The WVCBP is excited to welcome Teri Castle and Veronica Witikko to the team as our 2023 summer research fellows!

Teri is serving as our criminal legal reform summer research fellow. She was born in Huntington, WV, and grew up in the surrounding region. She recently graduated from Marshall University, earning a B.A. with a concentration in psychology. Teri also studied at WVU and Ashland University. Her passion lies in helping justice-involved individuals. She understands the importance of showing care and concern for those that may be going through a hard time. She wants to positively impact the lives of all West Virginia residents affected by the state’s legal system. She is supported in her endeavors by her fiancé, David, her daughter, Alantis, and her cat, Diva. Teri’s favorite pastime is Yoga. She studied Yoga teacher training with Barbara Steinke and Sue Julian, former Co-directors of Lautong Yoga.

Veronica is serving as our child welfare summer research fellow. Between receiving her bachelor’s degree in social work at Loras College in 2017 and enrolling in WVU’s Master of Social Work program in 2022, Veronica gained professional experience in child welfare and Medicaid waiver service coordination. Veronica graduated from WVU in May 2023 and is excited for this unique opportunity to work with West Virginia Center on Budget and Policy.

We asked Teri and Veronica a few questions to give them the opportunity to share about themselves. Check out their answers below.

What aspect of your work at the WVCBP are you most excited about?

Teri: The work I’m most excited about at WVCBP is learning how to research and develop briefs that could positively change West Virginia’s criminal legal system.

Veronica: I’m excited to collaborate with and learn from WVCBP employees and to gain professional experience in researching and writing for WVCBP publications.

What are you most proud of regarding your work prior to joining the WVCBP?

Teri: I am proud of completing a bachelor’s degree in my early 50s at Marshall University.

Veronica: I’m most proud of my time dedicated to working with refugee families as a Medicaid waiver service coordinator in Omaha, Nebraska.

What are three fun facts you would like to share with our supporters?

Teri:

Veronica:

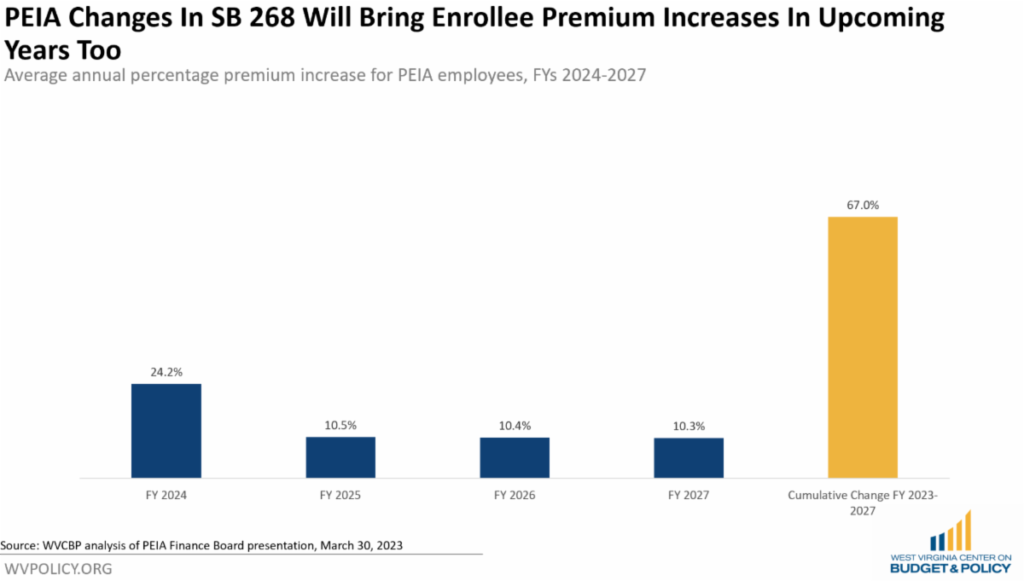

One of the most significant pieces of legislation passed in West Virginia this year was SB 268, which overhauled the Public Employees Insurance Agency (PEIA) to address the program’s solvency and preserve the provider network after years of state inaction following the 2018 teachers’ and service personnel strike and Governor Jim Justice’s promise to freeze premiums throughout his term. While the headlines of the legislation largely involved the public employee premium increases that will go into effect later this year, less talked about are the future premium increases for both those insured by PEIA and the state.

Lawmakers touted that SB 268 will “save” the state over $500 million through FY 2027. Those savings are primarily achieved by increasing costs on those insured by PEIA through two main avenues: enrollee premium increases for each of the next four years and a premium surcharge for dependent spouses who are offered health insurance through their own job, regardless of the cost or quality of that coverage. Together, these changes will achieve the legislation’s intent to get PEIA back to a strict 80/20 employer-employee premium split.

Impacts on Enrollees

The enrollee premium increase of 24.2 percent on average will impact all active employees of state agencies, colleges, universities, and county boards of education effective July 1, 2023. Additionally, in anticipation of costs continuing to go up annually, the PEIA Finance Board projects additional enrollee premium increases in each of the following three years, with an anticipated 10.5 percent increase in FY 2025, a 10.4 percent increase in FY 2026, and a 10.3 percent increase in FY 2027. All told, PEIA enrollees impacted are expected to see a cumulative 67 percent increase in their premiums from FY 2023 to FY 2027 before accounting for any spousal surcharges.

The PEIA Finance Board estimates that the spousal surcharge–an additional monthly cost of between $139-147 per month for state agency, board of education, college, or university employees who have a spouse on their PEIA plan that is eligible for another employer’s health insurance–will impact around 14,000 families. The Board estimates that around 9,000 families will pay the surcharge while about 4,800 will drop their dependent PEIA coverage.

Together, these premium changes will have fairly significant impacts on health insurance costs for workers and families this year and in upcoming years as premiums continue to increase. For the approximately 14,000 families who see both the premium increase and the spousal surcharge (or the increased costs of moving to other insurance) the $2,300 public employee raise they will receive later this year via SB 423 could be more than wiped out.

While state employees received pay raises in both 2022 and 2023, those raises combined fall short of inflation in many cases and still leave the West Virginia public sector paying far less than neighboring states across many positions. A public employee making $40,000 in January 2021 would have received a $2,000 raise in July 2022 and will see a $2,300 raise in July 2023, but after adjusting for inflation, both raises are more than canceled out today–even before accounting for the impact of increased health insurance premiums.

While the private sector has largely recovered from the pandemic recession, the state has only recovered 90.6 percent of state government jobs. Below-average public sector pay has been a contributing factor to vacancies across state agencies, impacting public services and, often, safety for all West Virginians. Staffing shortages have led to a state of emergency in state correctional facilities, increased classroom sizes and long-term substitutes in schools that cannot fill vacancies, and child welfare crises. With pay continuing to be below-average combined with health benefits becoming more costly via SB 268, the state’s vacancy issues could soon be exacerbated.

Impacts on the State Budget

As the employer, the state pays 80 percent of PEIA premiums. The freeze on premium increases since 2018 has also shielded the state’s general revenue fund from increased medical costs. While state lawmakers did approve a one-time allotment to the state’s PEIA Rainy Day Fund to offset increased medical costs in 2019, that was funded with state surplus dollars rather than an annual general revenue fund expenditure. Under SB 268, the state will incur an expected additional $108 million in costs in FY 2024 alone, with additional costs of about $62 million in FY 2025, $68 million in FY 2026, and $74 million in FY 2027.

These new costs impacting the annual budget could put a strain on state revenues, particularly in light of the significant tax cuts passed in 2023 and the potential for more automatically-triggered cuts in upcoming years.

PEIA is an incredibly important program for the more than 220,000 West Virginians for whom it provides health coverage, the providers and hospitals it helps support, and all West Virginians. Lawmakers must take a holistic approach to PEIA and state employee wages with an understanding of how the two impact one another and how vacancies impact the well-being of all West Virginians.

Read Kelly’s full blog post.

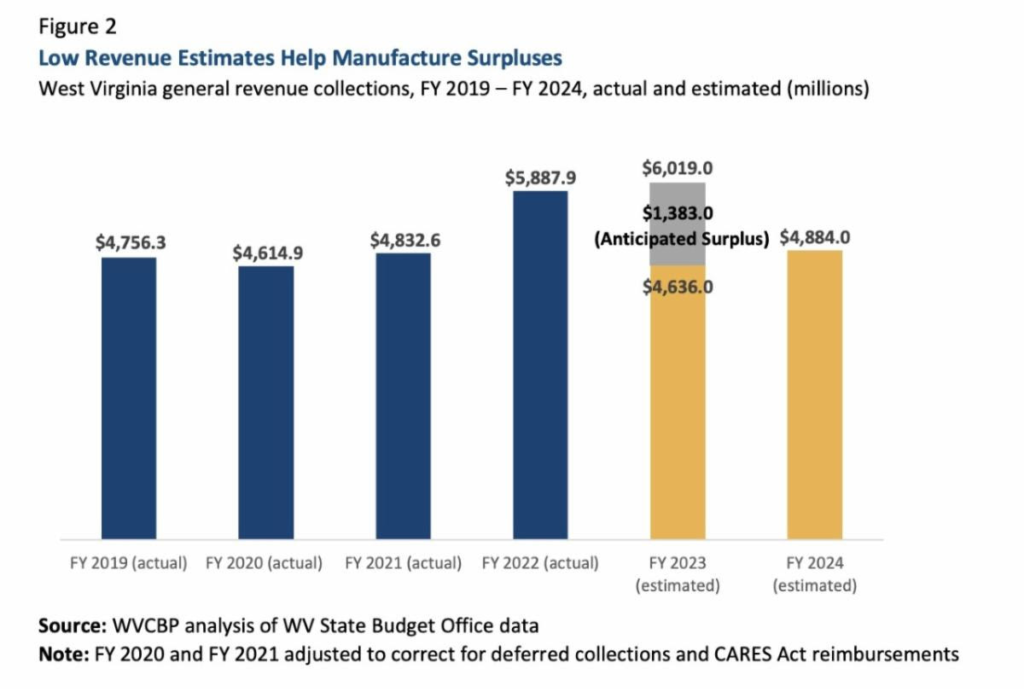

As the WVCBP has repeatedly noted, the Justice administration has an established history of manipulating revenue estimates in order to manufacture budget “surpluses” that are advantageous to the governor’s political aims. A recent article, featuring analysis from the WVCBP, provides further insight into this concerning pattern and how it impedes West Virginias’s ability to adequately fund and functionally operate the state’s public programs and services. Excerpt below:

West Virginia politics is a bundle of contradictions, as we’ve seen recently.

At roughly the same time Gov. Jim Justice was lauding the latest state budget surplus figures (made possible by hilariously low-balled revenue estimates), legislators were hearing about how multiple state agencies, notably Highways and DHHR, owe hundreds of millions in vendor payments that are 90 or more days past due.

Where have we heard this tune before? Oh yes, in the 1980s, when a combination of tax cuts, tax breaks and a downturn in coal left state government cash-poor, and left state agencies unable to pay bills in a timely manner.

The current inability of state agencies to timely pay bills is not the result of the $800 million a year of tax cuts and rebates enacted in March — the impact of that revenue loss has yet to be felt — but from four years, now going on five years, of essentially flat state budgets.

As noted, flat budgets mean that state agencies have to absorb cost-of-living increases, and as West Virginia families know, when money is tight, the first option often is to delay paying bills.

In 2019 — the last year that the Justice administration issued a six-year state financial plan — the plan forecasted that for the 2023-24 budget year, the state’s general revenue budget would be $5.494 billion, out of total state revenue of $5.593 billion.

In March, the Legislature approved a 2023-24 budget of $4.884 billion — effectively a budget cut of $610 million, or 11%.

As a report from the West Virginia Center on Budget and Policy similarly notes, when adjusted for inflation, the 2023-24 budget is $591 million less than the 2018-19 budget.

Not surprisingly, as the Gazette-Mail’s Roger Adkins reported, during April interim meetings, legislators were briefed on critical staffing shortages and issues with systemic underfunding facing the Division of Corrections and state first responders.

Staffing shortages driven by low pay are plaguing many other state departments and agencies, including public schools, DHHR and Highways — issues that were effectively ignored by Justice and the Legislature this session, other than to provide a token across-the-board pay raise that for many employees will be eaten up by PEIA premium hikes also imposed by the Legislature.

Of course, Justice couldn’t crow about supposed record budget surpluses if the state were making vitally needed investments in infrastructure.

And, of course, all of these crises driven by a lack of adequate state funding will only be exacerbated with the coming $800 million a year of lost revenue.

…

During his taxpayer-funded virtual self-promotional media session Wednesday, Justice was asked if his administration deliberately lowballs revenue estimates in order to create supposedly massive budget surpluses.

Justice launched into a word salad impressively oblique, even by his standards, stating, “You’re going to have a hard time trying to convince Jim Justice that not being frivolous and wasteful is not the way to have gone.”

Justice never answered the question, and given that the briefings still follow COVID protocols, meaning reporters still participate virtually, with no mechanism to ask follow-up questions, he wasn’t pressed on the matter.

Not to belabor the issue, but one need only look at April 2022 revenue collections to see that the administration’s revenue estimates are crooked as hell.

Revenue collections for April 2022 totaled $791.49 million. (April, for an obvious reason, is almost always the top month for revenue collections each year.)

At that point, with two months remaining in the 2021-22 budget year, year-to-date collections were $4.765 billion.

You would think those numbers would come into play in determining 2022-23 budget year revenue estimates — but they didn’t.

Revenue estimates for the month of April 2023 were set at $506.9 million — a projected drop of $284.59 million, or 26%, from April 2022.

Likewise, year-to-date revenue estimates through April 2023 were set at $3.841 billion, or a projected downturn of $924 million, or 20%, from April 2022.

What was the basis of predicting a 20% downturn in the state economy?

For comparison purposes, the U.S. economy contracted by 3.5% in 2020, at the height of the pandemic, and that was the largest economic contraction since demobilization from World War II in 1946.

So why did the Justice administration project a Great Depression-like contraction for West Virginia in 2022-23? The answer is clear: Because they wanted to cook the books.

The book cooking reaches hysterical levels when it comes to severance taxes.

In April 2022, the state collected $54.76 million in severance taxes, and for the budget year-to-date, had collected a total of $555.23 million.

So where did the Justice brain trust set severance tax estimates for April 2023? At $18 million for the month, and $200 million year-to-date, projecting collections would plunge 67% for the month and 64% for the year.

Since no economist not currently locked up in Bellevue projected a massive downturn in global energy demand for this fiscal year, and since energy is supposedly Justice’s area of expertise, one can only conclude the estimates were deliberately lowballed to inflate budget surplus numbers.

Year-to-date, 2022-23 revenue collections are up $662 million over the same point last year, a nice 14% bump. However, using Justice’s twisted numbers, the supposed surplus is more than double that, at $1.585 billion, or 141% above estimates.

Lowballing severance tax collections alone accounts for $622 million of that “record surplus.”

As I’ve noted, if a businessman cooked the books this blatantly, he’d be facing indictment for falsifying business records.

As it is, legislators enacted a massive tax cut based in part on budget surplus figures that aren’t really real, and since Justice has forbade the Budget Office from releasing the six-year financial plan, they can only guess at the potential impact of the revenue loss on future state budgets.

Read the full article.

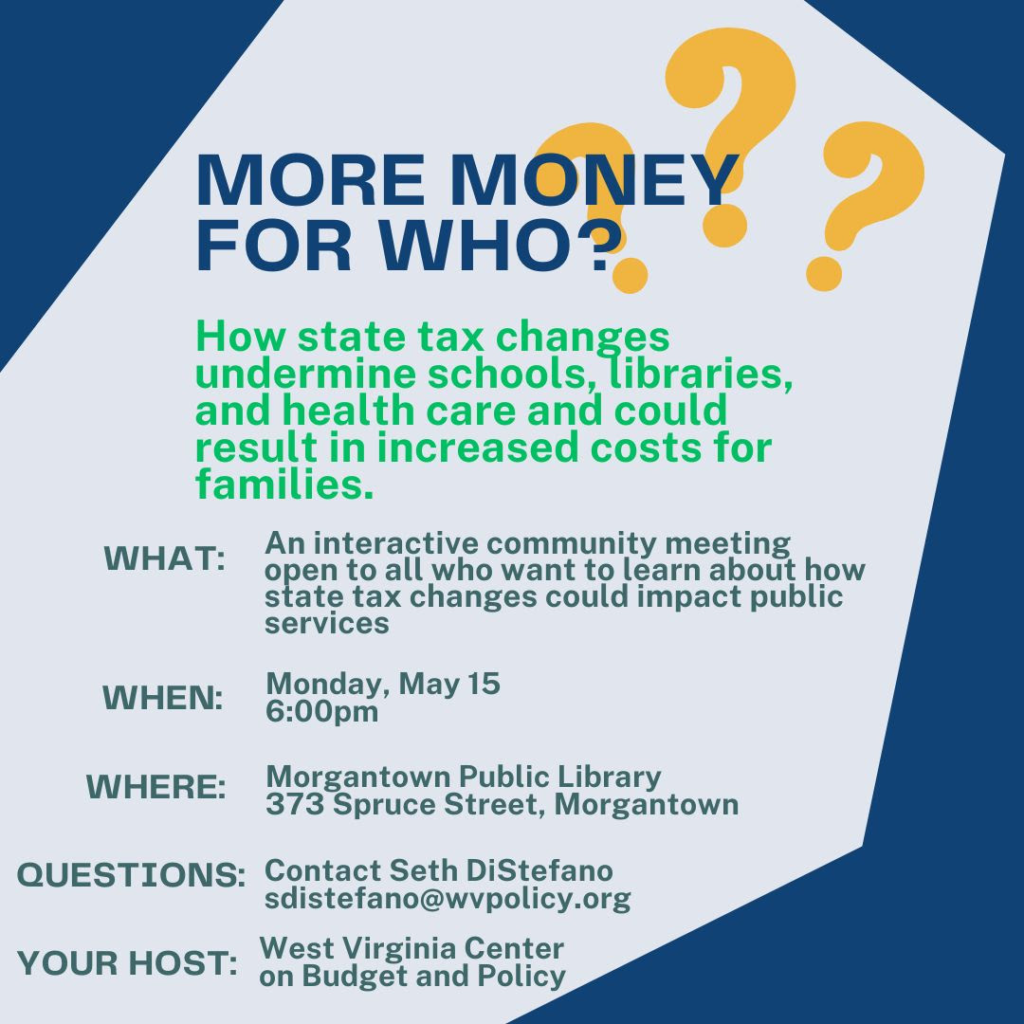

During the 2023 West Virginia legislative session, lawmakers passed significant tax cuts that will considerably reduce the revenue available to fund our state’s public programs and services.

Who will benefit the most from this year’s tax changes? What impact could they have on the quality of our state’s schools, libraries, health care system, and other public services and their ability to adequately serve our communities?

Join us to discuss, learn more, and have the opportunity to share how underfunding of public services has impacted you or your community.

MORGANTOWN:

WHEELING:

Please reach out to Seth DiStefano at sdistefano@wvpolicy.org with any questions!

The Summer Policy Institute brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

SPI attendees participate in interactive sessions where they learn the ins and outs of policy change through a research and data lens, as well as crucial skills rooted in community engagement and grassroots mobilization. Attendees will meet West Virginia leaders from government, non-profit advocacy, and grassroots organizing spaces to build relationships and networks.

Throughout the convening, participants work in small teams to identify and develop policy proposals to shape the future they want to see in the Mountain State, culminating in team “policy pitches” to community leaders. Sessions will equip participants to focus on defining the problem as an essential first step before progressing to proposing solutions.

After three years of virtual SPI, we’re excited to announce that we will be returning to an in-person format for SPI 2023! The event will take place at Fairmont State University from July 28-30.

There is no cost to attend, and students can work with professors to receive course credit. It is required that participants attend all sessions during the three-day convening.

To apply, please complete this Google Form and submit your brief letter of interest to summerpolicyinstitute@gmail.com. The application deadline is May 15.

For more information, please see our event landing page.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.