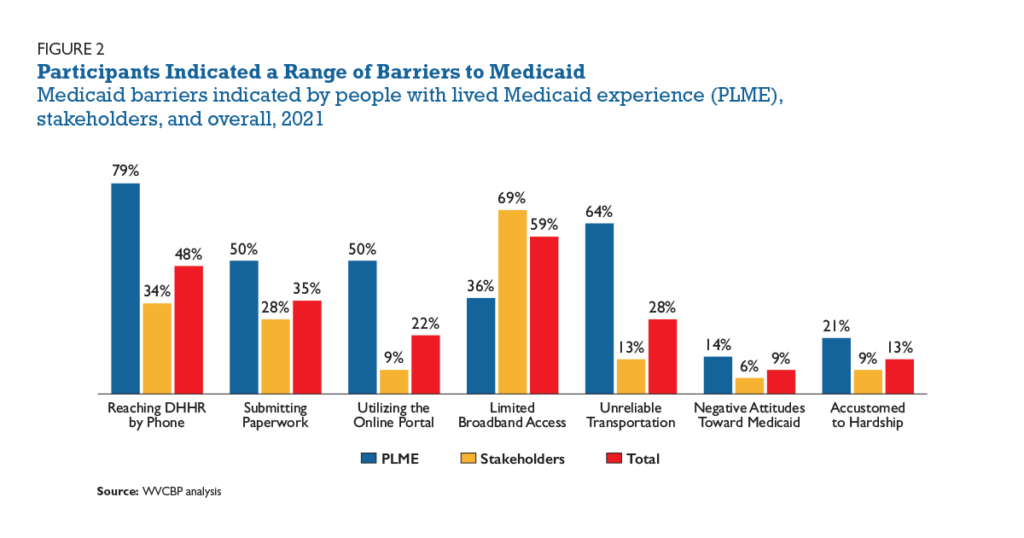

Medicaid is a critical economic and health program in West Virginia, serving over 616,000 people, including children, seniors, low-income adults, pregnant and postpartum women, persons with disabilities, and more. Medicaid’s flexibility and reach has never been more clear than during the pandemic recession, when it provided health coverage for tens of thousands of West Virginians who lost other health coverage. Nevertheless, Medicaid and those who rely on it are often faced with stigmatizing language, mountains of bureaucratic hurdles, and harmful policy proposals.

Over the last year and a half, the WVCBP has worked in partnership with West Virginians for Affordable Health Care on a listening project to identify ways to enhance the Medicaid experience for West Virginians. Over the course of this project, our team has learned more about the Medicaid process through the experiences of those who utilize and administer the program, including state officials and legislators, health care providers and advocates, and — most importantly — Medicaid enrollees and people who are eligible but not enrolled in the program.

Our new issue brief highlights several patterns identified through our correspondence with Medicaid stakeholders and people with lived Medicaid experience that are critical to understanding the role of Medicaid in the Mountain State, and how it can better serve enrollees. While the project is ongoing, our preliminary findings and recommendations can help stakeholders and policymakers craft policy priorities that can critically improve Medicaid’s efficacy and health outcomes in West Virginia.

Key Findings:

Read Rhonda’s full issue brief.

Significant improvements to both the Child Tax Credit and Earned Income Tax Credit were implemented as part of the American Rescue Plan Act in 2021. Now, instead of working to preserve those improvements, Congress is considering delaying an influential tax increase to appease corporate lobbyists. Our colleagues at Center on Budget and Policy Priorities published a blog post recently outlining the development. Excerpt below:

Corporate lobbyists are mounting an aggressive push for Congress to delay a tax increase enacted in the Trump 2017 tax law related to the tax treatment of research and experimentation (R&E) expenses, either in an upcoming economic package or in legislation to improve the U.S.’s international competitiveness (the so-called COMPETES Act). Congress shouldn’t place corporate tax interests ahead of two other tax priorities: delivering the full Child Tax Credit to the children who need it most and strengthening the Earned Income Tax Credit (EITC) so the federal government no longer taxes low-paid workers into, or deeper into, poverty.

Instead, lawmakers should put the Child Tax Credit and EITC improvements in the same bill as the corporate tax provision. That’s what they did when they reached a bipartisan compromise on a 2015 bill that paired Child Tax Credit and EITC improvements with a permanent extension of a separate R&E provision (a tax credit) and other corporate provisions.

Here’s some background

| Each of these provisions, in some form, is in the House-passed Build Back Better bill, which includes possible elements of an economic package that Congress would consider this year under the fast-track reconciliation process. The House bill extends the Rescue Plan’s expansions of the Child Tax Credit and EITC for one year, makes permanent the Child Tax Credit’s full refundability feature, and delays the Trump tax law’s R&E tax increase until 2026. All three of these provisions could be addressed in an economic package considered under reconciliation rules, which should also include a strong and progressive revenue-raising package along the lines of the what’s in the House-passed bill. Read CBPP’s full blog post here. |

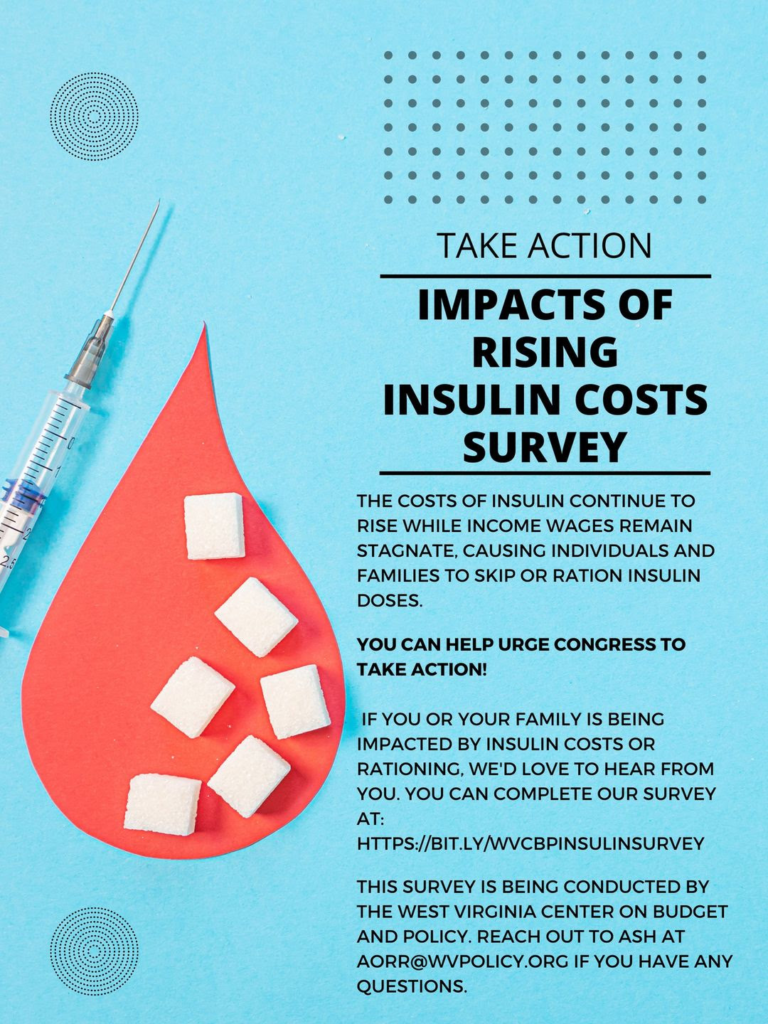

The costs of insulin continue to rise while income wages remain stagnant, exacerbating pressure on individuals and families to skip or ration insulin doses in order to make ends meet.

You can help us in our fight to urge Congress to take action! If you or your family is being impacted by insulin costs or rationing, please consider completing our survey and aiding us in our advocacy– we appreciate your time and insight.

Applications for Appalachian Prison Book Project (APBP)‘s 2022-2023 Education Scholarship are live!

Four, $3,000 scholarships will be awarded to individuals who have been released from a West Virginia Department of Corrections and Rehabilitation (WVDCR) state prison or federal prison (BOP) in West Virginia and who will be beginning or continuing their undergraduate or graduate education at a college or university in West Virginia.

This is an incredible opportunity for justice-impacted folks in the Mountain State who want to further their education. Please share with anyone you think may be interested and eligible! Application submission deadline is July 15, 2022.

You can find full details and instructions to apply here.

Since July 2021, most households with children had received monthly enhanced Child Tax Credit payments of $250- 300 per child. However, the enhanced Child Tax Credit was temporary and expired at the end of 2021 unless Congress acts to extend it in 2022 through the Build Back Better Act or other legislation.

The impact on children and families since the expiration of the enhanced Child Tax Credit has been severe. Between Dec. 2021 and Jan. 2022, there was a staggering 41 percent increase in child poverty nationwide due to the loss of the monthly payments. And as inflation continues to exacerbate family financial hardship, the need to make the enhanced Child Tax Credit permanent is as urgent as ever.

If you received monthly Child Tax Credit payments, we’d love to hear how they had been helping your family and how your family has been impacted now that the payments have (at least temporarily) expired.

Join us in our advocacy by completing our survey here or participating in the #Unbearable Child Tax Credit campaign.

Learn more about what’s at stake if the enhanced Child Tax Credit is not extended in our blog post here.

Find guidance on how to collect your Child Tax Credit payment here.

The WVCBP’s Elevating the Medicaid Enrollment Experience (EMEE) Voices Project seeks to collect stories from West Virginians who have struggled to access Medicaid across the state. Being conducted in partnership with West Virginians for Affordable Health Care, EMEE Voices will gather insight to inform which Medicaid barriers are most pertinent to West Virginians, specifically people of color.

Do you have a Medicaid experience to share? We’d appreciate your insight. Just fill out the contact form on this webpage and we’ll reach out to you soon. We look forward to learning from you!

You can watch WVCBP’s health policy analyst Rhonda Rogombé and West Virginians for Affordable Health Care’s Mariah Plante further break down the project and its goals in this FB Live.