I’ve talked before about the relationship (or lack thereof) between the level of business taxation and economic growth in the states, concluding that things like quality public services, access to markets and inputs, and a quality workforce all matter more to economic growth and prosperity than taxes.

But there is another

argument out there that is closely related to the business tax argument – the size of government. Proponents argue that the size of government matters to economic growth; states with large governments see their economies struggle under the stifling weight of government, while states with smaller governments see their economies flourish without the heavy burden of government, and that their is a direct relationship between the size of government and economic growth.

So, how much of a connection is there? First you need to measure the size of government. Using data from the Bureau of Economic Analysis, one simple way is to measure the share of state and local government GDP as a percent of total GDP. I did this (using real GDP) for each state from 1997 to 2009 (the dates available from the BEA) and came up with an average for the time period for each state.

West Virginia’s average was 12.7%, meaning that on average, between 1997 and 2009, state and local government made up 12.7% of West Virginia’s economy. West Virginia’s score was high, the national rate was 9.0%, and only 1 state, New Mexico, had a higher rate than West Virginia.

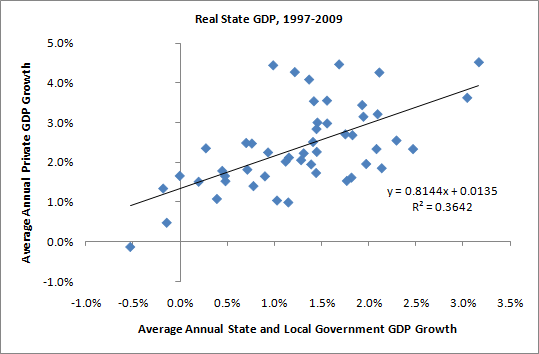

So how was the size of government related to economic growth? I measured economic growth as the average annual growth rate of private GDP in each state from 1997 to 2009, and then compared it to my measure for the size of government. And this is what it looked like.

The results showed no direct connection between the size of government in a state and that state’s economic growth. The two had a correlation coefficient of 0.06, again suggesting no connection.

But what about another question – government growth. Does government grow at the expense of the rest of the economy? To examine that question, I used the same data, only this time, instead of using the average share of GDP that state and local government had in each state, I used the average annual growth rate of state and local government, comparing it to the average annual growth rate for private GDP. And this is what that look like.

This time there is a more direct relationship, and a correlation coefficient of 0.60. But instead of government growth stunting economic growth, the two moved together. States with low levels of growth in government, also had low levels of economic growth, and states with high levels of government growth also had high economic growth. Perhaps as economies grow, so do demands for new roads, schools, and other public services.

Like tax levels, focusing on the size of government misses out on what really matters for economic growth. And as states grow their economies, they also grow their demands for public services. Trying to shrink government in the face of these new demands is only going to hurt in the future.