Last week, Governor Justice held a round table promoting fiscally irresponsible tax reform policy. Notable speakers included Stephen Moore and Grover Norquist, staunch supporters of Kansas’ failed tax experiment of 2012. WVCBP executive director, Kelly Allen, recently published an op-ed outlining why it defies both evidence and common sense to follow supply-side pundits down a path of economic destruction. Excerpt below:

“Go big or go home.” That was the message from Stephen Moore — an adviser to Kansas Gov. Sam Brownback on his disastrous tax experiment — during a panel promoting tax cuts earlier this week. Alongside him was Grover Norquist, who famously said of the state’s supply-side driven tax cuts, “Kansas is the future. Kansas is the model.”

So, what happened in Kansas in 2012 and 2013 when the state adopted their recommendations? State revenue fell hundreds of millions of dollars and bond ratings were cut, while the promised economic benefits never materialized. In the five years that followed the tax cuts, jobs in Kansas grew at less than half the national average, business growth trailed the rest of the country, and the Republican-controlled legislature was forced to increase the state’s regressive sales tax before ultimately undoing the disastrous tax cuts altogether.

Inexplicably, the architects of the Kansas tax cut crisis are now being welcomed to West Virginia to spout cliches and discredited economic theories without knowing much at all about our people or our budget needs.

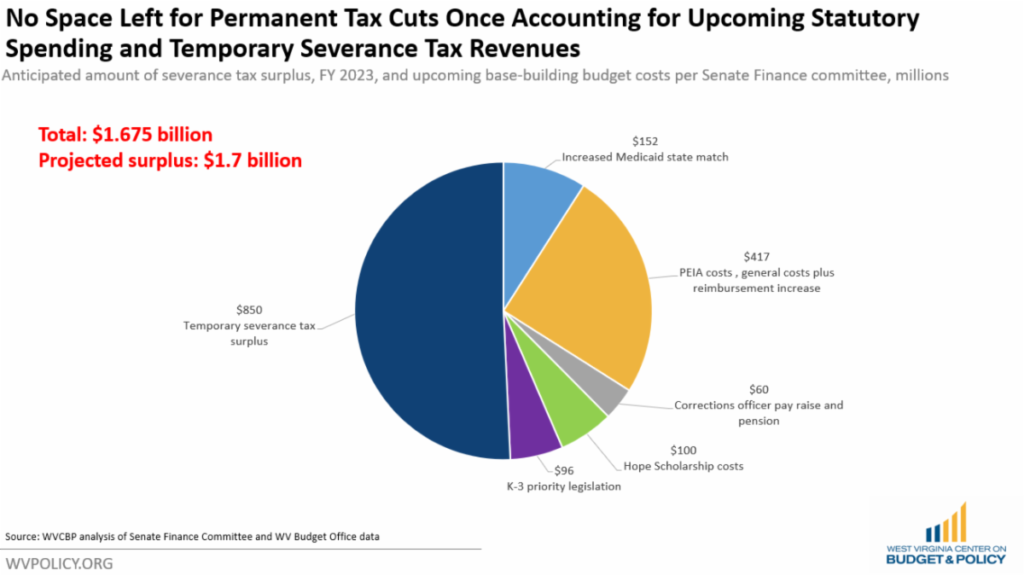

While Moore and Norquist likely haven’t spent enough time in West Virginia to know this, our current revenue surplus, projected to be about $1.7 billion this fiscal year, is largely a result of years of neglecting state budget needs. After four years of flat budgets, the state’s Public Employees Insurance Agency is underfunded, our teachers and other public employees are underpaid, thousands of families have lost their child care assistance, we have a child poverty and foster care crisis, and building and infrastructure needs have gone unaddressed.

According to Senate Finance Chairman Eric Tarr, R-Putnam, the state is on the hook for about $1 billion per year in new budget spending over the next few years just to meet current commitments, before even accounting for any new legislation that might be passed this session. That includes funding for Medicaid and PEIA, pay increases for correctional officers and the cost of expanding the state’s private-school voucher program, the HOPE Scholarship.

After accounting for that $1 billion, the surplus drops to about $700 million. But that’s all because of the severance tax, a fleeting revenue source completely dependent on volatile and fluctuating energy prices. Building a permanent income tax cut based on temporarily high severance tax revenue would mean that, when energy prices come back down, lawmakers could be forced to increase the regressive sales tax, which would squeeze working families, or slash the budget, which could result in cuts to higher education, health care and other services that affect all West Virginians.

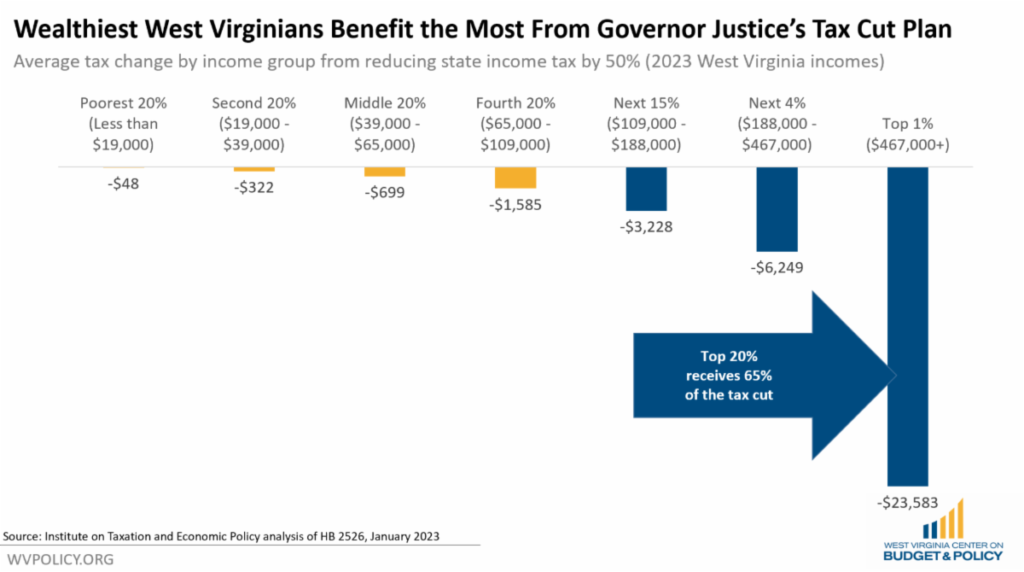

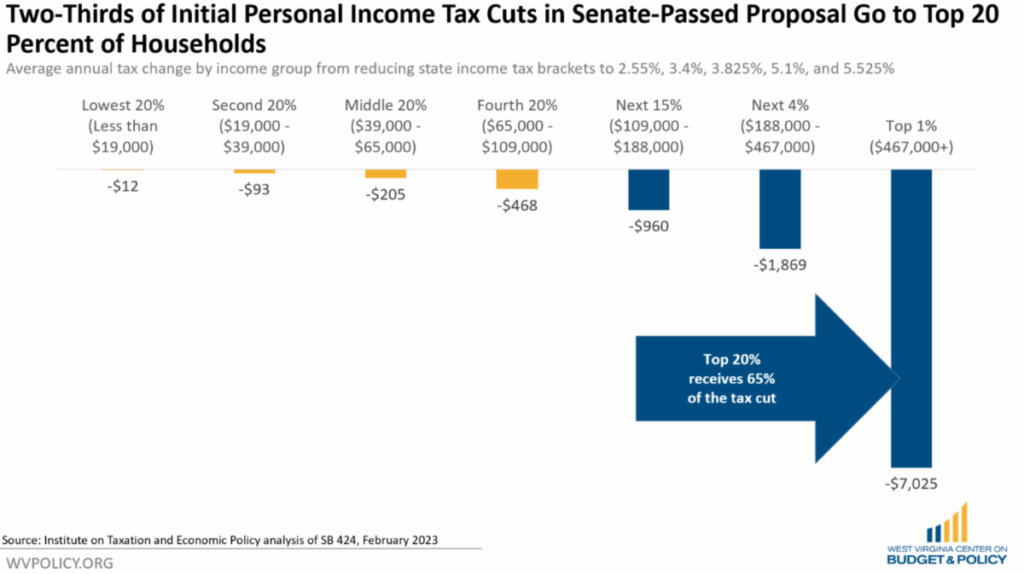

Both tax reform plans we’ve seen this year — Gov. Jim Justice’s 50% personal income tax cut (House Bill 2526) and the Senate’s combination of income tax and property tax cuts (Senate Bill 424), are far too close to Kansas’ approach for comfort.

The governor’s big income tax cut would force almost immediate harm — likely via budget cuts or increases in other taxes nearly right away. The Senate’s plan, while touted as a safer approach, would eventually eliminate the income tax completely, in a trigger scheme similar to that in Kansas, where all future revenue growth would be diverted to tax cuts, instead of budget needs. This would exacerbate the already concerning state budget scenario we are currently in, where underfunding of state programs has led to crises in our schools, correctional facilities, and more.

And for what? We’ve already seen in Kansas, and here in West Virginia, that big tax cuts don’t entice people to move to the state, particularly if those cuts undermine things like education, population health and infrastructure. What business or family would want to locate in a state that has decimated public programs?

That’s why supply-side tax cuts defy common sense. Instead of attracting people or creating jobs, they undermine the things that do draw people to a new place — strong and safe communities, quality schools, a healthy workforce and thriving infrastructure.

Income tax cuts won’t bring people here, and they won’t grow our economy. More than 60% of the benefits of both tax plans would go to the state’s wealthiest households and big businesses, where, instead of circulating throughout our economy as promised, they would mostly be removed altogether — going into investment accounts or shareholders’ pockets, rather than to Main Street.

Read Kelly’s full op-ed here.

Tell your legislators to reject budget-busting income tax and business tax cuts and instead invest in programs that benefit children and families here.

The 2023 state legislative session has seen both chambers heavily focused on turning the state’s revenue “surplus” into personal income tax cuts, despite the clear need for new spending after four years of austerity forced by flat budgets. We’ve covered at length the temporary factors driving the surplus, as well as the fallacy of calling it a surplus at all when much of that money is obligated to future budget spending based on decisions lawmakers have already made. This piece will take a look at West Virginia’s expected FY 2023 surplus and outline how we could spend it in equitable and sustainable ways while still meeting our budget obligations.

Seven months into the fiscal year, West Virginia has a budget surplus of $995.3 million. Half of that, $497.8 million, is severance tax collections above estimates, which have resulted from temporarily high energy prices due to factors outside of West Virginia’s control. To put the historic severance tax collections into context, just seven months into FY 2023, we’ve collected 252 percent of the severance tax we estimated to bring in this year.

If current revenue trends continue, we would expect the total FY 2023 surplus to be just over $1.7 billion, which is the amount state officials are projecting as well.

Earlier this month, Senate Finance Chairman Eric Tarr identified in an interview that they used the budget hearing process as a workaround to understand each state agency’s upcoming spending needs. What the Senate Finance committee learned is that the state is already on the hook for “at least $917 million” in ongoing, base budget spending obligations based on legislation previously passed, which means that much of the surplus is simply not available to fund tax cuts without changing existing laws or drastically cutting the budget. Chairman Tarr noted that over $900 million is already obligated before lawmakers pass any additional legislation this year that has a price tag.

That leaves about $800-850 million remaining of the FY 2023 surplus. If current trends continue, we can expect the severance tax portion of the surplus to be around $800-850 million. We’ve long cautioned that severance tax revenues are incredibly temporary as they are tied to volatile energy prices. A fiscally responsible practice would be to not use any temporary severance tax revenue toward permanent spending — either for the budget or for permanent tax cuts. That said, it’s important for the state to meet its legal spending obligations.

With the $800-850 million of severance tax surplus remaining, these funds could be incredibly transformative in the coal and natural gas communities where these tax benefits derive from and which, in many cases, have seen underinvestment in recent years in both infrastructure and economic development. Last year, we called on lawmakers to create an infrastructure and development fund for counties that have coal and natural gas production and to place the FY 2023 severance tax surplus into that fund. With an $800-850 million pot of money, many meaningful projects could be pursued to improve economic opportunities in these communities for this and the next generation.

That more than exhausts the FY 2023 surplus. However, some of the costs Chairman Tarr identified as upcoming base-building costs do not become part of the budget until FY 2025 or later. Additionally, the state still has about $500 million in unappropriated surplus funds from FY 2022 that could go to one-time needs, but again, it would be deeply irresponsible to base any ongoing spending or tax cuts on temporary surplus dollars—either those from the severance tax or from the remaining FY 2022 surplus.

West Virginia could make some long-needed one-time investments with these dollars — for example, investing in child care subsidies for thousands of families who lost theirs at the end of last year, launching a paid family and medical leave program, and investing in education and workforce training programs.

There are also equitable one-time ways to get money back into the pockets of West Virginians. The best option would be a child tax credit applied to all children in the state under the age of 18. For about $350 million, every child in the state could get a one-time $1,000 child rebate. If revenues continue to grow in future years, the legislature could come back and consider making the program permanent.

West Virginia’s FY 2023 surplus does present significant opportunities to invest in our people—but most of that investment will need to be in the form of meeting our obligations for public services that serve all of our people. The plan laid out above to meet our spending obligations, invest temporary severance tax revenues back into our coal and natural gas communities, and get more money into the pockets of families with children is both a sustainable and an equitable approach.

Read Kelly’s full blog post.

The Legislature is currently considering a bill that would expand health care access for low-income West Virginians. HB 3274 would create the state’s first Medicaid buy-in program, which would increase access to quality, affordable health insurance for people who are ineligible for traditional Medicaid. A recent article, featuring insight from WVCBP staff, provides further details. Excerpt below:

HB 3274 would create a new state option for a high-quality, low-cost health insurance plan for low-income West Virginians who earn just enough to not qualify for Medicaid. The buy-in plan allows residents to pay a low monthly premium based on a sliding scale for individuals who earn under 200% of the federal poverty level, prioritizing families who have been bumped off of Medicaid.

Beginning Jan. 1, 2024, the state Department of Health and Human Resources would establish a state-administered healthcare coverage plan that leverages Medicaid coverage. The program would be limited to residents who are ineligible for Medicaid and Medicare, and whose employer has not disenrolled or denied the resident enrollment in employer-sponsored health coverage because they would otherwise qualify for the buy-in program.

Covered benefits in the buy-in program would include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance abuse disorder treatment, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services.

According to West Virginians for Affordable Health Care, a Medicaid buy-in program would benefit individuals and families who earn more than the current Medicaid income eligibility cap of 138% of the federal poverty level and 200% of the federal poverty level; or between $1,677 per month and $2,430 per month for an individual and $2,859 per month and $4,143 per month for a family of three.

Cindy Beane, commissioner of DHHR’s Bureau for Medical Services, told committee members her office deals with individuals and families who end up making $100 more than the cap and asking to remain in Medicaid, but the rules require them to be bumped.

“They’re seeing the workers not even want to work the full amount of time any longer because they are afraid of losing their benefits,” Beane said.

Sometimes called the “cliff effect,” individuals who were in Medicaid and start work at a job that bumps up their salary just beyond Medicaid eligibility often face high costs for health insurance coverage, often leaving them as poor as they were before taking the new job. Dr. Jessica Ice, executive director for West Virginians for Affordable Health Care, said this issue often causes someone to quit a job and remain on Medicaid.

According to the West Virginia Center for Budget and Policy, a left-of-center public policy advocacy organization, Medicaid buy-in programs help ease people leaving Medicaid into the workforce until they can earn enough to afford other health insurance plans.

“As it currently stands, transitions in and out of Medicaid eligibility based on small income changes can be disruptive to impacted workers and families, creating challenges to accessing providers, obtaining needed medications, and seeking care,” wrote Kelly Allen and Rhonda Rogombe. “Under a Medicaid buy-in, rather than losing eligibility altogether with a change in income, a worker or household would have the option to move into a plan very similar to the one they are currently enrolled in, by beginning to pay a monthly premium that is affordable based on a sliding scale.”

HB 3274 would not cost the state additional dollars, with tax premiums credits from the payments to managed care companies being used to pay the cap, though there could be some costs for additional administration services down the road.

Read the full Wheeling News-Register article.

The Summer Policy Institute brings together highly qualified traditional and non-traditional undergraduate students, graduate students, and policy-curious people of all ages to build policy knowledge, leadership skills, and networks.

SPI attendees participate in interactive sessions where they learn the ins and outs of policy change through a research and data lens, as well as crucial skills rooted in community engagement and grassroots mobilization. Attendees will meet West Virginia leaders from government, non-profit advocacy, and grassroots organizing spaces to build relationships and networks.

Throughout the convening, participants work in small teams to identify and develop policy proposals to shape the future they want to see in the Mountain State, culminating in team “policy pitches” to community leaders. Sessions will equip participants to focus on defining the problem as an essential first step before progressing to proposing solutions.

After three years of virtual SPI, we’re excited to announce that we will be returning to an in-person format for SPI 2023! The event will take place at Fairmont State University from July 28-30.

There is no cost to attend, and students can work with professors to receive course credit. It is required that participants attend all sessions during the three-day convening.

To apply, please complete this Google Form and submit your brief letter of interest to summerpolicyinstitute@gmail.com. The application deadline is May 1.

For more information, please see our event landing page.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.