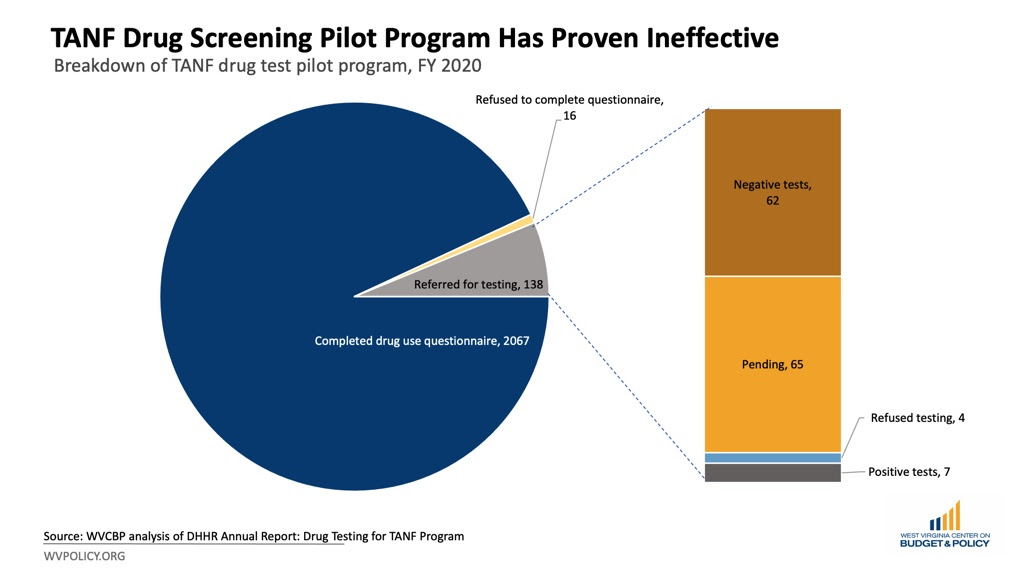

SB 387 is currently being considered by the West Virginia Senate. This bill would make applicants who test positive for drugs or refuse a drug test ineligible for Temporary Assistance for Needy Families (TANF) assistance.

Our new blog post from health policy analyst Rhonda Rogombé explains how such a policy choice would further stigma, harm vulnerable populations, and contradict public health best practices.

“Rendering benefits contingent on passing a drug test for individuals otherwise eligible for cash assistance does not meaningfully address substance use problems. Instead, it does quite the opposite — drug screening creates barriers for those who may otherwise seek treatment.

“In a state already riddled with budget shortfalls, dedicating resources to an initiative that further stigmatizes individuals with low incomes — while worsening their material conditions — contradicts the core mission of TANF and other social programs, as well as best practices for public health. Rather than punishing TANF recipients by extending the drug screening program, West Virginia must recommit to providing basic assistance to families. Redirecting funds toward these initiatives would better serve low-income families and help create a healthier West Virginia.”

Read Rhonda’s full blog post.

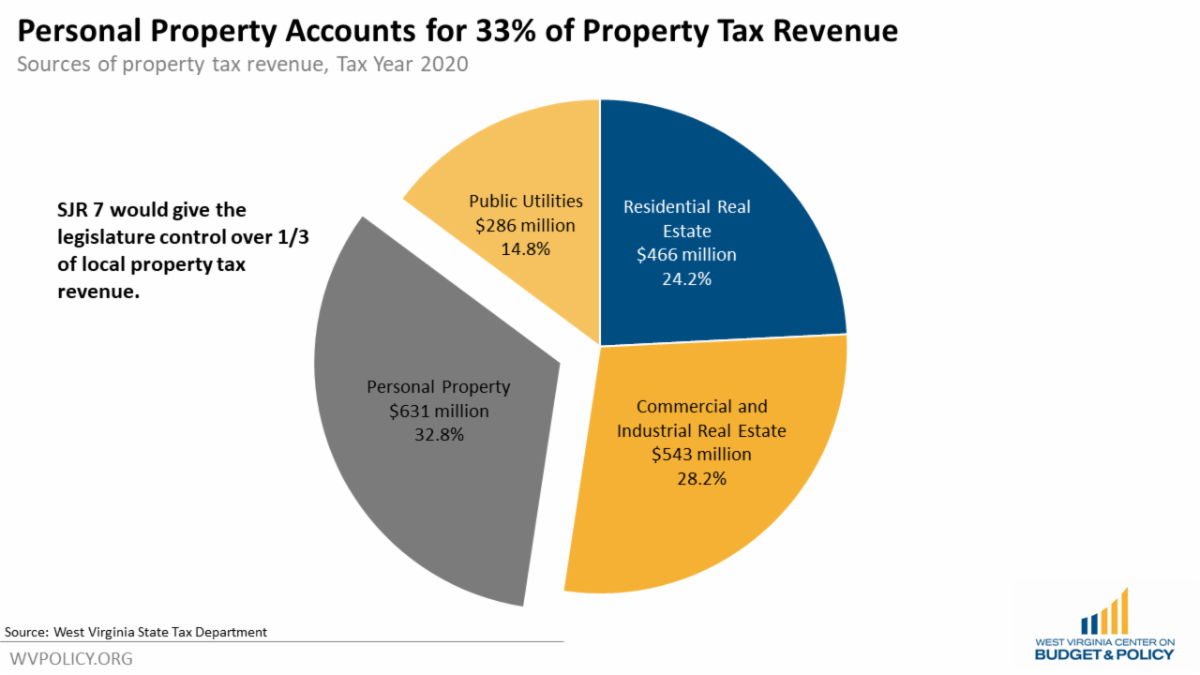

With the elimination of the business personal property tax once again a top legislative priority, the first piece of the plan has been introduced in the legislature in the form of Senate Joint Resolution (SJR)7.

SJR 7 is identical to SJR 9, which failed to pass the legislature last year. SJR 7 starts the process for eliminating the business personal property tax by amending the constitution to give the legislature the power to exempt from or reduce property taxes on personal property, as well as reassess the value of personal property, while also doing away with the constitutional requirement that property taxes must be uniform across different types of property. Since the proposal amends the constitution, it would have to be voted on by the public during the next election. If passed, SJR 7 would be a significant shift of power away from local governments and to the state legislature.

Property taxes from personal property account for just under 1/3 of all property tax revenue in the state. SJR 7 would take the authority of assessing and taxing this property away from local governments and give it to the state legislature, despite the fact that less than 0.5 percent of property tax revenue goes to state government. In addition to taking control of 1/3 of property tax revenue away from local governments, SJR 7 would also take control away from voters. Nearly 40 percent of property tax revenue in the state comes from voter-approved excess or bond levies.

For more, read Sean’s full blog post.

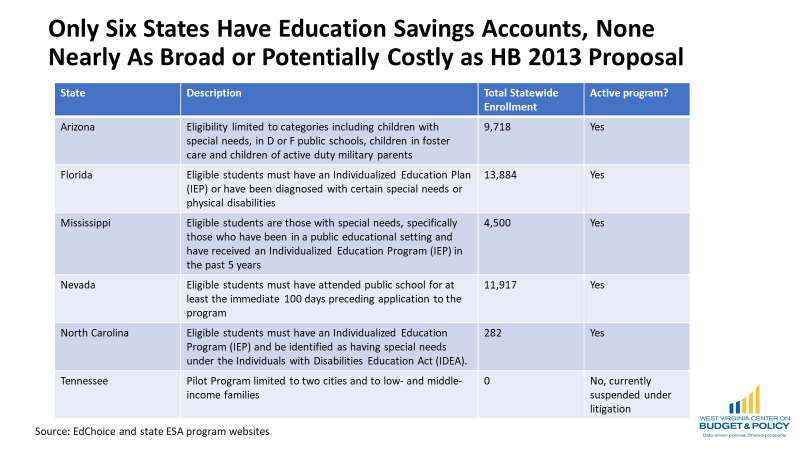

Last week the West Virginia House passed HB 2013, the Hope Scholarship Program. After concerns about the growing costs of the proposal, the bill was sent back to House Finance for further consideration. This is a necessary move, as the program is much broader and potentially much more costly than any similar Education Savings Account (ESA) program in the country. We are glad that legislators heard our concerns and are reconsidering the bill accordingly.

ESAs divert public education funding to private and nonpublic education programs by allowing families to apply for public education dollars to be put into a bank account to pay for personal education costs including homeschooling, tutoring, or private school tuition.The Hope Scholarship, the value of which is pegged to the per pupil’s state share of public education spending, would be worth approximately $4,600 in FY 2021.

Of note, the average private school tuition in West Virginia is $6,068, meaning that there is little benefit to lower income households who don’t have $1,000 or more to make up the difference in tuition in addition to the hundreds of dollars in fees that private schools levy. Further, nine West Virginia counties do not have private schools at all, with most of the state’s private schools located in its more urban and wealthier counties, likely meaning that rural students and low-income students would be left out of the program.

Without income guidelines or enrollment caps as seen in earlier iterations of ESA bills, the costs of this program could grow quickly. This results in less public education funding for the vast majority of students who remain in the public school system. West Virginia’s legislative auditor estimated that the original bill could cost between $22 million and $33.5 million, coming out of the state’s K-12 education funding. Importantly, the auditor does note that the estimate is based on enrollment in other states with ESAs where eligibility is limited to students with special needs and, as such, the costs of West Virginia’s broad program could be significantly higher.

West Virginia is well below the national average in overall per-pupil education spending, and this bill will only result in fewer resources for the vast majority of students who remain in public schools.

Ignoring the impacts of socioeconomic factors in educational outcomes ensures that education reform will fail. West Virginia is currently one of only eight states that does not consider poverty when allocating funding.

Fully funding our public schools ensures opportunity for all, not a few.

We invite you to join us and contact your legislators urging them to oppose HB 2013. You can send them a quick letter here. It will only take a minute of your time.

For further details on why most West Virginia families do not benefit from ESAs, read our ESA Fast Facts sheet or watch our explainer video.

To learn more about additional bills being considered at the legislature that could have a sweeping impact on public education funding, check out Kelly’s blog post from last week.

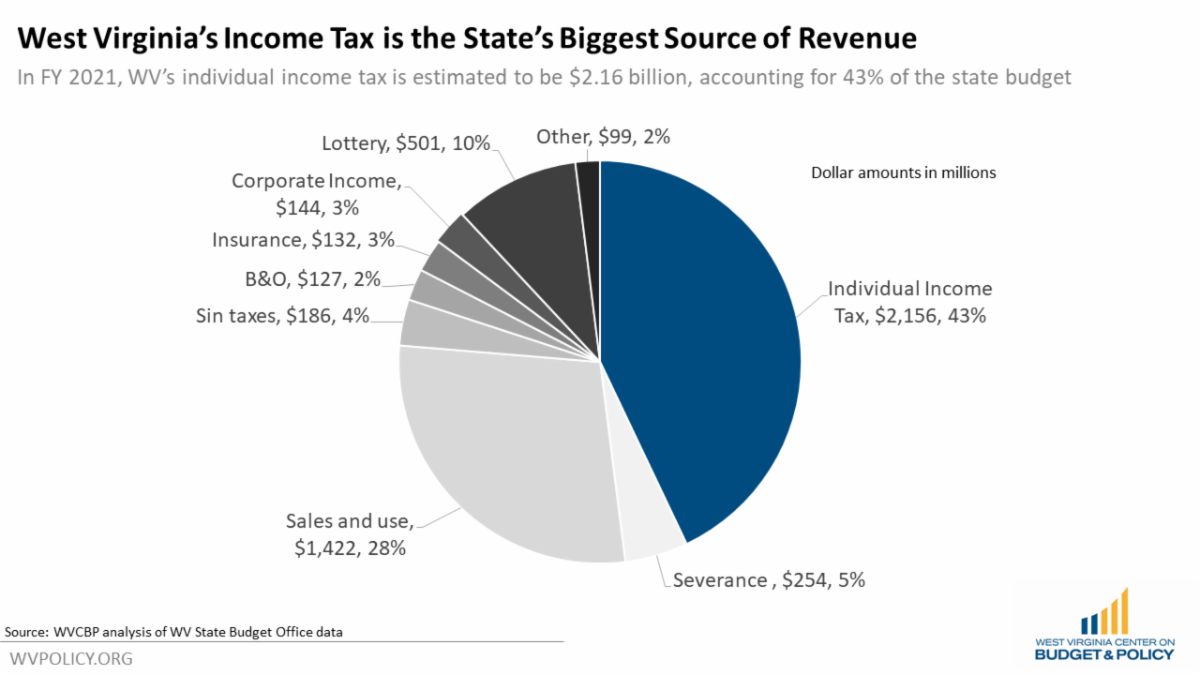

Last Wednesday, WVCBP hosted its 8th Annual Budget Breakfast, where we provided analysis of Governor Justice’s proposed budget as well as a keynote panel highlighting the lessons learned and painful tax cuts necessitated from Kansas’ failed Brownback Tax Experiment.

WVCBP senior policy analyst Sean O’Leary kicked off the event by breaking down Governor Justice’s proposed FY2022 budget and its implications for the state. A recording of his presentation can be viewed here and his PowerPoint slides can be downloaded here.

Sean’s presentation was followed by a keynote panel featuring policymakers Don Hineman & Duane Goossen of Kansas, who were able to provide us a cautionary tale by diving into the repercussions of the Kansas Tax Experiment, the so-called “March to Zero” which sought to eventually eliminate the state’s income tax. You can view a recording of their presentation here.

Here is a quote from Rep. Hineman that cannot be ignored:

“As an elected Republican and a former House Majority Leader, my message to my counterparts in West Virginia is simple: if you wish to reduce taxes, understand what you are doing before you do it. Have a plan. Do not expect that simply cutting taxes will magically produce economic prosperity. It did not happen in Kansas and it will not happen elsewhere. Things are never so simple.

“Remember that government at its core is a service provider, and if desperate budget cuts compromise the core missions of state departments and agencies, then the citizens and the businesses of the state will suffer.”

The full recording of Budget Breakfast can be found here.

Leading up to the legislative session, Sean had spent weeks outlining why eliminating the state personal income tax is misguided and truly harmful policy. You can find links to his numerous blog posts on this subject below:

A broad coalition of 30+ community organizations recently called on West Virginia political leaders to reject cuts to the income tax and instead protect our state’s revenues and public services during this year’s legislative session. You can read the full letter here.

You can read the latest from the media on the income tax cut proposal here.

Finally, we welcome you to join us and send a letter of your own urging legislators to prioritize investing in West Virginia’s families and communities over providing a tax cut to the state’s wealthiest here.

As Solutions Oriented Addiction Response’s (SOAR) harm reduction efforts come under threat, WVCBP reaffirms our full support of the organization’s life-saving work.

At the end of 2020, we published a blog exploring the surge in HIV and Hepatitis C cases in Kanawha County largely due to the sharing of needles to inject drugs, and how syringe services programs (SSPs) like those operated by SOAR play a critical role in reducing the spread of these diseases. SSPs are effective, cost-saving, and treat those in our community who inject drugs with the dignity that all folks deserve.

Despite the fact that harm reduction efforts are supported by the U.S. Centers for Disease Control and Prevention (CDC), SB 334 — a bill that would effectively ban harm reduction programs statewide — is currently on the table at the state legislature. If the bill is passed, it will have not only a severe moral cost, but a dramatic financial cost, as well. The increase in Hepatitis C and HIV cases in Kanawha County alone in a single year has an estimated health care cost of $47 million.

Harm reduction is also facing attacks at the city-level. Charleston City Council will likely vote on a new ordinance that would make SOAR’s currently legal harm reduction program a misdemeanor with hefty fines. If this ordinance were to pass, it would also make Charleston the first West Virginia city to outlaw an active harm reduction program.

In the wake of the CDC calling the HIV outbreak in the Kanawha Valley “the most concerning in the nation,” we partnered with the ACLU of WV and other community organizations to demand Charleston city leaders start listening to science and stop leading with fear. Read the full letter here.

If you are a Charleston resident, we invite you to join us in contacting your City Council Member and voicing your support for the full authorization of SOAR’s work.

Not sure who your Council Member is? There’s a handy map here and a list of contact information here.

Again, we at WVCBP wholeheartedly believe that needs-based harm reduction programs make our communities both kinder and safer. We would sincerely appreciate if you contacted your Council Member and expressed support for SOAR’s work.

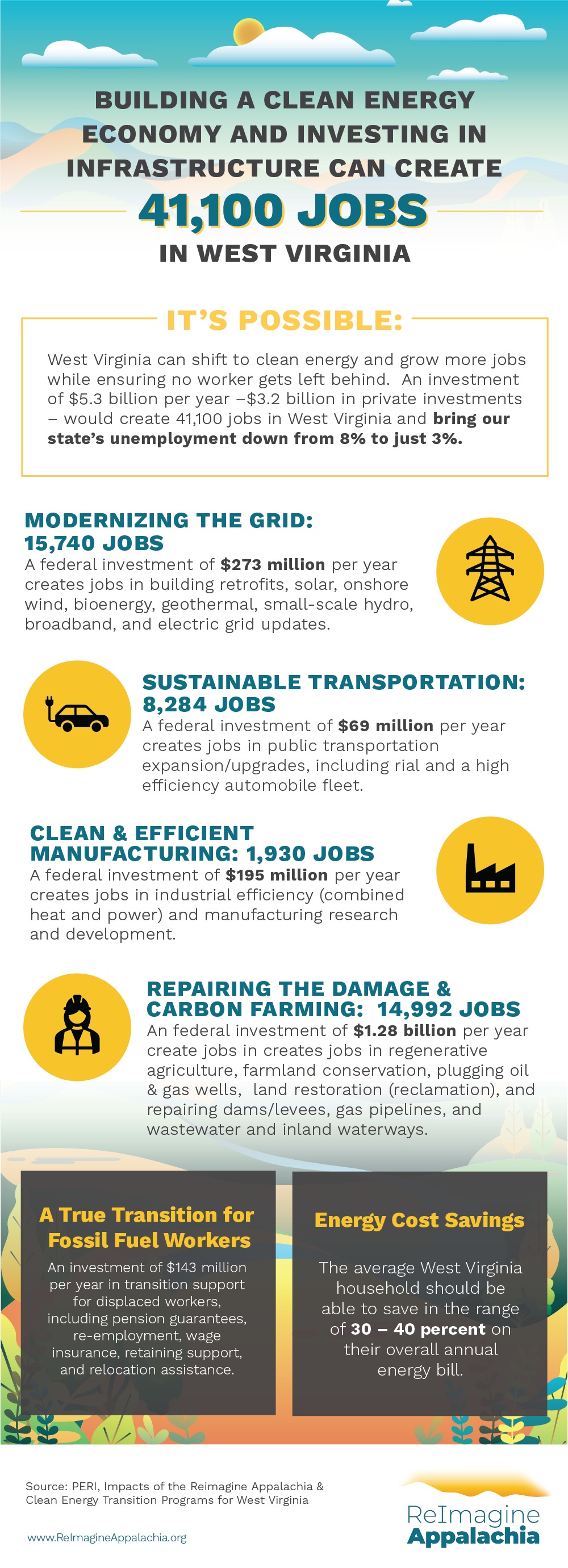

Yesterday, ReImagine Appalachia released a study that finds that West Virginia could gain over 40,000 green, family-wage jobs if the federal government makes the smart, efficient investments needed to bring our nation’s infrastructure into the 21st Century.

The study, written by the Political Economy Research Institute (PERI), breaks down how many good-paying jobs West Virginia stands to gain from investments in needed Mountain State infrastructure projects. It finds that tens of thousands of jobs can be created through:

ReImagine Appalachia hosted an online briefing outlining into some of the report’s findings. You can find a recording of the event here, the full PERI report here, and a helpful summary of the report here.

Learn more about ReImagine Appalachia’s blueprint here.

We are now accepting applications for the summer of 2021! Priority will be given to applications received by February 26, 2021.

WVCBP seeks a summer policy associate for an internship to work on issues associated with our research and advocacy priorities. Our summer policy associates work closely with WVCBP staff, coalition partners, and stakeholders in an immersive experience in research and advocacy for evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians.

The WVCBP internship program’s mission is to partner our organization with highly motivated undergraduate and graduate students committed to building shared prosperity through policy change. Our internship program prepares students for potential employment in the non-profit policy world by training them to conduct rigorous data and policy analysis or outreach and advocacy while developing effective communications strategies.

Find the full job posting and instructions to apply here.

| WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks. Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government. Applications for SPI are being considered through April 30. Further details and link to apply here.  |