Last weekend, the Senate Finance Committee unveiled and passed their second attempt at a tax cut without discussion or questions and then suspended rules to pass it out of the chamber. The legislation, HB 2526, looks very much like the plan they passed earlier this session (SB 424). Both versions overwhelmingly benefit the wealthy, contain a workaround for the tax cuts rejected by voters via Amendment 2, and contain automatic triggering mechanisms that would ultimately eliminate the state’s personal income tax at the cost of needed budget investments.

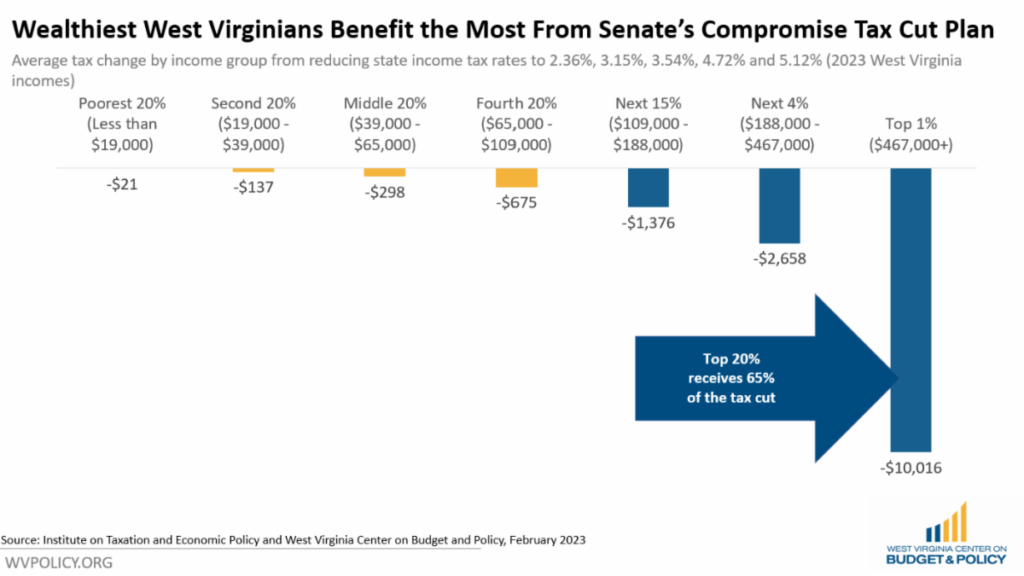

In an attempt at compromise with the House, the Senate plan increases the personal income tax cuts across all brackets from 15 percent to 21.25 percent. This still overwhelmingly benefits the wealthy, with the top 20 percent of households receiving nearly two out of every three dollars in tax cuts. While the average household would see a tax cut of about $298 annually, or about $11 per biweekly pay period, the tax benefit varies widely by income. The bottom 20 percent of households would receive on average about $21 per year, while the top 1 percent of households would get an average annual tax cut of nearly 500 times as much, at $10,016 per year.

The legislation also provides rebates for the voter-rejected personal property tax cuts from Amendment 2. Taxpayers would be able to file at income tax time for a rebate of 100 percent of their local taxes paid on personal motor vehicles and businesses with less than $1 million in aggregate appraised value personal property would be able to file for rebates of 50 percent of taxes paid toward the business personal property tax categories (machinery and equipment, inventory, leasehold investments, computer equipment, and furniture and fixtures). The rebate proposal would likely involve a significant amount of new intergovernmental coordination and administrative costs. While personal property taxes are paid to county governments, the state tax department would be issuing the rebates, creating some concerns around compliance for people who own personal property in multiple counties.

HB 2526 contains concerning automatic triggers that would ultimately eliminate the personal income tax altogether, and with it over $2 billion of annual general revenue. While SB 424 tied future personal income tax reductions to the sales tax, this legislation ties it to all sources of general revenue except for the severance tax. This means that all sources of revenue growth above inflation would be diverted to personal income tax cuts rather than future budget needs. And like prior triggers, it only requires hitting the trigger one time to create a permanent tax cut, which is not a fiscally responsible or sustainable approach. We’ve highlighted at length why triggering mechanisms are fiscally irresponsible and hamstring future legislators by setting tax cuts automatically into motion regardless of future budget needs.

Overall this legislation is certain to harm low- and middle-income families by reducing the state’s ability to invest in current programs and services or to make new needed investments.

Read Kelly’s full blog post here.

Tell your legislators to reject budget-busting income tax and business tax cuts and instead invest in programs that benefit children and families here.

On Tuesday, the Senate passed Senate Bill 547, a radical reimagining of the Controlled Substances Act that doubles down on decades of failed drug policies.

West Virginia has been called ground zero of the drug overdose crisis. For the last decade, West Virginia has had the highest fatal overdose rate in the country–more than twice the national average. While experts urge public health solutions to this public health crisis, the Senate took steps to do the opposite and instead increase criminal penalties for those with substance use disorder.

The bill overhauls drug offenses and sentences in three main ways.

1. SB 547 Changes Simple Possession from a Misdemeanor to a Felony.

Currently, simple possession of a controlled substance is a misdemeanor offense, with a maximum penalty of six months in jail. SB 547 would elevate simple possession of certain drugs (e.g., heroin, opioids, cocaine, methamphetamine) to a felony offense, with a possible prison sentence of one to five years.

For the last several years, 1 out of 10 people admitted to a West Virginia jail were charged with simple possession. If this bill passes, there will be even more people jailed for this offense, and they will be incarcerated for longer periods of time.

The bill states that this provision is “expressly designed to assist in getting persons unlawfully using controlled substances…in obtaining treatment for any substance abuse issue they may have.” But the bill’s treatment goals don’t match the reality of treatment availability. In 2021, there were more than 4,300 jail admissions for simple possession.

That same year, all drug courts across the state admitted a total of 348 people (out of 576 that were even considered for drug court programs). At the beginning of this year, West Virginia had only 1,349 residential treatment beds across the state to offer people with substance use disorder. No matter its intentions, the effect of this bill will be more incarceration–not more treatment.

2. SB 547 Triples the Cost of Incarceration for Felony Drug Offenses

The most common felony drug charge faced by West Virginians is possession with intent to deliver a controlled substance. Today, a person convicted of that offense faces a prison sentence of 1 to 15 years. This means that if sentenced to prison, they would serve one year before they were eligible for the Parole Board to consider their release.

SB 547 would triple the minimum time a person must serve in prison from one to three years. According to the DCR, it costs the state $38,099 to imprison a person for one year. Passing this bill means tripling that cost to $114,297 for every person convicted of West Virginia’s most common drug felony.

3. SB 547 Creates Mandatory Minimums for Other Drug Offenses

SB 572 imposes mandatory minimums for the felony offenses of transporting drugs into the state and delivering a controlled substance that results in death.

Some may argue that mandatory minimums are a deterrent. But as the National Academies of Sciences concluded, they aren’t. In a 50-state analysis, the Pew Charitable Trusts found no statistically significant relationship between drug imprisonment rates and three indicators of drug problems: self-reported drug use, drug overdose deaths, and drug arrests. In other words, mandatory minimums will not lead to fewer West Virginians using drugs or dying from drug overdose.

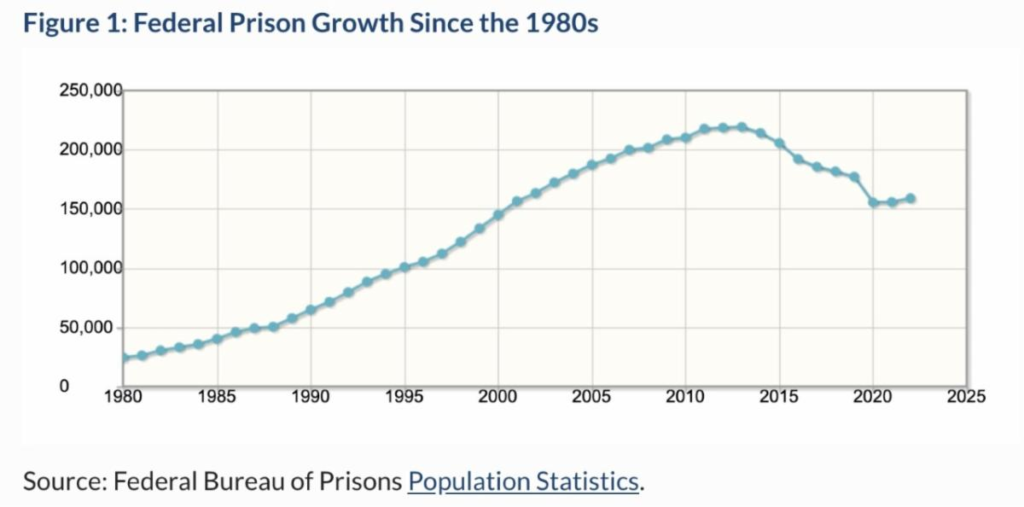

What mandatory minimums will lead to is more jail and prison overcrowding. After mandatory minimum sentences were imposed in the federal system in the 1980s, the number of people serving federal prison sentences for drug offenses grew 1,740 percent. Federal judges and prosecutors charged with implementing mandatory minimums have called them “cruel and ineffective” and one reason “why innocent people plead guilty.”

More incarceration does not reduce drug use or overdose rates. Nor does it reduce drug use behind bars. What it does do is reduce the chance to save lives. Every dollar spent on incarceration is a dollar not spent on proven public health programs that reduce harmful drug use.

Read Sara’s full blog post.

The start of a new month always brings with it new economic data. In addition to new revenue numbers and natural gas price data, Governor Justice also revised his FY 2024 revenue estimates upward with little explanation. All told, what we saw this week should give lawmakers pause as they consider making large, permanent tax cuts based on temporary revenue factors.

February’s general revenue collections’ report showed the state’s revenue sources comfortably exceeding the Justice administration’s intentionally low-balled revenue estimates. Of note, February severance tax collections above estimate made up 38 percent of the month’s total revenue surplus. In FY 2023, severance tax collections above estimate still represent about half, or 48 percent, of the total revenue surplus.

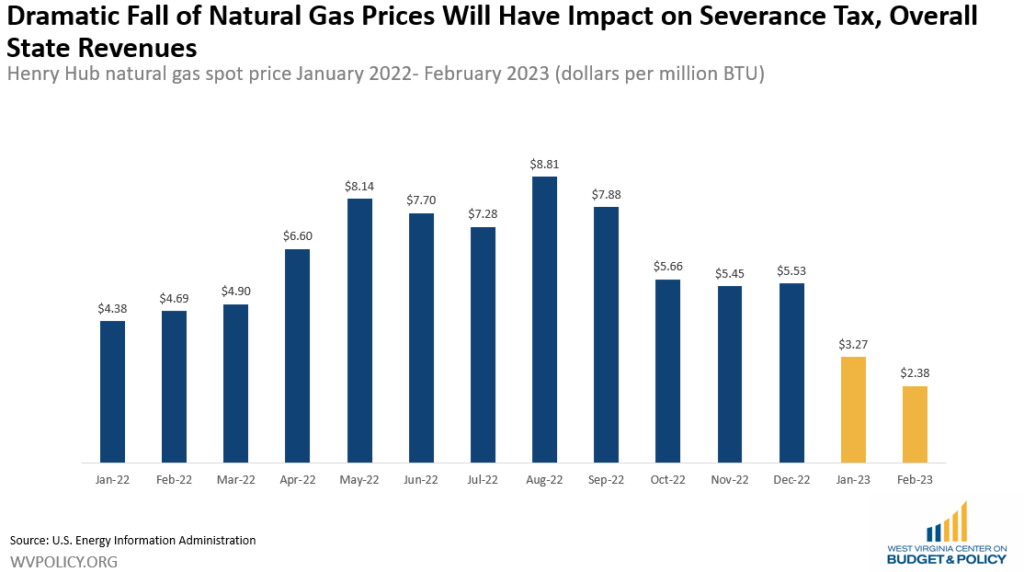

The new month also brought new data on natural gas prices, which have dropped dramatically compared to last year. February natural gas prices averaged just $2.38 per million BTU, the lowest monthly price seen since September 2020 and just one-quarter of the average price in August 2022 ($8.81 per million BTU). The U.S. Energy Information Administration projects this to be a continuing trend, forecasting that 2023 natural gas prices will average about 50 percent less than 2022 prices.

February’s revenue report reflected those price shifts, with severance tax revenues starting to decline. Last month, West Virginia collected $71.0 million in severance tax revenue, which was $43.0 million above the low-balled estimate. However, while above the estimate, severance tax collections were down $9.5 million from February 2022’s actual collections of $80.4 million, a decline of 11.7 percent year-over-year. Severance tax revenues are clearly trending downward, with year-over-year growth getting smaller each month since October before going negative in February.

In addition to market forces, West Virginia lawmakers are considering policy measures that would reduce coal severance tax collections. HB 3133, passed by the house earlier this week, would be an effective 20 percent cut on the steam coal severance tax. The tax department estimates it would reduce coal severance tax revenues by $70 million annually.

Despite declining natural gas prices, Governor Justice revised the FY 2024 revenue estimates upward by 17.4 percent, or $850 million, without explanation. We’ve discussed at length the Justice administration’s tendency to low-ball revenue estimates, basing them on what they want the budget to be rather than an accurate forecast of expected revenues.

After four years of artificially holding the budget flat to create an illusion of surpluses to drive the narrative for income tax cuts, Governor Justice’s revised revenue estimate seemed timed to provide the space needed to cut taxes. Unfortunately, there was no magic revenue adjustment when thousands of families lost their child care subsidies, schoolchildren were facing homelessness, or state agencies were understaffed. That said, all of those issues still remain and the additional space provided by the revenue estimate adjustment presents policymakers with a profound choice: invest those funds in state programs and services that have not seen increased investments in years or give tax cuts to mostly wealthy households.

Read Kelly and Sean’s full blog post.

Late last week, the Senate passed their budget proposal. Notably–to account for their plan to cut taxes for the state’s wealthiest households and businesses–the proposed budget is significantly smaller than that proposed by Governor Justice. It also includes a significant adjustment regarding how Medicaid is funded. A recent article, featuring insight from WVCBP executive director Kelly Allen, includes further details. Excerpt below:

Under the proposal, $264 million of the low-income federal insurance program’s expenses would be removed from general revenue funding this year. That funding, at least for this year, would come from the state’s surplus, recently estimated by the state budget office at just under $1 billion.

While Medicaid expenses will likely be paid for this year, they may be in jeopardy of not being funded in the future. Kelly Allen, executive director of the West Virginia Center for Budget and Policy, said that assigning the cost to the surplus puts it at risk of going unfulfilled after 2023.

“After this year, when the tax cut is potentially phased in, when temporary factors start to subside…I think there will be tough decisions that have to be made,” she said.

If the state doesn’t have a surplus in the future, West Virginia’s Medicaid wouldn’t just lose $264 million – around 60% of the total state general revenue contribution. Because the federal government contributes money to programs based on what states invest, the total loss of funds would likely total well over $1 billion.

That billion-dollar loss would be felt by the over 600,000 West Virginians who use Medicaid, plus many who could become eligible soon. It may come in the form of state residents losing coverage for health needs that already go unmet and lower service reimbursement rates that may lead providers to stop accepting the insurance altogether.

“Shifting it to the surplus is concerning and just makes us wonder what the plan is in future years,” Allen said. “It prioritizes tax cuts over ongoing spending needs that help families and kids.”

Read the full Mountain State Spotlight article.

The Summer Policy Institute brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

SPI attendees participate in interactive sessions where they learn the ins and outs of policy change through a research and data lens, as well as crucial skills rooted in community engagement and grassroots mobilization. Attendees will meet West Virginia leaders from government, non-profit advocacy, and grassroots organizing spaces to build relationships and networks.

Throughout the convening, participants work in small teams to identify and develop policy proposals to shape the future they want to see in the Mountain State, culminating in team “policy pitches” to community leaders. Sessions will equip participants to focus on defining the problem as an essential first step before progressing to proposing solutions.

After three years of virtual SPI, we’re excited to announce that we will be returning to an in-person format for SPI 2023! The event will take place at Fairmont State University from July 28-30.

There is no cost to attend, and students can work with professors to receive course credit. It is required that participants attend all sessions during the three-day convening.

To apply, please complete this Google Form and submit your brief letter of interest to summerpolicyinstitute@gmail.com. The application deadline is May 1.

For more information, please see our event landing page.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.