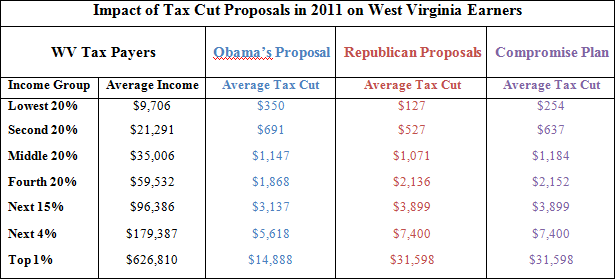

The compromise tax plan agreed to by President Obama and congressional Republicans would double the tax cut for the top one percent of earners in West Virginia from the tax cut the President proposed, while offering a smaller tax cut to the poorest West Virginians, and almost no change for the middle class.

The compromise tax cut plan is a result of negotiations between President Obama and congressional Republicans. Here is a quick description of each proposal and the eventual compromise.

President Obama’s original plan included a permanent extension of President Bush’s income tax cuts for those making less than $200,000 (single) and $250,000 (married) annually, the estate tax cut back to 2009 levels, and a permanent Earned Income Tax Credit (EITC) and child credit expansion, and an extension of the Making Work Pay tax credit. The original Obama plan would have added $301 billion to the budget deficit in 2011.

The proposal made by congressional Republicans included a permanent extension of the Bush income tax cuts for all income levels, the estate tax cut to below 2009 levels, a cut in payroll taxes, and ending the extensions to the EITC, child tax credit, and Making Work Pay credit. The Republican proposals would have added $413 billion to the budget deficit in 2011.

The compromise plan includes a two year extension of the Bush income tax cuts for all earners, an estate tax cut below 2009 levels for two years, a cut in payroll taxes, and a two year extension of the EITC and the child tax credit, and an end to the Making Work Pay credit. The compromise plan would add $424 billion to the budget deficit in 2011.

Source:Citizens for Tax Justice and the Institute on Taxation and Economic Policy

The clear winners of the compromise tax plan in West Virginia are the top 5% of wage earners, whose tax cut is substantially more from Obama’s original plan, particularly for the top 1%. While the poorest West Virginians benefit more from the compromise plan than they would have from the Republican proposals, they would have been even better off under Obama’s original plan. The middle class fairs about the same under all three plans.

So at the end of the day, the major difference between President Obama’s original plan and the compromise plan for West Virginians is an additional $16,000 cut for someone making over $600,000, and an additional $123 billion added to the deficit.