Yesterday at the state Capitol, legislators joined the Invest in Working Families Coalition to call for support for a West Virginia Earned Income Tax Credit (EITC). Delegates Rohrbach (R-Cabell) and Guthrie (D-Kanawha) spoke about the bill they sponsored during the 2016 Legislative Session.

“Over 2,900 families in my district get up every day and work jobs that pay low wages. They are struggling to make ends meet until a better employment opportunity comes along,” stated Delegate Matthew Rohrbach. “A state Earned Income Tax Credit sends a clear message of dollars and common sense that we support their work and desire to move up the economic ladder.”

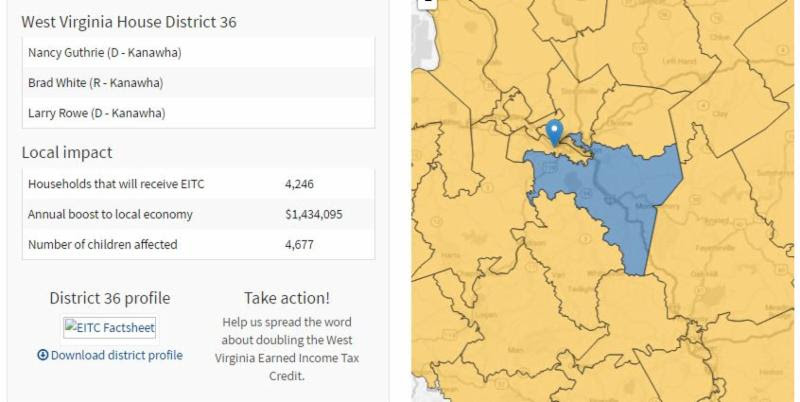

“This is as kitchen table as it gets in my district,” said Delegate Nancy Guthrie. “$325 may not seem like a lot but for West Virginians working low-paying jobs, that money will be spent for something important. In District 36, over 4,200 will benefit while spending that money in our local economy. A state EITC provides immediate results now as well as critical investment in West Virginia’s next generation.”

A West Virginia EITC would benefit over 141,000 working families. The tax credit can only be claimed by people who work. Over 160,000 West Virginia children would be helped.

The amount of the tax credit varies based on family income and size. A single mother with two children who works a full-time minimum-wage job could keep over $800 more of her earnings because of a state EITC. A family of four making $36,000 per year could keep over $400 more.

Here’s more in the Huntington Herald-Dispatch and the State Journal.

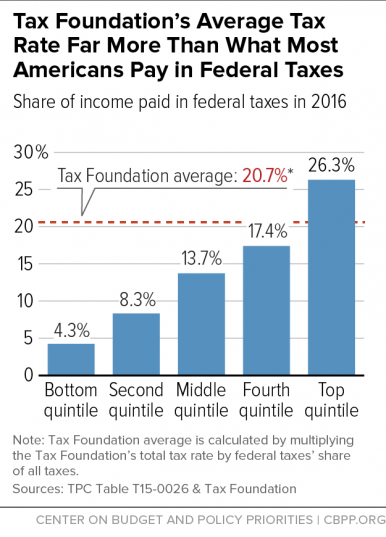

The Tax Foundation’s annual “Tax Freedom Day” report once again left a strikingly misleading impression of tax burdens – showing an average federal tax rate across the United States that’s likely higher than the tax rate that 80 percent of U.S. households actually pay.

Here’s are the facts from the Center on Budget and Policy Priorities.

No word yet on when Governor Tomblin will call a special session of the legislature to address the ongoing budget crisis. In an op-ed this week, Ted lays out the reasons why now is not the time for more budget cuts.

Legislators need to look beyond another round of budget cuts and consider a number of options this spring when they reconvene, including closing corporate tax loopholes, making the wealthy pay their fair share, and enacting higher taxes on things that are making people unhealthy, like tobacco and sugary soft drinks.

Read Ted’s op-ed here.

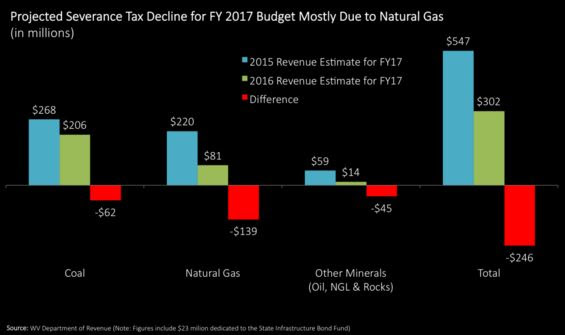

While some have blamed the state’s budget crisis on the decline of coal severance taxes, declining natural gas severance taxes are also taking their toll. The decline in mineral extraction, along with a weak economy and major tax cuts phased in between 2006 and 2015, is the central driver of the state’s weak revenue growth over the past several years and into the future. Here’s much more in Ted’s blog post.

Here’s more in this week’s State Journal on balancing the state budget in these challenging times of reduced severance tax revenue.

And here’s an editorial in this week’s Charleston Gazette calling for leadership to guide the state as it enters a post-coal economy.

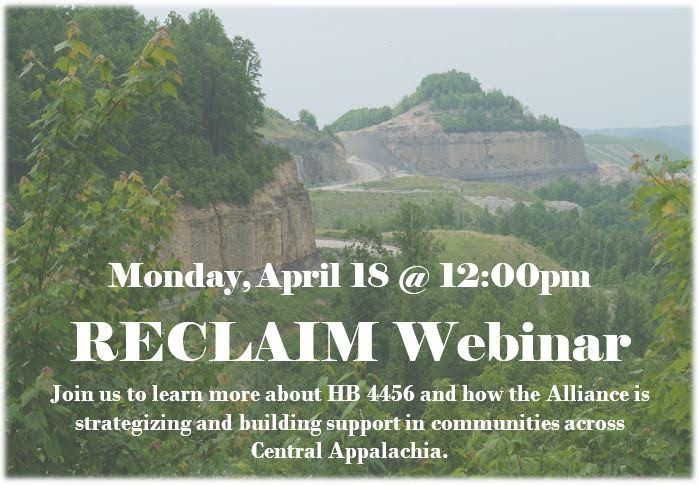

The Alliance for Appalachia’s Economic Transition Team is hosting a webinar to focus on the RECLAIM Act, which was introduced by Congressman Hal Rogers (KY) in February and is the legislative vehicle moving forward the reclamation piece of the POWER Plus Plan. Congressman Evan Jenkins is a cosponsor.

This webinar will give an overview of RECLAIM and its potential impact on Central Appalachia and other regions with coal-impacted communities. There will be a Q&A session at the end of the webinar.

Register here.

Join us for the first-ever Summer Policy Institute this July at West Virginia Wesleyan College!

Applications are due April 30, 2016. Join us for this tuition-free weekend!