It’s almost Halloween, and there is nothing more terror-inducing than ill-advised tax cuts and the loss of local control. So turn out all the lights, hide under a blanket, and get ready to have your bones rattle as you read these four ghoulish charts about Amendment 2.

If passed, Amendment 2 would amend the constitution to give the state legislature the authority to exempt business machinery and equipment, business inventory, and personal vehicles from local property taxation.

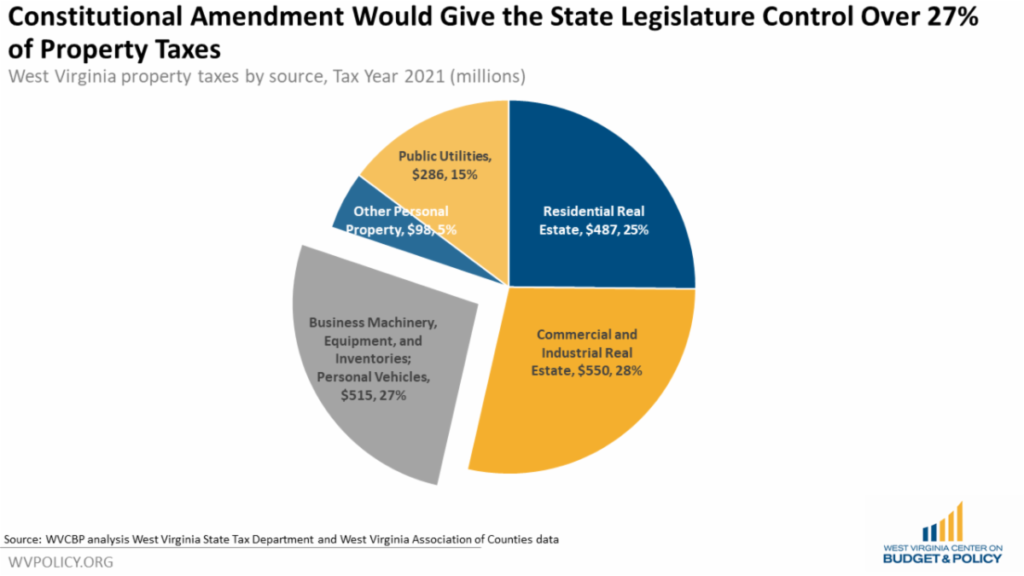

Amendment 2 would give the legislature control over 27 percent of total property tax revenue in the state–over $515 million–resulting in a severe loss of revenue for counties, municipalities, and school districts and marking a significant shift in power away from local governments and to state government.

Of that $515 million, approximately $340 million funds local school districts, $138 million funds county government services, $35 million funds municipal government services, and only $2 million funds state government services. What’s more, $205 million of the $515 million comes from excess and bond levies that have already been approved by voters in those counties. But if passed, Amendment 2 would take control of the full $515 million away from local governments and voters and give it to the state legislature.

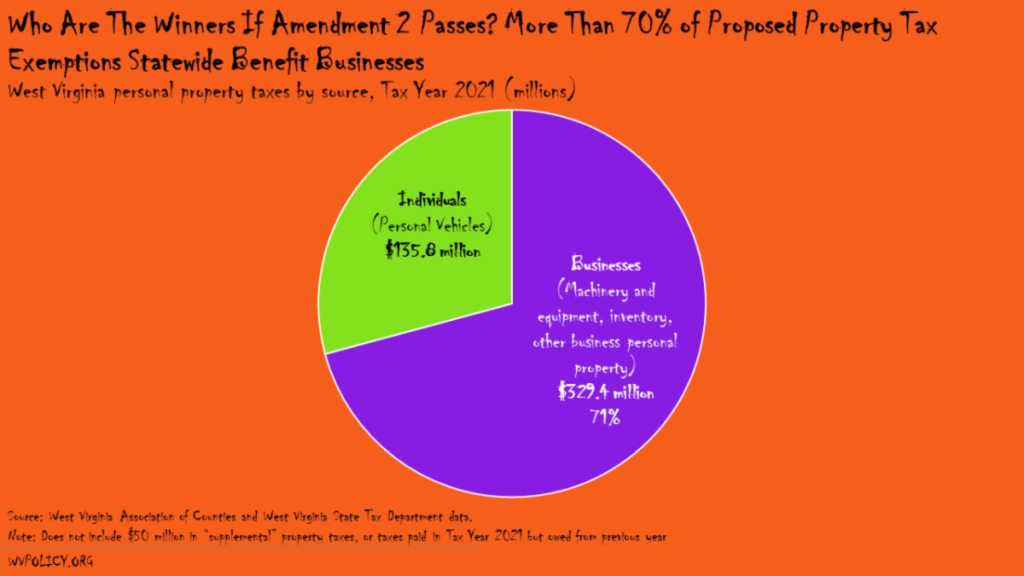

While the proposal has been framed by proponents as “relief for taxpayers from their car tax,” over 70 percent of the potential tax cuts would go to businesses. The property tax on individual vehicles accounts for less than one-third of the potential tax cuts included in Amendment 2.

Claims that eliminating the property tax on business machinery, equipment, and inventory would result in rapid job growth in the state are largely unsupported. In fact, during the last decade-long economic expansion, states with property taxes on business machinery, equipment, and inventory saw more manufacturing job growth on average than the states without the tax.

So this Halloween, don’t be tricked, Amendment 2 is no treat.

Read Sean’s full blog post.

Early voting in West Virginia started this week and Election Day is Tuesday, Nov. 8. Get out to the polls this fall and help us defeat harmful Amendments 2 and 4!

If passed, Amendment 2, or the “Property Tax Modernization Amendment” would amend the constitution to give the state legislature the authority to exempt business machinery and equipment, business inventory, and personal vehicles from property taxation. As such, passage of the amendment would give the legislature control over $515 million of property tax revenue, or 27 percent of total property tax revenue in the state, resulting in the fulfillment of a long-term goal of state legislators to take control of a significant portion of property tax revenue in order to pursue property tax cuts that largely benefit out-of-state businesses.

The proposed exemptions under Amendment 2 would result in local governments losing control over an essential revenue stream. The $515 million in property tax revenue from personal vehicles and business machinery and equipment, business inventory, and other business personal property accounts for up to 37 percent of total property tax revenue in some counties. The loss of this critical revenue will adversely impact the ability of municipalities, county governments, and school districts to provide needed services that benefit all West Virginians, and will likely lead to cuts to services or increased taxes on other parties, like homeowners.

Meanwhile, Amendment 4 would strip education experts of the ability to make decisions about school policy and curriculum and give that power to state legislators, setting the stage for book bannings and other political stunts.

As early voting gets underway, here are two key ways you can take action to help us defeat Amendments 2 and 4:

Learn more about what’s at stake here.

Find your polling place here.

Amendments 2 and 4 will be on the ballot this November and would both serve to harm our local schools and community services. WVCBP executive director, Kelly Allen, wrote an op-ed this week further detailing why the amendments are bad for West Virginians and our local communities. Excerpt below:

Amendments 2 and 4 would take power over important local schools and public services away from voters, communities and education experts and give it to partisan politicians in the Legislature. The all-but-certain result will be layoffs for teachers and emergency responders, larger class sizes, longer wait times for 911 calls and more political fights in the classroom. To stand up for local control, for our schools, and for the seniors, workers and families who rely on local services, we have to vote No.

Amendment 2 would remove nearly a century of constitutional protections that give voters the ultimate say over local funding for schools and public services and give that control over local revenues to state lawmakers. The Legislature has already made clear their plans of what they’ll do with their newfound power over our school and county funding: give out hundreds of millions of dollars in tax cuts to out-of-state corporations.

Amendment 4 would strip power over school policy and curriculum away from the nonpartisan education experts who work with parents and local school boards to make decisions and give that power to state legislators. This would effectively make our classrooms another battlefront for competing political agendas.

Both of these proposals reek of politics. Proponents of these amendments want to politicize our schools and take critical funding away from them, along with our fire departments and emergency services, all to give a big tax cut to their corporate donors.

While some proponents have suggested that the state legislature could use the one-time revenue surplus to offset the losses that schools and local governments see as a result of Amendment 2, we all know that surpluses are temporary — making the state’s promise to local governments temporary, too.

States across the country are expecting revenues to decline over the next year as federal COVID relief ends, and West Virginia will be no different. When the surplus dries up, some have already suggested that eventually they’d raise property taxes on our homes or the sales tax on the goods we buy — both of which fall more heavily on local families and small-business owners than the taxes that would be eliminated through Amendment 2, which mostly benefit big, out-of-state corporations.

Opposition to these proposals is broad and bipartisan. Anyone who understands the importance of local control over schools and county budgets knows this can only harm our communities.

The folks I’ve been talking to in communities across the state — voters, teachers, firefighters, sheriffs and parents — are the ones who’d see their voices, and even jobs, lost if these amendments pass. We should keep our power in our communities and not give away our own ability to make sure we have what we need in our schools and for the public services we all benefit from. Vote no on 2 and 4 on Nov. 8.

Read Kelly’s full op-ed.

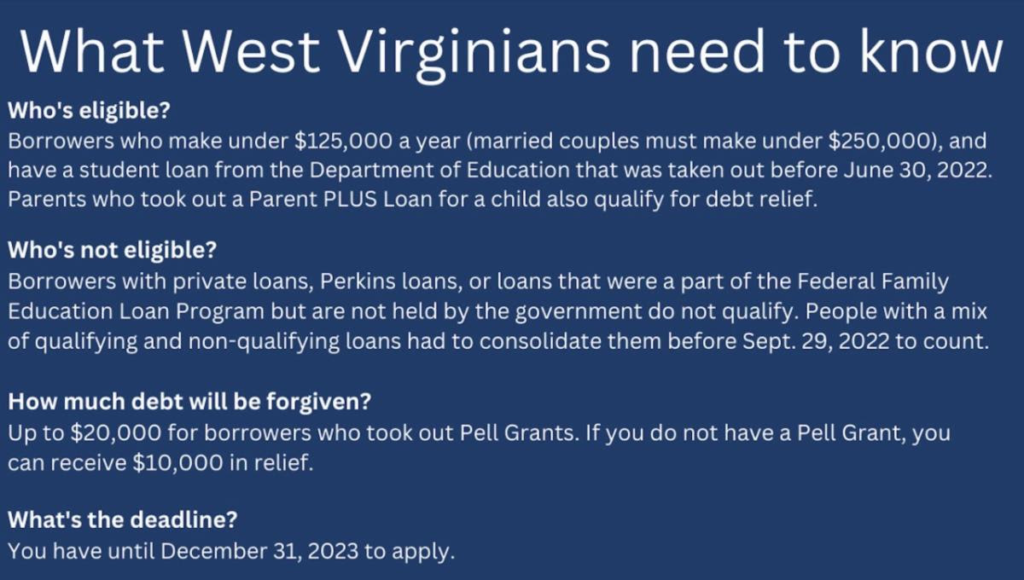

Last week, President Biden formally launched his administration’s student loan forgiveness program, which will provide up to $20,000 in relief to eligible applicants. A recent article, featuring insight from WVCBP health and safety net policy analyst, Rhonda Rogombe, provides further details about the program and how to apply. Excerpt below:

The loan forgiveness program is estimated to affect more than 40 million borrowers across the country and the Biden administration has said that 90% of relief will go to borrowers making less than $75,000 a year. As of Tuesday, more than 12 million people had already applied for the forgiveness according to the administration.

The program will provide up to $10,000 in debt forgiveness for borrowers making under $125,000, and up to $20,000 for low-income borrowers who took out Pell Grants. It could go a particularly long way in West Virginia, a high-poverty state that ranks as one of the worst when it comes to difficulties faced by student loan borrowers.

“In West Virginia we’ve seen increased health disparities, increased housing insecurity and a lot of other things like inflation that have all had an impact in recent years,” said Rhonda Rogombe, the health and safety net policy analyst at the West Virginia Center on Budget and Policy. “Not having to worry as much about paying off balances will provide a lot of relief for a lot of people, especially in rural areas where opportunities are fewer.”

About 213,000 West Virginians will be eligible for the federal student loan forgiveness — more than 11% of the state’s population, according to recent data from the White House and the U.S. Department of Education. Of that group 145,000 people could be eligible for up to $20,000 in relief because they received a Pell Grant.

Collectively, borrowers in the state hold roughly $6.5 billion in student debt according to a 2021 analysis from the West Virginia Center on Budget and Policy. Most have under $40,000 in individual student debt, which includes borrowers who started a degree program but did not finish. Last year, the center estimated that $10,000 in loan forgiveness could completely erase the student debt for roughly one-third of West Virginia borrowers.

In some states borrowers may need to pay taxes on the student loan forgiveness. A representative of the West Virginia Tax Division said the state is waiting for IRS guidance on how the federal government will treat the relief, but that “it is unlikely that this program will result in taxable income to West Virginians.”

Because West Virginia currently ranks as the fifth-highest state in the nation for defaults on student loans, experts say that the forgiveness program could have a significant impact — particularly at a moment when the state is struggling to grapple with an exodus of college graduates as well as rising tuition and declining enrollment at in-state colleges and universities.

In the months to come, there will likely be a protracted legal battle over the future of the program and the relief that it could provide. And while loan forgiveness will help, experts say that addressing student debt and the rapidly increasing cost of college will require additional reforms and changes to how the country thinks about higher education.

Read the full article here.

Access the application here. The deadline to apply is December 31, *2023*.

As November’s election and the 2023 legislative session approach, the West Virginia Center on Budget and Policy staff would like to invite you to join us at our 10th annual Budget Breakfast, taking place on January 20, 2023.

Each year, the WVCBP holds this event to provide analysis of the Governor’s proposed budget. You’ll hear from our executive director, Kelly Allen, our senior policy analyst, Sean O’Leary, and our chosen keynote speaker, to be announced closer to the event.

Please find further event details below. You can register for the event here.

WHAT: WVCBP’s 10th Annual Budget Breakfast

WHEN: January 20, 2023. Breakfast will be available starting at 7:30am. The WVCBP’s analysis of the Governor’s 2024 proposed budget will begin at 8am, followed by keynote speaker presentation and time for Q&A.

WHERE: Charleston Marriott Town Center (200 Lee Street East, Charleston, WV 25301)

WHO:

PLEASE NOTE: The cost of a single standard ticket is $50, but if you take advantage of our Early Bird Special (available to all who register by 12/31/22), you will receive $10 off.

We appreciate your ongoing support of the WVCBP and we hope you can join us at next year’s event!

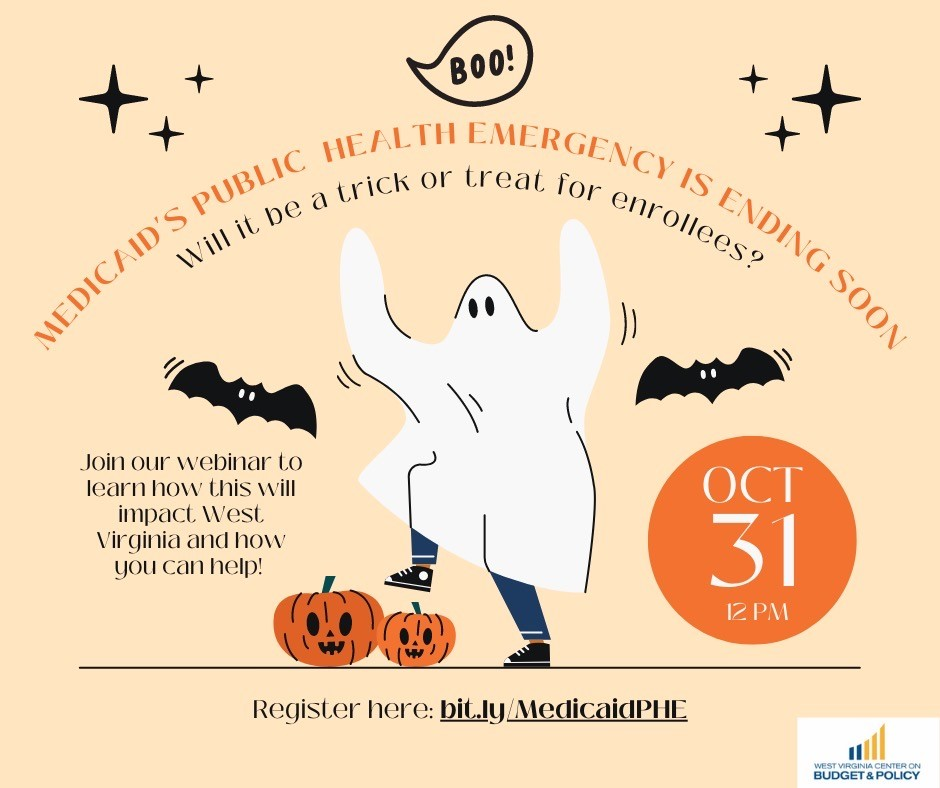

BOO! Medicaid’s public health emergency is set to expire as soon as January 2023. Change can be scary, but we’re here to help!

During this webinar, we’ll explain what the public health emergency is, what’s been happening nationally and in West Virginia, and what steps we can all take to protect public health in our communities!

The webinar will be held Tuesday, Oct. 31 at 12pm. Register here. Find the Facebook event here.

Please note: this event is aimed at direct service providers, advocates, researchers, and folks interested in learning more about the PHE. We’ll be hosting webinars early next year aimed specifically toward Medicaid enrollees, so stay tuned!

The fourth annual Food for All Summit is a place to learn about the decisions that state and federal policy makers are considering that affect both food access and farm viability. Come learn, build skills, and develop policy-changing ideas!

The event will take place on November 16 from 10am-4pm at the Brushy Fork Event Center (929 Brushy Fork Road, Buckhannon, WV 26201).

Please refer to the event landing page for updates on the event itinerary, speakers, and more. There is no cost to attend. Breakfast and lunch will be provided, but registration is required.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.