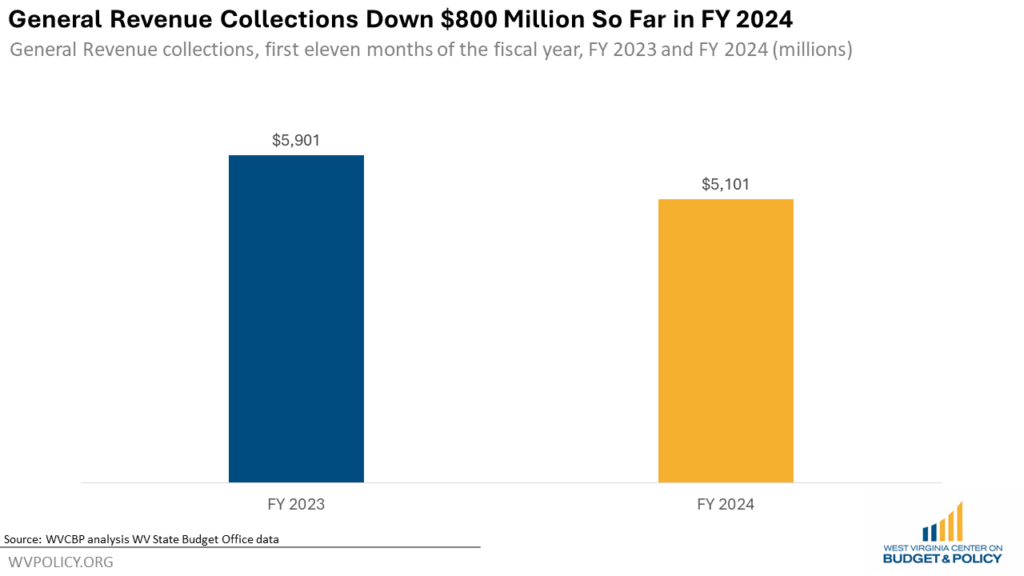

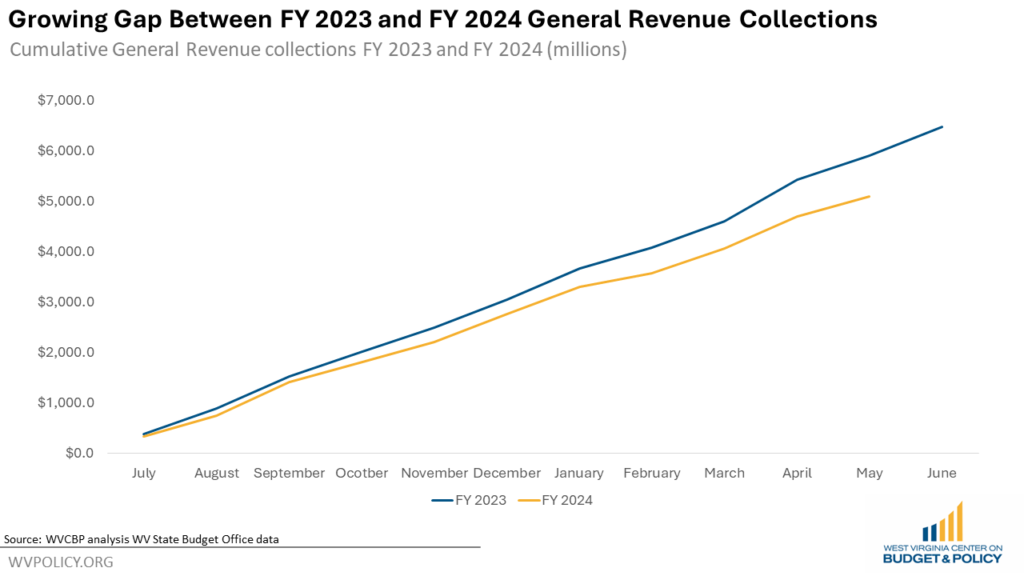

West Virginia’s latest revenue report shows that the state continues to feel the impact of income tax cuts. As of May 2024, and with one month left in the fiscal year, FY 2024 General Revenue collections are $800.2 million, or 13.6 percent, below FY 2023 collections.

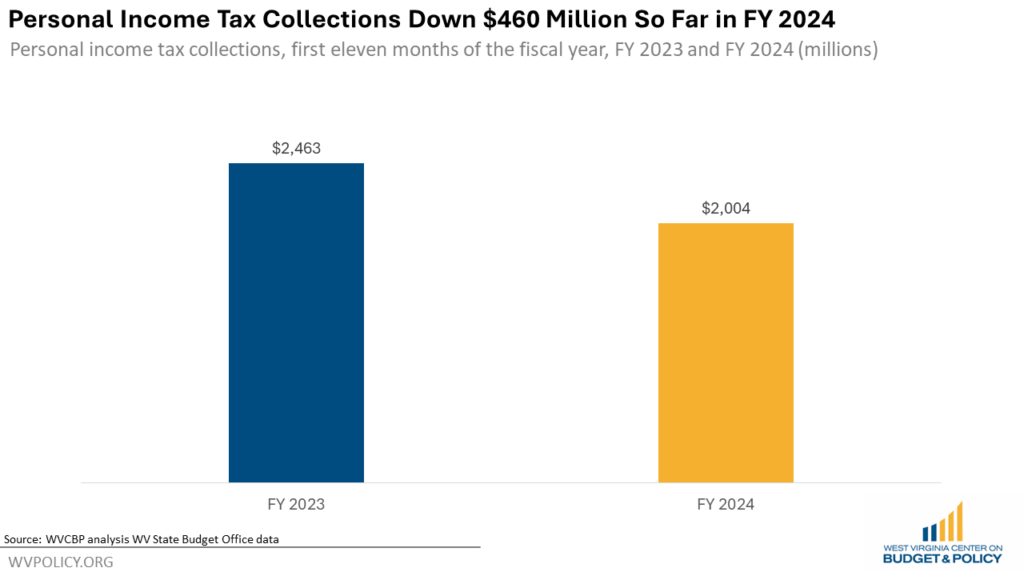

Income tax revenue collections in May of FY 2024 were $138.3 million, which is $47.2 million below collections in May of FY 2023. So far in FY 2024, income tax collections are $459.6 million dollars, or 19 percent, below FY 2023 collections. What’s more, personal income tax collections will continue to fall in FY 2025 by upwards of $200 million annually as property tax rebates and the exemption for Social Security benefits are phased in.

While the Justice administration continues to tout the so-called revenue “surplus” when measured against their flat revenue estimates, when measured against last year’s actual collections, FY 2024’s collections have fallen behind every month so far in the fiscal year. And this revenue gap is growing with time, reaching over $800 million in May.

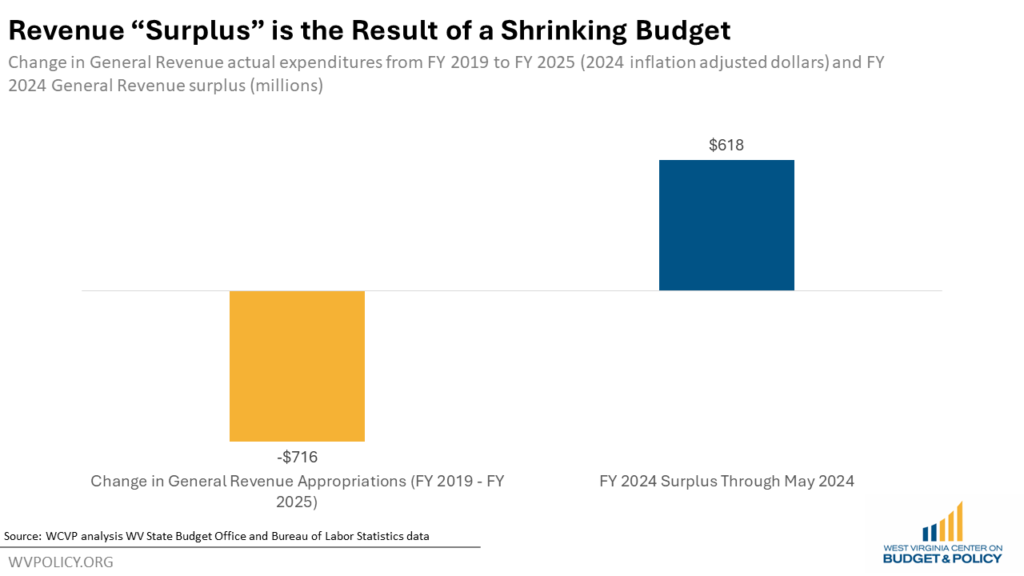

Much of West Virginia’s current revenue “surplus” is simply money that historically had gone into the annual budget. After adjusting for inflation, General Revenue appropriations in the FY 2025 budget are $716 million below actual expenditures in FY 2019. Had the state’s “flat” revenue estimates kept up with inflation, the revenue surplus would not exist, and alternatively that money would have been appropriated through the General Revenue budget. Instead, each year as of late the General Revenue Fund has been underfunded, with the difference made up via one time uses of surplus and supplemental funds.

Further, since FY 2019, the state has passed many new programs with ongoing, recurring costs–including the Hope Scholarship and the Third Grade Success Act–as well as incurred increased costs from public employee pay raises and the expiration of the enhanced federal Medicaid match. These costs have grown the base budget even as inflation-adjusted appropriations have fallen, meaning state agencies have had to do more with less.

With so much of the “surplus” dedicated to ongoing costs, and with more tax cuts on the horizon, West Virginia’s already flat budget continues to fail to meet the state’s basic needs. The reality is that the supposed “surplus” isn’t a surplus at all; rather, the state finds itself in an $800 million and growing hole and relying on short-term gimmicks to cover ongoing budget needs necessary to make programs and services whole.