The personal income tax is the state’s largest source of tax revenue. In FY 2019, West Virginia collected $2.096 billion in personal income taxes, funding nearly half of the state’s base budget. West Virginia’s income tax is structured so that higher-income residents pay a larger share of their income in personal income taxes compared to low- and middle-income residents. This makes the personal income tax the fairest source of revenue collected by the state government.

Soon after the 2020 election, Governor Jim Justice announced his plans to eliminate the state’s personal income tax in the upcoming legislative session. Eliminating the personal income tax would provide huge windfalls to West Virginians with high earnings at the expense of the majority of West Virginians. The inevitable result of such proposals can only go one of two ways: devastating cuts to public services or higher taxes on everyone else. Regardless of whether the ultimate proposal punts difficult choices to future lawmakers by gradually phasing out the income tax, onto local communities via cuts to state aid, or onto families by increasing the sales tax, the disastrous results would still be the same.

West Virginia families and businesses rely on the services that state taxes support including funding for public schools, universities, infrastructure, health care, and public safety.

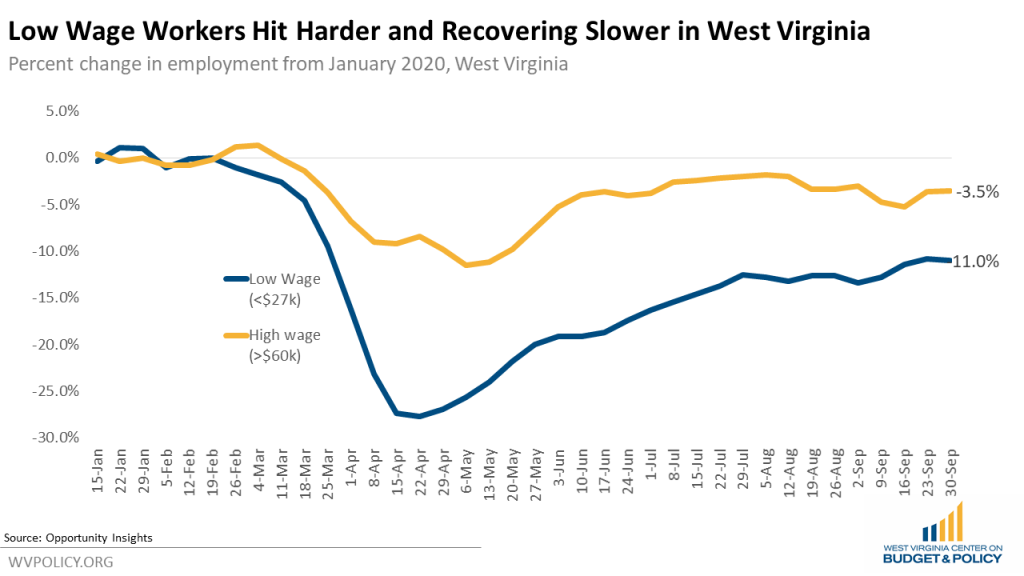

Regressive tax cuts are always a bad idea but enacting them during a pandemic and recession is unthinkably dangerous. Unemployment is still higher than it was during the Great Recession and increasing numbers of families are struggling to meet their basic needs. The economic recovery has largely left out low-wage workers, making it even more irresponsible to further shift the tax responsibility from the wealthy to the poor by eliminating the income tax.

Beyond being bad for the majority of West Virginia families, personal income tax cuts fail to achieve their stated goals of increasing economic growth. States that have eliminated their income taxes have, on average, slower income growth than the states with the highest income taxes. In fact, the nine states with the highest marginal income tax rates over the last decade saw faster income growth, faster overall economic growth, and lower pre-pandemic unemployment rates than the nine states without income taxes.

Instead of focusing on failed tax schemes, lawmakers looking to improve the lives of West Virginia families should preserve critical public services like Medicaid and education, while prioritizing proven ways of investing in our people like broadband, child care, infrastructure, and job training.