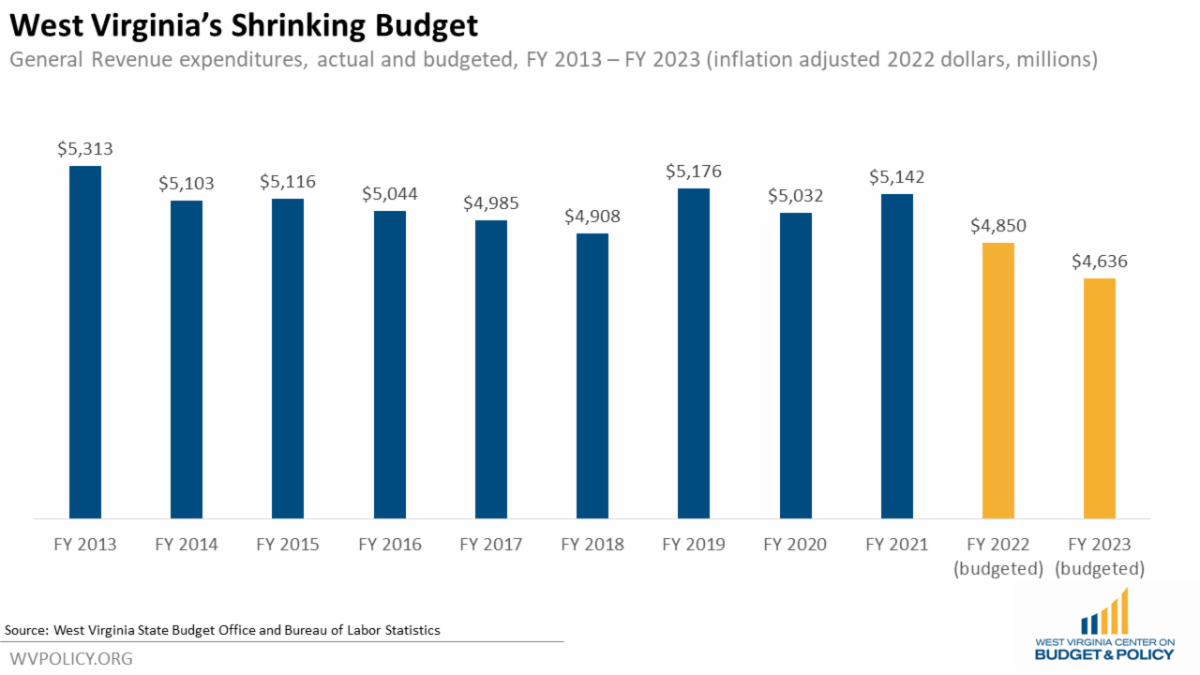

Earlier this month, Governor Justice approved the budget passed by the West Virginia Legislature at the end of the 2022 legislative session. Very little in the budget was changed from the flat budget proposed by the governor at the beginning of session. While appropriations from the base budget (which includes the General Revenue Fund and Lottery Fund) remained relatively unchanged from the previous year, the FY 2023 budget relies heavily on appropriations from the FY 2022 revenue surplus and a dramatic increase in federal funding related to the ongoing pandemic.

Our new blog post has the full breakdown.

Some key points:

Read Sean’s full blog post here.

West Virginia and the United States as a whole are outliers compared to the rest of the world regarding the provision and generosity of policies that support working families. Relative to our peer Organization for Economic Cooperation and Development (OECD) countries, we spend far less on child care and early education, which has adverse impacts on school readiness, future earnings potential, health outcomes, and the ability of parents to work. However, for a short time during the COVID-19 pandemic, policymakers seemed to shift course, investing significant public funds in support of these critical programs. Now, as temporary crisis funding is exhausted, we are at a crossroads that will determine whether these program expansions – and their accompanying benefits to family well-being and our economy – will disappear.

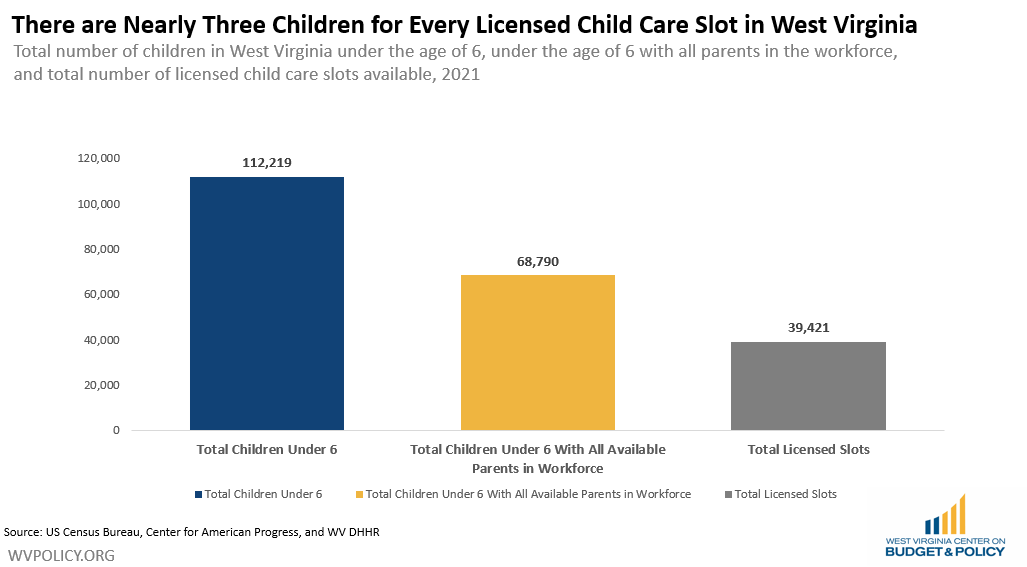

Prior to the pandemic, West Virginia faced many challenges related to underinvestment in our child care and early education system. Child care is a labor-intensive industry where the cost is simultaneously incredibly high for families and unacceptably low-paying for care professionals. These affordability challenges are magnified in rural areas like West Virginia, where accessibility is also an issue. Nearly two-thirds of families in West Virginia live in a child care desert, and there are nearly three children for every licensed child care slot in the state.

During the pandemic, several federal relief packages were passed that included funding to support child care providers and families with children. Together, these packages brought over $300 million into West Virginia’s child care system. While these provisions were able to help West Virginia’s child care infrastructure weather the storm, they are temporary and, without permanent state and federal funding sources, West Virginia will soon exhaust the resources that supported these protections and improvements.

With robust federal funding support for work supports like child care, West Virginia and the country have seen a historic bounce back from the pandemic recession. That said, it remains to be seen if policymakers recognize the importance of continuing these critical investments. At the federal level, bold child care funding provisions were included in the Build Back Better Act (BBBA), including raising wages for child care workers and increasing subsidies for child care. Unfortunately, the status of the BBBA remains unclear. At the state level, little was done to address child care needs during the 2022 West Virginia legislative session. Three bills were introduced, with just one passed – and it may have unintended impacts that could actually exacerbate inequities in the child care system.

It has become abundantly clear during the pandemic that quality, affordable, and accessible child care is a critical component of a healthy economy and a state that prioritizes children and families. While an influx of pandemic-related funding has allowed our child care infrastructure to remain intact, what happens next is just as important. Policymakers at all levels of government must prioritize public investments in permanent expansions of affordable and accessible child care for families, as well as increased wages, benefits, and professional development for child care providers.

Read Kelly’s full blog post.

A recent article revealed that McDowell County owes over $2 million in unpaid jail bills, and as the county’s tax revenue continues to shrink, local officials are struggling to find a way forward without decimating their budgets.

In January 2021, we published an issue brief sounding the alarm that the explosion of county jail incarceration in West Virginia was driving enormous and growing pressure on county budgets. Now, as evidenced by McDowell and other counties, we continue to see that play out in real time.

From our brief:

“Because county governments must ultimately pay the costs associated with keeping people behind bars in their local jails, the explosion of county jail incarceration is driving enormous and growing pressure on county budgets. County spending on jails is rising, and the amount billed to counties by the Regional Jail and Correctional Facility Authority is rising even more quickly, leading to a significant and growing gap between the counties’ share of jail incarceration costs and their ability to pay. This is propelling a burgeoning jail debt crisis with the potential to cripple county budgets, especially now as the pandemic recession pushes many county budgets into deficit due to falling tax revenues.

“As revenues from extractive industries like the severance tax continue to decline for counties and as state and local governments face major potential budget shortages as a result of the COVID-19 pandemic, county commissioners and policymakers should seek lower cost alternatives to jail incarceration that can improve public safety equitably. The money saved from jail incarceration could then be invested back into counties, e.g., via increased funding to services like parks, libraries, and public health, and could lead to improved outcomes.”

You can read the full issue brief here.

The Summer Policy Institute (SPI) is an annual convening hosted by the WVCBP and the American Friends Service Committee that brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the institute, participants work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government.

This year’s SPI theme is “Growing a West Virginia that Works for Everyone.”

Due to ongoing public health considerations, SPI 2022 will take place virtually via Zoom from July 28-30. Find further details and instructions to apply in the flyer below and on our event landing page here. There is no cost to attend. Please don’t hesitate to reach out to our team at summerpolicyinstitute@gmail.com with any questions.

We will be accepting applications through May 1. People of all ages are welcome to apply, so please feel free to share with any folks you think may be interested!

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make the enhanced Child Tax Credit permanent is as urgent as ever.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) expired.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.