In West Virginia, people convicted of felony offenses are not eligible to vote until after they have completed their sentence or parole supervision. As a result of this policy, one out of every 100 West Virginians is disenfranchised. This second-class citizenship disproportionately impacts Black West Virginians, who are more than three times as likely as the general population to be ineligible to vote.

More than half of those barred from voting are living in our communities under probation or parole supervision and may be subject to dozens of conditions that govern their daily lives. Despite this level of government monitoring and control, our government is not accountable to these citizens. Kenny Matthews, who worked at a substance use treatment center after his release from prison, described the absurdity of watching state legislators debate issues affecting people like him while he had no power to vote for those elected officials: “It’s taxation without representation.”

Research has shown that democratic engagement is associated with a reduction in recidivism. Studies of people with criminal convictions revealed that those who exercised their right to vote were less likely to be rearrested than those who did not.

Restoring the right to vote to returning citizens is a popular policy: 70 percent of Americans favor allowing people convicted of felonies to vote after serving their sentences. In recent years, several states have their changed laws to allow people to vote under probation or parole supervision.

Still, we can do even better. Like Maine, Vermont, DC, and Puerto Rico, we can ensure our citizens never lose the right to vote by allowing them to vote from prison. And we must, if we truly wish to have a government that aims to represent the will of all people.

Read Sara’s full blog post.

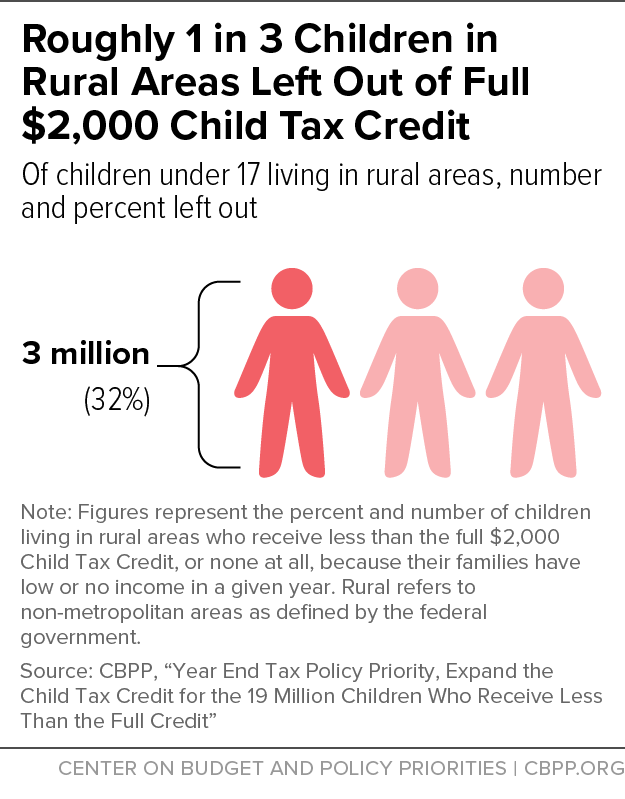

| The Child Tax Credit (CTC) expansion included in last year’s American Rescue Plan Act gave millions of low-income families with children additional money in their pockets, helping them afford the rising costs of basic needs while driving child poverty down to a record low. Now that the expansion has expired, 19 million children nationwide are at risk of being pushed back into poverty or facing greater hardship if Congress doesn’t act. Our colleagues at the Center on Budget and Policy Priorities (CBPP) published a blog post this week detailing how nearly one-third of children living in rural areas don’t receive the full credit, and how renewal of the expanded credit will be particularly beneficial for these families. Excerpt below: Under current law, an estimated 3 million children living in rural areas are left out of the full $2,000 Child Tax Credit because their families’ incomes are too low. Rural communities would benefit disproportionately from an expansion that makes the credit fully available to children in families with low incomes who currently receive less than the full amount or no credit at all. This crucial investment in children living in rural areas, which includes children of diverse racial and ethnic backgrounds, should be a bipartisan priority during year-end tax negotiations. Additional income such as an expanded Child Tax Credit can improve children’s health, educational, and economic outcomes. But the credit’s design leaves rural (non-metropolitan) communities at a disadvantage. Under current law, a family with low income sees their Child Tax Credit amount increase as their earnings rise. Pay is generally lower in rural areas, with the median yearly wage for year-round workers roughly 20 percent lower than in metro areas. And, just like families in all parts of the country, there are times when parents living in rural communities are out of work altogether, including during recessions and when illness or injury leaves someone out of work for a period. Roughly 1 in 3 children under age 17 living in rural areas receive less than the full credit because their families’ incomes are too low, while about 1 in 4 children living in metro areas don’t receive the full credit. Children in families with higher incomes (up to $200,000 in households with single parents and up to $400,000 in households with married parents) receive the full value of the Child Tax Credit, while many children in families with low or no earnings are denied some or all of the credit. This upside-down policy gives less help to the children who need it most. If Congress enables families with low incomes to receive the full credit amount (known as making the credit “fully refundable”), the resulting income boost would help many families in rural communities provide more financial security for their children, including by putting food on the table and paying the rent and utilities. Read CBPP’s full blog post. |

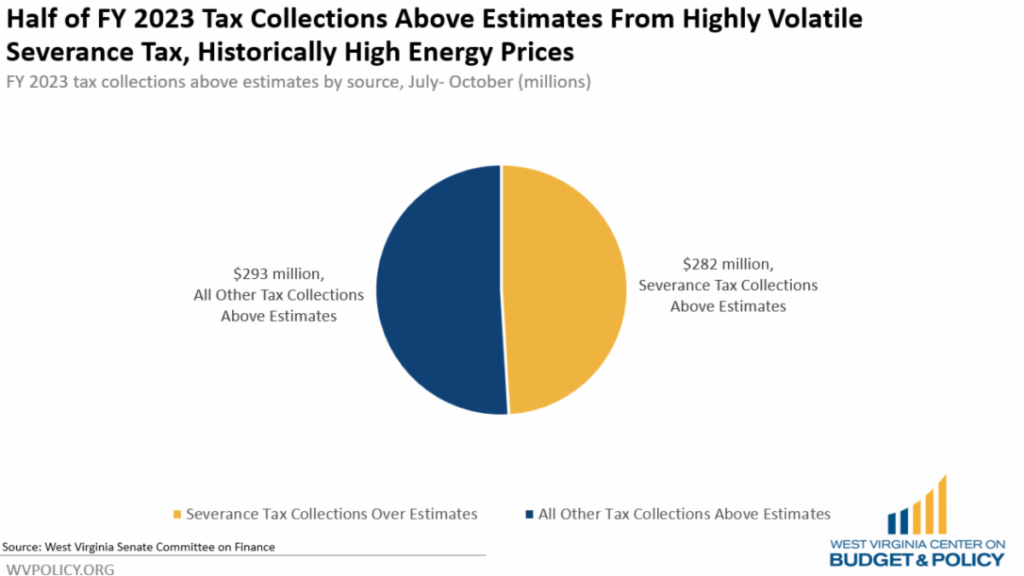

While recent tax collections are leading to calls for tax cuts, half of the surplus collections are from the highly volatile severance tax which is subject to energy prices.

Further, the flat budgets of recent years have created many unaddressed needs in our state. Amid staffing crises in our jails, thousands of families losing child care subsidies, a looming PEIA shortfall, cuts to higher education, and a woefully underfunded foster care system, to choose to prioritize more tax cuts for the wealthy is to choose to neglect ordinary West Virginians.

We can use our current revenue surplus to invest in PEIA, provide thousands of children with subsidized child care, enact paid family and medical leave for all workers, and more. This is how improve the lives of everyday people in our state.

Learn more about how we can meaningfully utilize our surplus here.

Join us on Dec. 15 at 6:30pm for our anti-stigma training, where we’ll discuss the social safety net, including Medicaid and SNAP. We’ll share lived experiences and how stigma affects accessing necessary services. And we’ll teach you how to combat that stigma and promote wellness in your community!

Register for the webinar here. RSVP to the Facebook event here.

As the 2023 legislative session approach, the West Virginia Center on Budget and Policy staff would like to invite you to join us at our 10th annual Budget Breakfast, taking place on January 20, 2023.

Each year, the WVCBP holds this event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our chosen keynote speaker, to be announced closer to the event.

Please find further event details below. You can register for the event here.

WHAT: WVCBP’s 10th Annual Budget Breakfast

WHEN: January 20, 2023. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2024 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

WHO:

PLEASE NOTE: The cost of a single standard ticket is $50, but if you take advantage of our Early Bird Special (available to all who register by 12/31/22), you will receive $10 off.

We appreciate your ongoing support of the WVCBP and we hope you can join us at next year’s event!

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.