Two significant tax breaks for the coal industry are currently moving through the West Virginia Legislature, and together they could cost nearly $100 million in state coal severance tax revenue annually.

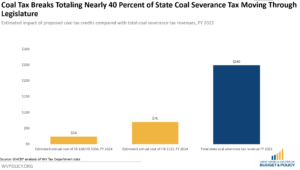

HB 3133 would enable the state’s coal producers and processors to reduce their severance tax responsibilities by 20 percent annually, by allowing them to claim a credit against the severance tax for up to 50 percent of their qualified operating costs including labor, materials, machinery and equipment, and services. Coal producers and processors could use this credit to reduce their coal severance tax liability by 20 percent each year, carrying any remaining credit up to nine years forward. In essence, HB 3133 is a backdoor 20 percent cut in the severance tax rate for the state’s coal processors and producers and, by extension, would reduce the state’s coal severance tax revenues by 20 percent every year going forward. A fiscal note provided by the West Virginia State Department of Tax and Revenue estimates the annual cost of HB 3133 at $70 million upon full implementation in FY 2024, with an estimated loss of $25 million in the final quarter of FY 2023.

A second, narrower credit for “road or highway infrastructure improvement projects” also contained within HB 3133 dominated the House Technology and Infrastructure Committee discussion of the bill, but per the tax department’s fiscal note, no coal company would likely need to use it, as they could each get a full 20 percent off their tax liability through the broader qualified expenses credit. And the roads and highways credit is limited to $50,000 per project and a total expenditure of $100,000 per year— meaning in the best case scenario the credit would make up an estimated one-tenth of one percent of the total cost of the legislation. This makes this legislation far less about roads and highway infrastructure than a broad tax credit against general expenses for the state’s coal companies.

HB 3304 (and similarly SB 168) would exempt thermal or steam coal sold to in-state electric generating facilities from severance taxation. According to the legislation, it is intended to “encourage and incentivize the sale of thermal or steam coal to coal-fired electric generating facilities which are based in West Virginia… thereby providing cheaper electricity to the state’s residents.” But notably, there is no language in the bill requiring that any savings to West Virginia electric generating facilities be passed onto West Virginians, which makes it very unlikely to have any impact on electricity costs for West Virginians.

Further, coal production is based on demand, supply, and prices that are set in the regional and global marketplace. Currently, an estimated one-third of steam coal produced in West Virginia is sold to in-state coal-fired electric generating facilities, while the other two-thirds is sold out of the state or even out of the country. It is difficult to see how reducing a coal company’s severance tax payments will stimulate demand from power plants to purchase West Virginia coal unless the coal companies pass the savings onto the power plants in the form of lower coal prices, but there is no requirement in the legislation for them to do so.

According to the fiscal note, HB 3304/SB 168 is expected to cost an estimated $24 million once fully phased in during FY 2024.

If both HB 3133 and HB 3304 are passed, the two bills would reduce the coal severance tax by approximately $94 million, or 38 percent of total FY 2022 state coal severance tax revenues. Taking into account HB 3142, which reduced the coal severance tax on steam coal from five percent to three percent in 2019, costing an estimated $60 million/annually, West Virginia will have reduced coal severance tax revenues by 50 percent over the last four years.

There is little evidence to support a severance tax cut or tax credit for coal as a tool to increase production and employment. Overall, the state has little ability to influence the forces affecting the coal industry, be they competition from natural gas, environmental regulations, productivity, or transportation issues. Further, while coal production and jobs have been and continue to be important for our state’s economy, they also come with serious health, infrastructure, and environmental costs. The severance tax is one of the only means we have to account for the costs created by the coal industry and invest in our state’s frontline coal communities.