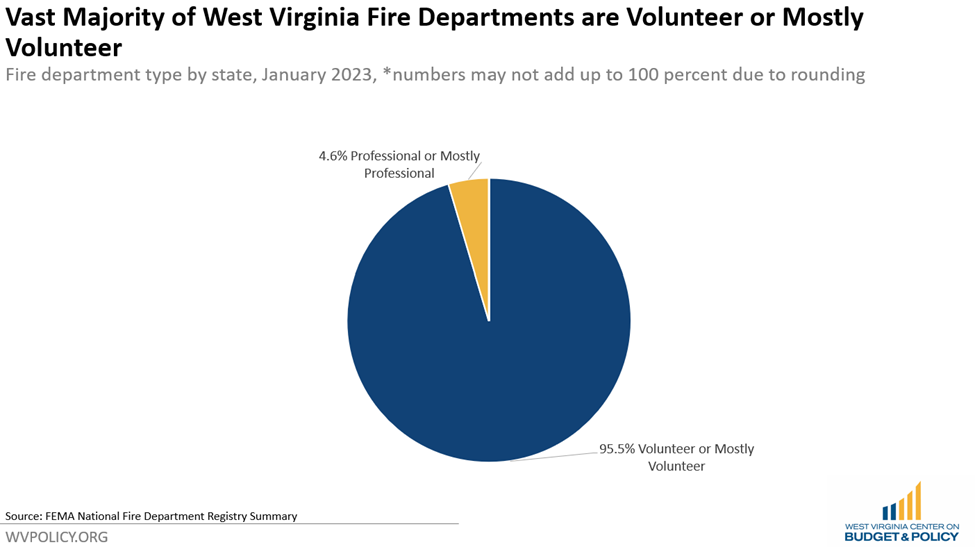

In West Virginia over 95 percent of fire departments are staffed by volunteers or mostly volunteers. Volunteer Fire Departments (VFDs) protect 85 percent of the state’s population serving as the bedrock of first response across our state. Despite the clear need to keep these life-saving services available, VFDs have seen stagnant state funding that has failed to keep up with rising costs since 2005. A 2015 report from the Office of the State Fire Marshal put it bluntly: “catastrophe looms unless drastic measures are swiftly undertaken.” But several years later, these issues remain unaddressed as lawmakers have repeatedly refused to increase the revenues needed to fund vital public services, instead going in the opposite direction and prioritizing sweeping tax cuts and austerity.

The funding crisis facing our state’s VFDs is just one example of many. West Virginia is the only state in our region that does not fund Emergency Medical Services (EMS) at the state level, leading to chronically low pay and turnover among emergency medical technicians and paramedics. In 2018, the West Virginia Legislature created the EMS Equipment and Training Fund but failed to fund it—the only funding allocated to date has been from federal COVID stimulus funds. The crisis levels of strain put on these vital public safety resources and the communities they serve are a policy choice, potentially leading to closures of local departments and the loss of life-saving first response for communities across the state.

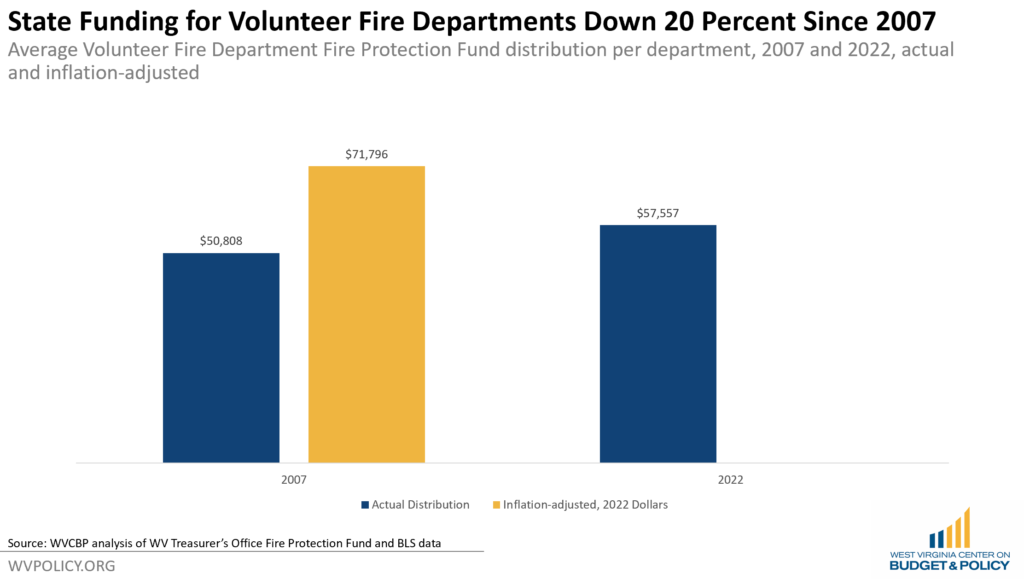

Just as we are seeing across a wide range of public services in West Virginia, VFDs and EMS have to contend with rising costs over time that are far outpacing state funding growth. It’s impossible to assess the adequacy of funding without accounting for inflation and the impact of rising costs.

State funds for VFDs are derived from surcharges on all fire and casualty policies that are then placed in the Fire Protection Fund and administered by the State Treasurer. Since 2007, the average VFD distribution from the Fire Protection Fund has declined by 20 percent after adjusting for inflation.

Over that same period, costs for VFDs have risen exponentially. One example is the cost of fuel to get fire trucks and ambulances to and from emergency situations. From 2003 to 2022, the average cost of gasoline products for Lower Atlantic states has more than doubled from $1.534/gallon to $3.743/gallon. The cost of diesel fuel for the same region and time frame has more than tripled, going from $1.475/gallon to $4.92. When we consider the rural nature of West Virginia, transportation costs— specifically fuel costs—are a major driver of the overall costs associated with being able to provide communities effective first response during an emergency.

Another key driver of costs mentioned in the 2015 State Fire Marshal’s report was exponential increases in workers’ compensation costs associated with the privatization of the system in West Virginia. According to the State Firemen’s Association this resulted in a 600-700 percent increase in premiums for VFDs in some cases. Additionally, VFDs are experiencing rising operations costs for things like vehicles and equipment which are outpacing state funding growth. Current state funding makes no room for the realities of growing costs and the crises currently faced by VFDs and EMS across West Virginia are directly attributable to those insufficient levels of funding. In fact, the funding shortages are exacerbating other crises, like recruitment and volunteer shortages. Per President Randy James of the West Virginia Fire Chief’s Association, the lack of funding has led to a smaller volunteer pool and a lack of interest in joining, usually because of the time-consuming fundraising commitments that come with the job.

During the 2023 legislative session, Governor Justice and state lawmakers—after months of boasting about surplus state revenues driven by low-balled revenue estimates, inflation, and holding state budgets flat—refused to consider nearly all legislation with a fiscal cost in favor of passing large, sweeping tax cuts. HB 2526 will reduce general revenue funds by just over $800 million initially and will eventually cost over $2 billion annually if triggers intended to fully eliminate the state’s personal income tax are hit.

“It’s aggravating to come away with basically no increase in our funding since 2005, but yet hear the news about record surpluses and tax collections,” said President James.

The significant reduction of revenues available to future governors and state lawmakers will be compounded by spending obligations based on passed legislation including an additional $300 million annually by FY 2027 for the state share of recently enacted PEIA changes. Instead of continuing down the current trajectory where critical public service providers are forced to vie for budget scraps, our lawmakers should protect and expand state revenues that serve West Virginians and grow our economy—as well as dedicate our available revenues to the programs they were intended to pay for.