Governor Justice recently announced a special session to be held at the end of September to override tax cut triggers enacted as part of the 2023 tax law and slash taxes by an additional $114 million. As we highlighted recently, the proposal ignores realities and defies fiscal responsibility. While policymakers are still learning the full impact of recently enacted tax cuts, we already know they have contributed to deep revenue declines not seen in 25 years. With slowing revenues, more tax cuts on the way, and a host of spending needs after years of austerity, lawmakers should reject the governor’s efforts and focus on the sustainability of programs that help families and businesses and grow our economy.

Historic Revenue Declines

Fiscal Year (FY) 2024 marked just the second time in 25 years that West Virginia’s nominal state revenue collections declined year-over-year outside of a recession. On average, state revenues grew by about 2.7 percent per year between 1999 and 2019, allowing the budget to keep pace with inflationary cost growth. In 2024, revenue collections shrunk by 12 percent. That experience is not unique to West Virginia—many states saw revenue collections shrink as federal pandemic-era funding expired and energy prices declined.

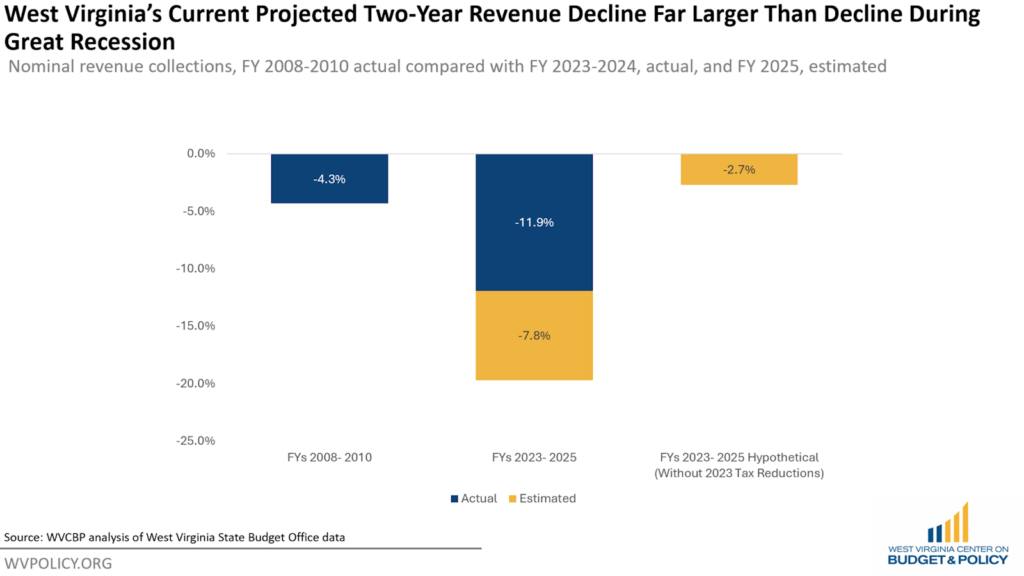

But West Virginia is on pace to have two consecutive years of revenue decline if the Justice Administration’s revenue projections are correct. That has not happened in 25 years outside of a recession. And the declines in FY 2024 and FY 2025 are much deeper than any over the span of more than two decades, including the years of the Great Recession.

This decline is in large part explained by recent personal income tax cuts. In addition to the nearly 12 percent revenue decline from FY 2023 to FY 2024, the Revenue Department anticipates an additional 7.8 percent (or nearly $500 million) revenue decline from FY 2024 to FY 2025. Combined, that would be a 19 percent nominal revenue decline over two years—more than four times greater than the losses seen during the Great Recession—even before adjusting for inflation.

While West Virginia would have likely seen slowing revenues between the pandemic-era revenue peak in FY 2023 and FY 2024, the decline would have been significantly smaller without 2023’s income tax cuts. If we assume that the tax cuts reduced revenues by $600 million in FY 2024 (consistent with the fiscal note), the overall revenue decline would have been just 2.7 percent, compared with the actual decline of 11.9 percent.

Monthly Collections Slowing

Two months into the new fiscal year, tax collections are below this point last year and below the Justice Administration’s own revenue estimates.

Over the first two months of the fiscal year, severance tax collections are down by 37 percent compared with this point last year. And that’s after FY 2024’s severance tax collections declined by 61 percent compared with FY 2023, the year the state enacted major permanent tax cuts.

While personal income tax collections are holding steady so far compared with this point last year, a significant portion of the tax changes implemented in the 2023 and 2024 legislative sessions have not yet been implemented, and thus have not yet been reflected in revenue collections. Both property tax rebates and a four percent reduction in marginal personal income tax rates will go into effect for the second half of the fiscal year, beginning in January. That is expected to reduce personal income tax collections by a combined $300 million annually, along with a three-year phase-in of the elimination of personal income tax on Social Security benefits for high earners.

Disappearing Surpluses

Proponents have attempted to justify previous tax cuts by pointing to revenue surpluses—but collections now are coming in below estimates. Now, Governor Justice is pointing to surpluses from prior years as justification for additional tax cuts. But tax cuts (and new spending programs) are recurring costs, meaning they must be accounted for in the budget every year, whereas surplus dollars are, by definition, only available one time. As such, justifications for tax cuts require a longer-term look at financial and economic conditions. And given there is no surplus in the current fiscal year, as the economic picture presently stands, any tax cuts would reduce our existing state budget.

Moreover, in recent years ongoing state budget costs have been paid for with surplus dollars—including a $180 million reserve fund for ongoing Medicaid costs and nearly half of the expected 2024-25 cost of the Hope Scholarship. As surpluses that were available in recent years substantially shrink or disappear entirely, lawmakers must consider how they will balance ongoing budget needs and new costs from enacted legislation including the expansion of the Hope Scholarship, rising PEIA costs, and the full implementation of the Third Grade Success Act.

West Virginia’s Pandemic-era Revenue Collections Particularly Fleeting

A recent Pew analysis highlighted the fleeting nature of West Virginia’s pandemic-era surge in revenue collections, which drove the 2023 tax cut fever as well as current efforts to cut taxes again. Pew researchers found that state tax revenues all over the country peaked between 2021 and 2023 and are now declining after historic revenue surges. But West Virginia stood out among the states whose pandemic-era revenue growth was likely temporary in nature, indicating that growth is likely an unsustainable replacement for revenue lost due to tax cuts.

Conclusion

The WVCBP has long cautioned that 2023’s tax cuts were based on temporary revenue surges due to federal aid, high energy prices, and other temporary factors. Even as lawmakers are still assessing the effects of recent policy changes, it is clear that the subsidence of pandemic-era revenue collections combined with recent tax cuts is having a deep impact on state revenue collections and, by extension, our ability to meet longstanding budget needs. To double down with even more tax cuts that primarily benefit the wealthy would be fiscally reckless and likely would impede even Republican spending priorities.

Read Kelly’s full blog post here.

Join us in telling your lawmakers to reject additional tax cuts using our form here.

School is officially back in session for children across the Mountain State—with the vast majority (90 percent) receiving their education in our public school system. The new school year brings excitement and opportunities, but this year in West Virginia it also brings challenges as school districts face serving their students with fewer resources as a result of declining enrollment—in large part due to the Hope Scholarship—as well as expiring federal school funds.

Over the past few years, all West Virginia schools received federal funds to address learning loss resulting from the pandemic and support students’ social, emotional, and mental health through the federal pandemic-era Elementary and Secondary School Emergency Relief (ESSER) Fund. The last of these funds, known as ESSER III, are set to expire this year and must be obligated by the end of this month.

A recent report by the Center on Budget and Policy Priorities found that West Virginia is one of 15 states that will be most impacted by the end of ESSER funds. This will be especially impactful for lower income school districts as ESSER funds were distributed using an equity approach which allocated more funds to the districts with higher amounts of low-income students. Over half (60 percent) of West Virginia school districts have more than one in five of their students living in poverty.

In West Virginia, nearly half (48 percent) of ESSER funds went toward critical costs to maintain workforce, meet student needs, and address pandemic learning losses through retaining staff and hiring new staff to support students, including counselors and math and reading specialists. In addition to eliminating staff through layoffs, the ESSER funding expiration represents a significant loss of funds for the continued operation of West Virginia public schools.

On average, districts will lose about seven percent of their annual spending with the expiration of ESSER funds and some counties face an even more dire circumstance. For example, earlier this year, Mercer County Schools announced the elimination of 90 service and staff personnel positions due to funding losses and enrollment decline. Following the ESSER expiration, Mercer County Schools is expected to lose the equivalent of over 11 percent ($13.5 million) of their annual district spending.

Based on our analysis, ESSER III funds represented between 7 percent and 10 percent of total district spending (during the 2020-2021 school year) in 20 West Virginia school districts and more than 10 percent of total district spending in 6 school districts. The impact of the loss of ESSER III funds will be felt by all students across the state, however, several school districts—including those in Mingo County, McDowell County, Mercer County, Summers County, Webster County, and Barbour County—will be particularly affected if policymakers do not find a way to replace these funds.

ESSER funds provided a valuable resource to public schools and bolstered investment in our students’ current and future success. Researchers estimate that every $1,000 in ESSER spending is worth $1,238 in students’ lifetime earnings. This amounts to almost $915 million in student lifetime earnings for West Virginia students from ESSER III alone and $1.4 billion cumulatively from ESSER I, II, and III.

As lawmakers consider how to continue addressing student mental health and behavioral issues and how to keep making gains in math and reading comprehension, they must prioritize replacing the ESSER funding that made support staffing and resources in these areas possible. Put simply, failing to do so would halt or even reverse the considerable gains that have been made in addressing the learning and socio-emotional impacts of the pandemic.

Statewide, the expiration of ESSER funds amounts to a loss of about $246 million annually. That is approximately the amount the Hope Scholarship is expected to cost annually once made universal, as it is currently slated to do in the 2026-27 school year.

This presents lawmakers with a clear choice. Rather than diverting even more dollars away from the public school system to subsidize the cost of private school for wealthy families who could already afford it, as expanding the Hope Scholarship would do, lawmakers must affirm their commitment to the 90 percent of children who receive their schooling through the public system and commit that additional $200+ million annually to sustaining staffing and support services in our public schools, which serve children in all communities across West Virginia.

Read Tamaya’s full op-ed.

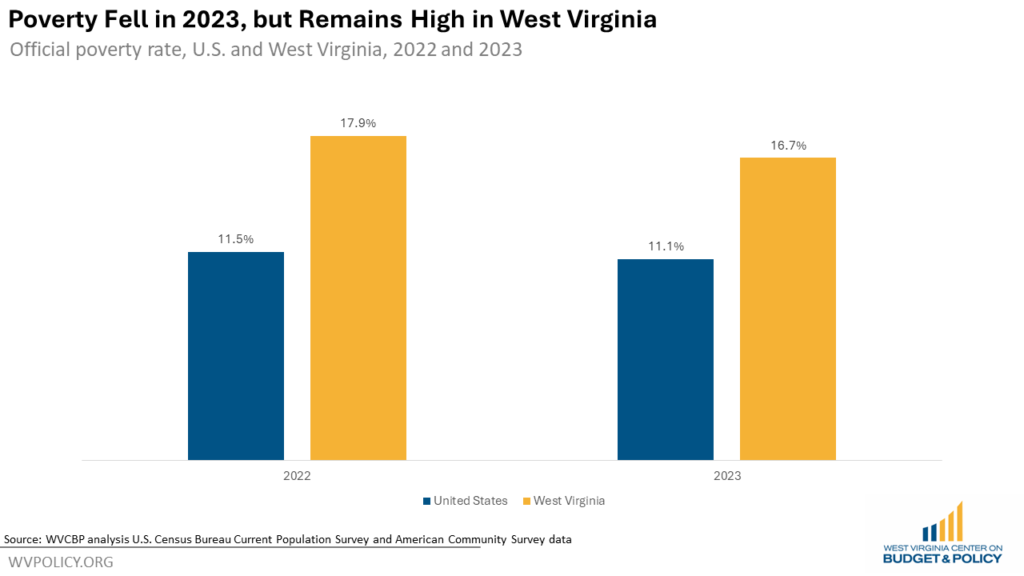

285,780 West Virginians lived in poverty in 2023, including nearly 70,000 children, according to the new estimates from the U.S. Census Bureau’s 2023 American Community Survey. West Virginia’s official poverty rate in 2023 was 16.7 percent, a decrease from 17.9 percent in 2022. West Virginia’s poverty rate was 5.6 percentage points higher than the national rate of 11.1 percent and the fourth highest poverty rate among the 50 states and D.C.

After spiking to 25.0 percent in 2022, child poverty in West Virginia fell to 20.1 percent in 2023. But even with this decline, West Virginia’s child poverty rate ranked eighth highest in the country.

Median household income in West Virginia also increased slightly in 2023, rising from $54,329 to $55,948. Median household income measures the income of the typical household – or the household in the middle of the income distribution – and serves as a good indicator for how the middle class is faring. Despite the increase, West Virginia ranked 50th out of the 50 states and D.C. for median household income and was $24,662 below the national average of $80,610. While the national median household income grew by four percent in 2023, growth was slower in West Virginia at three percent.

Other highlights from the 2023 American Community Survey include the poverty rate for Black West Virginians remaining flat at 30.2 percent, nearly double the overall poverty rate. The poverty rate for seniors was also flat in 2023, at 12.0 percent. Poverty was lowest for those West Virginians with at least a bachelor’s degree at 5.2 percent, while those who had not completed high school had the highest poverty rate at 32.8 percent. The poverty rate for men was lower than the poverty rate for women, at 14.8 percent compared to 18.4 percent.

Policy choices that reduce poverty—or allow poverty to surge—matter. With poverty highest among children, Black West Virginians, and those without higher levels of education, addressing poverty within these categories should be a top priority in the state. Policies like a state-level child tax credit, affordable higher education, and increasing the state minimum wage all would help continue to reduce West Virginia’s high levels of poverty.

Read Sean’s full blog post.

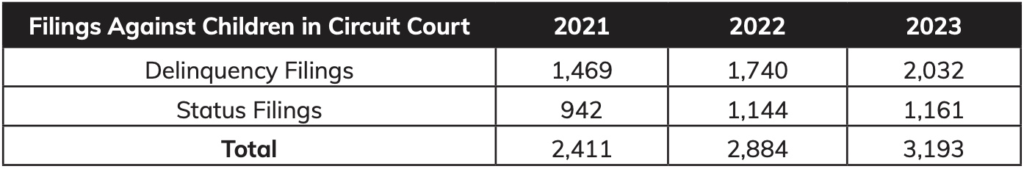

West Virginia’s criminal legal system for children is at a crossroads. Juvenile reforms implemented in the 2010s led to decreases in the number of criminal cases filed against youth. But as West Virginia emerged from the COVID-19 pandemic, the trend reversed, and criminal filings have increased each of the last three years. As cases filed against children have risen over this period, so have the number of kids behind bars.

The harms of youth incarceration are well-documented. We know that incarcerated children can be punished in ways that isolate, dehumanize, and undermine rehabilitative goals and that youth incarceration does not prevent future contact with the criminal legal system. We also know that the criminal legal system for children disproportionately harms Black kids.

In the spring of 2023, the Midian Leadership Project (Midian) teamed up with the American Friends Service Committee to host listening sessions with young adults who had spent part of their childhood in the criminal legal system to better understand how criminal system fines and fees affected them. Shortly after, Midian partnered with the West Virginia Center on Budget and Policy (WVCBP) to ask the broader question: What does it cost a child to be exposed to this system?

This report is our organizations’ joint attempt to combine the stories we heard at our listening sessions, research on fees and fines in the judicial system, and data about the criminal legal system in West Virginia to provide a fuller accounting of harms done by the system and what it might require to truly interrupt these harms.

Our research began with a look at the financial penalties imposed by courts: fines, fees, and restitution. But as we reviewed the data and spoke with those personally impacted by the criminal legal system, we learned that the most serious costs are those that go uncounted.

“Criminal cases extract wealth from children and their families in several ways that go unrecorded. Some costs are directly ordered by the court, such as paying for GPS monitoring or drug screens, while others are not ordered by a court, but are the result of court actions, like needing to miss work to attend a hearing,” explains WVCBP criminal legal policy analyst, Sara Whitaker. “Beyond those financial costs, children impacted by this system are burdened with trauma that lingers for years and a criminal record that follows them into adulthood, negatively affecting their education, employment, and housing opportunities.”

Our most significant finding was how the criminal legal system pours additional harm on top of pre-existing harm. For many children in the Mountain State, adversity begins long before they face the criminal legal system. And over the last three decades, we have learned how childhood adversity can have profound and long-term impacts on people’s well-being, including increasing their likelihood of criminal legal system involvement.

The criminal system for children claims to exist for the purpose of rehabilitating kids; in reality, it does the opposite. The system compounds old traumas by separating the child from whatever protective factors they might have access to. Then the system adds new traumas caused by isolation, stress, exposure to abuse, and more. As one listening session participant described the system simply: “It’s not designed for children. You’re supposed to be loved.”

We know that the criminal system for children fails to improve the lives of those it supposedly serves and that even bold, expensive efforts to “reform” the system, like the creation of youth reporting centers explored in our research, functionally serve to expand the system and the harms it perpetrates.

Our report concludes by offering three basic strategies for how advocates might thread the needle of helping children, without growing the system that is harming them:

We also emphasize the importance of disrupting the school-to-prison pipeline.

“The school-to-prison pipeline is a concerning national issue where children are systematically funneled out of public schools and into the juvenile and criminal justice systems. Many of these children, who often have histories of poverty, abuse, or neglect, would benefit more from supportive services than from punitive measures,” says Midian Leadership Project COO, Turan D. Rush. “I’ve personally witnessed the challenges my friends faced within the school system, providing me with firsthand insight into these issues. Understanding and sharing these stories is essential to addressing and dismantling the school-to-prison pipeline. The experiences of my friends highlight the racial and socioeconomic inequities and financial and social costs that are prevalent in disciplinary practices applied to youth in West Virginia.”

Read our full report here.

Tax filing can be a costly and complicated process for families and small businesses. The reason the system is so complicated is because for years, paid tax preparation corporations have profited by charging families to fulfill their legal obligation to file taxes each year. These companies, including Intuit and H&R Block, have conducted massive lobbying efforts to protect their profits and keep the Internal Revenue Service (IRS) from offering a free, public tax filing option for families. A free and easy option without a profit motive would simplify the process, eliminate filing fees, and ensure families successfully receive tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) which they are entitled to by law (in contrast to the current system where paid tax preparers often make credits too confusing or costly to claim).

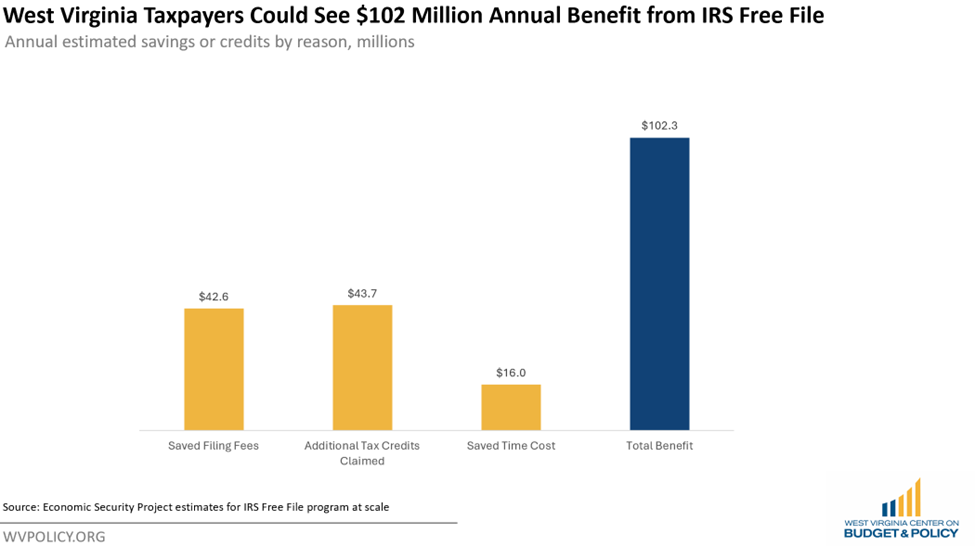

The good news is that this free and easy option is now available! For the first time in US history, the IRS has a free, simplified, public online tax filing tool: Direct File. In 2024, a Direct File pilot launched in 12 states and was so effective and popular that all US states have been invited to join the Direct File program. With more states announcing plans to opt in each month, West Virginia should follow suit. By adopting Direct File in West Virginia, state taxpayers—and by extension, the economy—will see over $100 million in annual benefits.

The Current Landscape

Under the current, for-profit system, it takes Americans an average of $150 and nine hours to file their taxes each year—a high cost for families to simply meet their legal obligation to file taxes and to claim credits to which they are entitled.

Paid tax preparation companies have spent years and tens of millions of dollars lobbying against a public tool for tax filing. To stall those efforts, they agreed to participate in a “Free File Alliance,” which requires them to offer free tax filing to low- and middle-income taxpayers. But while the free option is technically “offered,” these companies aggressively steer taxpayers away from the free option—so much so that less than three percent of households eligible actually receive free filing. What’s more, even the few taxpayers who can successfully file their federal taxes for free are often charged for filing state taxes. Just last year, Intuit was forced to pay $141 million, including over $700,000 in West Virginia, to taxpayers who were “tricked into paying for free tax services” according to state Attorney General Patrick Morrisey.

What has become clear is that paid tax preparation companies cannot be trusted to hold up their end of the bargain.

West Virginia Should Offer A State Filing Tool Integrated With IRS Direct File

Adopting Direct File would make the tax preparation market in West Virginia more equitable, inclusive, and competitive. When Direct File is at scale, it will be able to deliver over $100 million in total annual value to West Virginia taxpayers in the form of saved filing fees ($42.6 million), saved time cost of filing ($16 million), and additional federal EITCs and CTCs claimed ($43.7 million). That’s $102 million in local West Virginia economies that would have otherwise been siphoned off by tax preparation companies or gone unclaimed.

West Virginia should join the growing number of states adopting and integrating their system with IRS Free File. Just this summer, Pennsylvania, New Mexico, Oregon, and New Jersey have all announced they will offer this service for the 2025 tax filing season. In fact, West Virginia can provide its taxpayers with the same benefit without much difficulty. Civic organizations like Code for America are currently offering states across the country pro-bono support to get set up and integrated. Additionally, the West Virginia Department of Tax and Revenue already has a contract with FAST Enterprises, a company that successfully integrated Massachusetts with Direct File during the 2024 pilot. That means there are multiple options readily available to provide a public tax filing option for West Virginia families state leaders choose to take advantage.

Free File Will Benefit Low- and Middle-Income Households More Than Recent Tax Changes

Like many states, West Virginia has an upside-down state tax system, wherein poorer families pay a larger share of their total income to taxes than wealthier families. Further, 2023’s personal income tax cuts and subsequent tax cut triggers skewed the tax code even more towards the wealthy. While the wealthiest 20 percent of households received almost two-thirds of the benefit of the 2023 income tax cuts, low- and middle-income families saw less than the $150 average cost they often must pay to file their yearly taxes with a paid tax preparer.

To exemplify, the triggered personal income tax cut that will go into effect in January is skewed toward the wealthy, giving the top one percent in West Virginia a $1,500 annual tax cut, while the average household in will see just $44 per year. Compare that with the benefit of adopting Free File, which will provide the average West Virginia household $150 in saved filing fees annually—and that’s before even accounting for the benefit of additional money in families’ pockets from Earned Income Tax Credits and Child Tax Credits that could otherwise go unclaimed. The federal CTC provides up to $2,000 per child and the average EITC benefit in West Virginia is $2,327. For a taxpayer who benefited from the ability to claim either of those credits via Free File, the benefits would be substantially greater than either the 2023 tax cut or the triggered tax cut they’ll see in January.

Despite these incredible potential benefits for West Virginia taxpayers, state leaders have thus far failed to start the process of adopting and integrating Free File for the 2025 tax season.

For West Virginians, this is just more of the same old story. Too often, West Virginians pay higher costs because policymakers choose to prop up corporate interests. This has happened for decades with coal and natural gas. Refusing to make tax filing easier for West Virginians can only be seen as bending to the pressure of the paid tax preparation industry lobbyists. West Virginia and the Justice Administration should do the right thing and opt into Direct File for the 2025 tax season. A small investment will make state and federal income tax filing free and easy, putting up to $102 million back into the pockets of low- and middle-income West Virginia taxpayers. Families across the Mountain State will see immediate benefits via saved time, less stress when filing, and greater refunds with which they can make investments on their own terms.

Read Seth’s full blog post here.

If you want to see West Virginia join the growing number of states participating in IRS Free File, contact Governor Justice at 304-558-2000 and tell him to join for the 2025 tax filing season. Experts urge that states must start the process right away to be on board for the next filing season.

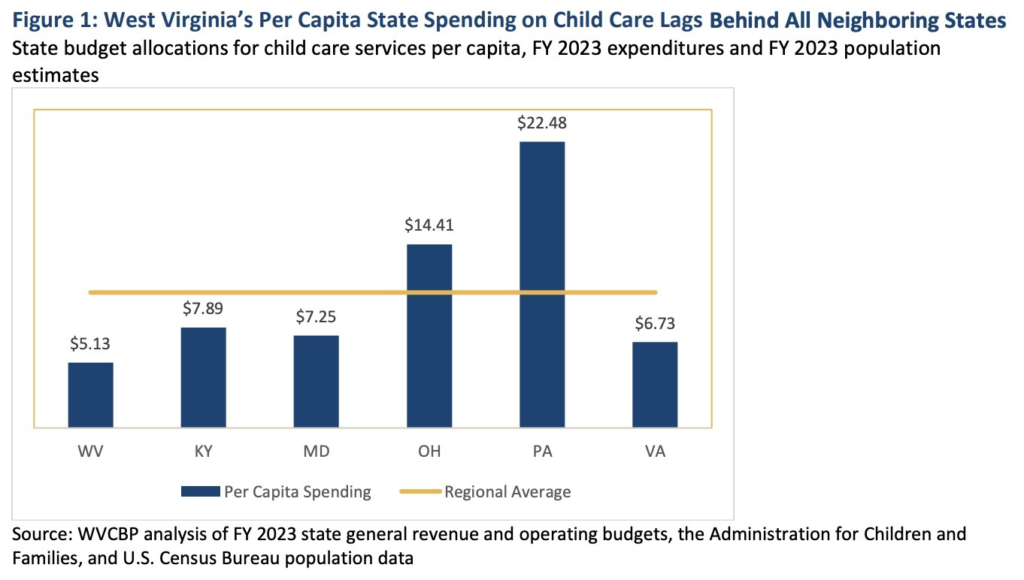

West Virginia spends less than all neighboring states on child care—a reality harming both West Virginia families and our local and state economies. Governor Justice recently announced a special session at the end of September focusing, in part, on funding for child care. A recent article, including comment from WVCBP policy outreach director Seth DiStefano, provides further details. Excerpt below:

When it comes to state spending on childcare, West Virginia ranks at the bottom of the region.

The critical need for daycare was the subject of two recent protests at the state capitol. The governor and legislature failed to pass any reforms during this year’s regular legislative session and a special session in May.

Now, they will take it up at another special session at the end of this month. The governor said he’s open to new ideas.

West Virginia spends a little more than $5 per capita on childcare, the lowest in the region. By comparison, Pennsylvania spends more than four times that amount.

“When we invest in childcare, we not only support a family’s ability to draw down additional income by being able to work. But we also support children and better educational outcomes,” said Seth DiStefano, of the West Virginia Center on Budget and Policy.

“If we come back with, you know, an alternative that would create additional childcare facilities, or whatever, within the state or opportunities and whatever like that, sure we’ll look that that. And I’ll probably look at it favorably,” said Gov. Jim Justice, (R) West Virginia.

The special session begins on Sept. 30.

Read the full article.

The Black Voter Impact Initiative and Black by God, the founders of West Virginia’s Black Policy Day, are hosting an exciting webinar series focused on specific aspects of the Black Policy Agenda. This is an excellent opportunity to deepen your knowledge and engage with experts across various issue areas ahead of the 2025 West Virginia legislative session.

You can register for the webinar series here.

You can share what you would like to see prioritized in the Black Policy Agenda by filling out this survey.

Mark your calendars for Black Policy Day 2025, which will take place on March 10, 2025.

The current system of reimbursing child care providers in West Virginia is based on the attendance of the child, not their enrollment. This approach often leaves providers at a financial disadvantage when children are absent due to illness or other reasons.

According to the National Association for the Education of Young Children, stable funding based on enrollment rather than attendance can provide more predictable income for providers and support higher quality care. By adopting this approach, we can ensure that our child care providers continue offering their invaluable services without worrying about inconsistent finances.

Please join us in signing this petition and helping us advocate for a fairer reimbursement system for our West Virginia child care providers.