After five years of flat budgets, lawmakers returned to Charleston for the 2024 legislative session with many important spending priorities to address major needs. Members of the Republican majority have said they want to provide pay raises for public employees and raise starting salaries in sectors with vacancies, increase provider reimbursement rates, and address child care affordability and provider sustainability. Meanwhile, already enacted legislation like the Hope Scholarship and the Third Grade Success Act, as well as ongoing programs such as PEIA and Medicaid, will necessitate growth to the base budget. Given all of these needs and spending obligations, the slowing of state revenues even before the impact of 2023’s tax changes has fully been felt should raise serious concerns for lawmakers.

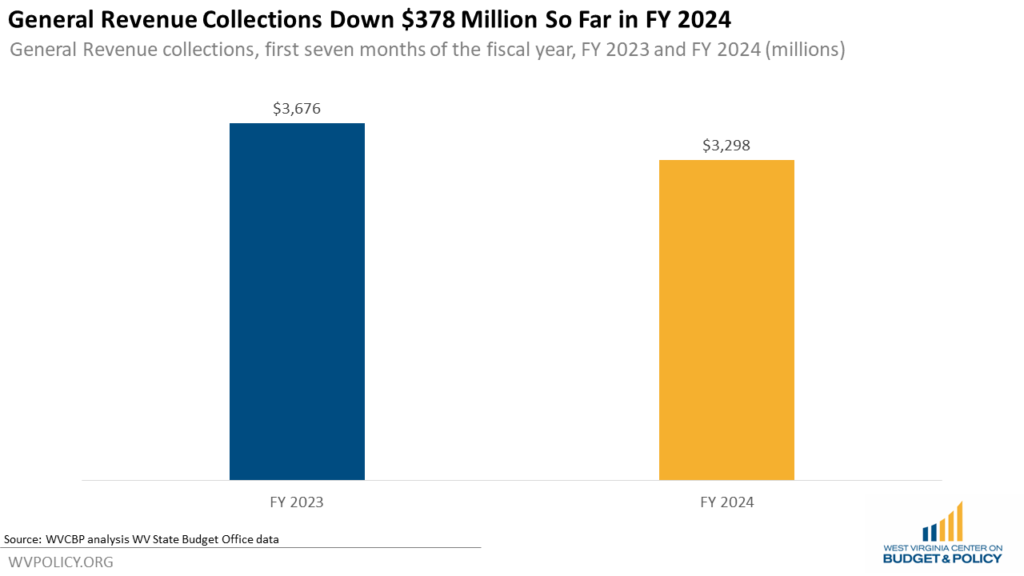

While Governor Justice and administration officials are touting a revenue surplus when measured against their flat revenue estimates, the state’s General Revenue collections are down $378 million (10 percent) compared with the same period in FY 2023.

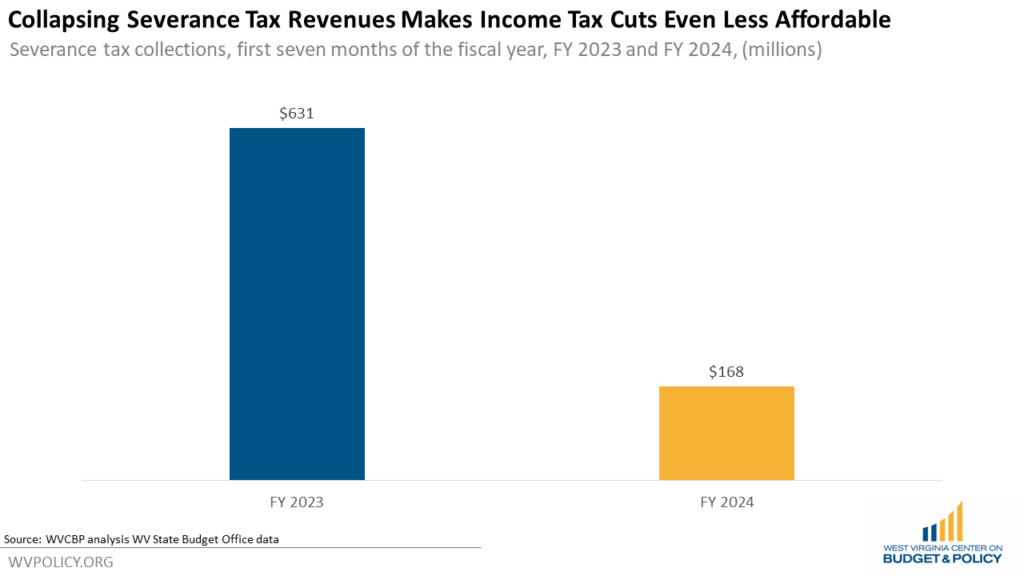

This revenue gap is explained by both a collapse in severance tax revenue and self-inflicted revenue declines stemming from 2023’s income tax cuts.

Global factors and the cooling of inflation remain the primary causes of low energy prices, and by extension, the collapse of severance tax revenue. Unusually high energy prices in the previous year led to unusually high severance tax revenues which were responsible for about 40 percent of the FY 2023 “surplus.” That surplus was then used to attempt to justify the income tax cut. But now, severance tax collections in FY 2024 are down 73 percent relative to this point in FY 2023.

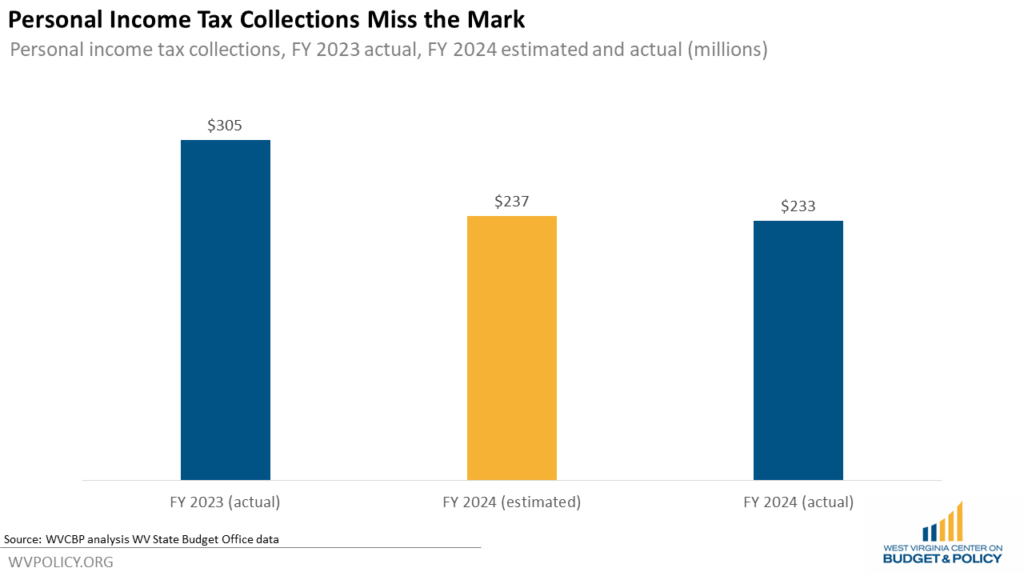

And while personal income tax collections are down only $75 million compared to this time in FY 2023, revenue officials have said the full impact of the income tax cuts will not be felt until later in the year, due to what is known as the SALT workaround related to 2023’s SB 151. That legislation allows pass-through businesses to prepay income taxes during the first half of the fiscal year and receive credit for those taxes paid during the second half of the fiscal year. So while SB 151 was officially revenue neutral for the full fiscal year, it frontloaded personal income tax collections to the first half of the year. Revenue officials have said they expect to finish FY 2024 with personal income tax revenues down 10-15 percent compared to last year. However, because of what is essentially a timing issue, some policymakers are under the incorrect impression that the personal income tax cuts have not reduced revenues, while in reality the full impact of the cuts will not be felt until later this year.

Further, the business property tax rebates pass last year–which are expected to cost an additional $200 million in revenue each year–will not go into effect until FY 2025, essentially reducing General Revenue collections by another 4 percent.

Despite the tax cuts not being fully implemented yet, the income tax dramatically underperformed in January. Personal income tax collections were $233 million in January 2024, down $72 million (24 percent) relative to January 2023 and $4 million below the estimate of $237 million. The personal income tax collection’s underperformance in January could be, at least in part, due to the start of tax season with pass-through entities beginning to receive credits for the income taxes they prepaid earlier in the fiscal year due to the SALT workaround.

Given the timing issues related to tax collections and the yet-to-be-implemented provisions of 2023’s tax cut legislation, lawmakers should not assume that the first half of FY 2024’s tax collection patterns–particularly regarding the personal income tax–will continue. Revenue officials told Senate Finance committee members earlier this year that they expect General Revenue growth to shrink by 1.6 percent annually between 2023 and 2029. And notably, that is before any additional income tax cuts are automatically triggered.

Lawmakers have identified important spending needs in their communities and advanced bills out of committees to raise starting pay for school service personnel, offer doula coverage to Medicaid and PEIA enrollees, provide raises to non-uniformed correctional staff, and make our child care system more sustainable. But without preserving the revenues needed to fund these programs, lawmakers will have to make tough decisions when it comes to determining which of these priorities will make it into the budget and receive needed resources.