In Thursday’s edition of the Charleston Gazette, gubernatorial candidate Bill Maloney echoed a familiar refrain, arguing that the state needs to reduce its business taxes to achieve economic growth, citing “supply-side economics.” It’s an issue I’ve discussed before, and the latest evidence continues to confirm that low business taxes are not associated with stronger economic growth, nor do they make a state “business friendly.”

Last year, we released a

brief demonstrating that there was no clear connection between low business taxes at the state and local level and economic and employment growth from 2001 to 2007, using data from the

Council on State Taxation (COST), one of the best sources for state and local tax data (COST is also funded by very large multinational companies, so it is not exactly a liberal group.)

COST recently updated their annual

report, with tax data for 2010, so I thought I would do the same. I compared change in private sector GSP, personal income, earnings, and nonfarm employment from 2009 to 2010 for each state with their respective total effective business tax rate, using the COST measurement of business taxes paid as a percent of private sector GSP. I also compared each state’s 2010 unemployment rate with their business tax rate.

I’ll go through each result individually, but the overall conclusion was simple: for each measure of economic growth, there was no obvious connection between low taxes and high growth (or low unemployment). The evidence just isn’t there for the assertion that the state needs to lower its taxes to achieve prosperity. Instead, it would be refreshing to hear from politicians how they plan to address what does

matter for economic growth: high-quality public services, a maintained infrastructure that is geared for the future, and quality schools and colleges that produce a highly skilled and well trained workforce. If we are forced to sacrifice these services in order to lower business taxes, we’ll likely end up disappointed.

While this post looks at just one year, stay tuned for a longer term look at the issue.

Private Sector GSP Growth (2009-2010) and Business Taxes

Source: BEA and COST

Private sector GDP growth and state and local business tax rates had a correlation coefficient of 0.0, suggesting there is no relationship between business taxes and state GDP growth.

Personal Income Growth (2009-2010) and Business Taxes

Source: BEA and COST

Personal income growth and state and local business tax rates had a correlation coefficient of 0.2,suggesting there is little relationship between business taxes and income growth.

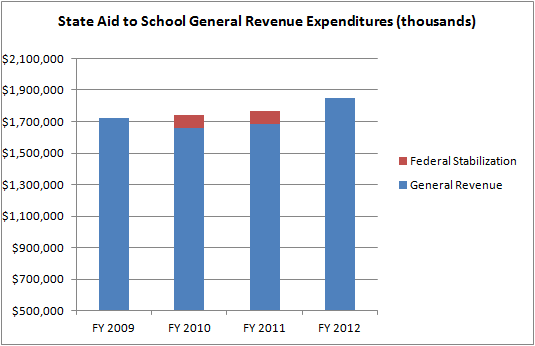

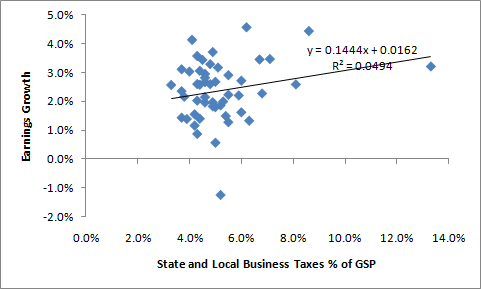

Earnings Growth (2009-2010) and Business Taxes

Source: BEA and Cost

Earnings growth and state and local business tax rates had a correlation coefficient of 0.2,

suggesting there is little relationship between business taxes and earnings growth.

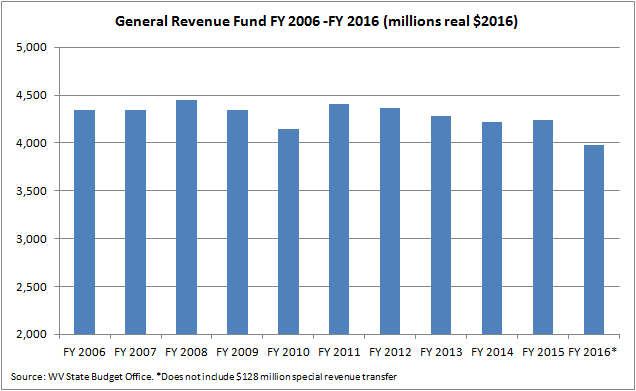

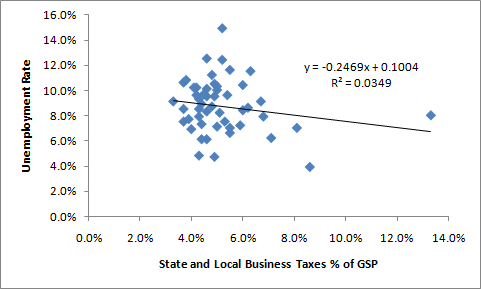

Unemployment Rate (2010) and Business Taxes

Source: BLS and COST

State unemployment rates and state and local business tax rates had a correlation coefficient of -0.2, suggesting that there is little relationship between unemployment rates and business taxes.

Nonfarm Employment Growth (2009-2010) and Business Taxes

Source: BLS and COST

Employment growth and state and local business tax rates had a correlation coefficient of 0.4, actually suggesting a slightly positive relationship between higher business taxes and higher employment growth, but by no means does it suggest causation.