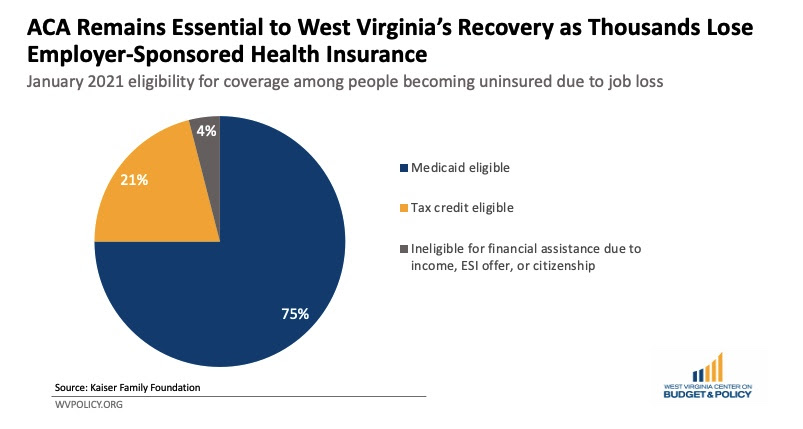

The open enrollment period to sign up for health insurance under the Affordable Care Act (ACA) started on November 1 and continues through December 15. This period allows individuals without existing health coverage to enroll in a private insurance plan or Medicaid – all in one place.

As the nation continues to contend with the COVID-19 pandemic, it is more critical than ever for our people to be able to access adequate health care. In spite of this, the upcoming lawsuit before the Supreme Court against the ACA threatens to weaken the current health care infrastructure.

The ACA has become an essential feature of West Virginia’s wellness over the past decade. Over a third of non-elderly West Virginians have pre-existing conditions, outpacing every other state in the country. Amongst other provisions, the ACA improved these residents’ health outcomes by ensuring that insurance companies could not charge them higher premiums than those without pre-existing conditions.

Furthermore, the Medicaid expansion included in the ACA allowed more than 200,000 residents to gain access to health care since its implementation in 2013. This year alone, as West Virginia experienced historic unemployment levels, the state enrolled over 50,000 new people in Medicaid. This notable figure highlights how integral Medicaid and the ACA will continue to be as the pandemic persists.

Read Rhonda’s full blog post here.

Find additional guidance navigating open enrollment here.

After much success in West Virginia’s 2020 election, Republican leaders are already discussing changes they would like to implement to the state tax code.

Governor Jim Justice claims he will prioritize eliminating the state income tax — which made up 43 percent of the General Fund this fiscal year and was a key source of funding for our state agencies’ basic services — while House Speaker Roger Hanshaw is looking to change equipment and inventory taxes.

Executive director Kelly Allen was interviewed recently on what such reform would mean for the well-being of our state:

“The way to grow West Virginia is by investing in our people, not by eliminating nearly half of our state’s general revenue,” Allen stated. “Efforts to eliminate the business inventory tax and the personal income tax both give disproportionate tax breaks to a few wealthier West Virginians and out-of-state corporations at the cost of working West Virginians—either through regressive tax increases or cuts to critical public services.”

Read the full article.

With the 2020 election complete in West Virginia, our friends at Mountain State Spotlight put together a brief look at the lingering problems in our state, and how they might fare given the election results.

Check out their piece to gain some helpful insight into where we stand regarding COVID-19 response, coal and natural gas, public health, poverty, representation in the West Virginia Legislature, voting rights, and more.

Find the full article here.

In March, the CARES Act provided $1.25 billion to West Virginia in Coronavirus Relief Funds (CRF), specifying that the funds can only be used to cover costs that are necessary expenditures due to the public health emergency, not accounted for in state budgets, and incurred during a period between March 1 and December 30, 2020.

As of early October, nearly $1 billion of that money remained unspent. While Governor Justice has proposed allocating nearly half of the total $1.25 billion toward the state’s unemployment trust fund, many believe that this money could be more wisely and compassionately used elsewhere.

As West Virginians across the state continue to face extreme hardship amid a diverging economic recovery, nearly 30 West Virginia groups sent a letter to Gov. Justice urging him to target the remaining CRF to those who are most in need of immediate relief before the funds expire at the end of the year.

They propose spending the money on:

Read the full letter here.

Sign our petition urging Gov. Justice to put our neighbors in need first here.

Governor Jim Justice has said time and again that West Virginia’s economy is on the verge of an economic boom driven by growth in natural gas production. However, our state has yet to see that boom, and amid the ongoing COVID-19 pandemic and recession, we have reason to be wary that such a boom is coming any time soon.

From an article on this yet unrealized promise:

“…as the COVID-19 crisis worsens in West Virginia and around the country, the state faces a grim reality. Natural gas prices have plummeted, casting doubts on that industry’s near-term future. And the pandemic has wrecked what was already a weak economy, further exposing what critics say is the folly of West Virginia leaders thinking that they can mine and drill their way to prosperity.”

As coal continues its steady decline and the future of natural gas remains uncertain in West Virginia, we must look to something new to spur our state’s economic revival.

Senior policy analyst Sean O’Leary was quoted emphasizing the need “to diversify and grow the economy as a whole, which we’ve seen time and time again through the years doesn’t happen with energy development.”

Read the full article.

Our recent blog post explored how West Virginia Medicaid enrollment continues to rise even as unemployment claims level out.

In the effort to better advocate for improved Medicaid administrative policy, the WVCBP is soliciting feedback from West Virginians who have been enrolled in Medicaid in the last five years. If you or your family members fit this description, we invite you to please complete our survey.

We appreciate your time, thought, and willingness to help us improve the Medicaid experience for West Virginians.

While the COVID-19 pandemic has had devastating consequences for many elements of the West Virginia economy, one of the most startling effects has been increased rates of food insecurity throughout the state, especially in households with children.

This year, the third annual Food For All Summit will take a closer look at the cracks in our food access systems that have only been made increasingly apparent as COVID-19 continues to harm our communities.

This free Summit will run from Monday, Nov. 16 through Friday, Nov. 20.

Find the Summit webpage here.

Register for the Summit here.

Mass incarceration of adults cost West Virginia over $314 million in 2019. The collateral consequences impact our communities, families, and economy.

Please join us on Thursday, Nov. 12 for a virtual summit to hear from experts, participate in dialogue, and discuss solutions to mass incarceration in our state.

Summit Schedule:

Register here.

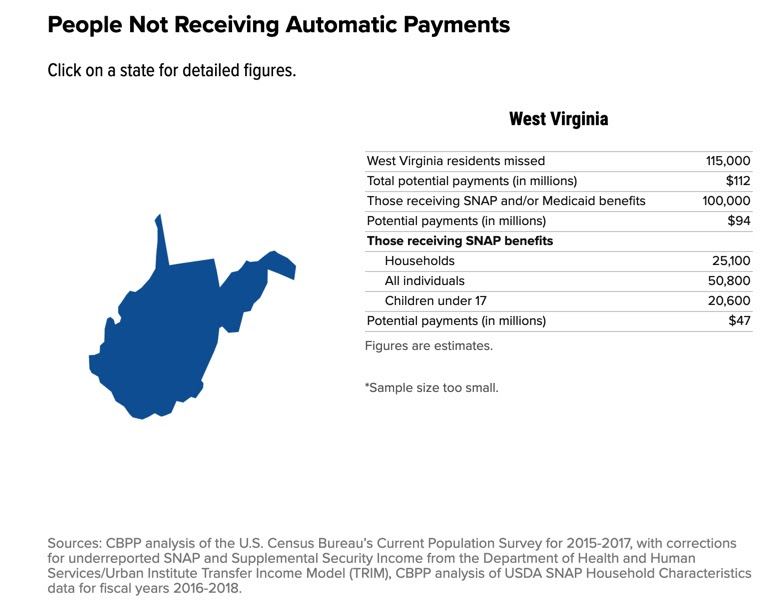

Did you know that millions of eligible people could miss out on their Economic Impact Payments (EIP) – commonly called “stimulus checks” – because they have to file an online form with the IRS to get it? While most people get their payments automatically after filing a tax return (or based on participation in certain federally administered programs), this group of “non-filers” must take additional action to get their money (worth $1,200 for adults and $500 for qualifying children).

An estimated 115,000 West Virginia residents did not receive their EIP automatically from the IRS, translating to $112 million in lost potential payments. Don’t leave money sitting on the table — if you are eligible, file for your EIP before the Nov. 21 deadline for paper claims.

Please note, per a federal judge’s recent ruling, incarcerated folks are eligible to receive the stimulus check. You can find a helpful list of FAQs about obtaining the payment for incarcerated people here.

Learn more about general eligibility and file for your EIP here.

Join us for our 8th annual Budget Breakfast!

Due to COVID-19 considerations, this year’s event will be held virtually via Zoom.

WVCBP’s analysis of the Governor’s 2022 proposed budget will start at 8:00am, followed by keynote speaker presentation and time for Q&A.

While attendees are welcome to join the webinar at no cost, we hope you will consider supporting the WVCBP’s work and contributing to our annual fundraiser by donating the usual cost of an in-person ticket ($40 before the end of year or $50 beginning Jan. 1, 2021).

Register here.

We hope to see you there!