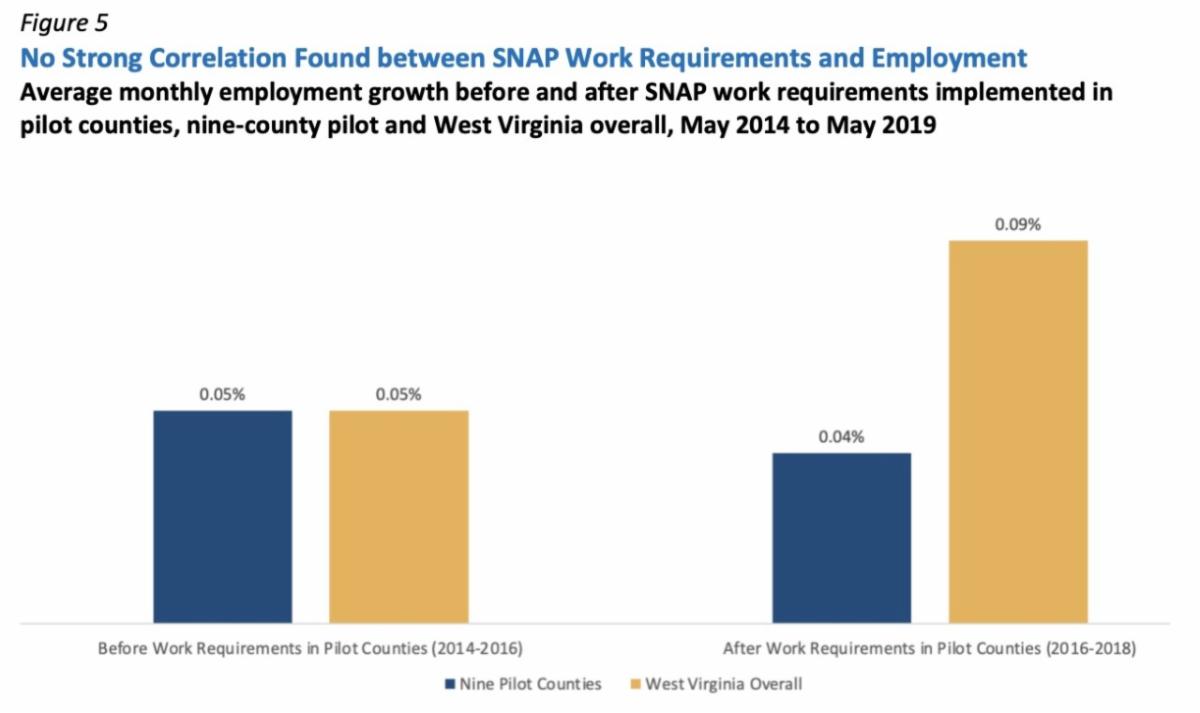

In May 2016, West Virginia implemented a pilot program that placed time limits on Supplemental Nutrition Assistance Program (SNAP) eligibility for adults without children in the home (officially referred to as “able-bodied adults without dependents” or “ABAWDs”) across nine counties. Under these time limits, those affected were ineligible for SNAP if they could not meet certain work requirements. Despite the pilot project’s overwhelming failure to increase employment among impacted folks and clear role in increasing food and economic insecurity, in 2018 West Virginia legislators passed a law, HB 4001, implementing these time limits statewide. This legislation will go into effect later this year while also ending state authority to waive the time limits in future economic downturns. While the federal government has suspended these time limits for the duration of the COVID-19 public health emergency, without further legislative action, HB 4001 will soon apply to ABAWDs across the entire state – regardless of available job opportunities, the unemployment rate, or other factors that may impact these individuals.

In addition to a lack of beneficial impact on SNAP enrollees, SNAP time limits harm West Virginia’s economy as the state forgoes millions of dollars that circulate beyond food purchases annually. In transferring the state’s authority to make nuanced food policy decisions to the federal government, West Virginia lawmakers fail to address hunger needs and relinquish their power to address economic downturns in the future.

Fortunately, state lawmakers can pass legislation to stop the ticking clock that will soon take away their ability to address future recessions and regional variances in our economy.

Our new issue brief examines the failure of the SNAP time limit pilot program, the negative implications of HB 4001, and the urgent need for state lawmakers to reverse course during the 2022 West Virginia legislative session to preserve critical SNAP flexibilities. Access the full brief here.

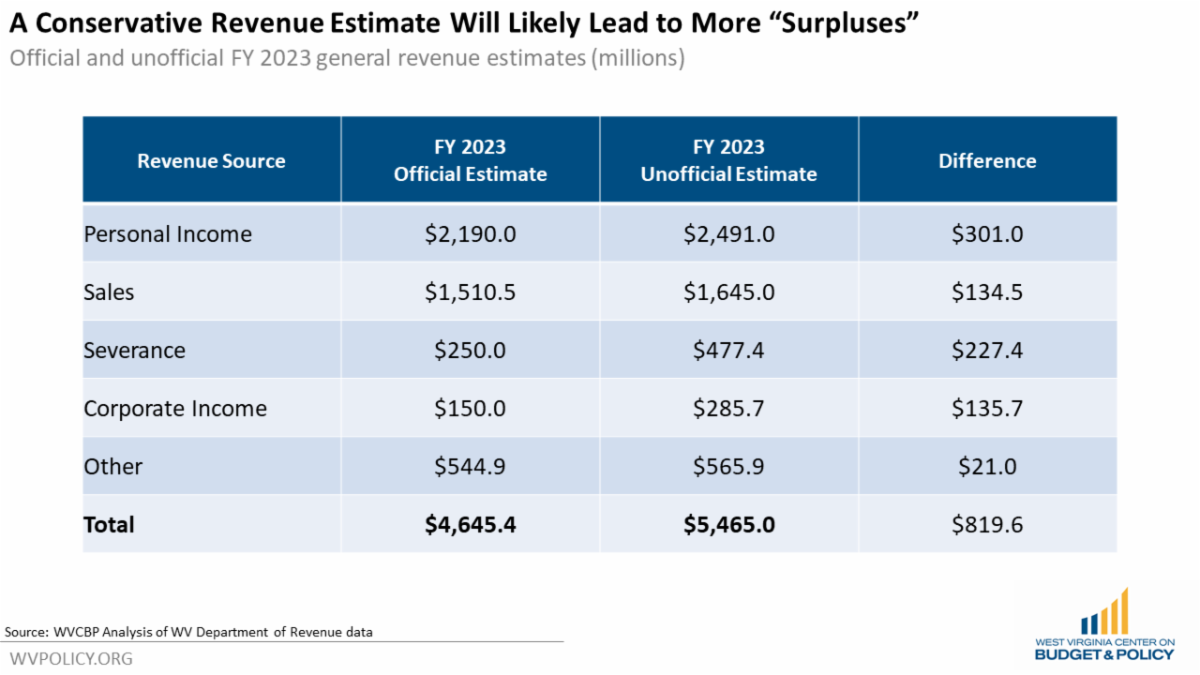

West Virginia is one of very few states where revenue estimates are made by the governor alone. Official revenue estimates determine the total size of the state budget, and lawmakers cannot exceed the official estimates when funding state agencies and programs. Governor Justice’s administration seems to be exploiting that power by setting flat budgets year after year, even as an “unofficial revenue estimate” from the Department of Revenue shows significantly higher expected revenue than the official estimate – a discrepancy of nearly $820 million in FY 2023.

Artificially lowering official revenue estimates, and by extension the state budget, takes fiscal authority away from the Legislature, robs citizens of public services they should be receiving commensurate with the taxes they’ve paid, and will likely lead to major acceleration of the proposed personal income tax cuts in HB 4007 if it is ultimately passed.

In addition to accelerating proposed income tax cuts (that overwhelmingly benefit the wealthy) in HB 4007, artificially low revenue estimates resulting in a flat budget prevent lawmakers from having the ability to adequately address current needs or to make new and necessary investments.

An “expected” surplus is not a surplus at all and if revenues are projected to be higher than the “official estimate,” they should be built into the state budget process so that taxpayers receive the services they paid for and lawmakers can more responsibly allocate West Virginia’s resources. By failing to include an additional expected $820 million in the state budget, the Justice Administration is tying the hands of legislators and denying state agencies and programs the resources they desperately need.

Read Kelly and Sean’s full blog post.

Please join justice-impacted leaders, their families, and other criminal law reform advocates next Tuesday, Feb. 22 for a day of action at the State Capitol.

West Virginia’s incarceration crisis continues: our regional jails are as overcrowded and dangerous as ever before, West Virginians with criminal convictions struggle to find stability after incarceration, and people incarcerated are denied access to basic necessities.

But the good news is that the movement for criminal law reform is growing in the Mountain State and we hope you’ll help continue this positive momentum at Smart Justice Advocacy Day!

You can find further event details, including full schedule, here and event registration here.

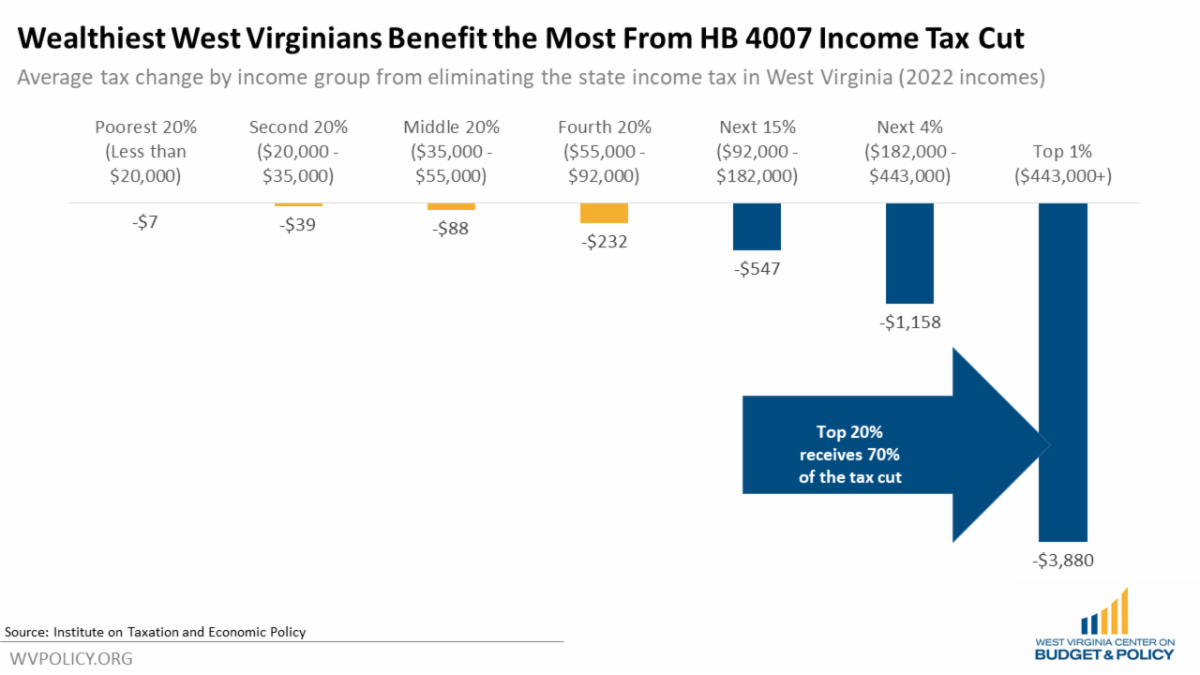

West Virginia lawmakers are currently considering HB 4007, legislation that seeks to eliminate the state personal income tax, the single largest and fairest source of revenue for West Virginia’s budget.

The bill would cut the personal income tax rates by 10 percent across-the-board, with the top 20 percent of income earning households getting a whopping 70 percent of the tax cut. It would also set up the eventual elimination of the income tax by creating a fund into which 50 percent of future revenue surpluses would be deposited in order to continue to phase out the income tax. Make no mistake, this bill starts a ticking clock that would eventually eliminate West Virginia’s personal income tax altogether and, with it, nearly half of our state budget.

HB 4007’s fiscal note makes clear that the income tax reduction plan shares the same flaw as versions that failed to pass last year: relying on a one-time source of revenue – in this case a one-year budget surplus – to fund a permanent, ongoing tax cut. This means that next year and every year after, lawmakers will likely either need to raise other (more regressive) taxes, slash funding for public services, or some combination of both to pay for the ongoing tax cut. HB 4007 would overwhelmingly benefit the wealthiest West Virginians while putting at risk the programs that benefit us all: K-12 education, health care, programs for children, and more.

To use a one-time surplus to cut taxes for the wealthiest households in our state instead of addressing ongoing urgent needs is short-sighted, immoral, and bad for our state’s economy.

Please consider contacting your legislators and telling them that you oppose this proposal, which would disproportionately benefit the wealthiest West Virginians at the expense of low- and middle-income families and create massive budget shortfalls that ensure significant and painful cuts to the public services that touch all of our lives.

Learn more about HB 4007 in Sean’s blog post here or a recent article featuring his insight here.

Essential workers were championed throughout the pandemic for their critical jobs keeping our economy afloat. But now, West Virginia legislators are considering gutting unemployment benefits for those very same workers if they lose their jobs through no fault of their own. Senate Bill 2 would cut the number of weeks that displaced workers are eligible for unemployment insurance from 26 weeks to as few as 12 weeks. This action would make West Virginia a major outlier as only two other states offer just 12 weeks of unemployment benefits. SB 2 will endanger economic security and peace of mind for workers, children, and families, while also harming our state’s economy and doing nothing to address lawmaker’s stated goal of getting West Virginians to work.

Please join us in contacting your legislators and urging them to vote no on SB 2.

Learn more about how SB 2 and SB 3 needlessly harm West Virginia workers in our blog post here.

West Virginia legislators are currently considering whether to — yet again — cut the state’s already low severance tax. This would prove costly and harmful to our state budget.

An additional severance tax cut would largely serve out-of-state corporations and would mean West Virginia could miss out on hundreds of millions of much needed new revenue that it could otherwise use to address outstanding needs or make new — and necessary — investments.

West Virginia’s natural resources are finite, and West Virginians deserve to benefit from their extraction.

Learn more in Sean’s blog post or in our educational video.

West Virginia currently has $110 million of untapped Temporary Assistance for Needy Families (TANF) funds at its disposal. These federal dollars are intended to provide short-term relief for families with children, often being put toward household essentials like food and rent. As the ongoing pandemic continues to exacerbate hunger and other financial hardship, it remains unclear why West Virginia is not putting these funds to use when so many Mountaineer families would benefit from them. A recent article, featuring insight from WVCBP policy outreach director Seth DiStefano, examines this question. Excerpt below:

DHHR oversees West Virginia’s distribution of the state’s annual TANF block grant. Allison Adler, DHHR spokeswoman, denied interview requests for this story.

In an email, Adler said the surplus funds are due to having more money than there are allowable expenses for the funds.

Burnside emphasized that states have flexibility in how they spend the federal dollars, which are doled out each year, as long as they meet the TANF program’s four goals as outlined in the original 1996 federal welfare reform legislation. Those goals include assisting needy families so children can be cared for in their own homes, and helping parents move on from federal assistance by connecting them with jobs.

…

Both nationwide and in West Virginia, the number of people on TANF has declined, though experts warned that it wasn’t necessarily an indication of less people in need.

LaDonna Pavetti, the vice president for family income support policy at the Center on Budget and Policy Priorities, attributed part of the decline — despite a pandemic — to unemployment insurance payments made over the last two years and families receiving stimulus money from the federal government.

There are also more restrictive policies in place. Last year, West Virginia lawmakers, who have input into how TANF functions, voted to keep drug testing TANF recipients. The program, according to DHHR leadership, was meant to help get people into treatment. But as of last year, only one West Virginia resident flagged through the program has successfully completed treatment.

Pavetti said a policy like this can deter families from reaching out for help.

She said that in many places, applying for TANF is an “undignified experience.”

“It treats them as if they’re not deserving of help even though people are turning here in a crisis to meet their basic needs,” she said.

Read the full article.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) stopped being distributed.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about the #Unbearable campaign launch here and watch a recording of the launch event here.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.