Last month, state lawmakers met in Charleston for a special session mostly to allocate funding for budget needs that were shorted when they passed the state budget in March. Of 15 bills passed, 12 dealt with appropriations and state spending, with lawmakers continuing a troubling trend of using one-time surplus funds to pay for ongoing, base budget costs. Rather than creating certainty, many of their actions in May kicked the can down the road on some of the state’s most pressing needs.

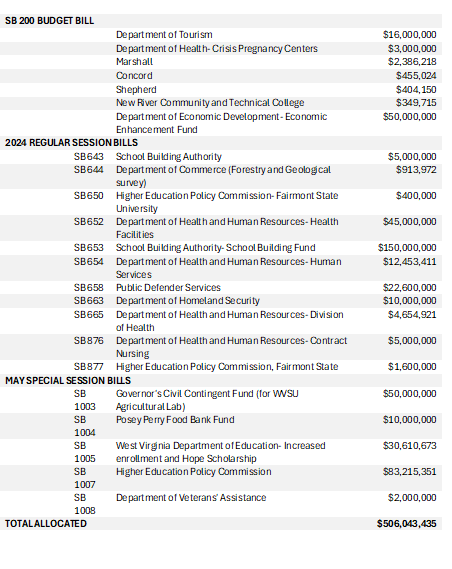

During the special session, lawmakers appropriated additional funding to the Departments of Health and Human Services, the State Road Fund, a food bank fund, and the Hope Scholarship, among other allocations. Altogether, lawmakers have allocated about $506 million of the year-to-date $637 million surplus for FY 2024. The special session failed entirely to address longstanding economic and family well-being issues like funding for child care providers and families. And, as we’ve noted before, lawmakers are increasingly relying on one-time surplus allocations for ongoing, annual budget costs—which raises significant concerns for future budget solvency as the budgeting tactic masks true spending needs just as tax cuts and economic factors are making future surpluses less and less likely.

Lawmakers Increasingly Relying on One-time Funds for Ongoing Budget Needs

Several of the line items funded via one-time surplus dollars are for ongoing costs, which Senate Finance Chairman Eric Tarr noted during the regular legislative session. Among them include $30.6 million to the West Virginia Department of Education, of which $27 million goes to the Hope Scholarship—an ongoing and growing state budget cost. Ongoing annual budget needs of both the Department of Tourism and Public Defender Services have regularly been funded via surplus allocations in recent years. Additionally, surplus allocations to the former DHHR for contract nursing and crisis pregnancy centers have the “propensity to be a base [budget] item” according to Chairman Tarr.

Medicaid Gap Measure Falls Short

The legislation receiving the most attention before and during the special session was SB 1001, which purported to close funding gaps in Medicaid and the Department of Health left when lawmakers passed the state budget in March. According to the WVCBP’s analysis, the enacted state budget left Medicaid with an estimated $150 million funding shortfall for FY 2025.

SB 1001 creates a reserve fund of $183 million, from which the Department of Human Services secretary can draw monies and move them into other Medicaid line items that were reduced in the final FY 2025 budget, including the I/DD waiver, the Traumatic Brain Injury Waiver, and Medical Services, among others.

But the final enacted legislation contains language amended in by the Senate stating that “any unexpended balance remaining in the Reserve as of March 31, 2025 shall revert to the unappropriated surplus balance of General Revenue.” This creates significant uncertainty around whether the reserve funds will be available to close budget gaps at all because the agency, already funded with approximately 85 percent of their budget in each Medicaid-associated line item via the FY 2025 budget, likely wouldn’t need to transfer funds until the final quarter of FY 2025—at which point the monies would no longer be available because they will have reverted to the General Revenue Fund.

Speaking with reporters during the final hours of the special session, Senate leaders described this maneuver as a safety net in the event of a state revenue shortfall in the second half of FY 2025. According to Finance Chairman Tarr, “What we are doing right now is no different than when times were tight, and you had to be really conservative with that dollar because revenue might not be there. What this does is says alright, for the first six months of the fiscal year, every bit of that budget that was anticipated by the governor is available [to Human Services] if there happens to be a shortfall. But if there’s not then that money reappropriates to general revenue and we can look at it at in six months and see if we need to adjust those lines going forward.”

Essentially, this language creates a new funding cliff of March 31, 2025, ensuring that the next legislature and governor seated in 2025 will be the ones to determine if the Medicaid shortfall, including full funding of the I/DD waiver, will be closed in the new fiscal year.

Kicking the Can on Budget and Spending Needs

In addition to utilizing one-time funds for ongoing budget needs and creating a new funding cliff for Medicaid, other bills also seemed to prioritize short-term solutions over longer-term budget solvency. SB 1015 changed the calculation for allocating funds into the state’s Rainy Day Fund, presumably to ensure that lawmakers would not have to put any of this year’s surplus into the fund. The legislation changed the calculation for allocations from being based on General Revenue expenditures to the enacted and enrolled budget which, as discussed above, does not represent the state’s spending needs given the increasing reliance on passing flat budgets followed by surplus spending to meet ongoing needs.

While many states do have historically high balances in their Rainy Day Funds due to a stronger-than-expected bounceback from the pandemic and federal aid, reducing the state’s ability to weather a future recession—particularly to enact more tax cuts—is short-sighted, especially as economic conditions tighten.

Read Kelly’s full blog post.

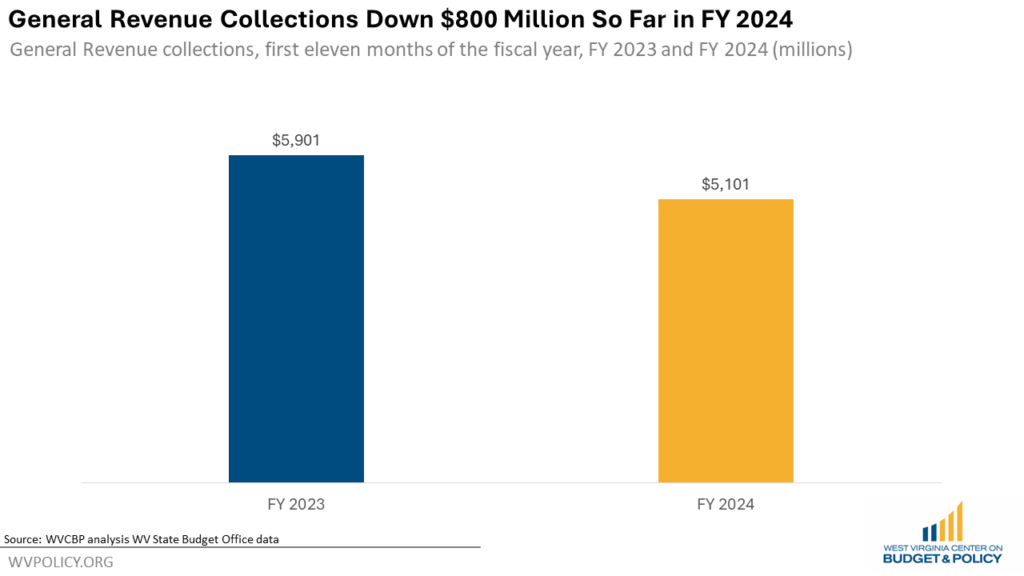

West Virginia’s latest revenue report shows that the state continues to feel the impact of income tax cuts. As of May 2024, and with one month left in the fiscal year, FY 2024 General Revenue collections are $800.2 million, or 13.6 percent, below FY 2023 collections.

Income tax revenue collections in May of FY 2024 were $138.3 million, which is $47.2 million below collections in May of FY 2023. So far in FY 2024, income tax collections are $459.6 million dollars, or 19 percent, below FY 2023 collections. What’s more, personal income tax collections will continue to fall in FY 2025 by upwards of $200 million annually as property tax rebates and the exemption for Social Security benefits are phased in.

While the Justice administration continues to tout the so-called revenue “surplus” when measured against their flat revenue estimates, when measured against last year’s actual collections, FY 2024’s collections have fallen behind every month so far in the fiscal year. And this revenue gap is growing with time, reaching over $800 million in May.

Much of West Virginia’s current revenue “surplus” is simply money that historically had gone into the annual budget. After adjusting for inflation, General Revenue appropriations in the FY 2025 budget are $716 million below actual expenditures in FY 2019. Had the state’s “flat” revenue estimates kept up with inflation, the revenue surplus would not exist, and alternatively that money would have been appropriated through the General Revenue budget. Instead, each year as of late the General Revenue Fund has been underfunded, with the difference made up via one time uses of surplus and supplemental funds.

Further, since FY 2019, the state has passed many new programs with ongoing, recurring costs–including the Hope Scholarship and the Third Grade Success Act–as well as incurred increased costs from public employee pay raises and the expiration of the enhanced federal Medicaid match. These costs have grown the base budget even as inflation-adjusted appropriations have fallen, meaning state agencies have had to do more with less.

With so much of the “surplus” dedicated to ongoing costs, and with more tax cuts on the horizon, West Virginia’s already flat budget continues to fail to meet the state’s basic needs. The reality is that the supposed “surplus” isn’t a surplus at all; rather, the state finds itself in an $800 million and growing hole and relying on short-term gimmicks to cover ongoing budget needs necessary to make programs and services whole.

Read Sean’s full blog post.

Under West Virginia law, judges have no power to reconsider long sentences – even when a person poses no threat to the community. Second Look policies give judges the power to review a sentence if a person was 25 or younger at the time of the crime, and they have served at least 10 years of their sentence. A recent op-ed by Stephen Logan, a former educator at Mount Olive prison, where he was recognized as teacher of the year, lends insight into the importance and power of prison education programs and the need for Second Chance policies in the Mountain State. Excerpt below:

I never imagined myself as an educator in a maximum-security prison. Yet, for 11 years, that’s exactly where I found myself — teaching computers and business education at West Virginia’s Mount Olive prison.

Because I had not spent time with people in prison, I began the job with fear and uncertainty. But over the next 11 years, my perspective shifted dramatically. By the time I retired in 2014, I held a firm belief in the need for second chances.

What changed me? My students.

Before Mount Olive, I taught college and graduate courses in multiple states. But at Mount Olive, I found the most engaged and motivated students. The men I taught took advantage of each educational opportunity. They were quick to offer help or take on extra work. I saw how my students, when treated with respect, treated me and the rest of their world with respect.

One student showed the creative problem-solving that was typical in my classes. Observing the logistical challenge of computer shutdowns after class ended, he developed an automatic shutdown program. His solution not only eased class transitions, but also demonstrated the talent that is common behind prison walls.

My students found ways to overcome their own personal challenges, too.

One left his abusive parents when he was 16 years old. He lived on the streets for a few years until he was charged and convicted as a teenager. But in the prison education program, he thrived — completing 17 college-level courses and earning the Outstanding Student of the Year award. He was one of the lucky ones who got a chance to come home when the parole board granted his release. Today, he is married, with a small child, and employment to support his family.

A prison education is more than the opportunities it creates after a person’s release. It offers people in prison a chance to earn respect. It creates incentives and makes prison safer. And, as one student told me when I retired, education brings “light into a dark place.”

But hundreds of students who have spent years working on themselves and developing their skills and talents will never have the chance to come home. They are serving sentences they will not outlive — or they are sentenced to life without parole.

That’s because, in West Virginia, courts have no power to take a second look at sentences that may no longer fit the person being punished. The result is a state prison system that costs taxpayers a quarter of a billion dollars each year. As sentences get longer, the people in prison get older and sicker.

The first student I mentioned was on dialysis multiple times each week for kidney failure. He never received a medical release or second chance, and died in prison a few years after I retired.

Our state prisons are full of people like him — people with untapped potential who are ready to contribute, if given a second chance.

Lawmakers can fix this by giving judges the power to reconsider long sentences. Second Look policy is not a guarantee that a person will return home. But it does guarantee hope.

When I taught in prison, I learned that giving people something to strive for had a transformative and rehabilitative effect on them. It’s time to embrace Second Look policy and bring more light into our state prisons.

Read the full op-ed here.

The WVCBP’s criminal legal policy analyst, Sara Whitaker, authored a fact sheet earlier this year detailing how Second Chance policies serve as compassionate and effective solutions to address West Virginia’s incarceration crisis, aging prison population, and facility staff vacancies–all while saving the state millions annually. You can read the full fact sheet here.

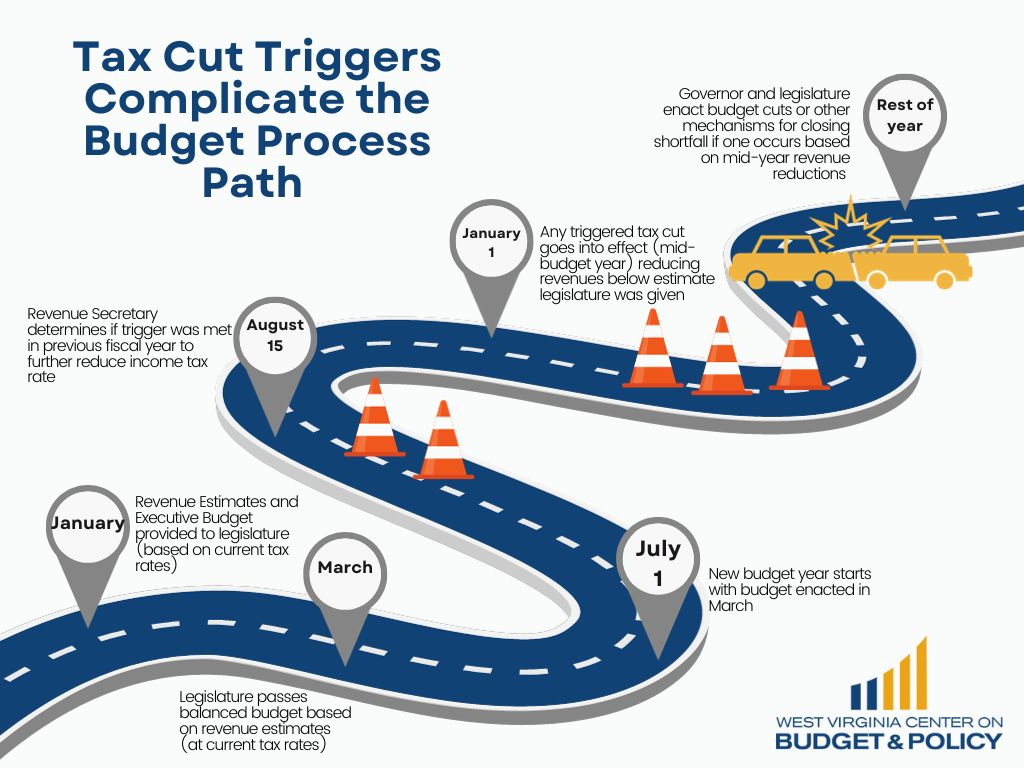

As part of the tax cut package enacted in 2023, lawmakers didn’t just slash the personal income tax once—they also set into motion a ticking clock that could eventually fully eliminate the tax without any replacement revenue. This is due to the law including a complicated triggering mechanism that automatically enacts more tax cuts if a modest trigger is met, regardless of spending needs at that time. A recent article, featuring insight from WVCBP executive director Kelly Allen, provides details about the likelihood that the trigger will be hit this year and what the revenue consequences will be. Excerpt below:

As August approaches, state leaders are still uncertain about what the impact could be of the impending trigger that could — depending on revenue collections — bring an end to the state’s personal income tax and, in turn, a budget deficit of unknown proportions.

Senate Finance Chair Eric Tarr, R-Putnam, said, based on recent revenue projections, he expects to see the trigger hit at the end of fiscal year 2024 at a rate that would mean about a $36 million decrease in revenue over the next two years ($18 million in each fiscal year).

According to a news release from Gov. Jim Justice, with one month to go in the fiscal year the state so far has collected $5.1 billion in general revenue for 2024. Of that, about $701 million is being classified as surplus dollars with about $63.7 million of those funds — “a record,” according to Justice — coming in May alone.

Fiscal analysts for the state initially projected to see about $600 million in surplus this year. In April, Deputy Revenue Secretary Mark Muchow told lawmakers that the forecast had increased to $800 million, making it more likely that the personal income tax trigger will be activated for next fiscal year.

The trigger is activated on a sliding scale, with the amount of the personal income tax reductions dependent on how high revenue collections are. The tax cuts will be implemented over the next two years, but economic circumstances for the second fiscal year are not considered in cuts for that year. On the highest end of the scale, the state could have seen a $250 million decrease in revenue over the next two years because of the decline in personal income tax collections.

But even with the trigger mechanism being adjusted for inflation, Kelly Allen, executive director for the West Virginia Center on Budget and Policy, said there is no way to project what the economy looks like in future years as those tax cuts roll over onto each other.

“It only takes hitting the trigger baseline one time to implement the tax cut for every year over. The theory on that would be yes, the economy has grown, we’re good. But it’s a fact that economies get worse and we can’t know when or how that will look,” Allen said. “We’re doing this every year. This uncertainty is going to be recreated every single year. This is going to be a situation legislators find themselves in year after year after year.”

Tarr acknowledged that there is a veil of uncertainty around the entire situation. To limit this, he would like to see a change to when the trigger would impact the tax reduction, moving it from August (the beginning of the fiscal year) to January (the middle of the fiscal year). This would mean the Legislature would adjust the budget mid-fiscal year depending on the revenue impact.

Allen said doing so would create more uncertainty for state agencies, which apply for grants and commit funding for programs based on the full year’s worth of a budget.

And, with May’s special session come and gone without any legislation considered to do so, it’s unclear how the Legislature could — if the will exists — change the trigger mechanism before it’s hit. There have been talks of another special session being called in August to deal with still underfunded state programs, like child care, but Tarr said he did not have any more information on what else could be included in that call or the potential for a call itself.

The Legislature could, with enough votes, repeal the tax trigger mechanism, though it’s incredibly unlikely that leaders will support doing so or that Justice would sign off on such a move.

Allen said that would be the ideal scenario. As state leaders tout record surplus collections, she said it’s not responsible to act as though the state is flush with funds while operating on a continuously flat and small budget while, simultaneously, new programs are starting that need additional funding to operate.

“Today, it’s not as if we were able to meet the state budget needs with the budget passed during session,” Allen said, referring to cuts to Medicaid, the lack of child care funding and low pay for some of the state’s largest sectors even after more money was allocated to programming during the special session. “To be even contemplating and prioritizing tax cuts when we’re not taking care of our own house, that is not fiscally responsible. It does not serve the people of West Virginia.”

Read the full article.

The Hope Scholarship is a school voucher-style program that allows individual students to divert their state share of public school funding away from the public school system to be used instead for private school or homeschooling costs. Proponents of the Hope Scholarship argue that because the student who is using it is no longer in the public school system, the loss of state funding will not negatively harm the school district or the students remaining in the public schools. But the WVCBP’s recent analysis debunks this claim, showing that the students remaining in the public school system—the vast majority of the state’s total students—are significantly impacted, via school consolidation, reduced course offerings, and fewer support programs for students with learning and social support needs.

A recent article, featuring insight from the WVCBP, further details how the Hope Scholarship hurts West Virginia public schools and students while disproportionately benefiting the wealthy. Excerpt below:

West Virginia public schools need money, that’s no secret.

Many schools are struggling to figure out what they’re going to do when they lose the temporary federal pandemic funding, which ends in September. For the 2024-2025 school year, there will be $392 million less in funding statewide for public schools.

As part of the federal Elementary and Secondary School Emergency Relief Fund, the state has received $1.187 billion over the last few years to help students return to the classroom after closing during the COVID-19 pandemic. However, of the $368 million of the third round of ESSER funds, nearly half of that funding was used for personnel costs, according to the West Virginia Center on Budget and Policy. Now that the funding is ending, many of those positions are in question.

Schools aren’t only losing temporary funding. West Virginia is one of a very few states that funds education based almost entirely on school enrollment numbers. Senate Finance Chairman Eric Tarr, R-Putnam, said because of that school funding formula, the state would need to put less money into public education. Most of West Virginia’s counties — 47 out of 55 — are losing population, which has led to declining enrollment.

But while public schools are struggling with funding, the West Virginia Legislature gave $27 million more of unused state dollars to the Hope Scholarship.

While these programs are promoted as a way to help families pay for tuition, it’s not always how the money is used. In Arizona, an ABC affiliate found that families were using the Arizona Empowerment Scholarships Account money for golf equipment, lessons on driving luxury cars, ski resort passes and trampoline parks. In Florida, theme park tickets, televisions, stand-up paddleboards, kayaks, surfboards and treadmills are among the items that school vouchers are allowed to be used for. These are all items the parents of public school students have to pay for themselves, but tax dollars can pay for private and homeschooled kids’ field trips and sports equipment?

West Virginia has the nation’s broadest version of the program — if a child is eligible for kindergarten, they are eligible to apply, and all other students are required to attend school for 45 days before applying. In some other states, the programs are limited to students with special needs or individualized education programs, or they must attend school for at least 100 days before applying.

Recipients of the Hope Scholarship receive roughly $4,400 per student per school year. In the 2023-2024 school year, more than 6,000 students received the Hope Scholarship, taking away approximately $26.4 million that would otherwise go to public schools.

The program has no restrictions or requirements that the money go to education providers located in West Virginia, and as of August 2023, $300,000 went out of state. More than $117,600 went to education providers in Maryland, and a private Christian school in Pennsylvania received $42,400 in Hope Scholarship money. The Washington Post found that billions in tax dollars go to religious schools across the country through school vouchers.

There’s also no requirement that the schools be accredited. More than $15,000 in Hope Scholarship funding went to a microschool in Martinsburg where parents found students just hanging out and playing on their phones. The school shut down, and paid the state back the Hope Scholarship money.

There is no enrollment cap on the Hope Scholarship, and there’s no income limits for people who apply, meaning there’s no restriction on how much money can be taken away from public schools.

School voucher proponents claim that it opens up school choice for all families. However, the Center on Budget and Policy found that while the Hope Scholarship provides $4,489, the average private school tuition in West Virginia is $6,200 per year, meaning parents are still on the hook for thousands in tuition.

In 2021, private school parents held a meeting to teach others how to work around the system to become eligible for the Hope Scholarship, like temporarily enrolling their children in online public school classes while they were still attending their private schools. When the Gazette-Mail reporter, Ryan Quinn, questioned the Cross Lanes Christian School administrator who said the school was working on a plan about dual enrollment, he said that the meeting wasn’t for the public.

The Hope Scholarship, like most school voucher programs, benefits the wealthy more than low income families.

If West Virginia public schools are broken, reducing their funding won’t fix them. If we want better public schools, the state needs to support them with appropriate funding, giving teachers a livable wage and listening when educators say there are problems with discipline and actually make an effort to help.

This past legislative session was filled with nonsense like getting “In God We Trust” put in every classroom, and whether or not a teacher could discuss intelligent design — which is not a scientific theory — with students. Fund public schools. If we have a better public education system for our children, we all win.

Read the full article.