During the 2023 West Virginia legislative session, lawmakers had the opportunity to use available revenues to address longstanding needs like ensuring PEIA and Medicaid solvency, filling crisis-level staffing vacancies across state agencies, or increasing investments in neglected areas like higher education and child care. But instead, the FY 2024 budget debate was dominated by creating space for tax cuts that overwhelmingly benefit the wealthy and hamstring future budgets for years to come. The FY 2024 budget once again lacked a six-year plan, leaving the impact of the tax cuts on future budgets unclear, and questions about potential future budget deficits unanswered.

Our new report outlines the FY 2024 base budget appropriations, explains how artificially low revenue estimates contributed to manufacturing a revenue “surplus” that was used to justify costly tax cuts, and details how those tax cuts favor the wealthy and will negatively impact everyday West Virginians.

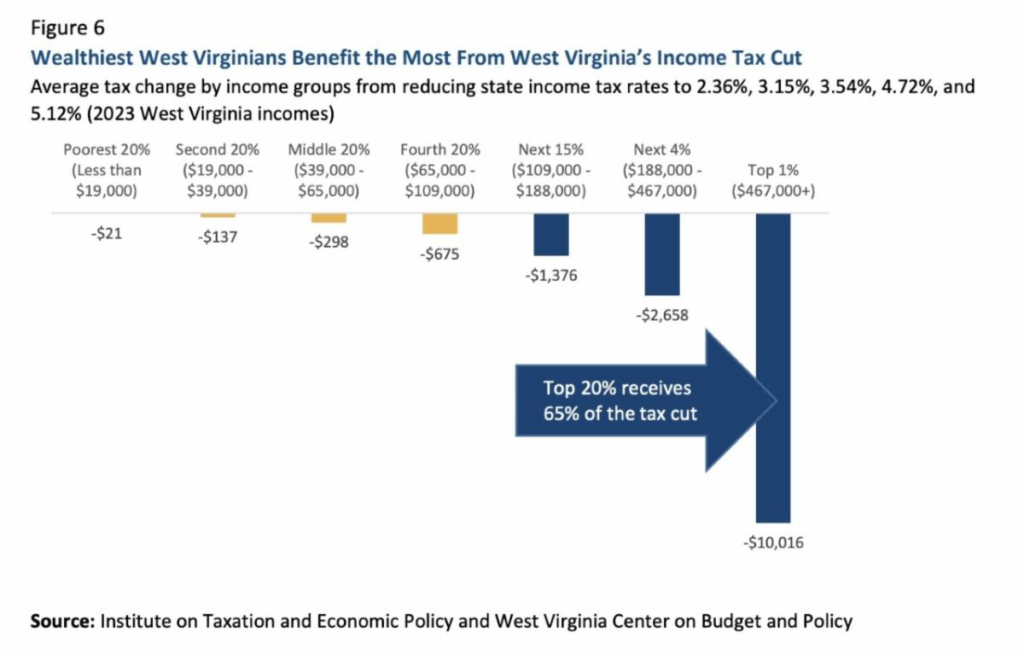

The biggest piece of legislation affecting the budget is HB 2526, a major personal income tax cut that will cost the state budget hundreds of millions of dollars annually and disproportionately benefit West Virginia’s wealthiest households. The legislation also includes a workaround for the tax cuts rejected by voters via Amendment 2 and contains automatic triggering mechanisms that seek to ultimately eliminate the state’s income tax at the cost of needed budget investments.

Even before the tax cuts included in HB 2526 go into effect, West Virginia has seen its budget shrinking over the past several years, resulting in increased needs going unmet. The FY 2024 budget relies on one-time surplus funds to pay for ongoing needs, including tax cuts. While that may not pose a budgetary issue this year, once the tax cuts are fully phased in, enacted legislation fully hits the general revenue budget, and temporary surpluses come back to earth, the Legislature will face difficult decisions that include making more budget cuts, raising other taxes, or both.

Key Findings

Without much debate or a six-year budget plan, lawmakers essentially voted for major tax changes without any informed idea of what effect they will ultimately have on public services in upcoming years. However, we do know several new costs and programs will have to be incorporated into future budgets, all of which are at risk given this year’s tax cuts and future tax cut triggers. Overall, these tax cuts will harm low- and middle-income families by reducing the state’s ability to invest in current programs and services or to make new needed investments.

You can read the full report here.

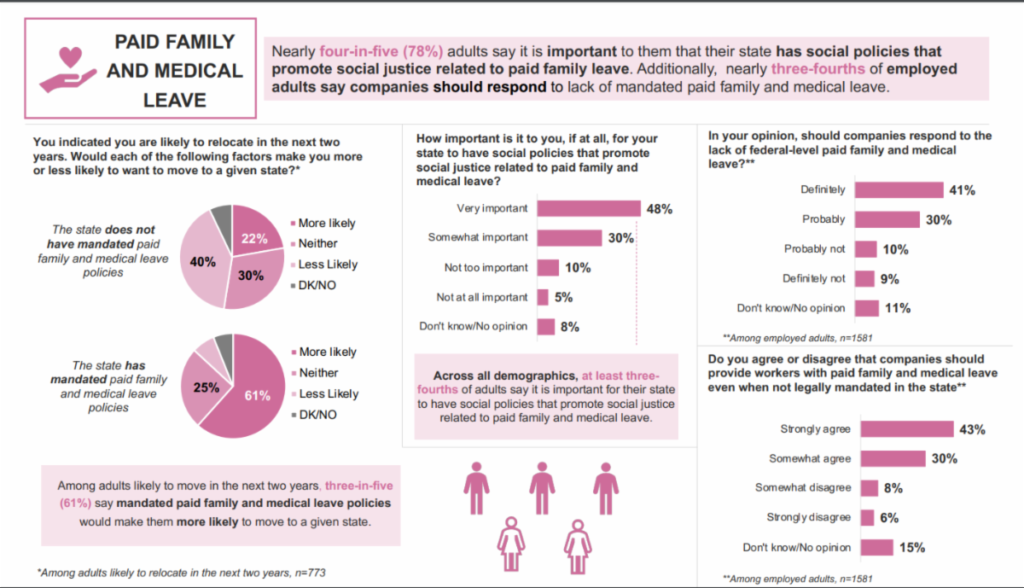

Recently shared polling data from our friends at Businesses for Social Responsibility further evidences the nationwide popularity of paid family and medical leave. For those considering relocating to a new state, the existence of paid leave proves to be a significant attractant, especially for Millennials and Gen Z. Some compelling findings from the recent polling include:

Access further polling details here.

During the 2023 West Virginia legislative session, lawmakers passed significant tax cuts that will considerably reduce the revenue available to fund our state’s public programs and services.

Who will benefit the most from this year’s tax changes? What impact could they have on the quality of our state’s schools, libraries, health care system, and other public services and their ability to adequately serve our communities?

Join us to discuss, learn more, and have the opportunity to share how underfunding of public services has impacted you or your community.

MILTON:

BARBOURSVILLE/HUNTINGTON:

PARKERSBURG:

Please reach out to Seth DiStefano at sdistefano@wvpolicy.org with any questions!

The Summer Policy Institute brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

SPI attendees participate in interactive sessions where they learn the ins and outs of policy change through a research and data lens, as well as crucial skills rooted in community engagement and grassroots mobilization. Attendees will meet West Virginia leaders from government, non-profit advocacy, and grassroots organizing spaces to build relationships and networks.

Throughout the convening, participants work in small teams to identify and develop policy proposals to shape the future they want to see in the Mountain State, culminating in team “policy pitches” to community leaders. Sessions will equip participants to focus on defining the problem as an essential first step before progressing to proposing solutions.

After three years of virtual SPI, we’re excited to announce that we will be returning to an in-person format for SPI 2023! The event will take place at Fairmont State University from July 28-30.

There is no cost to attend, and students can work with professors to receive course credit. It is required that participants attend all sessions during the three-day convening.

To apply, please complete this Google Form and submit your brief letter of interest to summerpolicyinstitute@gmail.com. The application deadline is May 1.

For more information, please see our event landing page.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.