Feb. 10 marks the beginning of West Virginia’s 85th Legislature, and with this session lawmakers will have the opportunity to build upon their 2020 criminal justice reform efforts.

The following are WVCBP’s criminal justice priorities for 2021:

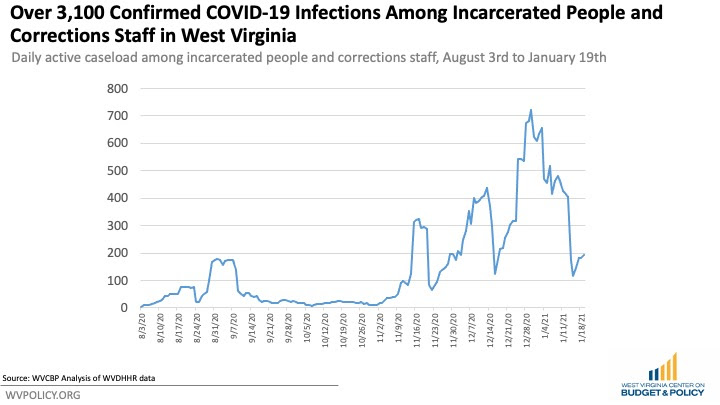

– Immediately Protect Incarcerated People & Correctional Facility Staff Amid COVID-19

– Pursue Robust Sentencing Reform

– Enhance Transparency in Parole Decisions

– Improve Data Collection and Reporting

– Reduce Female Incarceration

– Eliminate Barriers to Reentry

With the national spotlight on the need for criminal justice reform, now is the time for the Legislature to take steps to address the consequences of mass incarceration in West Virginia.

Read Quenton’s full blog post.

Registration is live!

Next week, from Jan. 27 – Jan. 30, participants at the West Virginia Criminal Justice Reform Summit will attend sessions exploring the significance of poverty before, during, and after incarceration. In addition to a wide variety of panels, there will be skill-building workshops as well as ample opportunity for participants to connect with one another. The conference will feature national and state-level experts, including people who have been directly impacted by the criminal justice system.

Our hope is that every participant leaves feeling more informed about the problems and solutions, more equipped to take action, and more connected. Together, we are a powerful force for change.

This summit is being hosted by the West Virginia Criminal Law Reform Coalition, of which WVCBP is a proud member.

Find more details on the summit landing page, follow the event on Facebook, and register here.

West Virginia’s Governor Justice and top lawmakers have expressed support for eliminating or reducing the state’s income tax during the upcoming legislative session.

The personal income tax is the state’s largest source of tax revenue, providing the state with $1.95 billion in FY 2020, which accounts for 43 percent of the state’s general revenue fund. The personal income tax is also usually the fairest source of revenue collected by state and local governments. A well-designed income tax can ensure that wealthier taxpayers pay their fair share, allow for lower rates on low- and middle-income families, and provide a counterweight to less balanced taxes.

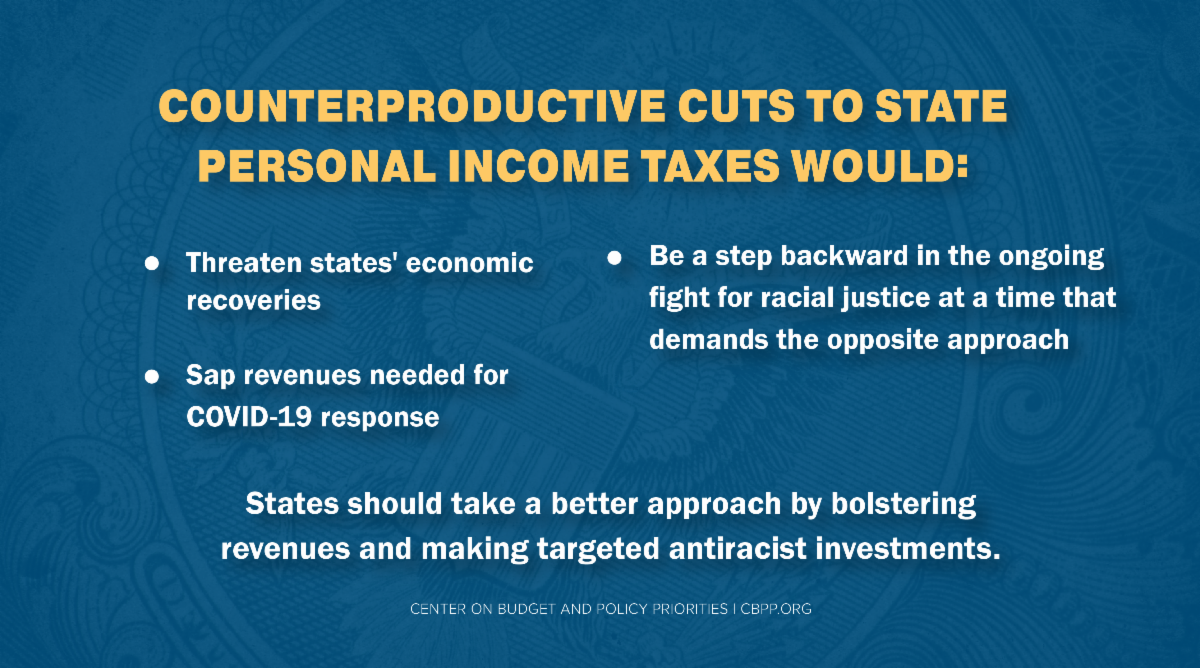

A new publication from the Center on Budget and Policy Priorities (CBPP) outlines how cutting state income taxes is counterproductive to states’ prosperity and racial justice. This report is extremely relevant for West Virginia as we face the threat of eliminating the personal income tax in the 2021 legislative session.

The piece finds that cutting state income taxes:

– Would likely worsen racial inequities

– Hasn’t boosted state economies in the past

– Doesn’t promote small businesses or jobs

– Hinders investments to create thriving, more equitable economies

Last week, CBPP held a panel featuring WVCBP executive director Kelly Allen to discuss the expected harms of making such a drastic change to the tax code. They said that eliminating the state income tax would be “inexplicable.”

Read what members of the media who tuned in to the panel are saying about the proposed tax cut here and here.

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Currently, SOAR’s work is deemed 100% legal in Charleston. Over the next couple weeks, Charleston City Council will likely vote on a new ordinance that would make SOAR’s current harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that SOAR’s work makes the Charleston community both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

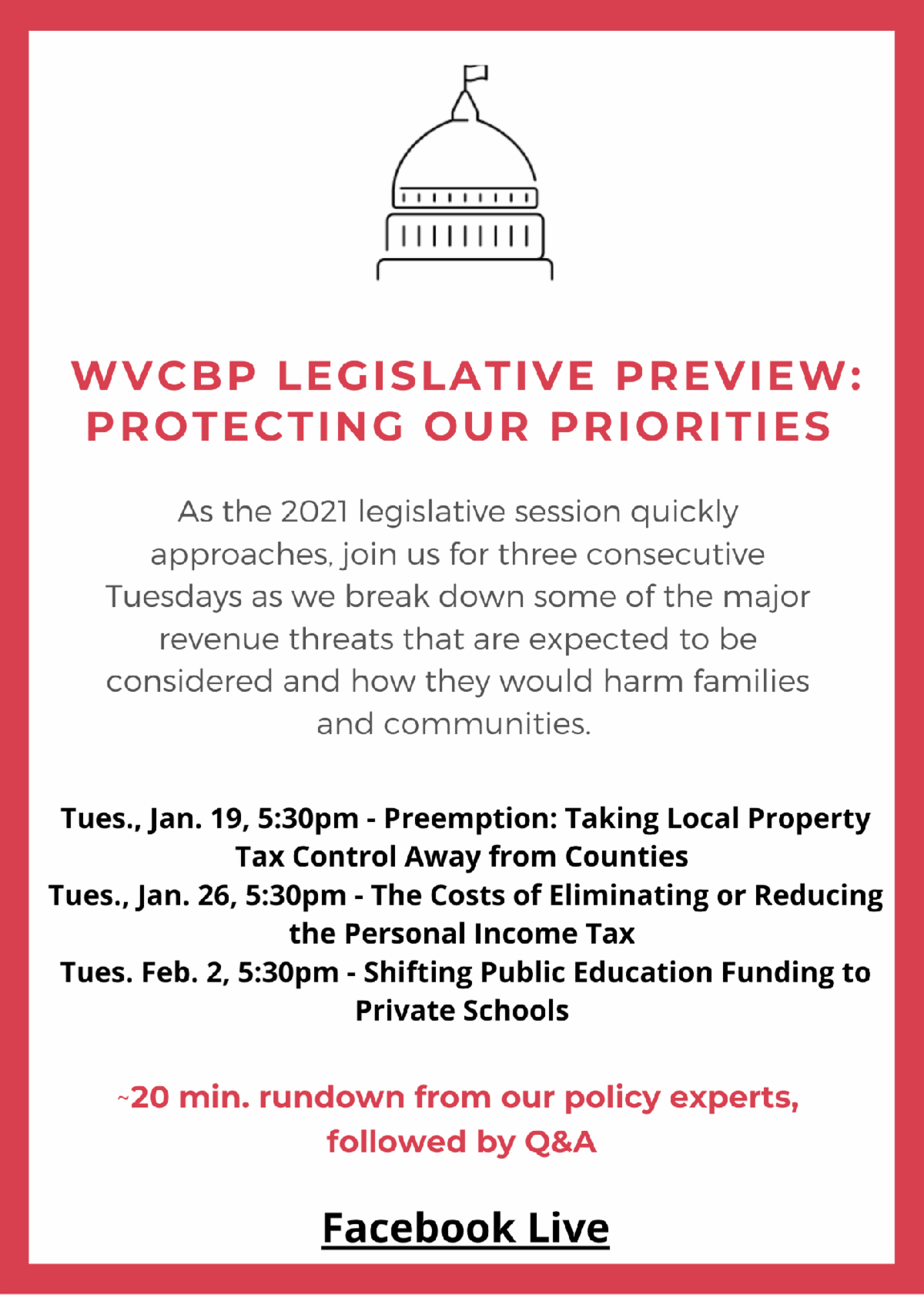

We started out our Legislative Preview Facebook Live series this past Tuesday with a conversation on the expected threats to the business personal property tax and the impact such threats would have on our counties.

If you couldn’t make it this week, you can find the recording here.

We hope to see you next Tuesday!

At the beginning of 2021, WVCBP’s criminal justice policy analyst Quenton King published an issue brief exploring the explosion of county jail incarceration in West Virginia and how this surge is driving enormous and growing pressure on county budgets.

A recent Dominion-Post article highlights some of the brief’s findings. Excerpt below:

Counties in West Virginia are responsible for a lot of bills — including the cost of housing inmates from the county being held in regional jails. That makes the 81% increase in inmate population from 2000-2019 a problem for some counties.

That population increase was one finding in a report by the West Virginia Center on Budget and Policy released this month. The report found the state’s regional jails are primarily used to hold people who are awaiting trial. Each has been charged with a crime but are unable to afford bail.

From 2014-19, jail billing outpaced jail spending statewide. Payments by counties to jails increased 0.3% in that time while the total bill increased 7%.

Our brief’s findings indicate that many counties are incarcerating beyond their ability to pay. At a time when county budgets are particularly strapped as we continue to endure the economic impacts of the pandemic — and at a time when incarcerated people are particularly vulnerable to COVID-related harm as a result of living in congregate settings that don’t allow for proper social distancing — it makes sense now more than ever to prioritize decarceration efforts.

Join us for our 8th annual Budget Breakfast!

Due to COVID-19 considerations, this year’s event will be held virtually via Zoom.

WVCBP’s analysis of the Governor’s 2022 proposed budget will start at 8:00am, followed by keynote panel presentation and time for Q&A.

Our keynote panelists, Rep. Don Hineman and Duane Goossen, will highlight the failed Brownback tax experiment in Kansas and why West Virginia lawmakers should avoid going down the same path. Don Hineman is a Republican member of the Kansas House of Representatives, representing the 118th District. He has served since 2009. He was the Majority leader from 2017 to 2019. Duane Goossen is the former Kansas Secretary of Administration and the Director of the Kansas Division of the Budget. Goossen has served as the Secretary of the Kansas Department of Administration since 2004 and Director of the Kansas Division of the Budget since 1998. Goossen also served in the Kansas House of Representatives 1983 to 1997.

While attendees are welcome to join the webinar at no cost, we hope you will consider supporting the WVCBP’s work and contributing to our annual fundraiser by donating the usual cost of an in-person ticket ($50).

You can find registration here.

We hope to see you there!