West Virginia lawmakers are under pressure from Governor Justice to override the tax cut triggering mechanism created as part of the 2023 state income tax law and enact additional cuts on his way out the door. But state revenue and budget pressures, including slowing revenues, costly enacted legislation, and a myriad of unmet needs come into direct conflict with rushing to push through more tax cuts that mostly benefit the state’s wealthiest households.

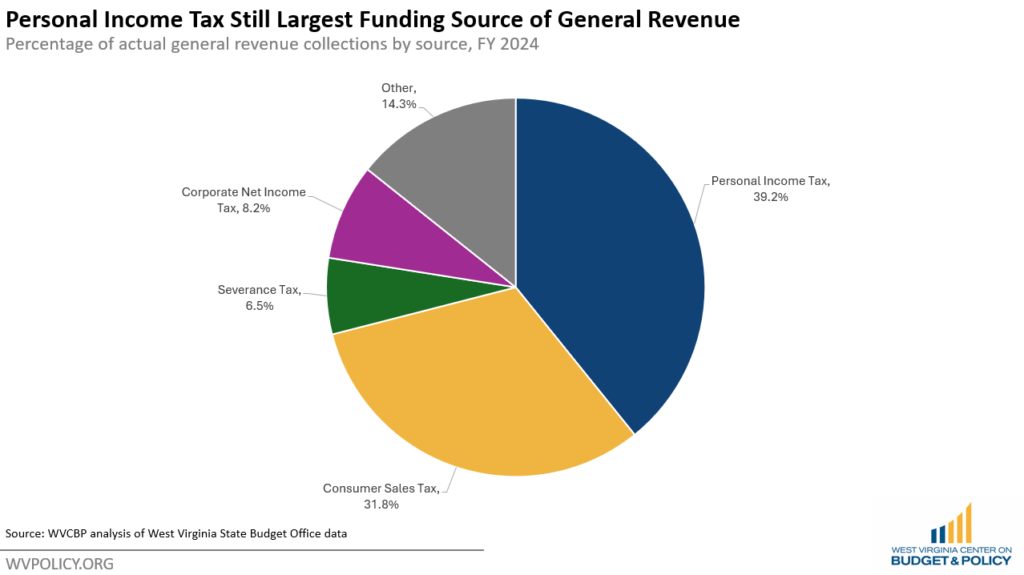

As policymakers consider slashing revenues even further, it is important to understand both the state’s revenue mix and forecasted expectations in coming years. Even after 2023’s cuts, the personal income tax is West Virginia’s largest source of state revenue, bringing in 39.2 percent of funding for the general revenue fund in FY 2024. After the personal income tax, the next largest sources of general revenue are the consumer sales tax, corporate net income tax, and severance tax, respectively.

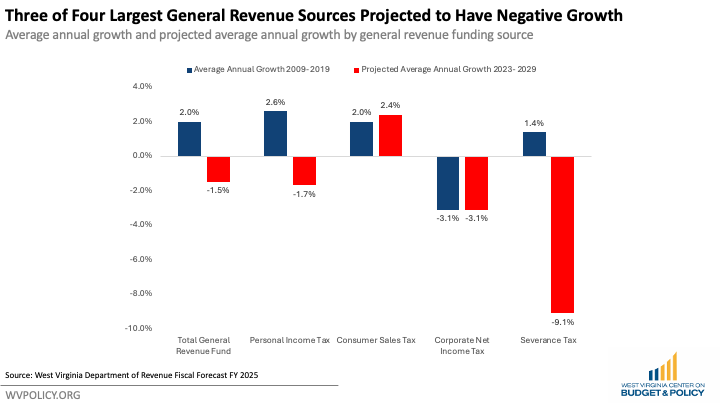

Annual growth is critical to maintain public services relative to inflation year-over-year, which increases the costs of goods and services that the state provides to residents. Historically, the personal income tax has grown at a faster rate than the state’s other major tax sources, making it the most stable and important source of state revenue. Between 2009 and 2019, the personal income tax grew at an average annual rate of 2.6 percent, compared with the sales tax at 2.0 percent and the severance tax at 1.4 percent; conversely, the corporate net income tax rate declined by 3.1 percent primarily due to corporate tax rate cuts over this period.

With 2023’s personal income tax cuts, Justice Administration officials within the Department of Revenue projected that personal income tax collections will decline by 1.7 percent annually between 2023 and 2029—and that was even before accounting for the triggered four percent personal income tax rate reduction this summer or any additional cuts.

Given the continued fiscal projections of declines in both the corporate net income tax and the severance tax, combined with the self-inflicted decline in the personal income tax, three of the four largest revenue sources for the state’s general revenue budget are projected to decline through 2029. Cumulatively, the Department of Revenue projected the total general revenue fund to experience negative 1.5 percent growth between 2023 and 2029.

Continuing to chip away at the personal income tax would naturally make the state budget more reliant on regressive, declining, and volatile sources of revenue. The sales tax, which falls most heavily on low- and middle-income West Virginians, will make up an increasingly large percentage of future state budgets–as will the severance tax, which historically is incredibly volatile largely due to factors outside of state policymakers’ control, including global energy prices.

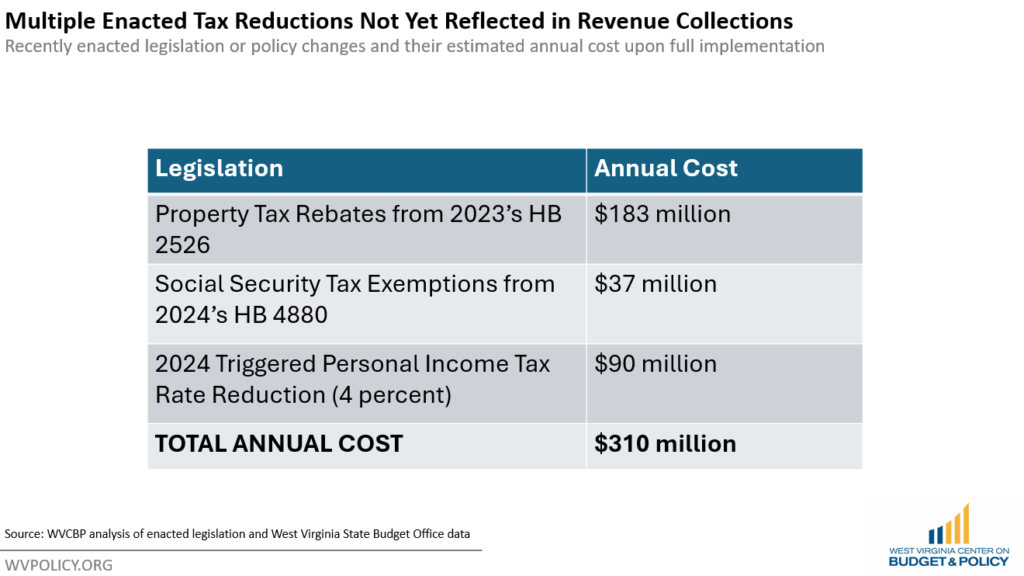

Another reason lawmakers should be cautious about enacting additional tax cuts is that multiple recent tax cuts are still in the process of being implemented or phased in, thus their total impact on tax collections–and, by extension, the state budget–is still yet to be fully felt.

Included in the 2023 tax package was a workaround for the failed Amendment 2 personal property tax elimination wherein lawmakers created a rebate against the personal income tax for personal property taxes paid for households and businesses. The revenue loss from that rebate will not begin impacting state revenue collections until the second half of FY 2025 when individuals and businesses begin filing their calendar year 2024 taxes. In total, those rebates are expected to reduce personal income tax collections by an additional $183 million above and beyond the initial 2023 tax cuts.

Lawmakers also passed an elimination of the personal income tax on Social Security income for higher income seniors (those making more than $50,000 year individually or $100,000 per year married). Once fully phased in, that elimination will reduce personal income tax collections by another $37 million.

Finally, the four percent personal income tax cut that was triggered this year will cost an estimated $90 million annually.

Altogether, that means an additional $310 million annually in tax cuts that have not yet been reflected in tax collections—shrinking the general revenue fund by an additional five percent on top of the personal income tax rate reduction from 2023.

The final factor lawmakers must consider as they weigh additional tax cuts is upcoming spending—both via enacted legislation and unmet needs. Unfortunately, this task has been made more difficult for lawmakers in recent years due to the Justice Administration’s elimination of the six-year financial plan. Prior to 2021, gubernatorial administrations in West Virginia (including Justice’s) provided this information as part of each year’s budget package, allowing lawmakers to see both projected revenues in upcoming years and, importantly, anticipated areas of budget growth so that they could take both into consideration when enacting new spending or cuts.

The last available six-year financial plan, produced with the FY 2020 budget documents, highlighted base budget growth in outyears for PEIA, the teachers’ retirement system, the former Department of Health and Human Resources (now split into three separate departments), correctional facilities, and salary enhancements. Now, without having had a six-year plan for several years, lawmakers are being asked to make major revenue decisions without the aid of that critical information from the governor’s administration, resulting in major questions and concerns about fiscal responsibility and long-term budget sustainability.

Even without that information, we know large spending obligations are on the horizon given already-enacted legislation. A few examples include the expansion of the Hope Scholarship, expected to cost an additional $150- 200 million annually by FY 2027; the remainder of the Third Grade Success Act, which will cost approximately $100 million annually once fully implemented; and annual inflation-level cost increases for programs like PEIA, public employee salaries, and other ongoing annual costs.

Additionally, there are several critical needs that have not yet been able to see solutions get across the finish line due to the uncertainty around the tax cut triggers and revenue projections. Priorities like funding for child care, EMS agencies, child welfare services, home health workers, flood preparedness, and support staff in public schools are all widely popular across the political spectrum but have not been able to get passed due to the pressure to keep the state budget flat in order to prioritize tax cuts that primarily benefit the wealthy.

Just as cutting the income tax will push more of the cost of funding public services onto regular families, the costs of reduced public investment will also harm them. Flat budgets are functionally declining budgets that fail to account for the impact of inflation on goods and services. As such, flat budgets erode the quality and availability of public services that are integral to our society and our broader economy.

The Justice Administration has proposed additional tax cuts and allocating more of the FY 2024 budget surplus to a personal income tax reserve fund, which would set aside revenues in a locked account that could be much better utilized now to help families, businesses, and the state’s broader economy. By opposing efforts to go beyond the personal income tax triggers—or even better, by repealing the triggers entirely—we could begin to address some of those widely popular needs both via the FY 2024 surplus and the additional space in the base budget that would be created.