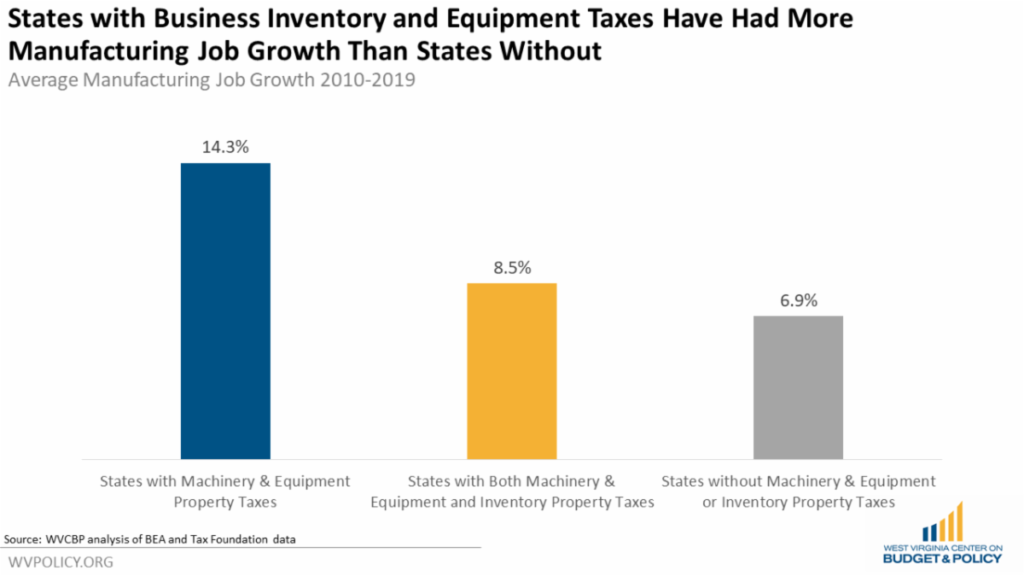

This fall, West Virginians will vote on a proposed constitutional amendment that could jeopardize hundreds of millions in property tax revenue benefiting local communities. Here’s our second in a series of blog posts outlining why the amendment should be rejected.

This blog post details how claims that West Virginia’s property taxes are out of line with other states’ or make the state unfriendly to businesses are not supported by the data, nor are claims that eliminating the property tax on business machinery, equipment, and inventory would result in rapid job growth.

The property tax, including the tax on business machinery, equipment, and inventory, directly funds the government services that West Virginians and businesses benefit from on a daily basis. Rhetoric suggesting that the tax is a “job killer” or makes West Virginia uniquely uncompetitive is not supported by data, which is why arguments for eliminating it rely on rhetoric alone. When making a decision this fall that will affect communities in every corner of the state, West Virginians deserve to have a clear understanding of the data and its implications, including the still unanswered question of what will replace the lost revenue if the tax is eliminated.

Read Sean’s full blog post.

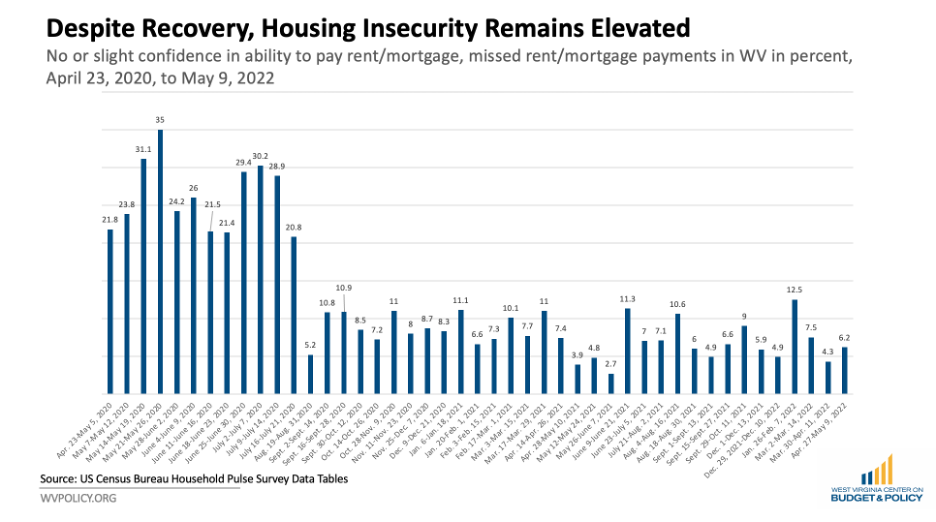

Despite meaningful recovery in employment since the start of the pandemic, housing security continues to lag in West Virginia. Over the pandemic, the estimated percentage of West Virginians behind on rent or mortgage payments averaged 12.7 percent. Housing insecurity estimates averaged nearly 20 percent in 2020. The most recent data collected during the week of April 27, 2022, averages just over six percent.

The most recent US Census data indicated that four percent of homeowners are behind on their mortgage, and an additional four percent have little or no confidence in their ability to pay it next month. However, the outcomes are much grimmer for renters: over the same period, 13 percent of renters indicated that they were behind on rent. Furthermore, nearly a quarter of renters reported having little to no confidence in their ability to pay rent next month.

There is also a sizeable discrepancy in housing insecurity between adults with and without children. Households without children had a three percent housing insecurity rate in most recent estimates. However, in households with children, this rate jumped to 23 percent—over seven times the childless household rate.

As a consequence of housing insecurity, houselessness severely threatens community wellness in West Virginia. As of January 2020, there were over 1,300 people who were without a home on any given night in the state.

While the federal government has been sending additional support to people facing housing insecurity, the state and local levels have not made as robust efforts. State legislators and other government officials have done little to improve housing outcomes. In fact, rather than passing proactive legislation to reduce housing insecurity and homelessness, they have introduced legislation that makes addressing it more difficult — for instance, by limiting where homeless shelters can be in relation to schools.

West Virginia must prioritize efforts to improve housing outcomes for all of its residents. Beyond introducing and supporting laws that can ensure funds reach vulnerable renters and homeowners, the state must also ensure that the agencies that distribute these funds are adequately staffed and funded.

Read Rhonda’s full blog post.

Right now, Congress has before it two major tax policy changes: One would give a tax break to wealthy tech and other corporations, while the other would help hundreds of thousands of West Virginia families and parents of kids across the country make ends meet during a time of rising prices. The WVCBP’s new op-ed from executive director Kelly Allen provides further context and argues that Congress should not prioritize corporate tax interests over our country’s children and families. Excerpt below:

At the end of 2021, Congress allowed temporary improvements to the Child Tax Credit (CTC) to expire. The consequences of inaction were costly to West Virginia families, where 346,000 kids and their families were impacted—losing income that had been helping pay for education costs and basic needs. Worse, the support was taken away just as inflation, largely caused by supply chain issues and geopolitical crises, spurred price spikes for essentials like gas and groceries.

The corporate tax cut under consideration is an extension of a provision in the 2017 Tax Cuts and Jobs Act that allows corporations to write off expenses related to research and experimentation or “R&E”. Extending this tax cut would cost roughly $150 billion over a decade. And even without this extension, corporations are still reaping the benefits of significant tax cuts under the 2017 tax law.

Both expansion of the Child Tax Credit and the corporate R&E tax cut have been part of an overall tax policy reform package approved by the House last year as part of the “Build Back Better” plan. That plan would have raised revenue needed to fund meaningful investments in climate change and support for families — in part by closing loopholes that let corporations avoid paying their taxes, even as it contained pro-corporation policies like the R&E tax credit.

Corporate lobbyists have been hard at work trying to separate the fate of the corporate tax cut from programs that support families like the expanded Child Tax Credit. And they’re close to getting their wish.

We have a responsibility to make sure all kids have what they need right now and in the future. Without Congressional action, we are at imminent risk of losing the gains achieved by the expanded CTC, with millions of children consigned to poverty, and the long-term harms to health, school performance, and long-term earning potential that result from growing up poor.

Read Kelly’s full op-ed.

The costs of insulin continue to rise while income wages remain stagnant, exacerbating pressure on individuals and families to skip or ration insulin doses in order to make ends meet.

You can help us in our fight to urge Congress to take action! If you or your family is being impacted by insulin costs or rationing, please consider completing our survey and aiding us in our advocacy– we appreciate your time and insight.

Applications for Appalachian Prison Book Project (APBP)‘s 2022-2023 Education Scholarship are live!

Four, $3,000 scholarships will be awarded to individuals who have been released from a West Virginia Department of Corrections and Rehabilitation (WVDCR) state prison or federal prison (BOP) in West Virginia and who will be beginning or continuing their undergraduate or graduate education at a college or university in West Virginia.

This is an incredible opportunity for justice-impacted folks in the Mountain State who want to further their education. Please share with anyone you think may be interested and eligible! Application submission deadline is July 15, 2022.

You can find full details and instructions to apply here.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make the enhanced Child Tax Credit permanent is as urgent as ever.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) expired.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.