The health and economic impacts of COVID-19 have exacerbated longstanding economic inequities faced by West Virginians. Thankfully, the recent stimulus and rescue packages have shown us a way to rebuild from the pandemic by investing in families. In particular, the expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) in the American Rescue Plan (ARP) were among the most critical provisions for family economic security. However, the ARP was narrowly designed to address the high levels of hardship created by the pandemic, and its temporary measures — along with the progress they make in addressing economic hardship — will begin to reverse when these provisions expire.

Policymakers should invest in measures that will create a truly equitable recovery that allows all families to thrive. Fortunately, in the coming weeks and months, we expect Congress to consider a recovery package that can and must further those investments, build toward an equitable recovery, and lift West Virginia families out of poverty once and for all. An equitable recovery package should extend — or better yet, make permanent –important expansions of the Child Tax Credit and the Earned Income Tax Credit and eligibility for the Supplemental Nutrition Assistance Program, as well as ensure comprehensive paid leave for workers and families.

More on each of these items in Sarah’s full blog post.

Taxes were a major focus of the 2021 West Virginia legislative session, with the elimination of the state personal income tax a top priority for the governor as well as for House and Senate leadership. Fortunately for the state, all of the various proposals — which each would have devastated the state budget while shifting taxes away from the wealthy and onto low- and middle-income households — failed to pass this session. However, the threat remains.

While the personal income tax — and the critical public services and programs funded by its revenues — ultimately escaped the regular session unscathed, a number of other tax bills did make it through the legislative process. The impacts of the bills vary, with some having small, immediate impacts, and others having potentially large, future impacts.

Our new blog includes a recap of these bills, including:

– Aircraft Maintenance Tax Exemption (SB 305)

– Exempting Unemployment Benefits from Income Taxes (SB 693)

– Mobile Workforce Modernization (HB 2026)

– Small Arms and Ammunition Sales Tax Exemption (HB 2499)

– Natural Gas Property Valuation (HB 2581)

– Business Personal Property Tax Elimination (HJR 3)

Read Sean’s full blog post.

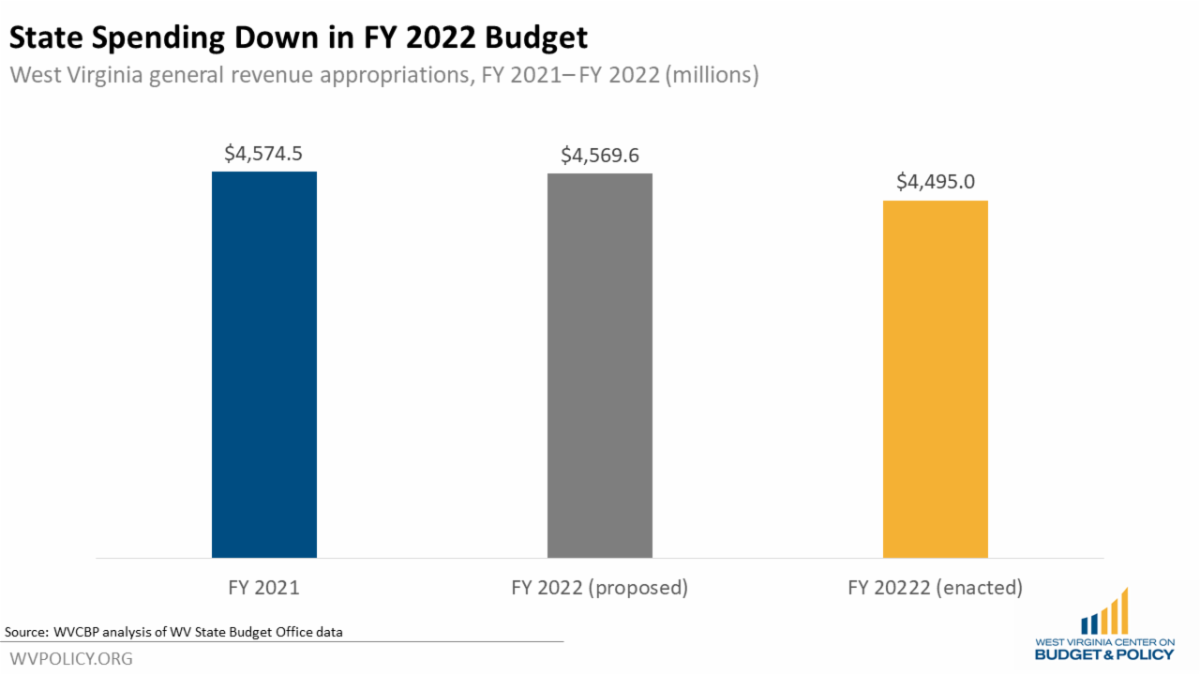

Last week, Governor Justice approved the FY 2022 budget passed by the legislature at the end of session. While the fate of the budget was up in the air for most of the session as the legislature attempted to eliminate the income tax, by the time the session came to a close, only a few bills had passed that required offsetting changes to the budget. Despite the governor originally proposing a “flat” budget with little new investment, the legislature made a number of cuts throughout the budget, leaving $72.7 million unappropriated. While most of these cuts are expected to be restored using the anticipated surplus at the end of FY 2021, the cuts will be built into future base budgets.

Overall, general revenue spending in the final FY 2022 budget is $74.6 million below the governor’s proposed budget, and $79.5 million below the FY 2021 budget.

For details on which areas of the budget received increases and which areas saw cuts, read Sean’s full blog post.

SB 387 was passed by both chambers of the WV Legislature and was sent to the governor’s desk. Gov. Justice has 15 days from session adjournment (Sundays excepted) to sign or veto the bill.

SB 387 would make applicants who test positive for drugs or refuse a drug test ineligible for Temporary Assistance for Needy Families (TANF) assistance. Our blog post from health policy analyst Rhonda Rogombé explains how such a policy choice will further stigma, harm vulnerable populations, and contradict public health best practices:

“Rendering benefits contingent on passing a drug test for individuals otherwise eligible for cash assistance does not meaningfully address substance use problems. Instead, it does quite the opposite — drug screening creates barriers for those who may otherwise seek treatment.

“In a state already riddled with budget shortfalls, dedicating resources to an initiative that further stigmatizes individuals with low incomes — while worsening their material conditions — contradicts the core mission of TANF and other social programs, as well as best practices for public health. Rather than punishing TANF recipients by extending the drug screening program, West Virginia must recommit to providing basic assistance to families. Redirecting funds toward these initiatives would better serve low-income families and help create a healthier West Virginia.”

Please join us in urging Governor Justice to veto this harmful and stigmatizing legislation. You can call him at 304-558-2000.

The 2021 WV legislative session is now wrapped, but the ways in which it may impact the state constitution remain unclear. This article from West Virginia Public Broadcasting explains the three constitutional amendments proposed this session and what they each could ultimately mean for West Virginia. Excerpt below:

While any 60-day legislative session focuses on the hundreds of bills introduced and considered, Republican supermajorities this year helped push three proposed constitutional amendments to the ballot for voters to ponder.

Come November 2022, West Virginians will have the opportunity to decide whether to amend the state constitution on three different issues — preventing the state Supreme Court from intervening in impeachment proceedings, giving the Legislature the ability to exempt more types of property taxes and allowing religious denominations to incorporate.

These proposals — considered by the Legislature as joint resolutions — require a two-thirds majority of both the House and Senate before heading to the voting public for ratification.

Late into the session, lawmakers had considered putting them on the ballot in a special election as soon as July but ultimately backed off from that date.

Voters will now wait until Nov. 2022 to decide these three issues.

For details on each of these proposed amendments, read WVPB‘s full article.

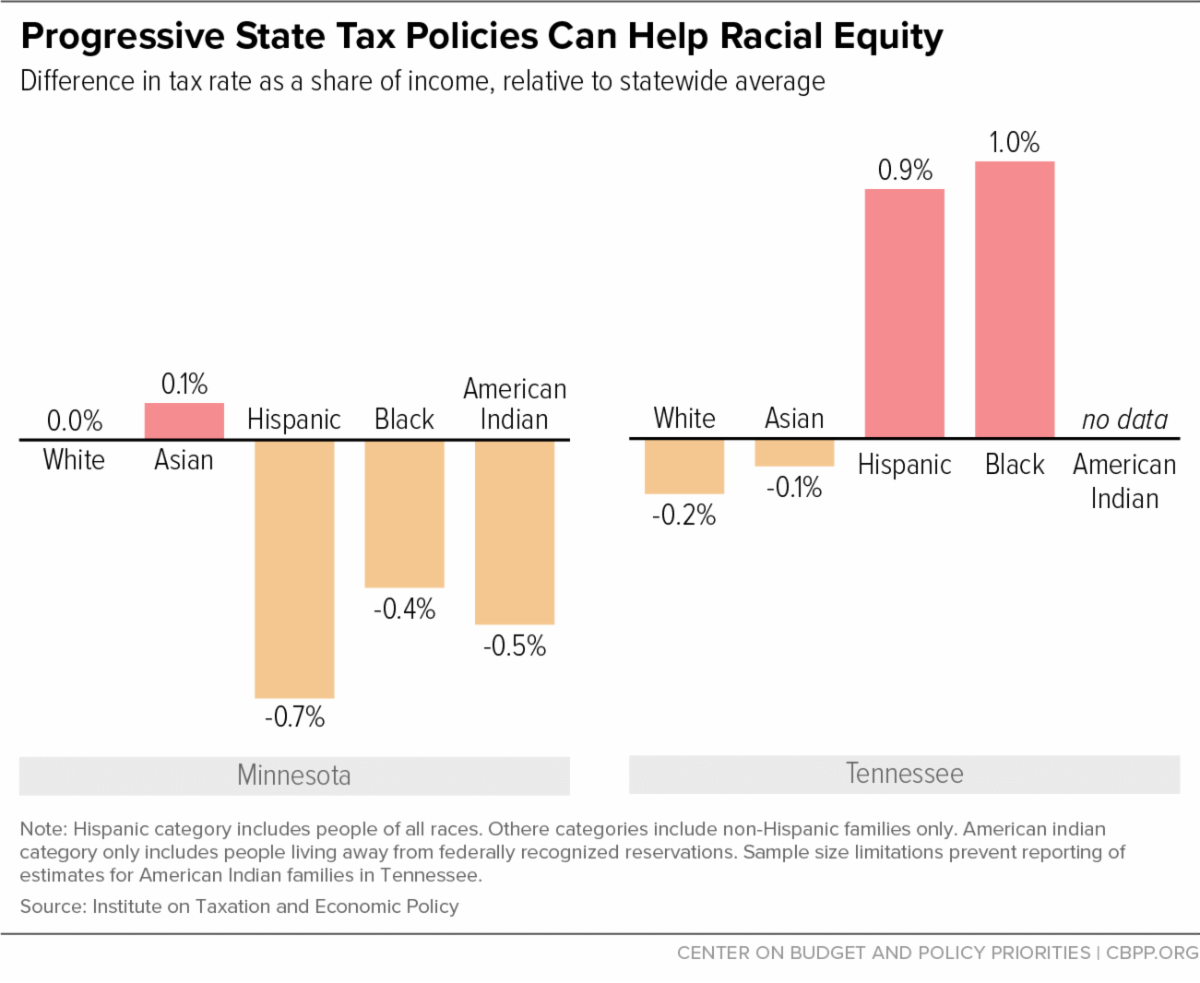

With the 2021 legislative session now closed and the fight to preserve the personal income tax temporarily won, we at WVCBP found this blog from the Center on Budget and Policy Priorities to be particularly pertinent. The piece, “States Can Create Antiracist and Equitable Tax Codes,” explores some ways in which states can implement more racially just tax policies. Excerpt below:

Many local, state, and federal policy choices also contribute to racial and economic disparities; and tax and revenue systems often underlie and worsen those choices. For example, many states and localities make existing income disparities even worse for communities of color by relying too much on regressive forms of revenue like consumption taxes or various kinds of fees and too little on income and wealth taxes, which ask more of those at the top, a group that’s disproportionately white.

States do not raise revenue or collect taxes based on people’s race, but historical racism and ongoing forms of discrimination and bias shape people’s incomes and the property they own. In short, tax policy cannot be race neutral because of the country’s legacy of racism. ITEP’s analysis demonstrates how regressive tax policies — regardless of intent — result in worse outcomes for people of color.

State lawmakers cannot afford to ignore the racial and economic inequities that are built into their tax systems. To reduce inequities and make the sorts of antiracist and forward-thinking investments needed for this recovery and the future, lawmakers should:

Read CBPP’s full blog post.

In the next several weeks, the first of $677 million will be distributed to county and city governments throughout West Virginia. The goal of this money is to support local efforts to recover from the widespread devastation caused by the COVID-19 pandemic, but how the money is spent will largely be up to the local government in question. With your help, we can create a list of priorities that center the needs of those most impacted, and a group of folks to advocate for the aid that is most needed.

We want to hear from YOU.

How do you think your local government could spend this funding? What areas of your city have suffered the most from the pandemic? What kinds of investments will help your community long term? Let us know by filling out this survey.

There are no wrong answers, and please share this survey with anyone whose input you’d like to see considered. We appreciate your thought and time!

| WVCBP’s Summer Policy Institute (SPI) is an annual event for college students and young people interested in bettering West Virginia through policy change. SPI brings together highly qualified traditional and non-traditional college students and young people to build policy knowledge, leadership skills, and networks. Attendees participate in interactive sessions where they learn the basics of data, policy, and state government and build their organizing and advocacy skills. Throughout the convening, attendees work in small groups to identify and develop policy proposals to shape the future they want to see in West Virginia, culminating in team “policy pitches” to state legislators and policy professionals. Many SPI attendees have gone on to continue advocating for their policy idea and to hold internships with West Virginia non-profits and in state government. Applications for SPI are being considered through April 30. Further details and link to apply here. |