This week, the House Finance Committee originated and quickly passed their own income tax cut bill (HB 3300) as an alternative to Governor Justice’s proposal. Unlike the governor’s proposal, the House plan contains no offsetting revenues and would instead lead to massive budget deficits while giving most of the tax cuts to high-income West Virginians. The bill would eventually eliminate the state’s progressive personal income tax – the single largest source of revenue for the state budget.

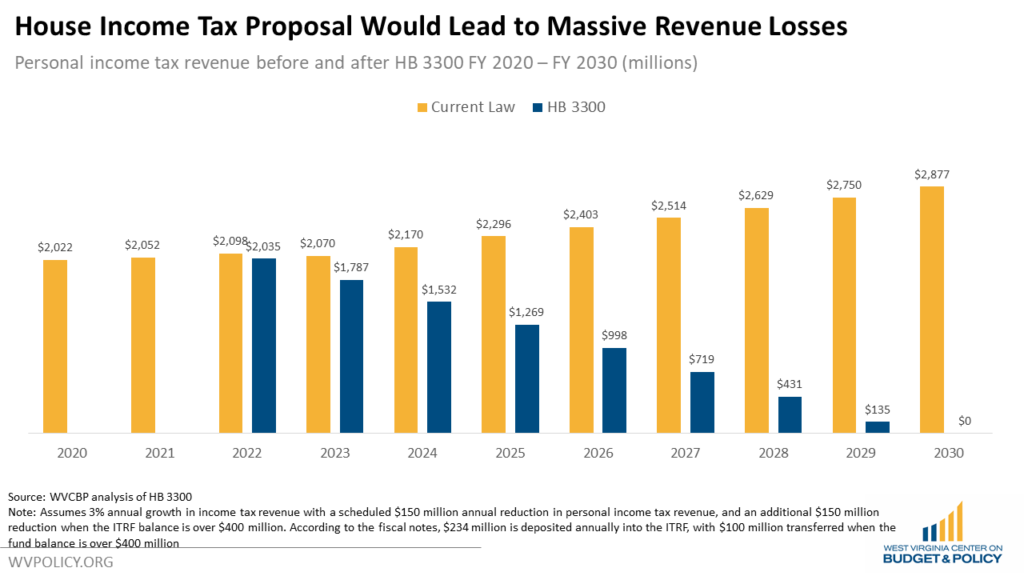

HB 3300 would immediately reduce the state’s income tax brackets starting January 1, 2022, and would then require a $150 million reduction in total income tax revenue every year thereafter, until the income tax is fully eliminated. The state’s income tax rates would be reduced by the tax commissioner to whatever rates are required to achieve the $150 million reduction.

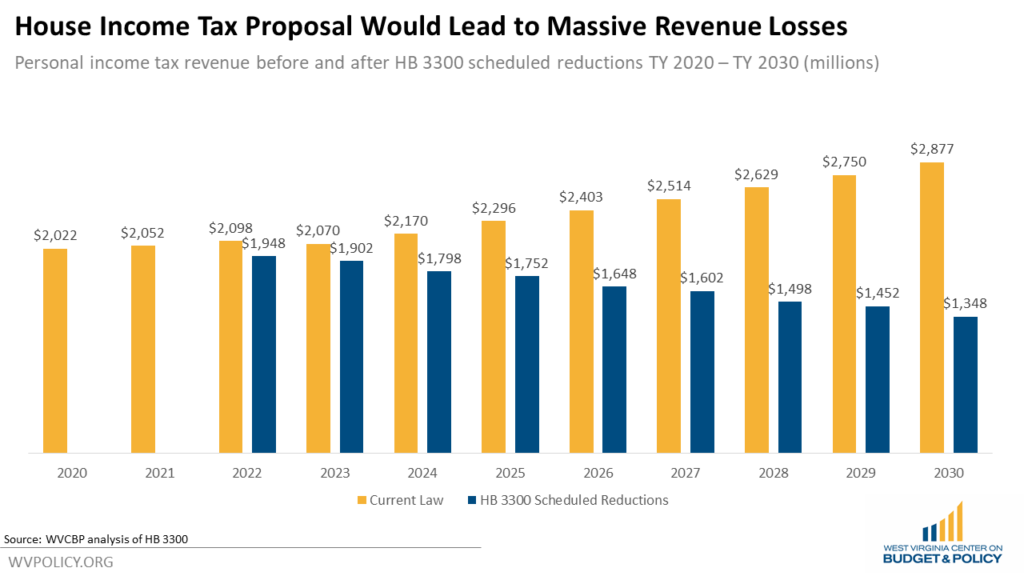

This $150 million annual reduction compounds quickly, as each year’s reduction is stacked on top of the previous year’s reduction. For example, after the initial rate reduction in 2022, the bill specifies that total income tax revenue in 2023 must be $150 million below revenue collections in 2021. Then in 2024, total income tax revenue must be $150 million below total collections in 2022, a year already impacted by the first rate reduction. That pattern continues, with each $150 million reduction compounding on top of the previous years’. Within just seven years, income tax collections will be down over $1 billion.

What’s more, those revenue losses could become even larger — and happen even sooner — thanks to another provision of the bill. The bill creates a Personal Income Tax Reduction Fund (the fund) to trigger additional reductions in the state’s personal income tax, on top of the compounding annual $150 million reduction. The fund would receive up to $25 million annually in sales tax revenue from online sales, $18 million in income tax revenue, $9 million in general sales tax revenue, $2.7 million in severance tax revenue, $1.8 million in tobacco tax revenue, $1.8 million in corporate income tax revenue, $1.8 million in insurance tax revenue, $1.8 million in business and occupation tax revenue, and an unspecified amount of Lottery Fund revenue. Twenty-five percent of any future General Revenue Fund surpluses and 0.5 percent of any new source of revenue enacted in the future would also go into the fund.

Once the fund collects $400 million, $100 million is transferred to the General Revenue Fund. However, for any year that the $100 million is transferred from the Personal Income Tax Reduction Fund, an additional $150 million tax cut is triggered, on top of the annual $150 million reduction, resulting in a $300 million total loss in tax revenue that year. This ensures that the fund transfer will always fall far short of the revenue lost from reducing the personal income tax, even in the first year.

The Personal Income Tax Reduction Fund hurts the budget in two major ways. First, each time the $400 million trigger is met, the annual $150 million tax cut doubles. So while $100 million is transferred from the fund, revenue is reduced by $300 million that year. And then the regular $150 million annual reductions continue each year, with or without the trigger being met.

The creation of the fund itself also hurts the budget. The fund diverts $61.9 million in existing General Revenue funds that are currently being used to keep the budget in balance. So not only is revenue reduced by $150 million each and every year, but another $61.9 million is taken from the budget to create a fund that will only lead to steeper and faster revenue losses.

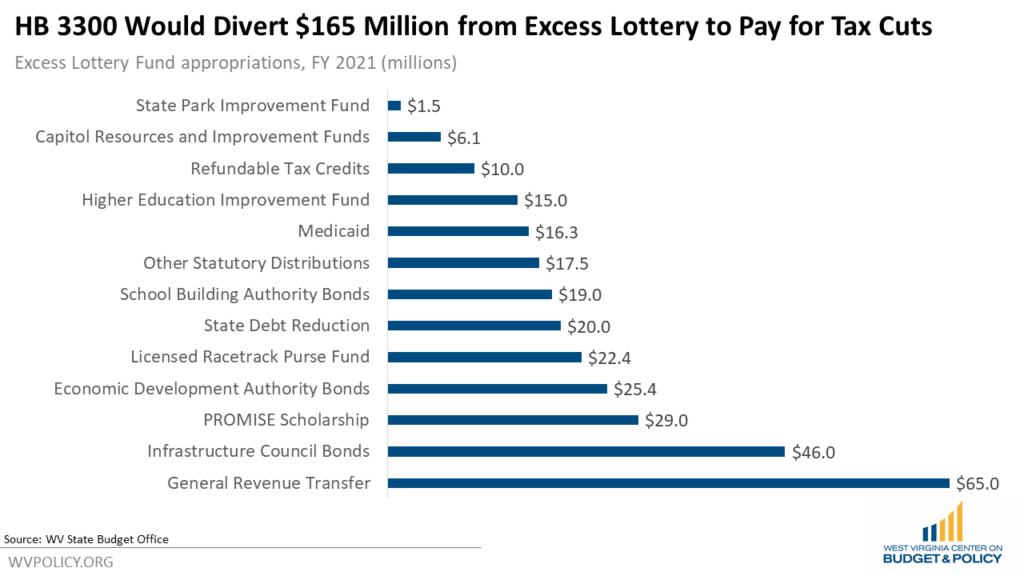

Without a fiscal note, it is unclear how much revenue would also be diverted from the Lottery funds. Based on the fiscal note for a similar bill, it appears likely to be in the tens of millions. This too would have a major impact on the budget. Lottery revenue has declined in recent years and is projected to be flat in the future. Diverting existing lottery funds would impact programs funded by the state’s lottery commission, such as the PROMISE scholarship, Medicaid, infrastructure, and veteran services, as well as likely lead to downgrades to the state’s lottery and general obligation bonds.

The magnitude of revenue losses to both the General Revenue and Lottery funds will put tremendous pressure on future legislatures to make painful budget cuts or raise other taxes — likely both. In an internal memo from before the session, House Republicans outlined what cuts would be necessary to eliminate the income tax, which included eliminating the PROMISE scholarship, eliminating all funding for WVU and Marshall, and 10-20 percent across the board cuts to all state agencies including public education, higher education, and DHHR, with the elimination of public services.

But even steep across the board budget cuts would not be enough to offset the lost revenue, meaning future legislatures would also have to consider tax increases. These increases would likely take the form of the tax increases proposed by the governor in his income tax cut plan, including increasing the sales tax to the highest rate in the country, expanding the sales tax to professional and personal services, and significantly increasing the tobacco, alcohol, and soda taxes.

And while the budget cuts and potential tax increases impact low- and middle-income households the most, those same households get the smallest savings from the income tax cut.

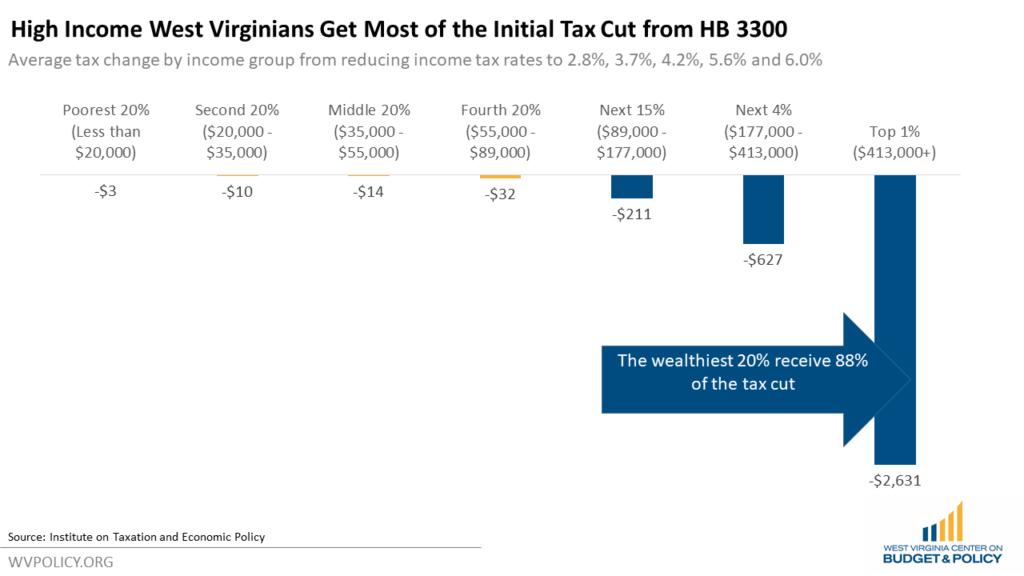

The bill’s initial rate reduction reduces the income tax rate for the highest income households more than twice as much as it does for the lowest income households. The top income tax rate, on income over $60,000, is cut from 6.5 percent to 6.0 percent, a 0.5 percentage point reduction. In contrast, the rates on middle incomes are cut by 0.3 percentage points, and the bottom income tax bracket is reduced by just 0.2 percentage points. As a result, over 88 percent of the first tax reduction would go to the top 20 percent of income earners in the state.

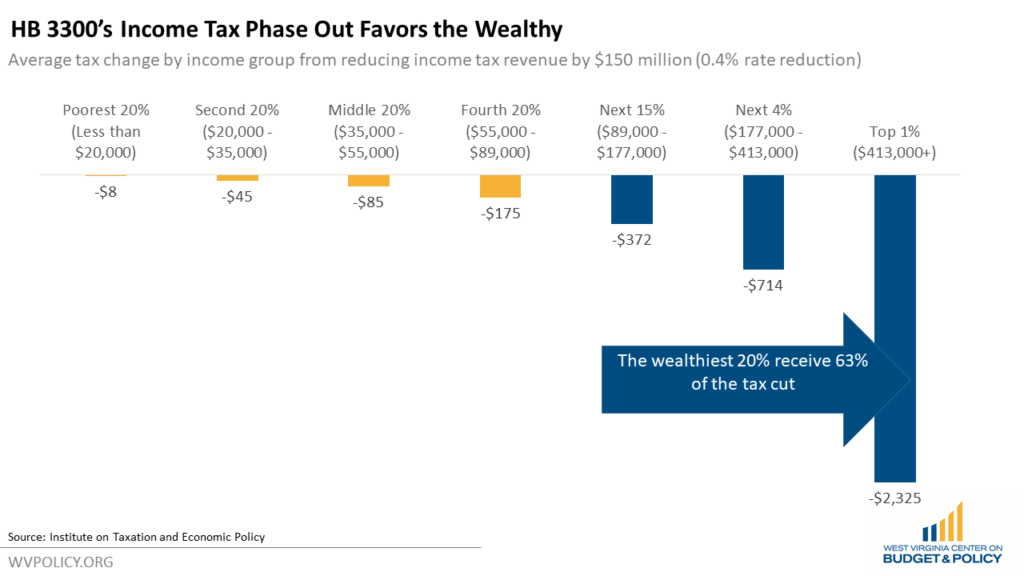

Each subsequent tax cut would also largely benefit the wealthy. A $150 million reduction in the income tax is roughly equivalent to a 0.4 percentage point reduction in the state’s income tax rates. HB 3300 calls for the rate reduction to be applied as “uniformly as possible,” with preference given to lower tax brackets if uniformity is not possible. Applying uniform 0.4 percentage point reductions to each personal income tax rate would give a West Virginian with an income between $35,000 and $55,000 an average tax cut of $85 compared to $2,325 for someone in the top 1 percent with an income of above $413,000. On average the wealthiest 20 percent of households would get 63 percent of each $150 million reduction.

If the income tax is fully eliminated, 70 percent of the $2 billion tax cut would go to the wealthiest 20 percent of households in the state, with 17 percent flowing to the top 1 percent. A household in the top 1 percent in West Virginia would receive a tax cut that is 18 times as large as that of a household in the middle 20 percent.

HB 3300 is a poorly designed tax bill that will throw the state into a fiscal crisis. Instead of responsibly designed cuts and offsetting revenue increases to protect state investments, the bill would enact large, compounding tax cuts every year that are structured to lose revenue, while diverting existing revenue into a fund designed to cut taxes even further — all in a year where there are major unanswered questions about the state’s fiscal health and future needs, and after years of failed tax cuts and underinvestment in education, public health, and infrastructure.

****UPDATED 3/26/2020****

Fiscal notes for the bill have now been posted, confirming both a major impact to the Excess Lottery Fund and how rapidly the tax cuts would take affect.

According to the Lottery Commission, $165 million of the $290 million Excess Lottery Fund would be diverted into the Income Tax Reduction Fund. Currently this funding is used largely used for the Promise Scholarship and paying state bonds. According to the fiscal note, the diversion would “result in the reduction of the State’s bond coverage by 2.3 coverage points, most certainly raising the costs to the State to do business.” Protecting the state’s bond ratings and Promise scholarship would require replacement funding, which the bill does not provide for.

With $165 million of lottery funds flowing into the bill, as well as $69 million in diverted General and Special Revenue funds, the bill would hit the targeted $400 balance in the Income Tax Reduction Fund in its second year, and every year thereafter, triggering an additional $150 million tax cut on top of the automatic $150 million annual tax cut. That means the state would be losing larger amounts of revenue, and the compounding losses would happen much faster.

By FY 2024 the state would be down $638 million compared to current law, and the income tax would be fully eliminated by FY 2030. This would have a devastating impact on the state budget almost immediately, forcing major budget cuts or unpopular tax increases just to break even.

The fiscal notes also confirm that there are no safeguards in the bill. The annual $150 million tax cut happens automatically, and compounds annually. The only trigger is tied to the income tax reduction fund, which accelerates the tax cut, doubling it to $300 million every year the trigger is met.