In the last post, we looked at how West Virginia – especially southern West Virginia – is being out-competed by other coal regions because of the decline in coal mining productivity that makes it cheaper to produce coal in places like Illinois and Wyoming. Not only do West Virginia coal producers face stiff competition from other coal basins, they see growing competition from large deposits of shale natural gas out west and in West Virginia and, to a lesser extent, from renewable energy.

#4 West Virginia coal is losing steam to natural gas and renewable energy

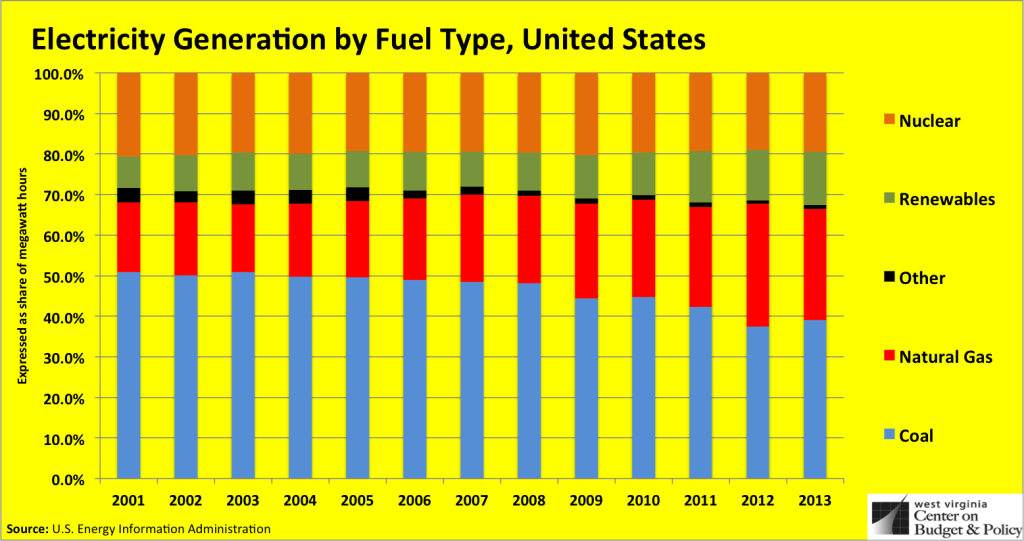

Over the last several years the amount of coal used for electricity production at power plants in the United States has dropped considerably, from just about 2 billion megawatt hours in 2008 to about 1.6 billion megawatt hours in 2013. This trend is largely driven by the nation’s recent development of shale natural gas. Electricity generated from natural gas grew from about 639 million megawatts in 2011 to over 1.1 billion megawatts in 2013 – growing from 17 percent to 27 percent of the country’s net electricity generation. Coal, on the other hand, has declined over this period from 51 percent to just 39 percent of total electricity generation. Renewable energy has also grown over this period, from about 8 percent in 2001 to over 14 percent in 2013.

The shift away from coal and toward natural gas electricity generation is also evident by looking at surrounding states that have relied heavily on West Virginia steam coal for electric power generation. Between 2001 and 2012, West Virginia’s largest domestic customers for steam coal (outside of West Virginia) were North Carolina, Ohio, and Pennsylvania. However, over the last several years West Virginia exported far less coal to North Carolina and Ohio. Meanwhile, Pennsylvania has shifted toward relying more on natural gas for electricity generation.

For example, in 2008, West Virginia shipped approximately 17.7 million tons of coal to North Carolina for electricity production compared to 11.6 million in 2012. Ohio received approximately 13.6 million tons of West Virginia coal in 2008 compared to just 5.1 million tons in 2012. While Pennsylvania imported more steam coal from West Virginia between this period (9.5 million tons in 2008 compared to 11.2 million in 2012), coal used for electricity generation in the state has declined.

From 2008 to 2013, Ohio, Pennsylvania, and North Carolina saw substantial drops in the share of coal used for electricity generation. In Ohio, the share of electricity generation from coal has declined from 85.5 percent to 67 percent since 2008, while in Pennsylvania it has declined from 53 to 40 percent, and in North Carolina it has dropped from 61 to 44 percent over this six-year period. Renewable energy has also grown in these states, from about 3 percent to 6 percent in North Carolina, 2.3 percent to 3.4 percent in Pennsylvania, and 0.4 percent to 1.4 percent in Ohio.

As shale development expands with new pipelines and with new natural gas utilities added in the region, the share of electricity from natural gas will likely grow over time in these states, putting more downward pressure on the ability of West Virginia to export coal to other states. As we shall see in the next post, natural gas is also becoming more competitive as the federal government implements rules around the problems associated with global climate change.