The biggest news this week at the Capitol was the bipartisan introduction of Senate Bill 648 which would expand adult Medicaid coverage to include dental care. This policy would be a remarkable investment in West Virginia’s people, both in the short and long term. Read more about why this is so important here.

Thursday saw the Senate Judiciary Committee debate SJR 9, yet another attempt to roll back business personal property taxes. This revenue source is a critical support for education and public safety services in every West Virginia county. Read more about Executive Director Ted Boettner’s testimony before the committee here.

Read more about the failed history of corporate tax cuts in West Virginia in this op-ed by WVCBP board member Rick Wilson in this week’s Charleston Gazette-Mail.

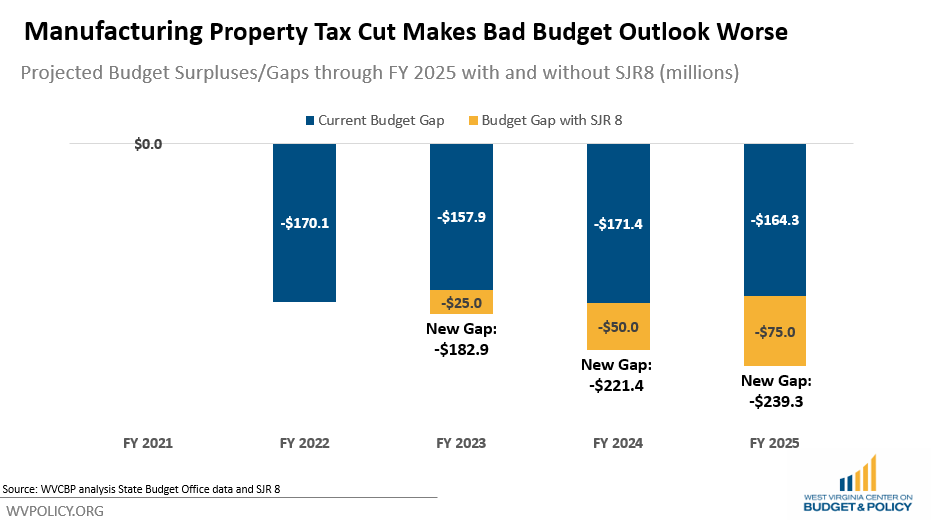

While we knew that eliminating the business personal property tax was at the top of the legislative agenda, it was unclear how the tax cut would take shape. Now with the introduction of Senate Joint Resolution 8, the Manufacturing Growth Amendment, we can better understand its potential impact.

The property tax on business personal property (which includes business machinery and equipment, inventory, and other business personal property like computers and fixtures, as well as the working interest in oil and natural gas property) totaled $388.4 million, accounting for 23 percent of total property tax revenue in the state in FY 2016.

SJR 8 proposes eliminating part of that tax, but only for manufacturers. All other businesses in the state would continue to pay property tax on their equipment and inventories. The property tax on manufacturing machinery, equipment and inventory totaled $91 million in tax year 2018.

While this tax cut is being sold as repealing the state’s number-one job-killing tax, evidence suggests it won’t have much impact on the state’s manufacturing jobs. Studies examining state-level inventory and other personal property taxes concluded they rarely impact business location decisions or have a significant impact on employment levels in manufacturing, wholesale, or retail industries. In fact, in recent years, more manufacturing jobs have been added in states with the “job-killing” business inventory and equipment tax than in states without it.

Read more in Sean’s blog post.

Today, the WVCBP was proud to participate in WVAHC’s Policy Prescriptions for Healthy Families event at the WV Culture Center. The WVCBP’s director of policy engagement, Kelly Allen, and WV Citizen Action Group’s Savanna Lyons presented the group with the coalition’s health policy agenda and provided legislative updates and ways for interested individuals to get involved to help get these proactive health proposals across the finish line.

After the event, over 100 attendees, many of them social work students, walked over to the Capitol to attend the floor session and to meet with their lawmakers.

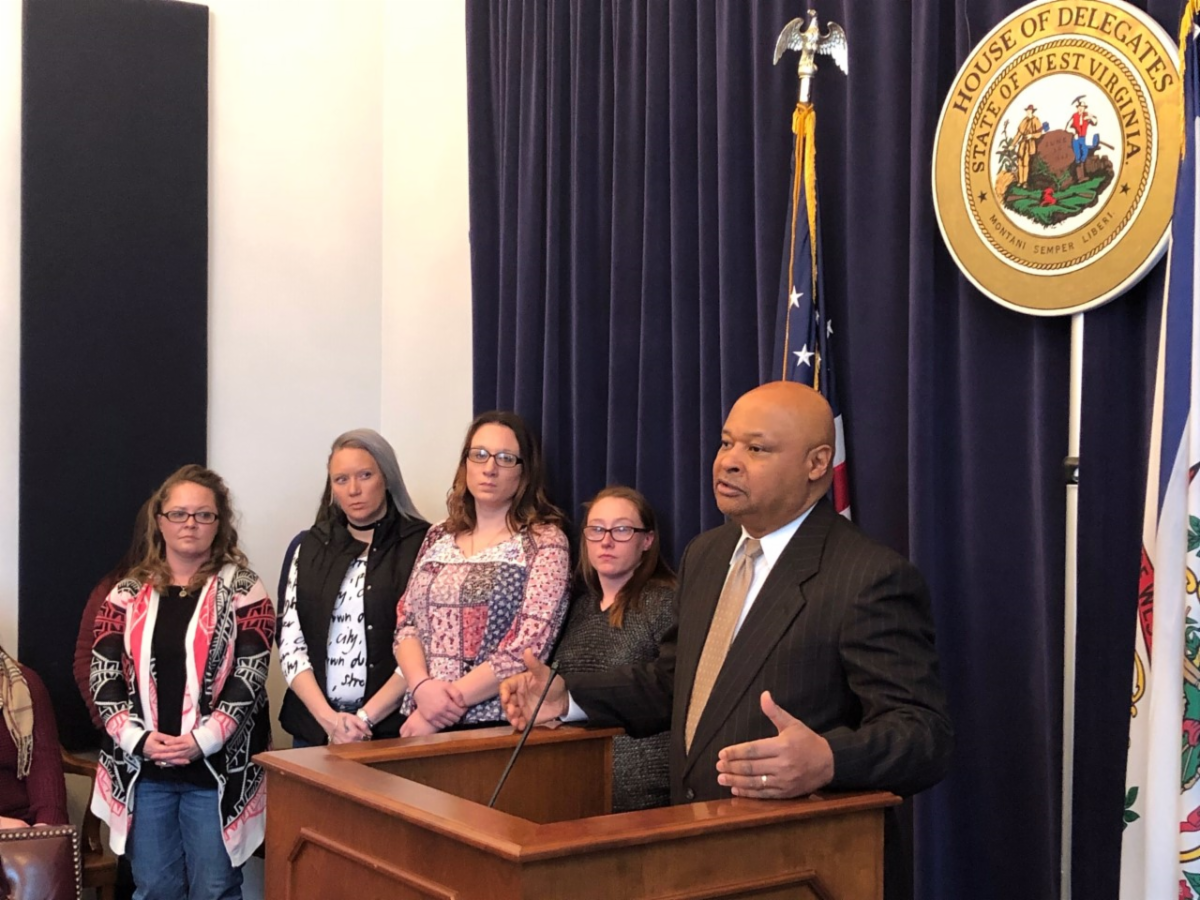

On Monday, proponents of criminal justice reform gathered at the Capitol to promote legislation that will reduce incarceration in West Virginia. Women from Recovery Point in Charleston, as well as men and women who are currently and were formerly incarcerated, attended, along with lawmakers and coalition partners.

HB 2419 passed the House this week 87-10 and is now in the hands of the Senate Judiciary Committee. This bail reform bill would require “a court or magistrate to release a person charged with certain misdemeanor offenses on his or her own recognizance except for good cause shown” and help prevent people who cannot afford bail from being held in jail, allowing them to keep their jobs and take care of their families while they await trial.

Two weeks ago, the House Industry and Labor committee passed out HB 4104 that would make it easier for employers to classify workers as independent contractors when it comes to Unemployment Insurance and Workers Compensation eligibility. A similar bill passed the House last year, but died in the Senate.

Employee misclassification has large costs and consequences. It can rob individual workers of their rights and benefits, create unfair market competition, shift costs from employers to workers, and reduce tax federal and state tax revenues.

While some misclassification occurs in good faith, a large amount is deliberate as employers try to avoid paying FICA taxes, workers’ compensation premiums, and unemployment insurance premiums, as well as block efforts toward unionization.

At the end of 2018, 201 random audits in West Virginia revealed 242 misclassified workers. Research suggests that between 10 to 30% of employers misclassify workers as independent contracts, costing state and federal governments billions in lost revenue.

Read more in Ted’s blog post.

Registration is now open for this year’s Summer Policy Institute! Join us at Fairmont State University this July for a great weekend of policy discussion and networking!

We are looking for a research associate for the summer of 2020. Our summer research associate will work closely with WVCBP staff, coalition partners, and other stakeholders to collect and analyze data to provide evidence-based solutions, policies, and practices surrounding issues that impact low- and moderate-income West Virginians.

Read more here.

More info here.

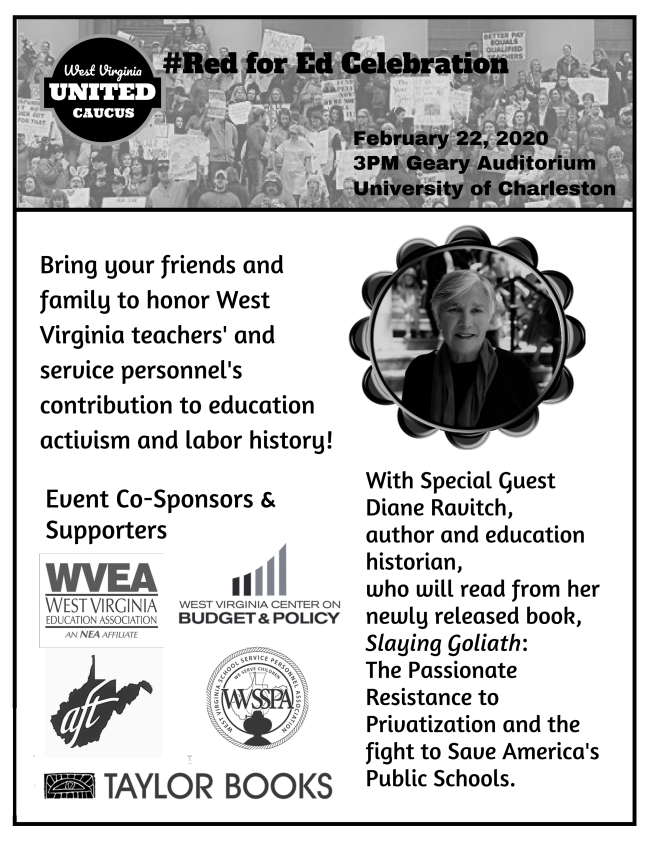

February 22: Red for Ed Celebration Celebrate the two-year anniversary of the 2018 WV Teacher and Service Personnel strike. Hear and share stories about the strike, and listen to a very special guest, Diane Ravitch discuss her new book, Slaying Goliath, and the impact our strike made on her and the nation! More information here. (This event is co-sponsored by AFT-WV, WVEA, WVSSPA, The WV Center on Budget and Policy, and Taylor Books).