Amid multiple state agency staffing shortage crises driven by low pay, state officials are proposing to cut state revenues even further through income tax cuts and proposed property tax cuts if Amendment 2, which will be on the ballot this fall, passes.

Just this month, West Virginia Education Association (WVEA) officials warned of record teacher vacancies in the state’s public schools, and Governor Justice declared a state of emergency in the state’s correctional facilities due to shortages of correctional officers. These staffing crises come on the heels of significant Child Protective Services (CPS) worker vacancies at the state’s health agency.

Average pay for all of these positions falls far below the national average—the driving factor across each of these agency staffing shortages. By failing to invest in good pay and benefits for our state’s workers, state policymakers are ensuring that these challenges will continue.

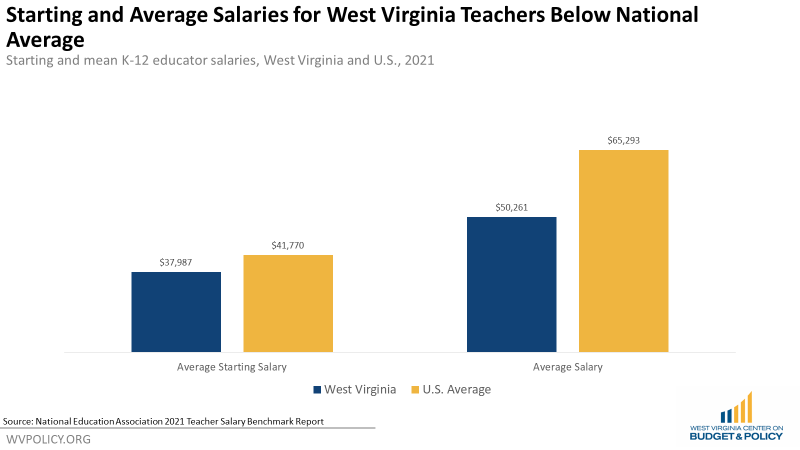

With West Virginia K-12 public schools starting next week, teacher vacancies will have a real and immediate impact on students and families. While the state’s Department of Education reported nearly 1,200 teacher vacancies in 2021, that number is expected to climb to 1,500 according to the WVEA. WVEA noted that concerns among teachers include workload and pay. Even despite recent pay raise legislation, West Virginia’s teacher salaries fall far below the national average, ranking 40th in starting teacher pay and 49th in average teacher pay.

In March, Department of Corrections and Rehabilitation officials reported nearly 900 vacancies statewide, a 29 percent vacancy rate. The average salary for a correctional officer in West Virginia is over $10,000 below the national average, while starting salaries fall below all neighboring states.

Despite awareness of these crises, lawmakers largely failed to increase pay and benefits for these positions during the 2022 legislative session. While a five percent pay raise for state employees and teachers was enacted, the impacts of inflation this year more than cancel out that raise.

The proposed property tax cuts that would follow if Amendment 2, the Property Tax Modernization Amendment, were to pass this fall would exacerbate these staffing crises among state agencies by stripping the state of critical revenue. Tax cuts like those proposed in Amendment 2 would fail to achieve proponents’ stated goal to create jobs precisely because they result in cuts to essential public services. Instead of more ineffective tax cuts, we should invest in good pay and benefits for state employees.

Read Kelly’s full blog post.

The financial impacts of incarceration are discussed regularly, but too often, we fail to keep at the forefront the human toll of our country’s mass incarceration crisis. Our newest blog post highlights just one man’s experience with pretrial detention, and what it cost him:

When Anthony was arrested in 2020, he sat at the police station for hours before a man came over the station telephone and told him, “We’re going to set your bond at $25,000 cash.”

The man on the phone was a magistrate conducting Anthony’s “first appearance” hearing. At this hearing, a magistrate explains the criminal charge, informs a person of their rights, and makes one of the most critical decisions of a criminal case: the bond decision. For most people who are arrested, this decision determines whether they will return home, or whether they will lose their liberty and await their next hearing from jail.

West Virginia law requires magistrates to set the least restrictive bond to ensure a person will appear in court and not commit a new crime. Magistrates must consider several factors, including a person’s criminal history, their ties to the community, and whether they can afford a money bond.

But during Anthony’s first appearance, the magistrate did not ask him about any of these factors, and Anthony did not know to offer this information. Unable to pay the high cash bond, Anthony was taken to the regional jail to wait for his next hearing.

This year, West Virginia jails average nearly 1,000 more residents than the facilities were designed to house. Half of the people in regional jails – 2,573 men and women as of July 2022 – have not been convicted and are awaiting trial. Like Anthony, most of these legally innocent individuals are jailed due to their inability to afford a money bond, even though there is no evidence that paying a bond deters crime or ensures that people will show up for court.

This unnecessary, pretrial detention makes it harder for people to have their day in court. When a person is jailed prior to trial, they are more likely to be convicted, more likely to receive a longer jail or prison sentence, and more likely to accrue court debt than those who had not been detained.

But what most research overlooks is the harsh experience of being confined to a cell. You are not allowed to hold your child or a loved one. You have no control of when you eat, when you open a door, or when the lights turn off. You must use the bathroom in view of strangers. Your belongings and your body can be searched at any time.

The trauma of these experiences is intensified in understaffed facilities in disrepair. In June 2022, a joint legislative interim committee heard testimony from women who had been in regional jails due to an inability to afford a money bond. One woman was in a cell for 12 days without hygiene products, including three days without toilet paper. Another described sleeping in two inches of standing water after the sprinklers went off in her section of the jail.

In the last decade, West Virginia jails had the highest death rate in the country – nearly 53 percent higher than the national average. Two-thirds of deaths were attributed to illness or suicide – underscoring the grave threat jail poses to people with physical and mental illnesses.

Anthony’s case was eventually dismissed, but only after he spent weeks in a “double-bunked” jail pod at the height of the pandemic. His incarceration cost taxpayers thousands of dollars, but it cost him much more. He lost time with loved ones, his car was repossessed, and his retirement savings were spent on court and jail fees.

When asked if a lawyer could have helped him through his first appearance hearing, Anthony remarked, “A lot. Because they had already made up their mind.”

Read Sara’s full blog post.

Next week Sara and the WVCBP will publish a policy brief highlighting a simple solution that would have benefited people like Anthony while also reducing harmful and costly pretrial detention.

The West Virginia Legislature’s special session (temporarily) ended last month after the two chambers and the governor failed to agree on which tax cut was the best to prioritize with the state’s historic — and notably fleeting — surplus money. While there was much debate during the session, there was alarmingly little discussion of how insignificantly either income tax cuts or property tax cuts would benefit the average West Virginia family.

In a recently published op-ed, WVCBP executive director Kelly Allen explains why West Virginians would be better served by investments in our communities than ineffective tax cuts. Excerpt below:

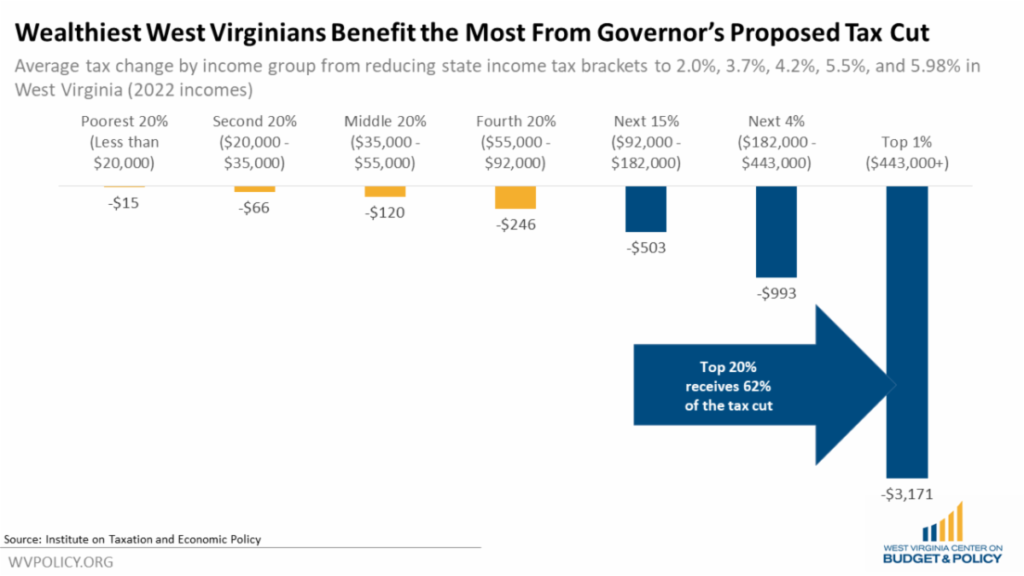

Income tax cuts overwhelmingly benefit the wealthy — that’s simply what they are intended to do. Under the income tax cut plan proposed by Gov. Jim Justice and passed by the House of Delegates last month, the wealthiest 20% of households would receive a whopping 62% of the tax cut. The average West Virginia household would see just $2.30 a week — not even enough to buy a gallon of gas.

The Senate proposed an alternative: the elimination of business and personal property taxes if Amendment 2, the Property Tax Modernization Amendment, passes. Again, under this proposal, everyday West Virginians would see very little benefit, with over 70% of the proposed tax cut going to businesses and corporations — many of them headquartered out of state. Meanwhile, the average West Virginia household would see about $3.50 a week from the elimination of the car tax (still not enough for a gallon of gas).

In addition to doing little for the average West Virginia family, both plans seek to continue years of the failed policy practice of giving tax cuts to the wealthy and corporations in the hope they will bring jobs and create prosperity for West Virginians. But we’ve tried that before, repeatedly, and it’s never worked. In the mid-2000s, West Virginia drastically reduced taxes and, in the decade immediately following, had the worst job growth of any state in the country. In the end, we had no jobs boom; instead we had fewer resources, resulting in cuts to higher education and public health departments, some of the lowest state employee pay in the country, and chronic budget shortfalls.

Proponents of the income tax cut and the property tax cut proposals try to fool West Virginia families by throwing them scraps, while the vast majority of the tax cut benefits go to the wealthy and corporations. Our state’s families, who would see very little from these proposals, would be the same people who bear the brunt of cuts to public services and lack of new investments that would inevitably follow, should the tax cuts be implemented.

Instead of another failed tax cut that ultimately hurts families and businesses that are already in our state, we should invest our temporary surplus in our people by making higher education more affordable, creating job training programs, and investing in our health and infrastructure. Those investments are what would really move the needle for West Virginia, our economy, and all our people, rather than helping the wealthy few.

Read Kelly’s full op-ed.

Beginning in July 2021, most households with children had received monthly enhanced Child Tax Credit (CTC) payments of $250- 300 per child. However, the enhanced CTC included in the American Rescue Plan Act (ARPA) was temporary and expired at the end of 2021.

The impact on children and families since the expiration of the enhanced CTC has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make a robust CTC permanent is as urgent as ever.

Recently, a new proposal to expand the CTC was announced by Senator Mitt Romney. While we are excited to see bipartisan interest in enhancing the credit and while the proposal does improve some elements of the current law, it also has serious shortcomings – primarily, it does not make the full credit available to the lowest-income families (a notable divergence from the now-expired enhanced CTC that was included in the ARPA). Further, it proposes problematic offsets that would prove detrimental to low-income families.

A blog post from our colleagues at the Center on Budget and Policy Priorities provides further insight into the proposal’s pros and cons. You can read it here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.