West Virginia’s natural gas industry has received significant attention in the past few years, particularly with the development of the Marcellus Shale. The increase in attention and activity has led to an increase in jobs in the industry, but what exactly are the jobs and are they all reacting to the Marcellus boom equally?

In their report on the economic impact of the natural gas industry, WVU’s Bureau of Business and Economic Research identified 7 oil and natural gas NAICS industry sectors, which included:

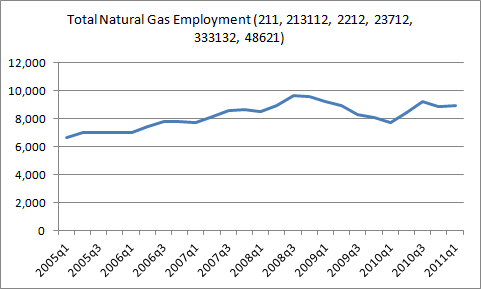

Of these 7 industry sectors, all but 213111 Drilling oil and gas wells have employment numbers available from WorkforceWV. The following charts track quarterly employment numbers for each available industry sector since 2005. We’ll start off with the total for all of the natural gas industry sectors. Definitions for each NAICS sector from the Census Bureau are also included.

Total natural gas employment grew steadily from 2005 to late 2008, when the effects of the recession hit West Virginia. Between 2005q1 and 2008q3, total natural gas employment grew from 6,656 to 9,632, a remarkable increase of 44.7%. Employment fell below 8,000 during the recession, but has resumed growth in the past year. Total employment in 2011q1 stood at 8,912, an 33.9% increase from 2005.

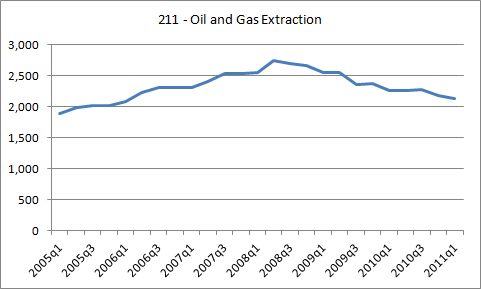

211 Oil and Gas Extraction

Industries in the Oil and Gas Extraction subsector operate and/or develop oil and gas field properties. Such activities may include exploration for crude petroleum and natural gas; drilling, completing, and equipping wells; operating separators, emulsion breakers, desilting equipment, and field gathering lines for crude petroleum and natural gas; and all other activities in the preparation of oil and gas up to the point of shipment from the producing property. This subsector includes the production of crude petroleum, the mining and extraction of oil from oil shale and oil sands, and the production of natural gas, sulfur recovery from natural gas, and recovery of hydrocarbon liquids.

Oil and gas extraction is the main natural gas industry sector, and employing 2,130 in 2011q1. However, this particular industry sector has been steadily declining since its peak in 2008, and is nearly back down to its employment level of six years ago. And, as the next section shows, oil and gas extraction has been surpassed by support activities as the largest natural gas sector employer.

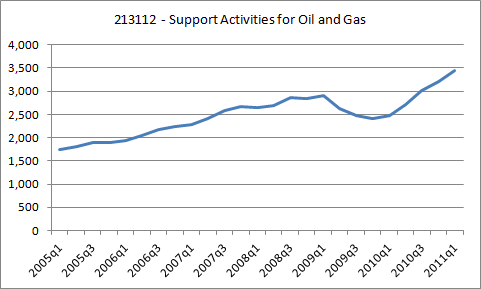

213112 Support Activities for Oil and Gas

This U.S. industry comprises establishments primarily engaged in performing support activities on a contract or fee basis for oil and gas operations (except site preparation and related construction activities). Services included are exploration (except geophysical surveying and mapping); excavating slush pits and cellars, well surveying; running, cutting, and pulling casings, tubes, and rods; cementing wells, shooting wells; perforating well casings; acidizing and chemically treating wells; and cleaning out, bailing, and swabbing wells.

While the oil and gas extraction sector has been in a steady decline the past three year, the support activities sector has bounced back from its recession induced decline. This sector employed 3,440 in 2011q1, an increase of 97.2% from 2005. The support activities sector is also the largest natural gas sector, surpassing the oil and gas extraction sector in number employed in 2007.

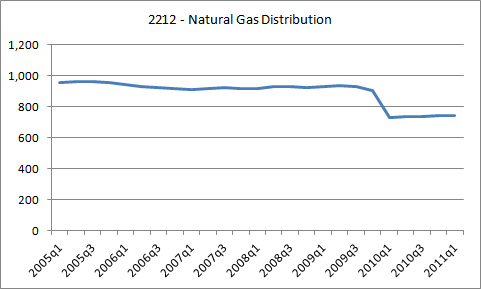

2212 Natural Gas Distribution

This industry comprises: (1) establishments primarily engaged in operating gas distribution systems (e.g., mains, meters); (2) establishments known as gas marketers that buy gas from the well and sell it to a distribution system; (3) establishments known as gas brokers or agents that arrange the sale of gas over gas distribution systems operated by others; and (4) establishments primarily engaged in transmitting and distributing gas to final consumers.

The natural gas distribution sector has been relatively flat compared to the overall natural gas industry, staying slightly below 1,000 from 2005 to 2010. The sector experienced a sharp drop in 2010q1, from 904 to 732, and has remained between 730 and 750 since then.

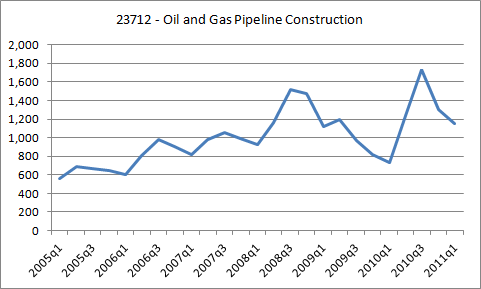

23712 Oil and Gas Pipeline Construction

This industry comprises establishments primarily engaged in the construction of oil and gas lines, mains, refineries, and storage tanks. The work performed may include new work, reconstruction, rehabilitation, and repairs. Specialty trade contractors are included in this group if they are engaged in activities primarily related to oil and gas pipeline and related structures construction. All structures (including buildings) that are integral parts of oil and gas networks (e.g., storage tanks, pumping stations, and refineries) are included in this industry.

While the pipeline construction sector has experienced the most growth since 2005 (558 in 2005q1 to 1,154 in 2011q1, an 106.8% increase) it has also been the most volatile, with many peaks and valleys. Employment in this sector fell to 734 as recently as 2010q1 before spiking to 1,737 in 2010q3.

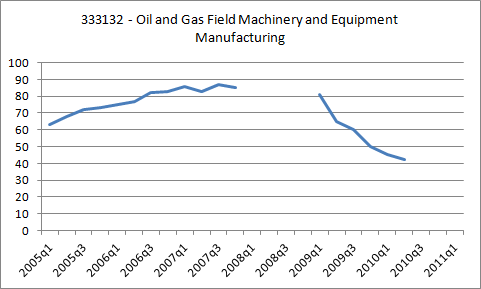

333132 Oil and Gas Machinery and Equipment Manufacturing

This U.S. industry comprises establishments primarily engaged in (1) manufacturing oil and gas field machinery and equipment, such as oil and gas field drilling machinery and equipment; oil and gas field production machinery and equipment; and oil and gas field derricks and (2) manufacturing water well drilling machinery.

The oil and gas machinery and equipment manufacturing is the smallest of the natural gas employment sectors, with only 42 employees in 2010q2, the most recent quarter with data available. the numbers on this sector are spotty, with some large gaps, but there seems to be a decline since 2008, when employment peaked at 87 in 2007q3.

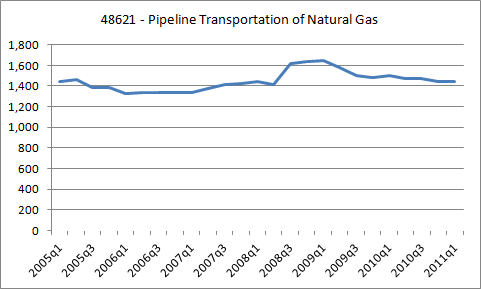

48621 Pipeline Transportation of Natural Gas

Industries in the Pipeline Transportation subsector use transmission pipelines to transport products, such as crude oil, natural gas, refined petroleum products, and slurry. Industries are identified based on the products transported (i.e., pipeline transportation of crude oil, natural gas, refined petroleum products, and other products). The Pipeline Transportation of Natural Gas industry includes the storage of natural gas because the storage is usually done by the pipeline establishment and because a pipeline is inherently a network in which all the nodes are interdependent.

Like the natural gas distribution sector, the pipleline transportation sector has been relatively flat during the Marcellus boom. Employment jumped from around 1,400 to over 1,600 in 2008, but has since come back down. With the exception of the bubble, employment in the pipeline transportation sector has stayed around 1,400 since 2005.

In conclusion, while overall employment in the natural gas industry has grown substantially since 2005, most of those gains have been limited to the support activities and construction sectors. Even then, employment in the construction sector has proven to be volatile, with major swings in employment numbers. Other sectors have remained flat during the Marcellus boom, with the oil and gas extraction sector experiencing a steady decline since 2008.