As West Virginia lawmakers continue to consider Senate Bills 2 and 3, we urge them to keep in mind the conclusions of a recent study, which found that the harmful effects of job loss on opioid overdose mortality decline with increasing state unemployment benefit levels.

The study, titled “Unemployment Insurance and Opioid Overdose Mortality in the United States,” looked at county mass layoff data and changes in the generosity of state unemployment benefits, both in terms of maximum weekly benefits and duration of weeks available, to determine if unemployment benefits moderate the relationship between job loss and opioid overdose death rates.

The researchers concluded that, “while job losses evoked a range of different responses, the findings here show that UI was consistently associated with lower opioid overdose mortality rates across demographic groups.”

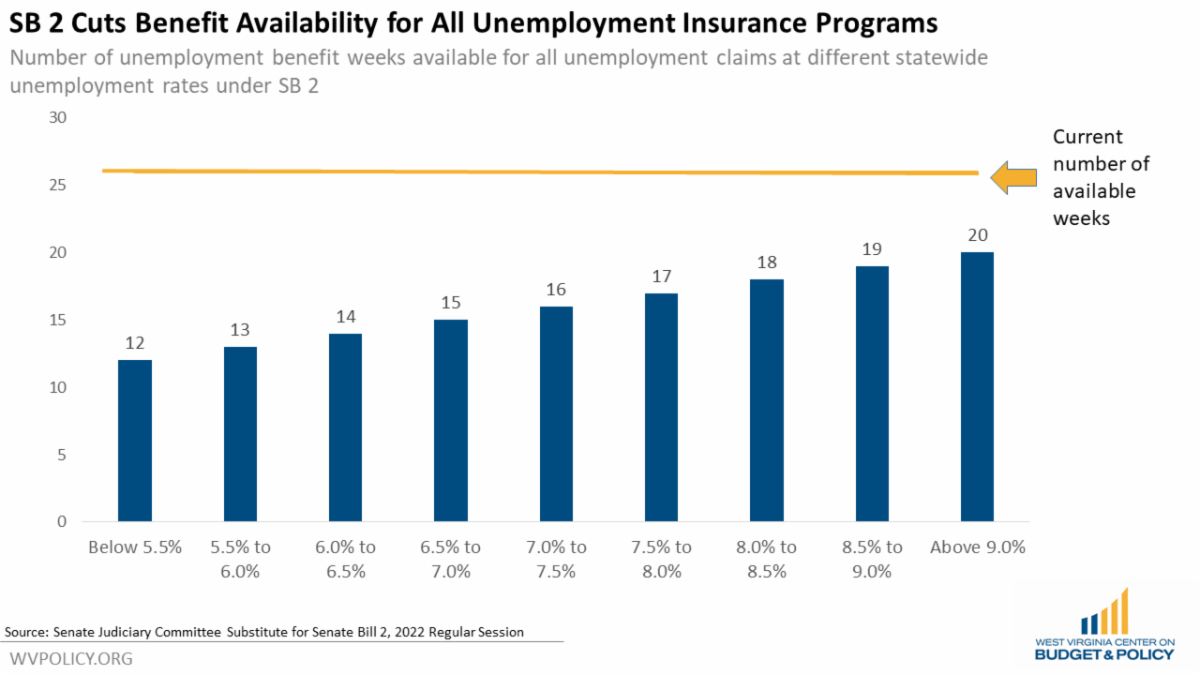

These findings cannot be overlooked as lawmakers consider SBs 2 and 3, which would cut the overall weeks of unemployment benefits available to displaced workers from 26 weeks to as few as 12 weeks, and enact more red tape for workers to navigate to establish eligibility for the fewer weeks that remain. Especially in West Virginia, a state that has been ravaged by the overdose epidemic, it is not hyperbolic to suggest that cutting the weeks of unemployment insurance available to workers will have an adverse impact on opioid overdose deaths. This is yet another serious concern in addition to the myriad of other issues with these bills, including their negative effect on family economic security; their failure to take into consideration variations in regional economies, industries, and barriers faced by workers; and the absence of a link between generosity of unemployment benefits and filling job openings.

Read Kelly’s full blog post here and find the study summarized in her blog here.

The Summer Policy Institute (SPI) is an annual convening hosted by the WVCBP and the American Friends Service Committee that brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the institute, participants work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

This year’s SPI theme is “Growing a West Virginia that Works for Everyone.”

Due to ongoing public health considerations, SPI 2022 will take place virtually via Zoom from July 28-30. Find further details and instructions to apply in the flyer below and on our event landing page here. There is no cost to attend. Please don’t hesitate to reach out to our team at summerpolicyinstitute@gmail.com with any questions.

We will be accepting applications through May 1. People of all ages are welcome to apply, so please feel free to share with any folks you think may be interested!

West Virginia lawmakers are currently considering HB 4007, legislation that seeks to eliminate the state personal income tax, the single largest and fairest source of revenue for West Virginia’s budget.

The bill would cut the personal income tax rates by 10 percent across-the-board, with the top 20 percent of income earning households getting a whopping 70 percent of the tax cut. It would also set up the eventual elimination of the income tax by creating a fund into which 50 percent of future revenue surpluses would be deposited in order to continue to phase out the income tax. Make no mistake, this bill starts a ticking clock that would eventually eliminate West Virginia’s personal income tax altogether and, with it, nearly half of our state budget.

HB 4007’s fiscal note makes clear that the income tax reduction plan shares the same flaw as versions that failed to pass last year: relying on a one-time source of revenue – in this case a one-year budget surplus – to fund a permanent, ongoing tax cut. This means that next year and every year after, lawmakers will likely either need to raise other (more regressive) taxes, slash funding for public services, or some combination of both to pay for the ongoing tax cut. HB 4007 would overwhelmingly benefit the wealthiest West Virginians while putting at risk the programs that benefit us all: K-12 education, health care, programs for children, and more.

To use a one-time surplus to cut taxes for the wealthiest households in our state instead of addressing ongoing urgent needs is short-sighted, immoral, and bad for our state’s economy.

Please consider contacting your legislators and telling them that you oppose this proposal, which would disproportionately benefit the wealthiest West Virginians at the expense of low- and middle-income families and create massive budget shortfalls that ensure significant and painful cuts to the public services that touch all of our lives.

Learn more about HB 4007 in Sean’s blog post here or a recent article featuring his insight here.

Essential workers were championed throughout the pandemic for their critical jobs keeping our economy afloat. But now, West Virginia legislators are considering gutting unemployment benefits for those very same workers if they lose their jobs through no fault of their own. Senate Bill 2 would cut the number of weeks that displaced workers are eligible for unemployment insurance from 26 weeks to as few as 12 weeks. This action would make West Virginia a major outlier as only two other states offer just 12 weeks of unemployment benefits. SB 2 will endanger economic security and peace of mind for workers, children, and families, while also harming our state’s economy and doing nothing to address lawmaker’s stated goal of getting West Virginians to work.

Please join us in contacting your legislators and urging them to vote no on SB 2.

Learn more about how SB 2 and SB 3 needlessly harm West Virginia workers in our blog post here.

The WVCBP was thrilled to see that HB 4011, a bill designed to intimidate educators out of teaching honestly about racism and sexism in our country, died last week. Unfortunately, SB 498, a sister bill to HB 4011 with the same intention of censoring classroom teachings, was passed out of the Senate this week and will now be considered in the House.

Fairness WV organizer and WVCBP board member, Yvonne Lee, published an op-ed last week opposing HB 4011. Those criticisms of classroom censorship can also be applied to SB 498. Excerpt below:

Let’s be clear: Schools don’t teach our children about the history of racism to make white students feel guilty. We teach this history because the first step to righting the wrongs of our past is to acknowledge how and why we’ve already failed.

If it makes you uncomfortable to hear the story of how a mob of white men in Mississippi brutally murdered a 14-year-old Black boy named Emmett Till for the crime of whistling at a white woman, I encourage you to lean into that discomfort. Sit with it. Sit with the story of Robert Johnson, a Black West Virginian who faced a similar lynching. He was accused of assaulting a white woman in 1912, but a jury later proved he was innocent.

The constitutional right to due process wasn’t enough to stop a mob of white men from kidnapping Robert out of police custody. They beat him with rocks, and strung his body up on a telephone pole, right there on the Main Street of Princeton.

Robert Johnson’s story is West Virginia’s history. We must not allow our discomfort with these truths to dictate our politics. We can’t let our discomfort become the shovel we use to dig our heads even further in the sand.

Our children deserve the truth of these stories, because they are the ones who will write the next chapter. If we can bring ourselves to confront these truths head on, we’ll find more than pain.

You can read Yvonne’s full op-ed here.

You can urge your legislators to oppose SB 498 here.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) stopped being distributed.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.