It is no question that students in West Virginia and across the country suffered academic losses in connection to COVID-19’s impacts on instruction and learning time. Our new issue brief explores how American Rescue Plan Act (ARPA) education funds can be utilized to address these losses, as well as longstanding challenges and racial inequity in West Virginia schools.

ARPA includes $123 billion in new, flexible funding known as the Elementary and Secondary School Emergency Relief Fund for school districts to spend over the next three and a half school years — the largest ever one-time federal investment in K-12 education. West Virginia schools will receive $761.9 million to ensure that they can reopen safely and meet students’ educational needs.

The majority of these funds will go to local school boards that will make critical decisions on how to use the money; however, the local decision-making bodies must receive public input from educators and parents on their proposed plans.

Our issue brief explores the persistent hardships and racial disparities present in West Virginia’s schools, how the pandemic likely exacerbated these challenges, and how ARPA education funds can be utilized to advance equity in the Mountain State’s education system.

The brief recommends that ARPA education funds be used to further equity through:

– Prioritizing Public Input;

– Addressing Root Causes of Disparities;

– Increasing Student Support Staff;

– Improving Educational Achievement by Addressing Systemic Racism;

– Expanding Summer Programs and Extended Day Options;

– Engaging in Local Collaboration to Provide Wraparound Services; and

– Supporting Students’ Home Lives

It is essential that school boards actively seek out the input of families whose children have suffered disproportionately large impacts of learning loss from the pandemic. Without this insight, school officials will miss critical input that could result in marginalized students falling further behind.

Read Tamicah’s full issue brief here.

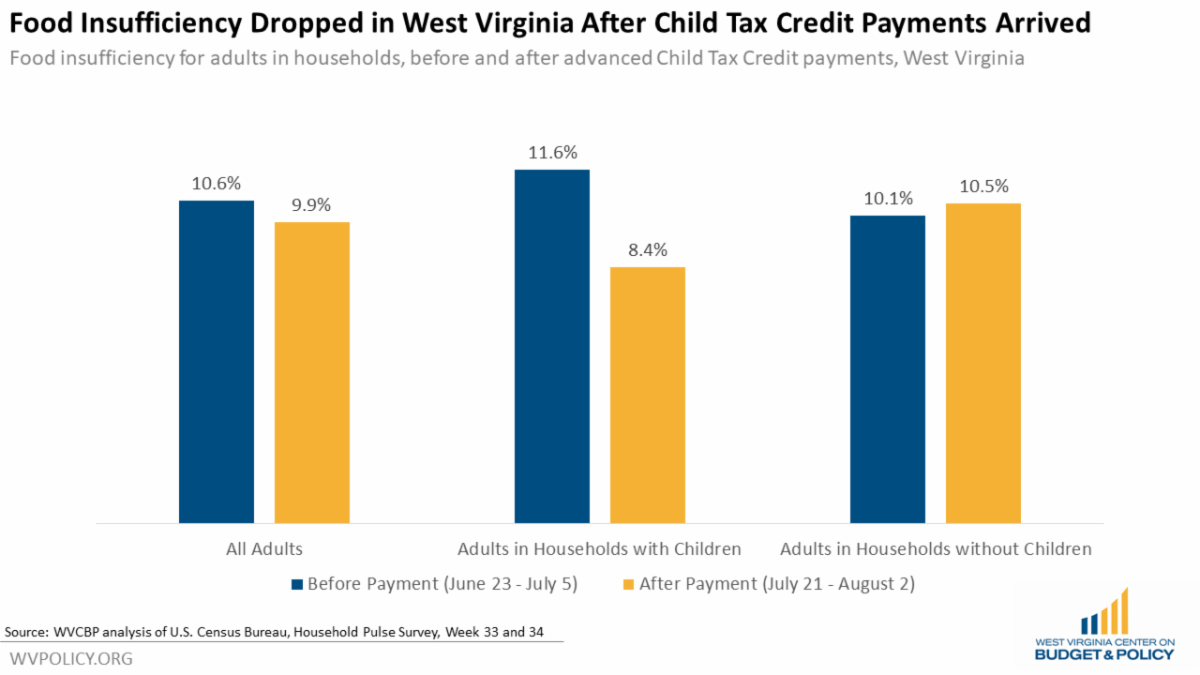

Recent data from the United States Census Bureau’s Household Pulse Survey shows a significant decrease in food insufficiency immediately after households received the first advanced payment of the newly expanded Child Tax Credit (CTC), with the largest decline in hunger being among households with children.

The American Rescue Plan Act (ARPA) made three significant, but temporary changes to the CTC, providing a crucial boost in household incomes to our country’s most vulnerable families. If all West Virginia children who are eligible are able to access the CTC, 346,000 children will benefit statewide, including 50,000 who would be lifted above or closer to the federal poverty line.

West Virginia state and local governments should consider conducting outreach to ensure that those who qualify for the expanded CTC, as well as other family supports under the ARPA, are aware of these programs and are able to successfully file to receive the benefits they are eligible for. Education and outreach campaigns could involve hiring “benefit navigators” to help families apply for expanded CTCs, Earned Income Tax Credits, SNAP benefits, Medicaid, rental assistance, and other public programs designed to address the impacts of the pandemic.

Without further action from Congress, the groundbreaking economic security impacts of the expanded CTC will expire at the end of 2021. Fortunately, Congress is expected to consider a multi-year extension of these benefits as part of the “Build Back Better” recovery package, which would also include additional family and worker supports.

Read Seth’s full blog post here.

Take action today to help secure longer-term, transformational change for families by sharing your CTC story here and urging our U.S. Senators to support the Build Back Better plan here.

For more on the positive impacts of the enhanced CTCs, check out this recent op-ed written by our colleague at the American Friends Service Committee, Rick Wilson.

West Virginia faces a pivotal moment as we begin to emerge and recover from the COVID-19 pandemic and recession. Our newest report, Emerging Stronger from the Pandemic: A Blueprint for an Equitable Economic Recovery in West Virginia, explores lessons learned from the pandemic, as well as provides policy recommendations by topic area that would serve as an equity-centered pathway forward for our state and its people.

The report’s areas of focus include:

– Tax and Budget

– Family and Economic Security

– Health

– Labor

– Education

Join us at our Facebook Live next Tuesday, Aug. 24 at 5:30pm for a look into our report’s findings and recommendations.

Read the full report here.

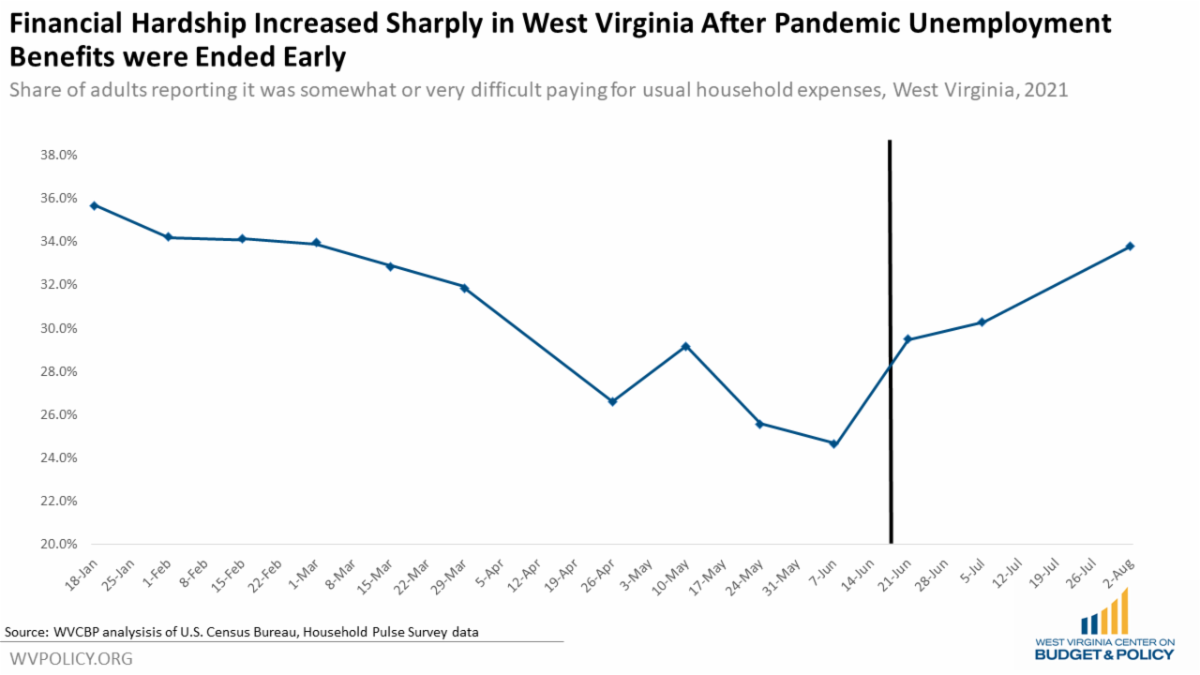

In June, Gov. Justice prematurely ended all federally funded pandemic unemployment benefit programs. The governor justified his decision to end the enhanced benefits by claiming that doing so would encourage people to return to work. But two months later, the data shows otherwise. A recent article, including insight from WVCBP senior policy analyst Sean O’Leary, dives into the numbers. Excerpt below:

Gov. Jim Justice’s decision to cut off federal enhanced unemployment benefits 12 weeks early did not improve state employment rates or reduce unemployment rolls, but coincided with a sharp spike in West Virginia households experiencing financial hardships, an analysis released Thursday shows.

“With the pandemic still ongoing and the economy still recovering, West Virginia chose to prematurely end these benefits based on a fictitious and discredited narrative of lazy workers abusing pandemic unemployment benefits to avoid returning to work. And in doing so, West Virginia not only failed to boost employment, but also needlessly harmed struggling workers and undermined our economic recovery,” the report from the West Virginia Center on Budget and Policy concluded.

According to the analysis by Sean O’Leary, senior analyst for the Center on Budget and Policy, state employment figures have actually declined slightly since Justice cut off the benefits, with employed West Virginians dropping from 53.3% of the population to 52.3%.

Likewise, he found that state unemployment claims were dropping by an average of 608 claims a week prior to the June 19 cutoff, but have declined to an average of 483 fewer unemployment claims a week since the cutoff.

Meanwhile, according to the Census Household Pulse Survey, the number of adults in West Virginia who had reported difficulty in paying weekly household expenses jumped sharply after the cutoff, going from 24.6% of adults for the week of June 7 to 33.8% of adults for the week of Aug. 2.

For further details, read the full article here or check out Sean’s recent blog post on the topic here.

We’re hiring!The WVCBP is seeking a federal campaign advocacy organizer to assist in developing and executing a federal campaign strategy that secures both public & legislative support for progressive policy at the federal level.

You can find the full job description here.

If interested, please submit an application packet to Kelly Allen at kallen@wvpolicy.org by 5pm on Monday, August 30, 2021. Application packet should include resume, an example of a campaign workplan you’ve executed, and a link to an earned media hit you’ve generated.

Morgantown folks! Join the Paid Leave Works for WV coalition on Aug. 30 at 5:30pm for a free, family-friendly evening to share and learn about paid leave, why it’s important, and how you can help West Virginia families secure this important support.

The coalition will provide free food, games, and more.

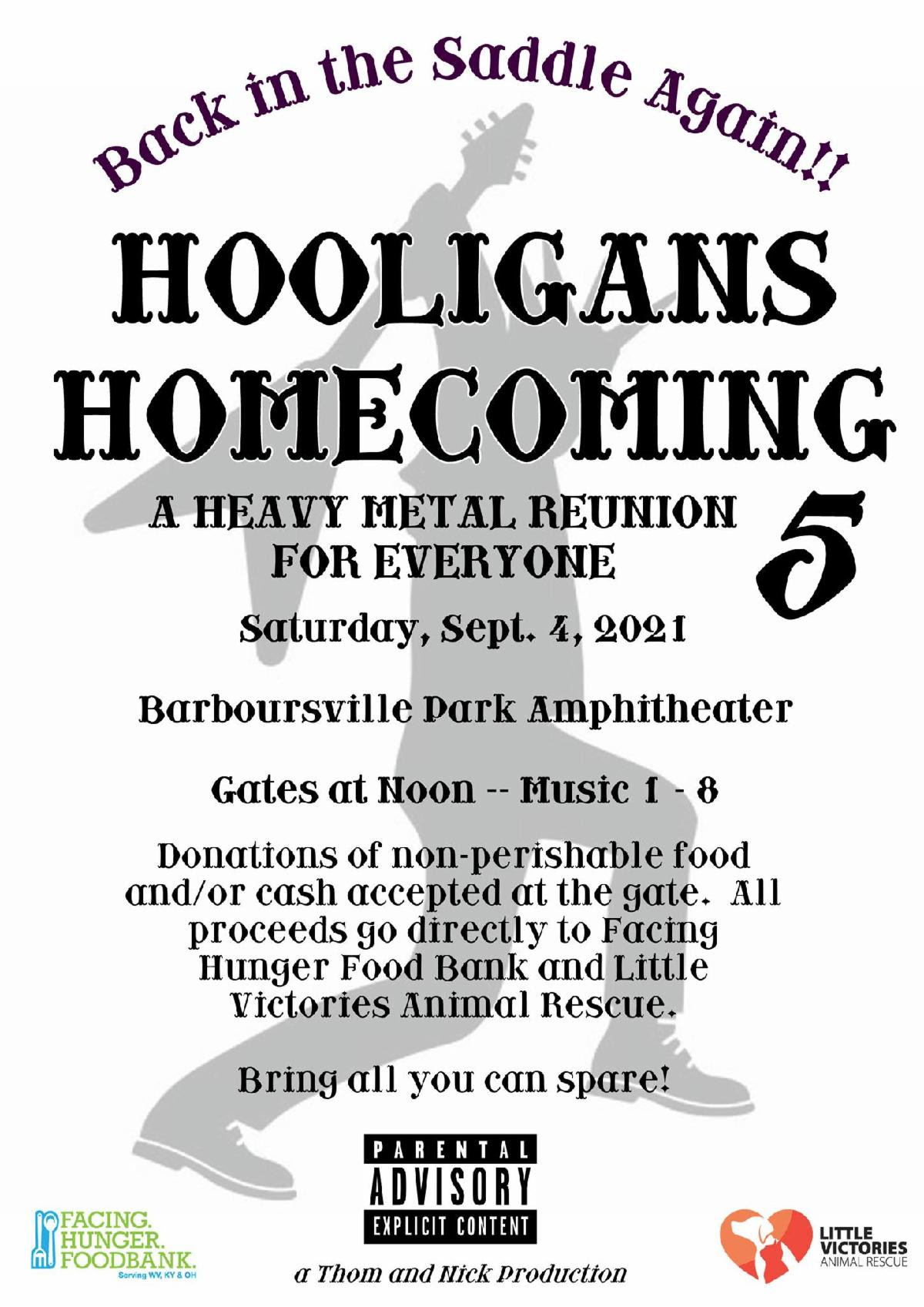

For all our music lovers, come enjoy some great tunes in exchange for donations to some great causes! The event will take place from 12-8pm on Sep. 4 at the Barboursville Park Amphitheater.

Find more details at the Facebook event here.

Earlier this year, our federal policymakers sent money to families so people can pay their rent and put food on the table, helped school districts protect teachers’ health and get kids back into the classroom, and boosted vaccine distribution—all of which will help accelerate our economy and address the immediate health and economic impacts of the pandemic.

Congress acted because we raised our voices together and demanded help. With short-term relief on the way, now Senator Manchin and Senator Capito need to look to our future and pass economic recovery legislation that ensures everyone can thrive, no matter what we look like or where we come from.

Our elected officials are drafting recovery legislation now, so it’s time to make yourself heard again. Tell them you want our government to support working families and invest in our economic recovery by making health care coverage more available and affordable, permanently expanding relief for struggling people, and ensuring children get the support they need to succeed.

Please join us in urging Senators Manchin and Capito to support the Build Back Better recovery agenda by sending them a letter here.

The American Rescue Plan Act (ARPA) authorized significant but temporary changes to the Child Tax Credit. Last month, eligible families received the first of their monthly enhanced credits. Research is already showing that the enhanced CTCs are helping to reduce food insecurity and financial hardship among households across the country, particularly among households with children.

Here are the four changes included in the ARPA that might help you with the financial burden of raising a family:

1. The credit amount has been increased. The ARPA increased the amount of the Child Tax Credit from $2,000 to $3,600 for children under age 6, and $3,000 for other children under age 18.

2. The credit’s scope has been expanded. Children 17 years old and younger, as opposed to 16 years old and younger, will now be covered by the Child Tax Credit.

3. Credit amounts will be made through advance payments during 2021. Individuals eligible for a 2021 Child Tax Credit will receive advance payments of the individual’s credit, which the IRS and the Bureau of the Fiscal Service will make through periodic payments from July 1 to December 31, 2021. This change will allow struggling families to receive financial assistance now, rather than waiting until the 2022 tax filing season to receive the Child Tax Credit benefit.

4. The credit is now fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the ARPA.

If you are a recipient of the Child Tax Credit, we’d love to hear how your family is being impacted to help us in our advocacy to make this credit expansion permanent. Please let us know by taking our survey here.