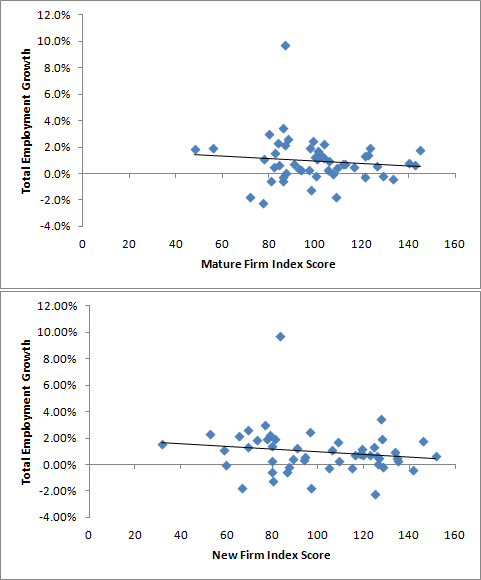

On the heels of their 2012 State Business Tax Climate Index is a new report from the Tax Foundation, called Location Matters: A Comparative Analysis of State Tax Costs on Business. What’s the difference? While the State Business Tax Climate attempted to measure the “business friendliness” of each state’s tax system, the Location Matters report attempts to measure the actual tax liability in each state. The report calculates effective tax rates as a share of profits for specific industries, both for existing mature businesses and for new businesses. It also makes adjustments for certain tax incentives (which is good). The study also includes an index for overall business tax responsibilities for both new and mature businesses.

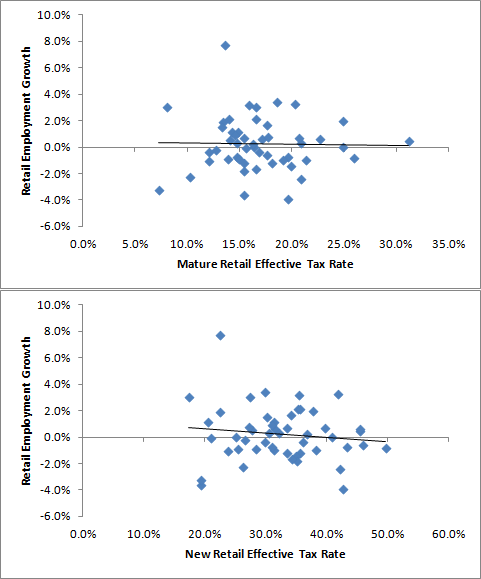

Again, there is no obvious connection between the Tax Foundation’s measure of effective tax rates on retail and employment growth in the retail trade sector. The effective tax rates for both mature and new retail firms had a very weak correlation with retail employment growth, with correlation coefficients of -0.02 and -0.12 respectively.

The top 5 performing states had a higher average tax rate on mature retail firms (17.0%) than the 5 worst performing states (14.1%). For new retail, the 5 best and 5 worst performing states had the same average tax rate (31.5%).

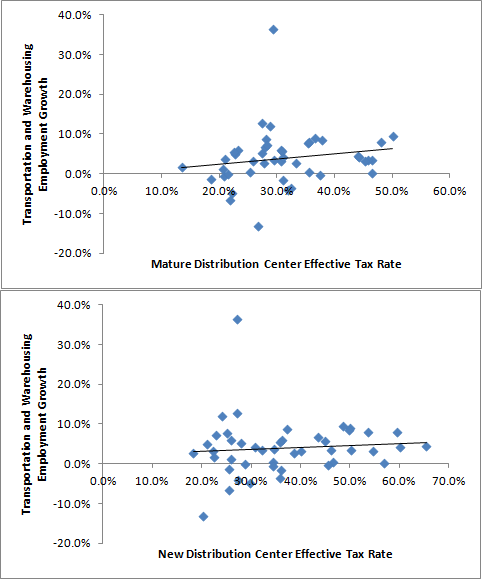

Next is data for a Distribution Center

The top 5 performing states had a higher average tax rate on mature distribution centers (34.5%) than the 5 worst performing states (26.6%), as well as for new distribution centers, (35.4% for the best, 27.5% for the worst.

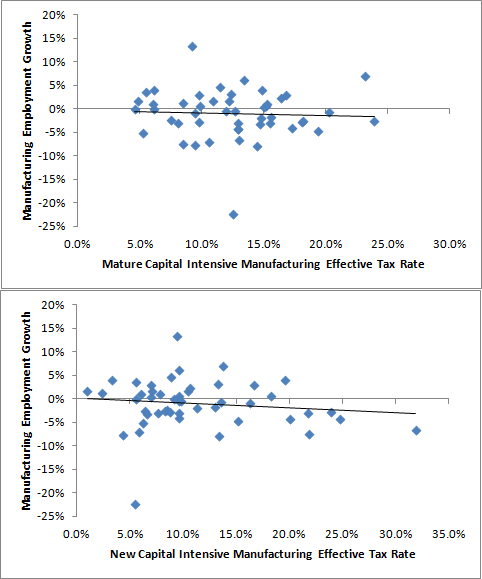

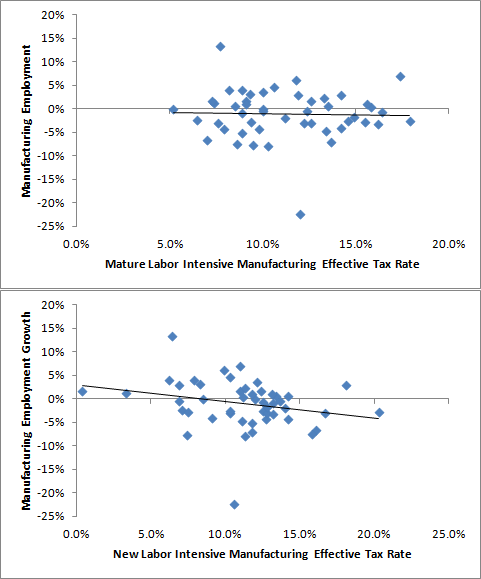

The results are similar for manufacturing. The Tax Foundation report calculates separate tax rates for labor and capital intensive manufacturing, and neither has an obvious connection to employment growth in manufacturing with weak correlations, as the charts show. And like retail and distribution, some of the best performing states have higher taxes than some of the worst performing states.

The report also calculates the effective tax rates on corporate headquarters. Looking at the locations of Fortune 500 company headquarters and the Tax Foundation’s rankings demonstrates how meaningless this particular tax measure is. The 5 states with the lowest tax burden on corporate headquarters have 0 Fortune 500 corporate hq’s located within their borders,while the 5 states with the highest tax burden on corporate hq’s have 110.

As shown in the above graphs, there is no obvious connection between low business taxes or business tax climate on the one hand, and economic growth on the other. In fact, low business taxes don’t necessarily matter for a good business tax climate, if both reports from the Tax Foundation are to be taken at face value. The Tax Foundation ranked West Virginia 23rd in business tax climate, but 48th in mature business tax burden. The opposite is true for our neighbor Ohio, which ranked 39th in business tax climate, but 5th in business tax burden. Regardless of the disparities between tax climate and tax burden, it appears neither have a correlation with employment and economic growth. This is because taxes are a small part of the cost of doing business and that a good workforce and infrastructure require taxes to fund them.