the $833 million surplus. To put that in perspective, in the FY 2023 revenue estimate, the severance tax was only predicted to account for 5.4 percent of total revenue.

Aside from the severance tax, the other main sources of state revenue–the personal income tax, the sales and use tax, and the corporate net income tax–are barely outperforming last fiscal year’s collections, after adjusting for inflation, and have actually fallen behind in recent months.

While total FY 2023 collections are $833 million above the low-balled revenue estimate, personal income tax, sales and use tax, and corporate net income tax collections are only $54.7 million above FY 2022 collections, after adjusting for inflation. And revenue collections are showing signs of slowing down compared to last year.

With so much of West Virginia’s surplus built on artificially low revenue estimates and volatile severance tax collections–and while other sources of revenue are beginning to slow–using the “surplus” to justify tax cuts is fiscally irresponsible.

Read Sean’s full blog post.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.