The start of a new month always brings with it new economic data. In addition to new revenue numbers and natural gas price data, Governor Justice also revised his FY 2024 revenue estimates upward with little explanation. All told, what we saw this week should give lawmakers pause as they consider making large, permanent tax cuts based on temporary revenue factors.

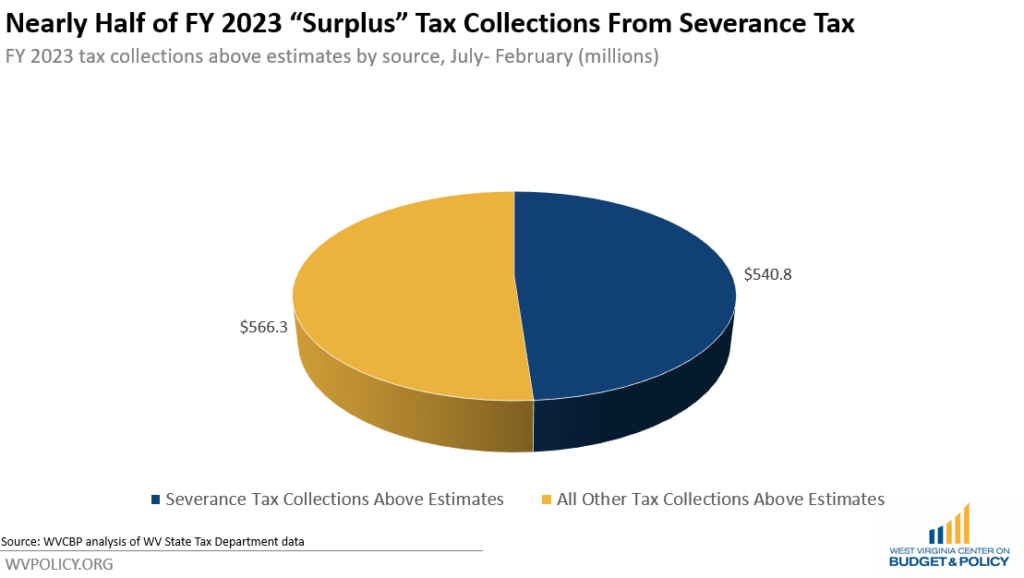

February’s general revenue collections’ report showed the state’s revenue sources comfortably exceeding the Justice administration’s intentionally low-balled revenue estimates. Of note, February severance tax collections above estimate made up 38 percent of the month’s total revenue surplus. In FY 2023, severance tax collections above estimate still represent about half, or 48 percent, of the total revenue surplus.

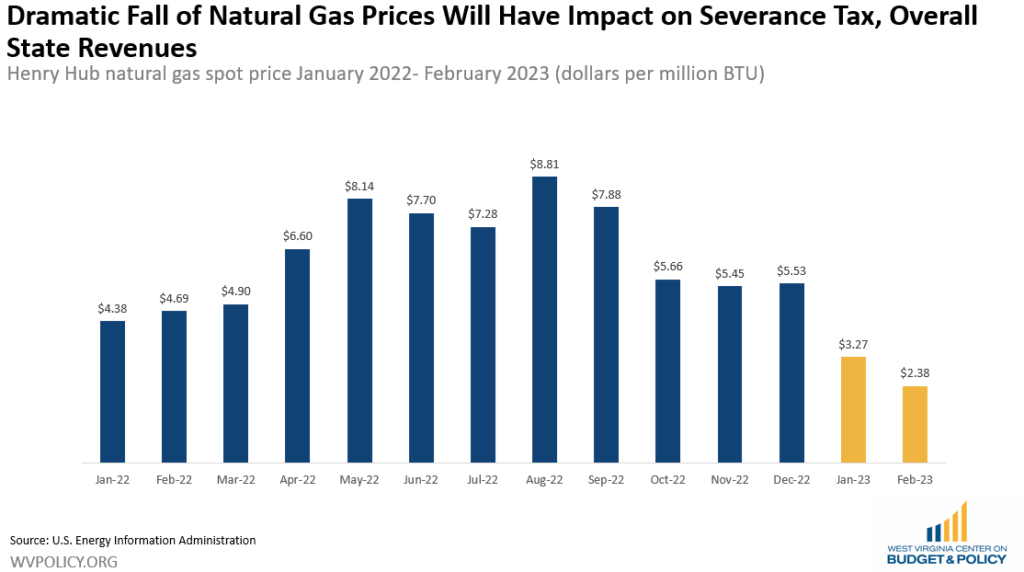

The new month also brought new data on natural gas prices, which have dropped dramatically compared to last year. February natural gas prices averaged just $2.38 per million BTU, the lowest monthly price seen since September 2020 and just one-quarter of the average price in August 2022 ($8.81 per million BTU). The U.S. Energy Information Administration projects this to be a continuing trend, forecasting that 2023 natural gas prices will average about 50 percent less than 2022 prices.

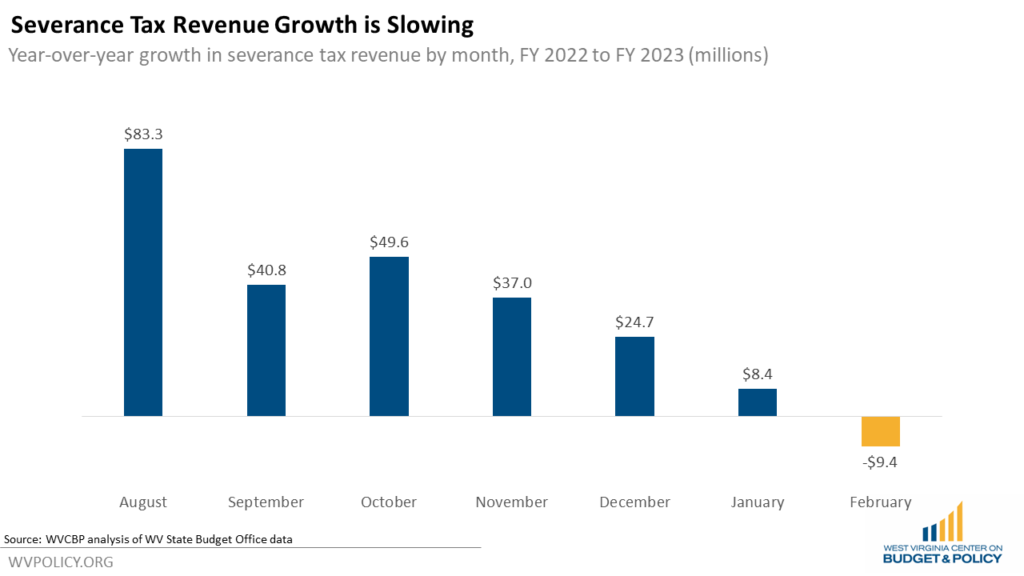

February’s revenue report reflected those price shifts, with severance tax revenues starting to decline. Last month, West Virginia collected $71.0 million in severance tax revenue, which was $43.0 million above the low-balled estimate. However, while above the estimate, severance tax collections were down $9.5 million from February 2022’s actual collections of $80.4 million, a decline of 11.7 percent year-over-year. Severance tax revenues are clearly trending downward, with year-over-year growth getting smaller each month since October before going negative in February.

In addition to market forces, West Virginia lawmakers are considering policy measures that would reduce coal severance tax collections. HB 3133, passed by the house earlier this week, would be an effective 20 percent cut on the steam coal severance tax. The tax department estimates it would reduce coal severance tax revenues by $70 million annually.

Despite declining natural gas prices, Governor Justice revised the FY 2024 revenue estimates upward by 17.4 percent, or $850 million, with little explanation. We’ve discussed at length the Justice administration’s tendency to low-ball revenue estimates, basing them on what they want the budget to be rather than an accurate forecast of expected revenues.

After four years of artificially holding the budget flat to create an illusion of surpluses and drive the narrative for income tax cuts, Governor Justice’s revised revenue estimate seemed conveniently timed to provide the space needed to cut taxes. Unfortunately, there was no magic revenue adjustment when thousands of families lost their child care subsidies, schoolchildren were facing homelessness, or state agencies were understaffed. That said, all of those issues still remain and the additional funding space provided by the revenue estimate adjustment presents policymakers with a profound choice: invest those funds in state programs and services that have not seen increased investments in years or pass tax cuts that disproportionately benefit the state’s wealthiest households.

With forces both within and outside the legislature’s control reducing severance tax revenues, lawmakers should take serious caution moving ahead with tax cut proposals.