At his State of the State address last week, Governor Justice announced a proposal he called a “tsunami” to reduce the personal income tax by 50 percent. As we’ve previously highlighted, personal income tax cuts by nature overwhelmingly benefit the wealthiest households. In this case, one out of every six dollars in tax cuts would go to the richest one percent of West Virginia households.[1] While wealthy households would see the majority of the tax benefits, every West Virginian would pay the price via a decimated state budget. Governor Justice’s plan costs $1.5 billion once fully phased in during FY 2026 and costs would grow year over year from there, forcing potentially devastating cuts to the state budget almost immediately and ensuring that maintaining current levels of services and making new investments will be impossible without increases to other taxes.

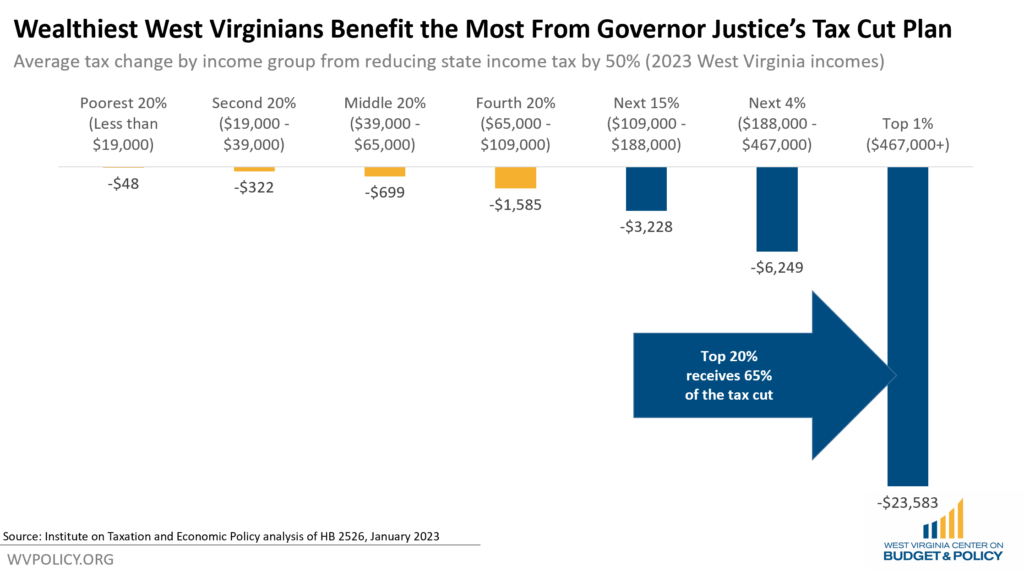

Governor Justice’s plan phases in the tax cut over three years, reducing the income tax by 30 percent in year one, an additional 10 percent in year two, and another 10 percent in year three. While the average West Virginia household would see just $699 per year, or about $58 per month, the tax cut varies widely by income. The poorest 20 percent of households would see on average $48 per year, while the richest 1 percent of households would get an average annual tax cut of $23,583. Sixty-five percent of the $1.5 billion tax cut would go to the wealthiest 20 percent of households, with one out of every six dollars in tax cuts going to the wealthiest one percent of households.[2]

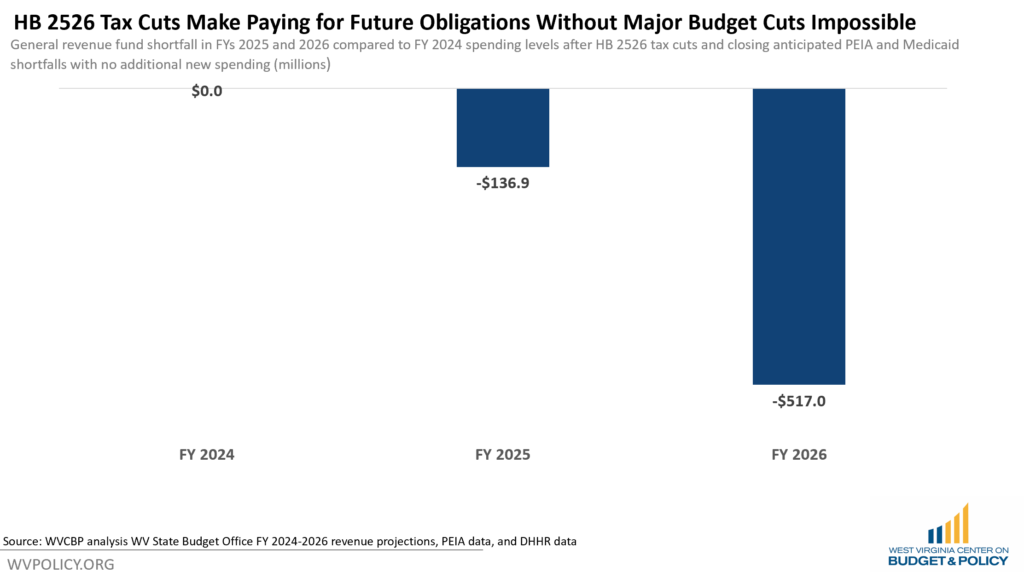

While the tax cuts are phased in over three years, the strain on the state budget kicks in immediately. After four years of flat budgets, the FY 2023 enacted budget is $540 million below FY 2019 expenditures after adjusting for inflation.[3] The governor’s proposed FY 2024 budget falls far short of making up those losses, coming in at just $240 million above FY 2023. This means that the budget has been losing value and is able to cover less than it could in prior years, driving PEIA and Medicaid shortfalls and public employee vacancies, to name just a few repercussions. Adding over a billion dollar annual tax cut ensures that flat—or more likely declining—budgets will be necessary in upcoming years, hampering our ability to keep pace with inflation, fill public employee vacancies, or make any new investments in state programs and services. In fact, in FY 2025, based on published revenue estimates, the state budget would see a $137 million shortfall with no increased spending aside from expected PEIA and Medicaid needs. In FY 2026, the state budget would see a $517 million shortfall with current spending levels and expected PEIA and Medicaid needs.

The shortfalls highlighted above rely on the Justice Administration’s future revenue estimates, which after years of being artificially low-balled and incredibly conservative, become quite optimistic in FY 2025. While revenue officials set the FY 2023 revenue estimate at $1.2 billion below the prior year’s actual tax receipts, the FY 2025 revenue estimate is over $6.1 billion — higher than FY 2022 tax receipts by over $220 million despite the temporary factors driving FY 2022 revenues. The optimistic FY 2025 revenue estimates, upon which the income tax cuts are premised, assume that corporate net income tax revenues will double, and the severance tax will grow by more than two and a half times their FY 2024 estimates. If actual tax revenues in FYs 2025 and 2026 prove to be short of these optimistic estimates, the budget shortfalls could be even larger than outlined above. For the third year in a row, the FY 2024 budget fails to include a six-year plan, which would normally outline state spending needs in upcoming years — an essential tool for responsible fiscal analysis.

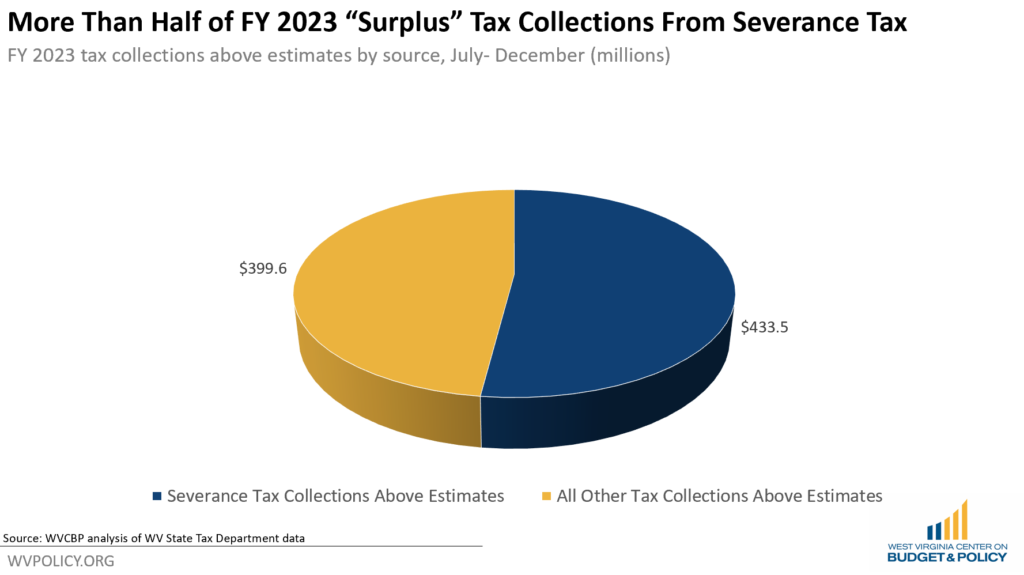

These revenue estimates are a significant departure from recent years under the Justice Administration and ignore the temporary factors driving current tax revenues. Exactly halfway into FY 2023, 52 percent of the surplus tax revenues are from the severance tax, a highly volatile revenue source that is dependent on energy prices and should not be the basis for any permanent spending or tax cuts. Further, recent inflation has increased sales and personal income tax collections, another temporary factor that will recede as inflation continues to come down. Finally, the state is still utilizing over $518 million in federal COVID relief funds under the American Rescue Plan Act (ARPA) in the FY 2024 budget, as well as an enhanced federal match rate for Medicaid, allowing the state to supplant state dollars with federal dollars — yet another factor in the maintenance of a so-called “flat” state budget that will end as the HB 2526 tax cuts are phased in. As all of these temporary factors recede or expire, budget needs could go up dramatically while revenues decline.

Reducing state tax revenues by $1.5 billion via HB 2526 would create a state budget crisis almost immediately — all to give windfall tax cuts to the state’s wealthiest households. HB 2526’s tax cut “tsunami” would consign the state to permanent austerity or other tax increases, likely ensuring that we would not have the revenue needed to address PEIA’s long-term needs, to raise public employee wages enough to fill vacant positions, or to make critically necessary investments in the state’s infrastructure — particularly in our coal and natural gas communities. Further, it would almost certainly create a future in which policymakers would be unable to make new investments in addressing child poverty, hunger, our state’s child welfare crisis, or economic development policies.

[1] Institute for Taxation and Economic Policy analysis of HB 2526.

[2] Ibid.

[3] WVCBP analysis of Bureau for Labor Statistics and WV State Budget Office data.